Spread betting vs CFD trading

Contracts for difference (CFDs) and spread betting are two common ways to trade financial markets. Both are leveraged derivative products that let you speculate on price movements without owning the underlying asset, but they differ in how trades are structured, taxed and funded, especially for UK residents.

This page explains how spread betting vs CFD trading works, highlights the main similarities and differences, and outlines the practical points to consider when deciding which may be more suitable for your circumstances. It’s for information only and doesn’t constitute investment or tax advice.

Key takeaways

- Both CFDs and spread bets use leverage, which magnifies profits and losses.

- CFDs use contract sizes, while spread bets use a £-per-point stake.

- Most CFDs have no fixed expiry, while spread bets are offered as DFBs or forwards.

- Overnight funding charges can apply to both when positions remain open past the end of the trading day.

- Tax treatment differs in the UK: CFD profits may be subject to CGT, while spread betting profits are usually tax-free for individuals.*

*Tax treatment depends on personal circumstances and may change.

Spread betting vs CFD trading: how they compare

CFD trading and spread betting share several similarities, including leverage, the ability to go long or short, and exposure to the underlying market price without owning the asset. However, their structure, tax treatment and practical use cases differ.

- Structure: CFDs use standardised contracts; spread bets use £ per point.

- Expiry: CFDs typically have no expiry, while spread bets may be DFBs or forwards.

- Tax (UK): CFDs may incur CGT, while spread bets are generally tax-free for individuals.

- DMA: Available on selected share CFDs, not usually available for spread betting.

- Currency: Spread bets are often GBP-denominated, which may reduce FX conversion.

- Funding: Overnight charges may apply to both products.

1. Structure

- CFDs: You trade standardised contracts that mirror the underlying market. For example, one share CFD typically represents one share, and an index CFD may represent a fixed monetary value per point.

- Spread bets: You choose a stake size in £ per point of price movement (for example, £1 per point on UK 100). P&L is calculated directly in GBP.

Because of this, CFDs may feel more familiar to those used to share dealing, while spread bets may suit traders who prefer thinking in pounds per point.

2. Expiry

Most spot CFDs have no fixed expiry, so positions can remain open as long as margin requirements are met and any funding charges are covered. Futures CFDs are the main exception and expire on a specified date.

Spread bets can be structured as daily funded bets (DFBs), which have no formal expiry but include daily funding adjustments, or as quarterly forwards, which expire on a set date and incorporate most funding costs within the spread.

3. Tax treatment (UK)

The choice between spread betting and CFD trading for UK residents often depends on how each product is treated for tax purposes.

Profits from CFD trading may fall under Capital Gains Tax (CGT), while realised losses can sometimes be used to offset other capital gains. CFDs don’t incur stamp duty because they’re derivative contracts rather than direct share purchases.

Spread betting is generally treated as gambling for tax purposes, meaning profits are usually exempt from CGT and stamp duty for individuals. However, if it’s done in a structured, frequent or business-like way, profits may be taxed as trading income instead. Tax rules depend on personal circumstances and may change.

It’s also common to compare spread betting with share trading in the UK, as stamp duty normally applies only to direct share purchases.

4. Regulation and protections

Both products fall under the FCA’s rules for 'CFD-like' products, which include:

- Leverage limits for retail clients

- Margin close-out at 50%

- Negative balance protection

- Restrictions on marketing and the use of incentives

FCA protections apply when trading with an authorised provider. They may not apply when using unregulated or offshore firms.

5. DMA and market access

Direct Market Access (DMA) is generally available on selected share CFDs, allowing orders to interact directly with the underlying order book in certain account types. Spread bets are normally internalised by the provider and therefore don’t offer DMA.

Corporate accounts are more commonly associated with CFDs, as spread betting is typically limited to individual accounts.

6. Currency and P&L treatment

Spread betting prices are often displayed in points, with P&L calculated in GBP. This can reduce FX conversion for traders who prefer to manage exposure in a single currency.

CFD prices follow the native currency of the underlying market – for example, USD for US shares or EUR for Eurozone indices – and P&L is usually converted back into your account currency, meaning FX considerations may apply.

7. Costs and overnight funding

Both products typically involve paying the spread.

- CFDs may charge a commission on some markets (such as share CFDs).

- Spread bets usually embed all costs within the spread.

Overnight funding may apply on positions held past the end of the trading day, usually based on a benchmark overnight rate plus a provider adjustment.

Calculation of P&L

Although tax and legal treatment differ, the core profit and loss (P&L) mechanics are straightforward.

The formulas below show how a spread bet vs CFD expresses the same market move in different ways:

Spread betting P&L formula

For example:

- You buy UK 100 at 7,400 with a £2 stake and close at 7,450.

- The 50-point rise multiplied by £2 gives a £100 profit (before costs).

Conversely, if the market moved 50 points lower instead, the same calculation would result in a £100 loss (before any applicable charges).

CFD P&L formula

For example:

- You buy 100 share CFDs at £10.00 and sell at £10.50.

