China’s National People’s Congress: The markets have again been left wanting more

China’s National People’s Congress (NPC) is underway, and the markets have so far been disappointed by what’s been delivered by the country’s central government. We look at some of the significant takeaways from the event, discuss China’s current economic conditions, and analyse the China A50.

All price information and forecast data in this article is sourced from Bloomberg

China’s National People’s Congress (NPC) is underway, and the markets have so far been disappointed by what’s been delivered by the country’s central government. We look at some of the significant takeaways from the event, discuss China’s current economic conditions, and analyse the China A50

China announces growth target but no major stimulus measures

The NPC reaffirmed the government will target 5% growth in 2024, the same number it targeted and exceeded in 2023. The number was slightly lower than economists had expected, with the consensus projection revised to 5.3% in the weeks before the NPC started.

(Source: Trading Economics)

(Source: Trading Economics)

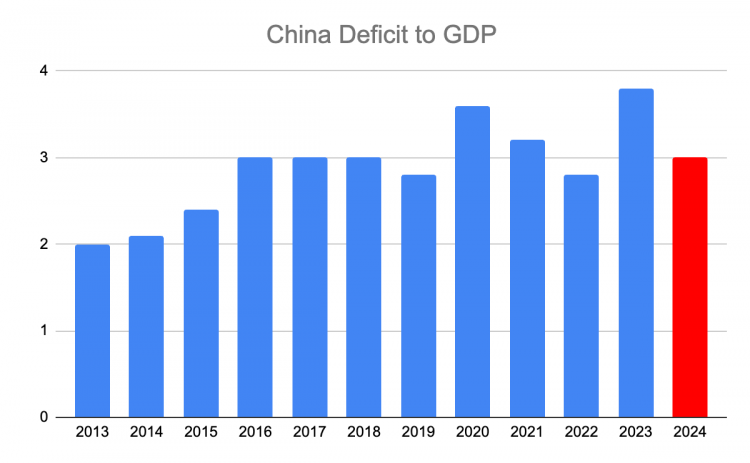

Despite hitting a growth rate of 5% last year, there’s concern that China will find it challenging to achieve the same growth rate this year. The reasons are twofold. First, China’s 2023 growth rate was supported by the base effects of a historically weak growth rate in 2022 of 3%. Second, the government provided scant detail on how it intends to achieve the growth target, with limited information about the specific fiscal or monetary policy levers it would pull. The NPC also outlined relatively conservative fiscal settings in the year ahead, projecting a deficit-to-GDP ratio of 3%, which is in line with historically neutral policy.

(Source: Bloomberg, Capital.com)

(Source: Bloomberg, Capital.com)

The NPC revealed how it would partially fund the deficit. According to the government’s work reports, the Ministry of Finance will authorise the issuance of 3.9 Trillion yuan worth of “special local government bonds”, a value slightly higher than 2023. The government also said it will issue 1 trillion yuan worth of “ultra-long special government bonds”.

When it comes to its other macroeconomic targets, China aims to create over 12 million urban jobs and maintain a 5.5% unemployment rate, while lifting headline CPI to “around 3%”.

China battles deflation and risk of ongoing economic malaise

The lack of substantial detail on how the Chinese economy will achieve a 5% GDP growth rate raises the risk of ongoing sluggish demand and price deflation. China remains mired in a state of deflation, with the most recent price data showing consumer prices fell 0.8% in January. China’s prices are also growing at a negative rate, falling a further 2.5%.

(Past performance is not a reliable indicator of future results)

The latest price data will be released on Saturday, March the 9th. Forecasters estimate that CPI rose 0.4% YoY in February - the first positive read since August 2023. Producer prices are expected to remain at -2.5%.

Market analysis: China A50

Recent efforts by the Chinese government to stabilise financial markets and stem outflows from the country’s assets have been successful. Authorities have implemented a range of measures, like banning the borrowing of stocks for short-selling, directing state-backed funds to buy equity ETFs, pumping additional liquidity into the banking system via the medium term funding facility, and lowering banks’ Reserve Requirement Ratio.

Although designed to reduce volatility and systemic risks, the assertive actions of Chinese policymakers has reduced risk-premia in the country’s equities and improved market sentiment. While still in a long-term downtrend, the China A50 has carved out a reverse head and shoulders pattern, with short-term momentum shifting to the upside. The index has recently broken out of a symmetrical triangle pattern, indicating a potential continuation of the upward move. However, it failed to push through the 200-day moving average at 12,100, with a potential level of short-term support around 11,900.

(Past performance is not a reliable indicator of future results)

All price information and forecast data in this article is sourced from Bloomberg