Purchasing power parity: a guide for UK traders

Here, we explore what purchasing power parity is, why it matters to traders, and how it’s calculated and applied, with hypothetical trading examples.

What is PPP (purchasing power parity)?

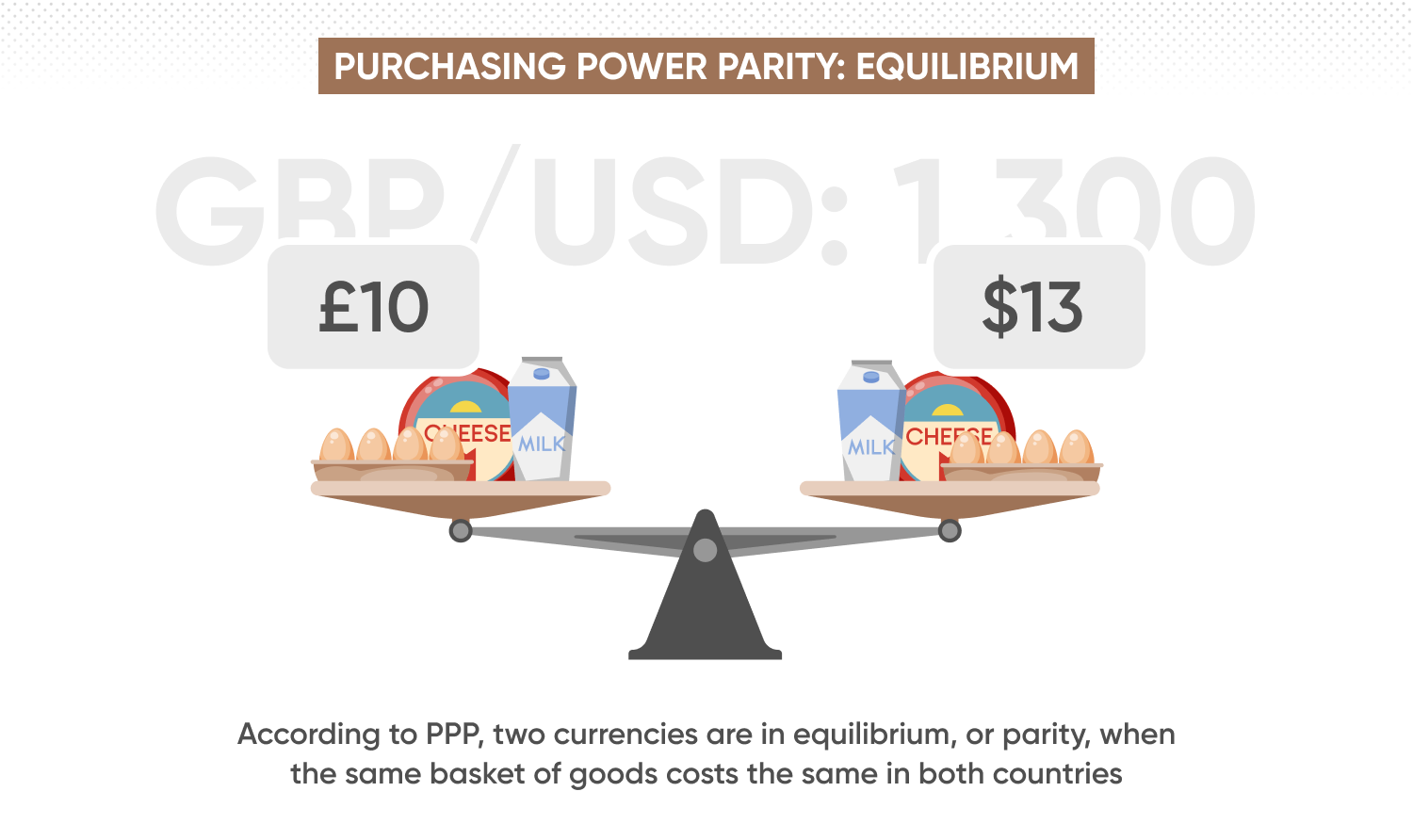

Purchasing power parity (PPP) is an economic theory that compares the relative value of different countries' currencies through a representative ‘basket of goods’. According to this theory, two currencies are in equilibrium, or parity, when the same basket of goods costs the same in both countries, after adjusting for exchange rates. If the price differs between countries, you could apply a variety of trading strategies in response (see below).