- The £0.50 movement × 100 contracts gives a £50 result (before costs).

However, had the price fallen by £0.50 instead, the same calculation would result in a £50 loss (before commissions or funding).

FX quote clarification

A forex quote such as GBP/USD at 1.2453 may appear as 12,453 points on a spread betting platform. The underlying price is identical; the points format simply reflects the stake-per-point structure.

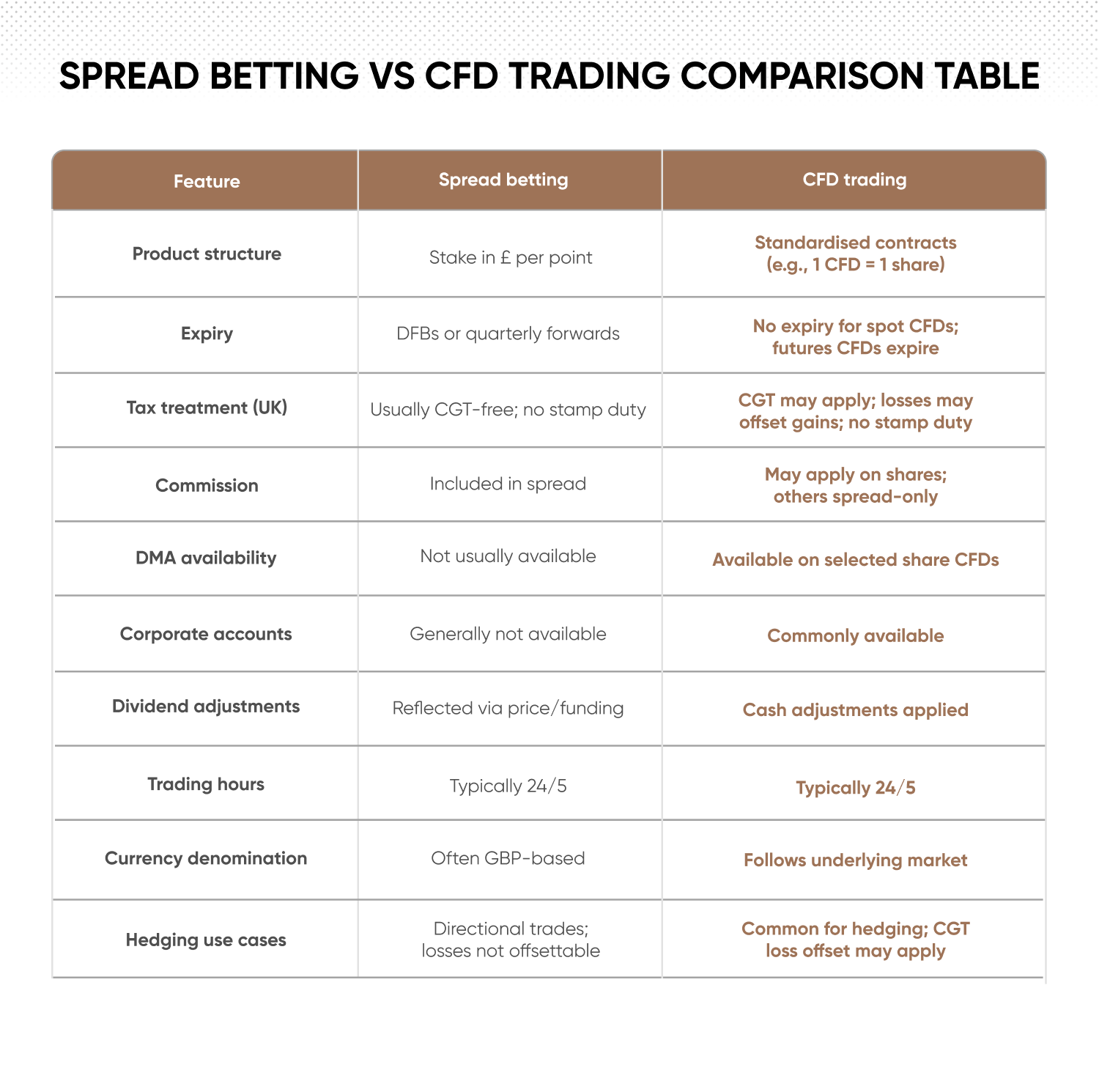

Comparison table

The table below summarises the main features of spread betting vs CFDs side by side.

Remember: market exposure can be similar; what differs is the legal structure, tax treatment and account features.

Does spread betting or CFD trading work better for me?

Choosing between the two depends on your preferences and circumstances. Common use cases include:

- Prefer trading in GBP and smaller stakes → spread betting

- Need DMA, hedging tools or the ability to offset losses → CFDs

- Corporate or institutional account → CFDs

- Want tax-free profits (UK) → spread betting*

- Using both products together is common, depending on the market and objective.

Explore the differences between spread betting and CFD trading by using our spread betting demo and CFD trading demo accounts in a risk-free environment with virtual funds.

