What is short selling and how does it work?

Short selling is a key concept employed across a range of trading strategies. We’ll explore what it means, how it’s done, and clarify how it works using short-selling examples.

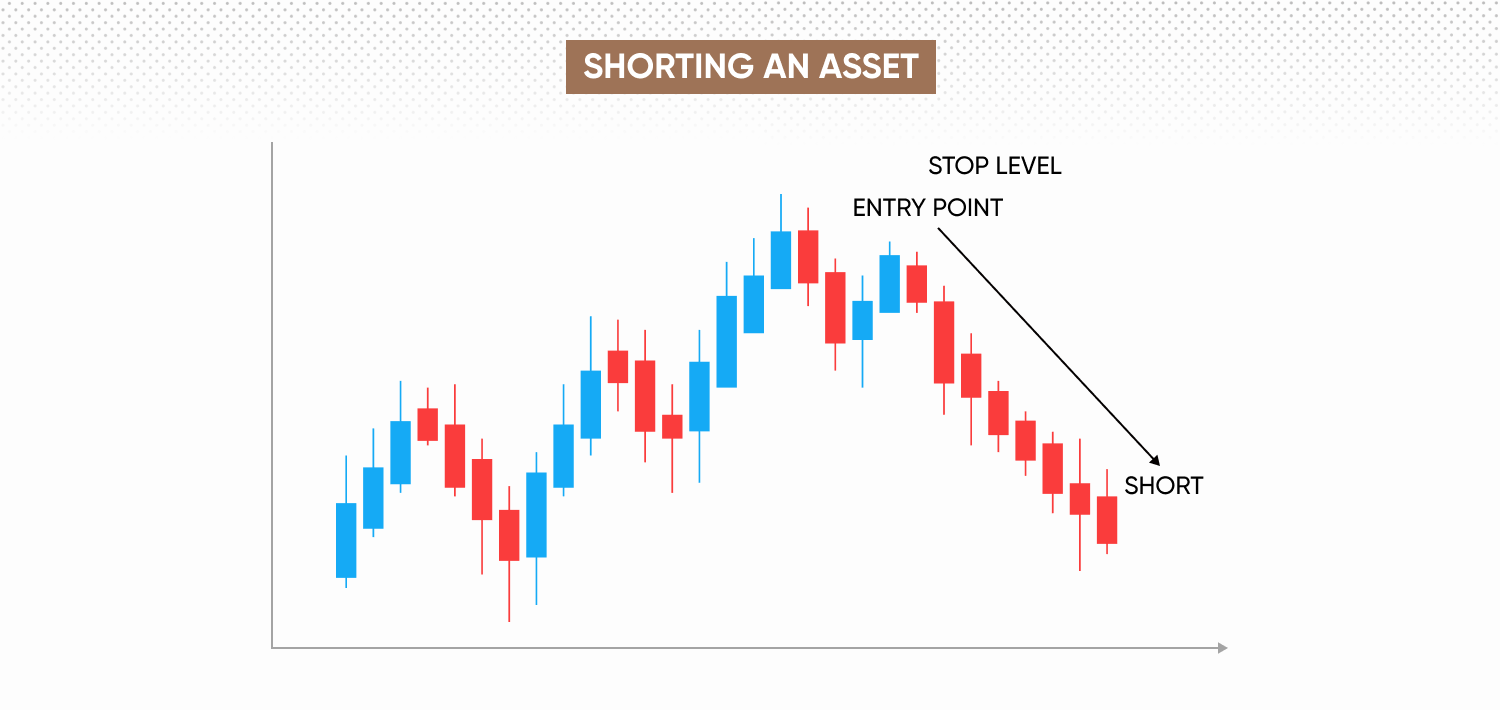

Short selling, in essence, involves taking a position on a financial instrument declining in value. In spread betting and CFD trading, short selling means entering into a contract with a broker to speculate on the price decline of a market such as a share, index, commodity, or forex pair, without actually owning the underlying asset.

If the price of the underlying asset decreases as planned, the value of the CFD position increases, allowing the trader to profit. Conversely, if the market moves the other way and price increases, the value of the CFD position decreases, resulting in a loss.