What purchasing power parity means for UK traders

For traders in the UK, purchasing power parity (PPP) provides a useful way to assess the real strength of the pound (£) beyond headline exchange rates. Rather than looking only at how sterling moves against currencies like the US dollar or the euro, PPP considers what each currency can actually buy in its domestic economy.

According to the Office for National Statistics (ONS), PPP comparisons are widely used to evaluate the UK’s economic performance and living standards relative to other countries by adjusting for variations in price levels and inflation. For traders, this can help indicate whether a currency appears over or undervalued, offer context when analysing forex pairs or international equities, and show how changes in domestic prices might affect the UK’s global competitiveness.

However, it’s important to recognise that PPP doesn’t always point to immediate trading opportunities. Price differences can persist for reasons unrelated to currency valuation, including economies of scale, production costs, local taxes and consumer preferences. These factors mean that PPP should be considered as part of a broader analysis rather than a standalone indicator, helping traders place PPP insights alongside other economic data when assessing market conditions.

Types of PPP

Absolute PPP

This version states that the exchange rate between two countries should be equal to the ratio of the price levels of a fixed basket of goods and services in those two countries.

Relative PPP

This form adjusts the concept to account for changes over time, suggesting that the rate of change in the exchange rate between two currencies over time should equal the difference in the inflation rates of the two countries.

Calculations

PPP can be used to compare economic productivity and standards of living between countries. It's also used to make more accurate comparisons of GDP between countries, adjusting for cost of living and inflation differences.

How to calculate PPP

To calculate absolute PPP, you can select an identical basket of goods between two countries, determine their prices in each country, and calculate the implied exchange rate. From there, you can compare this to the actual market exchange rate, consider if the current rate is under or overvalued, and use this information to inform your trading decisions.

- Step 1Select a ‘basket of goods’ that is identical in both countries. This could include everyday items like food and clothing.

- Step 2Determine the average price of this basket of goods in both countries by gathering prices from multiple vendors or sources to remove variance. For example, let’s say the average price of the basket is $100 in the US and 800 MXN in Mexico.

- Step 3Calculate the implied exchange rate by dividing the cost of the basket in one country by the cost in the other. In this example:

PPP exchange rate = ———— = 8 MXN/USD

100 USD

This means, according to PPP, the fair exchange rate should be 8 MXN for every US dollar.

Calculating relative PPP involves exploring inflation rate differentials between two countries and how exchange rates might be expected to behave in response.

- Step 1Find the inflation rates of the two countries.

Example: US inflation = 3%, UK inflation = 1% - Step 2Calculate the inflation differential between the two countries.

Example: 3% (US) - 1% (UK) = 2% - Step 3Adjust the current exchange rate by the inflation difference.

Example: If the current exchange rate is 1.3500 GBP/USD, and the US has 2% higher inflation, the US dollar may be expected to weaken by 2%. - Step 4Calculate the new exchange rate by applying the inflation adjustment.

This means the exchange rate is expected to increase to 1.377 GBP/USD, meaning the pound has strengthened against the dollar, since it now takes more dollars to buy one pound.

How to use purchasing power parity

To use purchasing power parity, calculate the PPP exchange rate. Then, compare it to the actual market exchange rate. Let’s say the current exchange rate is 10 MXN/USD. If the market rate is higher than the PPP rate (like in the absolute PPP example above), it suggests that the Mexican peso is undervalued compared to the US dollar. Conversely, if the market rate is lower than the PPP rate, the peso may be overvalued.

Potential action points for traders

-

Traders can look for currencies that are consistently overvalued or undervalued according to PPP and consider long-term positions that could benefit from eventual corrections.

