CFDs vs Futures: Key Differences Explained

We look at what to know when approaching CFDs vs futures, covering the essential differences between these trading instruments, from structure to trading hours and risk profile.

CFDs vs futures: how do they compare?

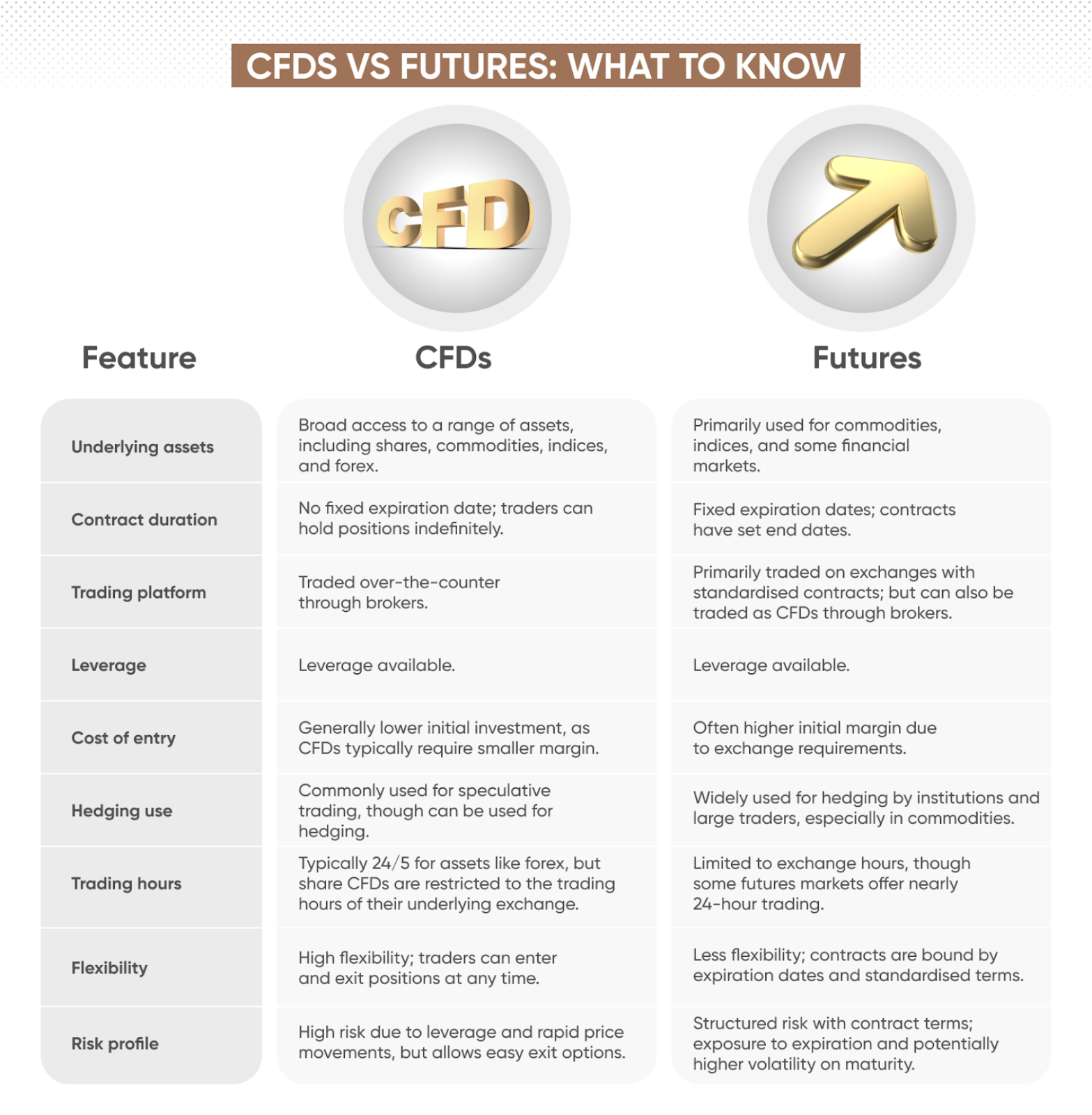

CFDs (contracts for difference) and futures are two common ways of trading financial markets such as shares, commodities and more. Broadly speaking, CFD trading can be seen as more flexible, making it popular for short-term strategies, while futures are based on trading at a fixed price, making them more suitable for longer-term strategies. You can trade CFDs with us at both the spot price, or future price.