The trader closes the CFD position by effectively ‘buying’ back the CFD contract. The profit or loss is the difference between the opening sell price and the closing buy price.

Why do traders short markets?

Here are the two main reasons to have a short-selling trading strategy in your arsenal.

Speculation

Traders who believe that the price of a particular asset or market is going to fall can short the market to profit from the decline. For example, an economic downturn might be a predictor of a decline in certain individual shares or even entire sectors. Traders may go short on assets they believe are overvalued due to excessive speculation or hype. When the market corrects these overvaluations, they can profit from the decline.

Speculation can be accompanied by the use of technical analysis, which might identify overbought conditions or resistance levels, prompting traders to short the market in anticipation of a pullback. Fundamental analysis, involving the assessment of macroeconomic drivers of markets, is also commonly used. For example, an interest-rate hike from the Federal Reserve may prompt a trader to go short on a stock that holds a large debt, as the debt may now be more expensive to service and lead to reduced profits.

Such an event may also make shorting gold a reasonable strategy. That’s because historically, rising interest rates can lead to a stronger US dollar and higher yields on bonds and other interest-bearing assets. Gold, which does not yield interest or dividends, often becomes less attractive in comparison, meaning it may be a shorting candidate in these circumstances.

Hedging

Traders might short certain assets to hedge against potential losses in their portfolios. For example, if an investor holds a diversified portfolio of shares, they might short an index to protect against a broad market downturn. Traders may also hedge exposure to specific sectors or industries that they expect to perform poorly, while maintaining their positions in other areas.

Past performance is no reliable indicator of future results.