*Tax depends on individual circumstances and may change.

If unsure, you may wish to seek independent advice.

CFD trading example

To mirror the spread betting scenario, imagine opening a long position on GBP/USD as a CFD. The market is quoted at 1.55805, and you buy one CFD contract, giving you a notional exposure of £100,000. With a margin requirement of 3.33%, you need £3,330 to open the position.

You keep the trade open overnight, which results in a £0.50 funding charge based on the relevant overnight rate and provider adjustment.

The next day, GBP/USD rose to 1.56950. The move from 1.55805 to 1.56950 represents a change of 0.01145, giving a gross profit of £1,145 when multiplied by the contract’s £100,000 notional size. After subtracting the overnight funding, the net result is £1,144.50.

Conversely, if the market moved lower instead – for example from 1.55805 to 1.54660 – the 0.01145 decline would result in a £1,145 loss, plus the £0.50 overnight funding charge.

A spread bet calibrated to the same notional exposure would produce a similar pre-tax outcome, showing that the economic exposure is broadly the same, while the main differences lie in structure, funding and tax treatment.

Margins and risk management

Both CFDs and spread bets are traded on margin. Leverage increases market exposure and can amplify both profits and losses, so understanding how margin works is essential.

Margin types

- Initial margin: The amount required to open a position.

- Maintenance margin: The minimum equity needed to keep a position open.

If your equity falls below the maintenance margin, positions may be closed automatically to limit further losses.

Margin calls and close-out

If your equity moves towards the maintenance level, you may receive an alert prompting you to add funds or reduce exposure. Under FCA rules, retail positions must be closed when account funds fall to 50% of the required margin, helping to prevent balances from turning negative. Learn more about margin calls.

Stop-loss orders

- Standard stop-loss: Triggers at a specified level but may be filled at the next available price in fast-moving or illiquid markets.

- Guaranteed stop-loss orders (GSLOs): Guarantee the exit price for an additional fee, even if the market gaps. They help define maximum potential loss but don’t remove overall trading risk.

Leverage and liquidity

Higher leverage increases sensitivity to price movements, meaning small market changes have a larger effect on your equity. During volatile or low-liquidity periods, spreads may widen and execution prices can differ from expected levels, particularly around stop-loss orders.

FAQ

What is the difference between CFD and spread betting?

The primary differences relate to legal structure and tax treatment. CFDs are derivative contracts where you trade a standardised quantity of the underlying market and may be liable for Capital Gains Tax on profits, with losses often offsettable against other gains. Spread bets are structured as bets in £ per point, and for most UK individuals, profits are usually exempt from CGT and stamp duty, although losses cannot be offset. Some traders use CFD trading vs spread betting for different purposes, such as hedging or managing FX exposure. Both products use leverage and carry a high risk of loss, and both provide exposure to the underlying market price without granting ownership of the asset.

Is spread betting tax-free in the UK?

For most individual UK residents, profits from financial spread betting are generally exempt from Capital Gains Tax and stamp duty, because spread betting is treated as gambling rather than investing. However, if spread betting is conducted in a systematic or business-like manner and forms a primary source of income, profits may instead be treated as taxable income. Tax rules can change and may differ based on your circumstances, so you may wish to consult HMRC guidance or a professional tax adviser if you’re unsure.

How is profit and loss calculated in spread betting?

P&L in spread betting is calculated as the difference between the opening and closing prices of the bet, expressed in points, multiplied by your stake per point:

P&L = (Exit price − Entry price) in points × stake (£ per point).

For example, if a market rises from 12,400 to 12,450 and your stake is £10 per point, that 50-point move results in a £500 profit or loss, depending on whether you went long or short (before any applicable funding charges).

What are spread betting margins?

Spread betting margins represent the deposit required to open a leveraged position. If the margin rate is 5%, you would need £500 to control a £10,000 notional position. Leverage in this case is 20:1 (1 ÷ 0.05). If the market moves against you, your equity may fall towards the maintenance margin level, at which point you may receive a margin call or have positions partially or fully closed if no action is taken.

Can I use CFDs to hedge my portfolio?

CFDs are sometimes used for hedging purposes, such as reducing exposure to broad market movements using index CFDs or offsetting risks around events like earnings announcements with single-stock CFDs. Because CFD losses can often be offset against other capital gains for UK tax purposes, they may provide flexibility when managing overall portfolio risk and tax outcomes, subject to individual circumstances and local rules.

Are CFDs and spread betting regulated by the FCA?

Yes. In the UK, CFDs, spread bets and rolling spot FX products offered to retail clients are regulated by the Financial Conduct Authority. The FCA has introduced permanent product-intervention measures to limit leverage, set margin close-out rules and require negative balance protection, as well as imposing strict standards for marketing, disclosures and fair value under the Consumer Duty. The FCA has also cautioned against unregulated offshore providers and high-risk promotions by 'influencers', urging consumers to verify that any firm they deal with is properly authorised.