To make understanding the differences between CFD and futures easier, here’s the definition of each term.

What are CFDs?

CFDs are derivatives that let you trade on price movements across various assets – like stocks, commodities, or forex – without owning them outright. They’re flexible, with no fixed end date, so you can keep your position open as long as you like. CFDs are popular for short to medium-term trading and allow leverage (also known as margin trading), meaning you can control a larger position with a smaller outlay, though this also increases potential losses as well as profits.

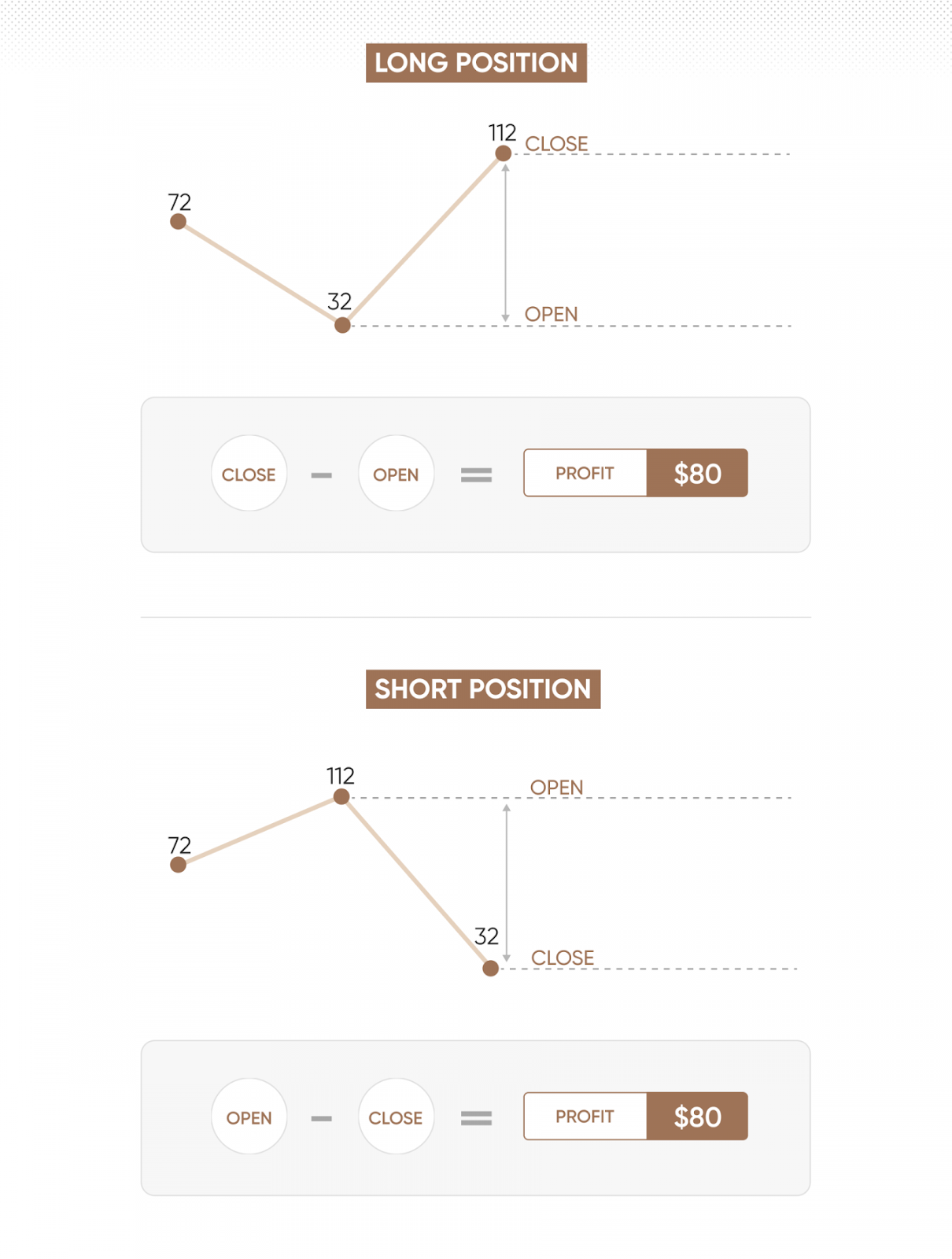

With CFDs, you have the choice of taking a position on an asset rising in price, known as a long position, or falling in price, known as a short position. Bear in mind that the below illustrations only shows the potential profit – if the price were to go in the opposite direction in each scenario, you would instead incur a loss.