How to short a stock

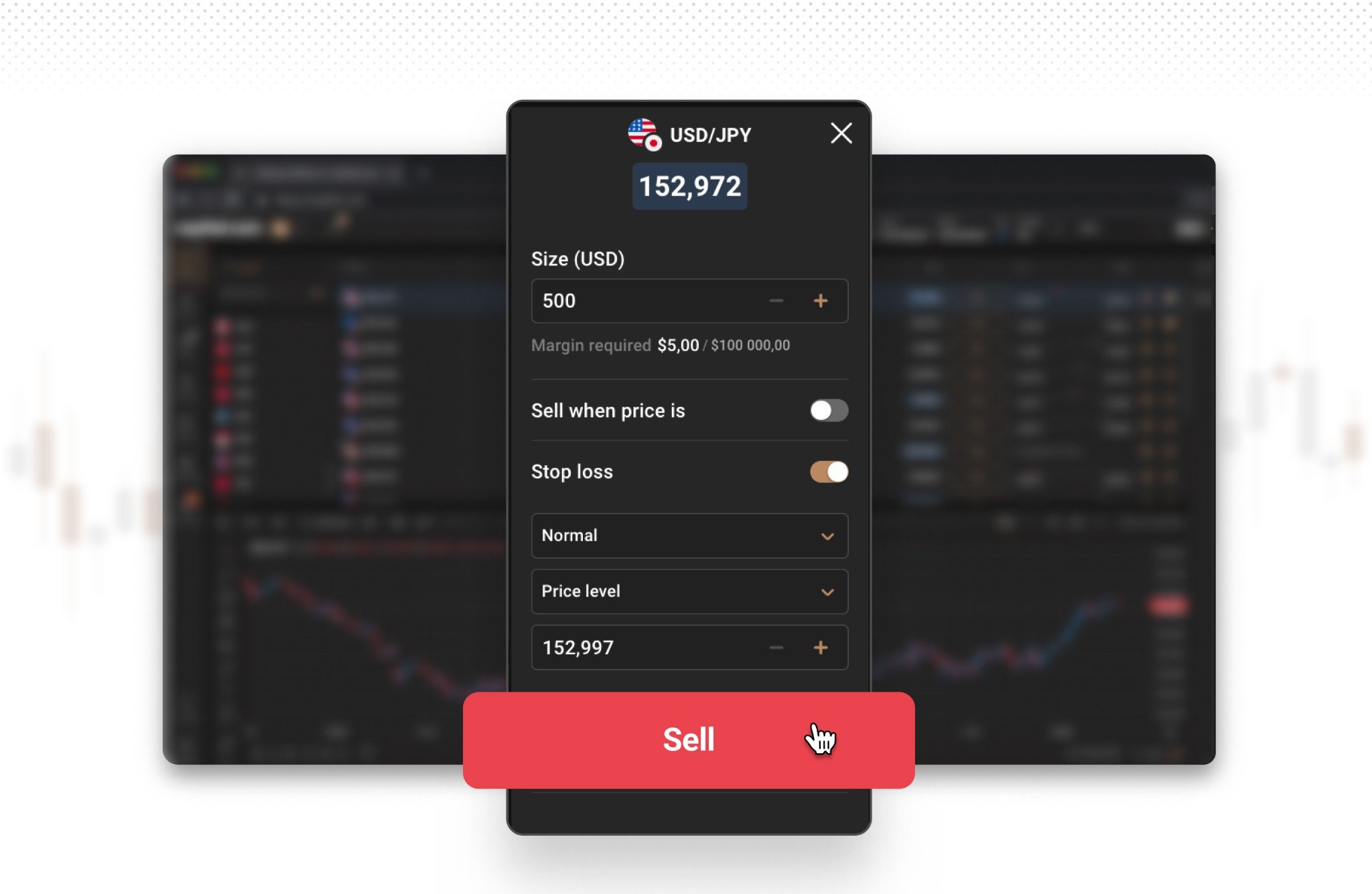

Short-selling stocks, or any other asset on the Capital.com platform, can be undertaken by first selecting from our range of 5,000+ available markets. These are listed by asset class in the left panel, or can be found through the search function above it.

Next, you’ll see the option to buy and sell on the main screen listing assets. Click ‘sell’ and your deal ticket will appear. You can then choose your position size and market orders (such as stop orders) to apply to your trade, before clicking ‘sell’ again, this time in the ticket itself. Make sure you monitor your trade, paying attention to the potential fundamental and technical influences on its price. When you want to exit your position, you can do so by clicking ‘Buy’ in your deal ticket.

