Disinflation resumes in the US as CPI drops in April

The rate of growth in US consumer prices dropped in April leading markets to price in more chances of rate cuts from the Fed

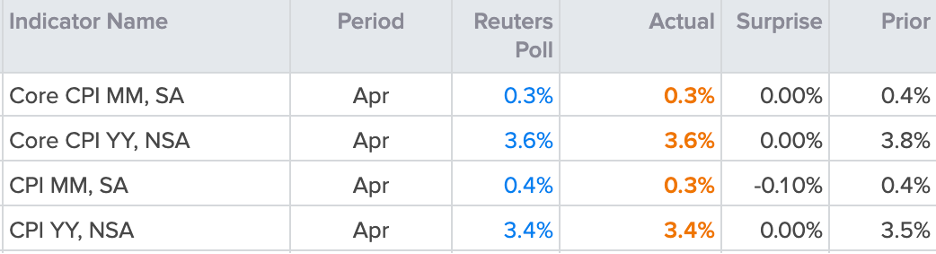

The US CPI data for April has come in mostly in line with expectations. Consumer prices have risen 3.4% in the last year, down from 3.5% in the month prior. On a monthly basis, prices rose 0.3% in April, slightly less than the 0.4% seen in March and what markets predicted to remain unchanged. When excluding volatile prices like food and energy, core CPI dropped from 3.8% to 3.6% on a yearly basis, with the monthly reading coming in line with expectations at 0.3%, down from 0.4% in March.

US CPI April data

Source: refinitiv

Source: refinitiv

The market reaction after the data release has been dovish as traders take the opportunity to price in further basis points of cuts from the Federal Reserve this year. Global equities have resumed the move higher whilst the US dollar pulls back to a five-week low. Markets had been trading with caution heading into the data release so we may see some followthrough in risk appetite over the coming days, but realistically, the April CPI data doesn’t change too much for the Fed. Yes, it evidences a return to the disinflation process which had stalled in Q1, but price pressures remain elevated and the Fed is unlikely to start cutting rates for a while considering the economy remains resilient. We’ll need to wait for confirmation from Fed speakers as to what the latest data means, but we may see markets have to adjust their expectations in the coming days if Powell and his team continue to disappoint dovish hopefuls.

For now, we can expect indices to continue moving higher and testing their respective highs. Meanwhile, the US dollar is being sold off as traders re-adjust their rate differential expectations but I wouldn’t expect there to be too much appetite to be a USD seller in current conditions, considering also that the currency has been pulling back for the past two weeks.

US Dollar Index (DXY) daily chart

(Past performance is not a reliable indicator of future results)

(Past performance is not a reliable indicator of future results)