Learn more about CFD trading here.

Learn more about CFD trading here.

What are futures?

Meanwhile, futures contracts are agreements to buy or sell an asset, such as oil or gold, at a set price on a specific date in the future. Futures are primarily traded on exchanges, with standardised terms and expiration dates, making them suitable for long-term strategies and hedging in asset classes such as commodities.

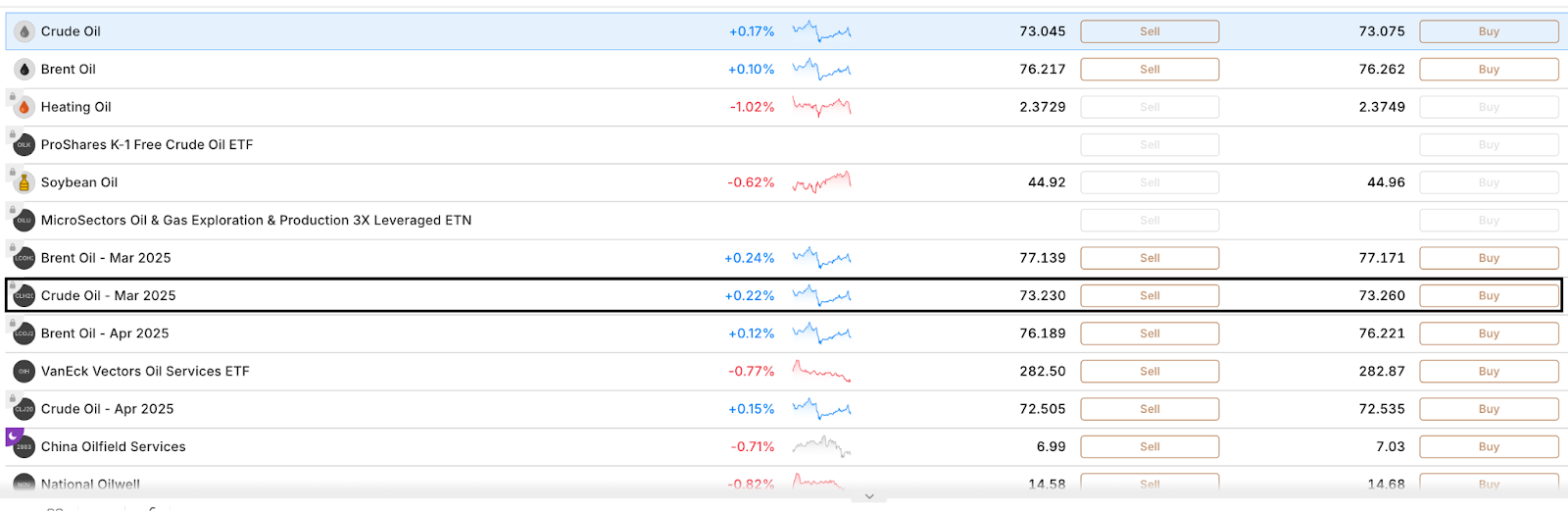

However, futures can also be traded in CFD form as derivatives (see below), which is how you’ll trade them using our platform. Below, you’ll see a Crude Oil future CFD with March expiry resulting from a market search.