Short-selling examples

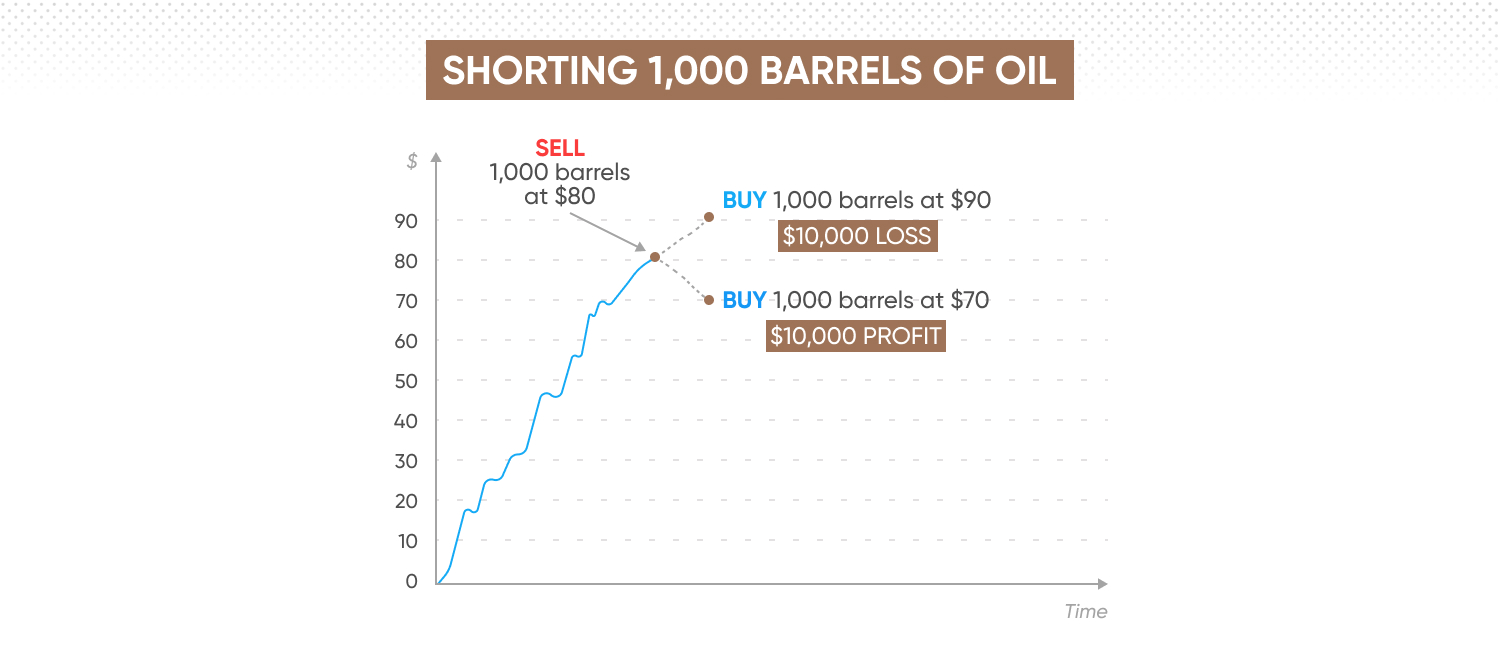

Let’s say you’re a crude oil CFD trader, and you believe that an upcoming OPEC meeting will result in a decision to increase oil production. You feel that this increase in oil production by OPEC members will likely lead to a surplus in the market, causing prices to drop.

The market sentiment on oil is bearish as traders anticipate higher supply levels.

Meanwhile, economic indicators include reports suggesting higher oil inventories and increased production capacity, which support the expectation of lower prices.

You decide to short oil using CFDs, selling 1,000 barrels at a current market price of $80 per barrel. With a margin of just 10%, you only have to put down $8,000 of the $80,000 position yourself, while having exposure to the price movements of the whole $80,000.

Since you’re careful to monitor market conditions, you keep a close eye on announcements from the OPEC meeting and other relevant news to confirm your anticipation of increased production.

After the OPEC announcement, the price of oil drops to $70 per barrel. You then buy back the oil CFDs at the lower price.

Profit calculation:

Market movement: The price drops to $70 per barrel

Closing the position: Buy back 1,000 barrels of oil at $70 per barrel

In this example, by accurately predicting the market movement and executing a short sell using CFDs, you were able to profit from the decline in oil prices. Short selling allows you to capitalise on downward price movements, enhancing your trading strategy and potential returns.

Scenario 2

Now let’s say that you make the same trade as the first example, shorting 1,000 barrels of oil. However, contrary to your expectation, OPEC decides to maintain current production levels instead of increasing them. This decision is based on member countries’ concerns about oversupplying the market and driving prices too low.

Simultaneously, geopolitical tensions arise in major oil-producing regions, such as the Middle East. These tensions raise fears of supply disruptions, causing market anxiety and driving oil prices up.

Additionally, recent economic data from major economies, like strong manufacturing output and higher-than-expected growth in China, indicate robust demand for oil, further supporting higher prices.

The price of oil rises to $90 a barrel. You decide to close your position to limit any further losses.

Loss calculation:

Buy back cost: 1,000 barrels x $90 = $90,000

Loss: $90,000 - $80,000 = $10,000.

FAQs

What is short selling?

Short selling refers to the practice of speculating that an asset will fall in price. Effectively, the process involves an investor or trader selling an asset they don't own, aiming to buy it back later at a lower price. Any potential profit comes from the difference between the selling price and the repurchase price, capitalising on expected price declines, although just like going long, shorting can also result in losses.

How profitable is short selling?

Short selling can be highly profitable, especially in prolonged bear markets or when specific assets are expected to decline significantly. However, it carries substantial risk, as potential losses are theoretically unlimited if the asset's price rises instead of falls. Successful short selling requires accurate market predictions, timely execution, and effective risk management. Therefore, while it offers significant profit potential, it also demands careful strategy and vigilance.

Is short selling good or bad?

Short selling is not inherently good or bad; its value depends on context and perspective. It provides liquidity, helps price discovery, and allows investors to profit from declining markets. However, it can be controversial, as excessive short selling may exacerbate market downturns and hurt companies' valuations. It's a useful tool for experienced traders but requires careful risk management due to its high-risk nature.