-

Those with long-term exposure in a particular currency might use CFDs to hedge against potential exchange rate movements suggested by PPP.

-

Understanding PPP can enhance a trader's overall macroeconomic analysis by providing insights into economic health. PPP differences can indicate economic imbalances, such as inflation rates or cost of living differences, which might affect a country’s currency and its relative strength.

-

Traders can anticipate potential central bank actions, such as interest-rate changes or interventions, based on PPP-related imbalances.

-

Derivatives traders often look at various markets, including equities, commodities, and indices. PPP can help you:

- Identify correlations. Understanding PPP can reveal correlations between currency movements and other asset classes, helping you anticipate how changes in exchange rates might impact other markets.

- Diversify your portfolio. You can diversify your portfolio by including assets from countries with currencies that are undervalued according to PPP, potentially benefiting from currency adjustments.

PPP: Example scenario

Let’s say that, after calculating PPP for JPY and USD, you notice JPY is significantly undervalued compared to USD. The current exchange rate is 110, but PPP suggests it should be around 100 JPY/USD. You may choose to:

-

Open a short position on USD/JPY, anticipating that the yen will strengthen relative to the dollar over time.

-

Monitor economic indicators and central bank policies that could support this adjustment.

-

Hedge your positions in related markets, such as the Japan 225, if expecting equities to benefit from a stronger yen.

By integrating PPP into your trading strategy, you can make more informed decisions, balancing short-term technical analysis with long-term economic fundamentals.

Purchasing power indices

Purchasing power indices are useful tools for traders conducting economic analysis and making international comparisons. These indices compare the relative value of currencies or the purchasing power of people across different regions or countries, helping you assess how much a unit of currency can buy in terms of goods and services.

By using purchasing power indices, you can gain a more accurate reflection of economic conditions and market inefficiencies than just relying on nominal exchange rates. This insight can help inform trading strategies, particularly in forex markets, where currency misalignments can create trading opportunities.

Here are five key types of purchasing power indices:

1. Purchasing power parity (PPP) index

The PPP index compares the purchasing power of different countries by examining the relative price levels of a standard basket of goods and services in each country.

If the index shows that a country has a higher PPP than another, it indicates that the currency in the first country has a stronger purchasing power (ie, the cost of living is lower, and a given amount of money can buy more goods and services).

2. Consumer price index (CPI) based PPP

This type of index is often used to adjust income or GDP data to reflect differences in the cost of living across regions. It compares consumer prices for similar goods and services in different areas to evaluate whether a currency's purchasing power is consistent across regions.

3. Big Mac Index

This is an informal purchasing power index created by The Economist, which uses the price of a McDonald's’ Big Mac burger as a proxy for comparing the value of currencies across countries. It’s a simplified version of PPP that offers a quick snapshot of currency overvaluation or undervaluation.

4. Regional purchasing power index

This index measures the purchasing power of consumers in specific regions within a country. It compares price levels across different regions to indicate which areas are more affordable.

It’s useful for understanding how far a salary or income stretches in various cities or regions.

5. GDP-based PPP index

This index adjusts a country's gross domestic product (GDP) to reflect the relative purchasing power of its currency, allowing for more accurate comparisons of economic output across nations. It’s widely used by international organisations like the IMF and World Bank to compare the economic productivity and living standards of countries in real terms.

FAQs

What is purchasing power parity in simple words?

Purchasing power parity, or PPP, is an economic theory that compares the value of currencies between two countries. It states that, in the long run, the exchange rate between two currencies should adjust so that the same basket of goods costs the same in both countries, after considering exchange rates. Essentially, PPP helps measure how much a currency can buy in one country compared to another.

How is PPP calculated?

Purchasing power parity is calculated by comparing the price of a fixed basket of goods in two different countries. First, find the cost of the basket in each country's currency. Then, divide the cost of the basket in one country by the cost in another. This gives the implied exchange rate. If the actual exchange rate differs from the PPP rate, it suggests one currency is either undervalued or overvalued relative to the other.