Futures CFD trading example

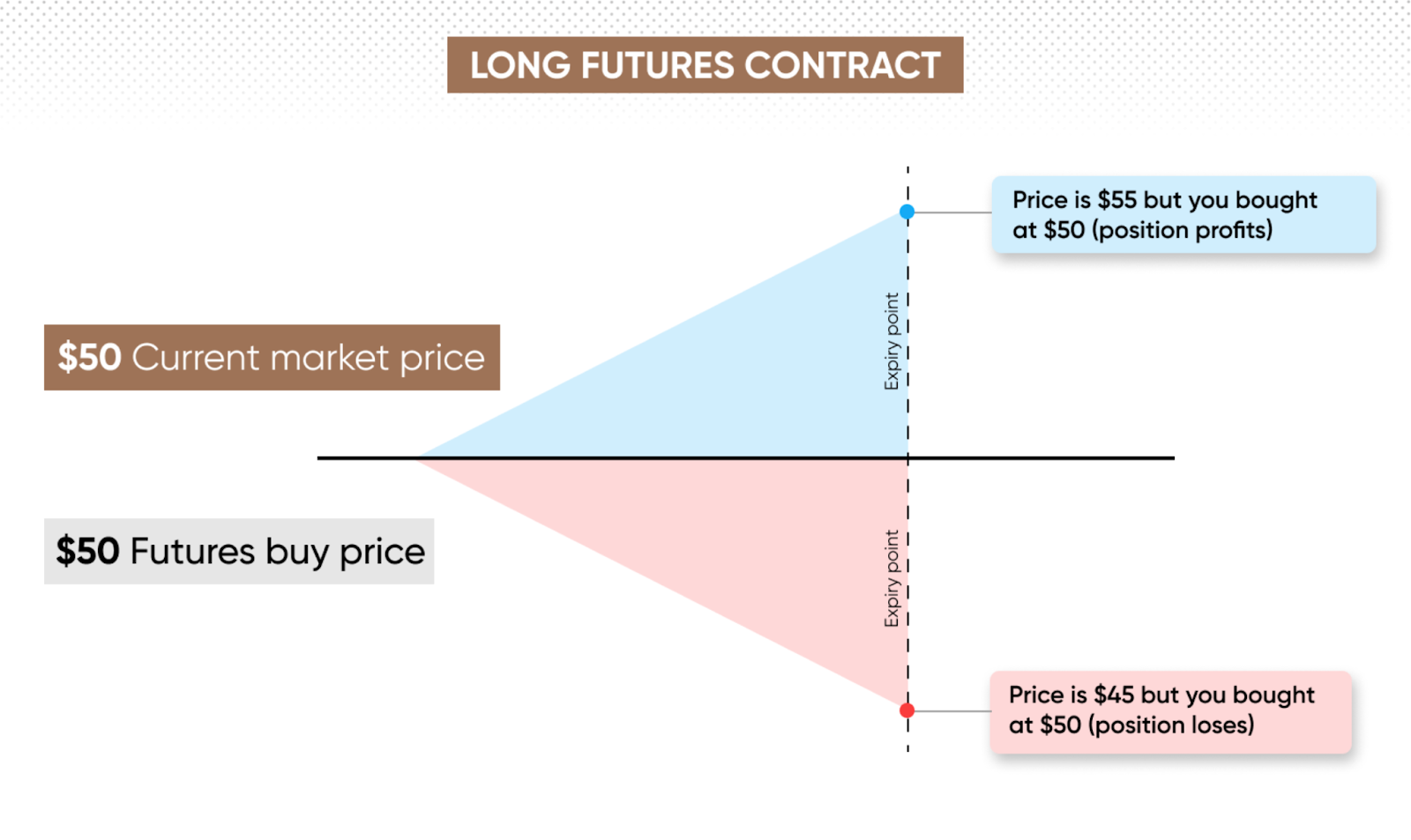

Say you want to trade US Crude, currently priced at $50, to secure a purchase price amid expectations of a potential price increase. In January, you buy a March US Crude futures CFD at $50, speculating that prices will rise before expiry.

- If the price rises to $55 by the March expiry (or when you close the position), your CFD gains value. In this case, your profit is the $5 difference ($55 - $50) multiplied by your contract size.

- If the price falls to $45, your position incurs a $5 per contract loss, as the market price has dropped below your entry price.

Conversely, you can go short on the future if you think the price will fall before expiry. Then, if the price rises before expiry, your CFD loses value, and if the price declines, your CFD will profit.

Why do traders choose CFDs?

Here’s an overview of why traders might choose to trade CFDs.

- Broad market access: trade stocks, commodities, forex, and more from a single platform.

- Leverage: control larger positions with a smaller initial outlay, enhancing potential returns (and risks).

- Flexible duration: no fixed expiration dates, allowing traders to close positions when desired.

- Diversification: easily diversify across different asset classes within one account.

- Short- and medium-term focus: may suit day trading, where people look to respond to immediate market conditions.

Why do traders choose futures?

Here’s an overview of why traders might choose to trade futures.

- Structured trading: fixed expiration dates and standardised terms provide clear timeframes.

- Price certainty: lock in prices to hedge against price fluctuations, especially in commodities.

- Leverage: control larger positions with a smaller initial investment, amplifying potential returns (and risks).

- Hedging opportunities: commonly used by traders and institutions to manage risk in specific markets.

- Long-term strategy focus: may suit traders focused on longer-term market trends and price management.

Here’s more on the differences between these instruments, when approached side by side.

What are CFD futures?

CFD futures are a type of CFD that mirrors the price movements of a futures contract. They allow traders to speculate on the price of an underlying futures asset, like commodities, indices, or currencies, without the need to buy the actual futures contract.

Unlike standard futures, CFD futures don’t have fixed expiration dates, providing more flexibility for traders who want to hold positions without being tied to a set contract expiry. This makes CFD futures popular with traders looking for leveraged exposure to futures markets with added flexibility.

Which is better out of CFDs and futures?

Whether CFDs or futures are ‘better’ depends on the trader's goals and market preferences. CFDs offer flexibility with no expiration dates, lower capital requirements, and access to diverse markets, making them a consideration for short-term trading and diversification.

Futures, with fixed expirations and higher capital needs, may be suited to those who value standardised contracts and a particular approach to risk management.

Remember though that aside from trading them directly on exchanges, futures can be traded as CFDs, allowing traders to speculate on futures price movements directly through their derivatives provider. This is often done using the same fundamental and technical analysis approach as with spot CFDs.

In short, CFDs are ideal for traders prioritising flexibility and variety, while futures (whether traded directly or as CFDs) may suit those who prefer structure and are focused on specific assets, like commodities.

How to trade CFDs and futures with us

When you trade CFDs and CFD futures with us, you can speculate long or short on the price of a wide range of spot and futures markets. To prepare, read up on the trading essentials, and inform your positions with the latest trading news and analysis from our expert analysts. Also, it’s advisable to ensure your risk management strategy is good enough to prepare you for potential volatility, and learn about how to improve your trading psychology to maximise your confidence in the markets.

FAQs

Are CFDs the same as futures?

No, CFDs and futures are different. CFDs are typically flexible contracts without set expiration, allowing traders to speculate on various assets over any time frame. Futures, however, are standardised contracts with fixed expiration dates, often used in commodities for structured trading and hedging. While both provide leverage, futures can potentially offer deeper liquidity and transparent pricing on exchanges. CFDs, however, allow access to futures markets without full contract commitments.

What is a futures CFD?

A futures CFD (or contract for difference) lets traders speculate on the price movements of a futures contract without owning the underlying asset or dealing with physical settlement. Unlike standard futures, CFDs offer flexibility, allowing traders to go long or short, with profit or loss determined by the price difference between opening and closing the position.

Do CFDs and futures have different costs and fees?

CFDs and futures can vary when it comes to cost structures. CFDs involve a spread – the difference between the buy and sell price – and may incur overnight financing charges if held beyond a day. When trading futures as CFDs, overnight funding costs may also apply, though these are calculated differently from spot CFDs. In contrast, exchange-traded futures often involve upfront costs like commissions, exchange fees, and margin requirements. Futures contracts do not incur overnight financing charges since these costs are usually factored into the contract pricing itself.

Which is better for short-term trading: CFDs or futures?

For short-term trading, CFDs can be more accessible due to their flexibility, ease of opening and closing positions, and the absence of expiry dates. Futures contracts, with their set expiry, are often better suited to longer-term or strategic trades, although some traders use them for day trading. CFDs are often preferred for day trading or short-term speculation, while futures may be more beneficial for traders with a specific market view or hedging strategy.