What is stock trading and how does it work?

Learn all about trading stocks, including the most-watched companies, potential trading strategies, and how to trade shares online via CFDs.

What is stock trading?

Stock trading – also known as shares trading – is the buying and selling of company shares with the aim of capturing gains from price movements. While we use the two terms interchangeably in this guide – ‘shares’ is the official name we use on our trading platform for the asset class.

Traders might buy or sell shares directly through a broker or share dealing account, or alternatively, via derivatives such as contracts for difference (CFDs). With CFDs, traders can take positions on both rising and falling markets without owning the underlying shares.

For example, if you believe the share price of Tesco plc will rise from 280p to 290p, you could open a ‘buy’ CFD position to profit if the price increases. Conversely, if the share price falls, you'd make a loss.

What types of stocks can you trade?

When trading stocks, you have access to a wide range of different companies, industries, and sectors via online stock trading platforms. Stocks are grouped into the following categories:

-

Blue-chip stocks: shares issued by companies with large market capitalisations, consistent revenues, and high liquidity – such as Apple, Microsoft, Unilever, Nestlé, and Shell.

-

Growth stocks: shares in companies expected to grow faster than the market average, often reinvesting earnings rather than paying dividends. Examples include Amazon, Tesla, and Nvidia.

-

Value stocks: shares that trade at prices considered low relative to their fundamental valuation, such as earnings, sales, or dividend yields – such as Coca-Cola and Procter & Gamble.

-

Dividend stocks: shares of publicly traded companies that regularly distribute a portion of their earnings to shareholders in the form of dividends. Examples include Johnson & Johnson, Altria, and ExxonMobil.

-

Penny stocks: low-priced shares, generally trading below £1 in the UK or $5 in the US, often associated with small, speculative companies – such as Imperial Petroleum and Akebia Therapeutics.

-

Initial public offerings (IPOs): where a private company offers shares to the public for the first time – explore our IPO trading hub if you’re keen to get involved even earlier in a company’s lifecycle.

Learn how to find the best dividend stocks in our best dividend stocks for traders guide.

How does stock trading work?

Stock traders speculate on price movements by analysing market conditions, aiming to profit from changes in share prices. For beginners, understanding these fundamentals is key for learning how to start stock trading.

Here’s how stock trading works:

‘Buy’ & ‘sell’ positions

You can open a buy position if you believe a stock’s price will rise, or a sell position if you expect it to fall. Sell positions may involve derivatives like CFDs, as you’re speculating on price declines without owning the actual shares. It’s important to remember sell positions carry higher risk, as losses could be substantial if prices rise.

Market sentiment and sector rotation

Market sentiment often shifts between different stocks and sectors due to factors such as economic cycles, geopolitical events, or industry trends. For instance, financial stocks such as Barclays and Lloyds can serve as bellwethers for overall economic health, while energy companies like BP and Shell typically move in response to global commodity prices, influencing trading decisions.

Liquidity and volatility

Liquidity refers to the ease of entering or exiting a trade quickly and with minimal price impact. Highly liquid stocks could have narrower spreads and reduced slippage risk. Less liquid stocks, such as smaller companies, may have wider spreads and increased trading risks.

Volatility describes the extent and speed of price movements. Higher volatility presents greater profit opportunities but also greater risks. Traders use fundamental and technical analysis to evaluate volatility when building strategies.

Trading fees

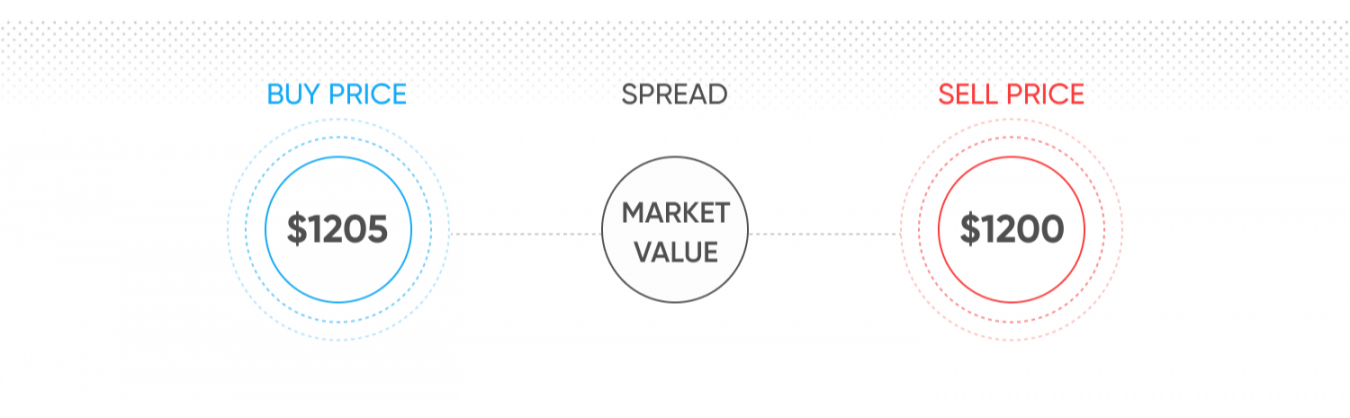

Be mindful of fees & charges when trading stocks, and how it might impact potential profits or losses – such as the ‘spread’ (the difference between the buy and sell price) and overnight funding rates. Other costs may include guaranteed stop-losses (GSLs), which ensure your position is closed at a set level, even if the market gaps.

Risk management

Risk management tools, when combined with an effective trading strategy, can help shield your stock positions from adverse price movements. Stock traders can use stop-loss orders to limit potential losses, and take-profit orders to lock in gains at a predefined price level.

What’s an example of stock trading?

Barclays Plc GBP CFD trade

Now imagine you decide to trade Barclays Plc using a CFD at a price of 190p.

Following analysis, you believe the share price will fall. You open a ‘sell’ CFD position on Barclays Plc for 2,000 shares, with a total notional value of £3,800 (2,000 x £1.90).

Again, you only need a 20% margin to open this trade, meaning you put down just £760.

Over a few hours, the Barclays share price increases by 15 points to 205p, and you decide to close the position.

You’ve incurred a loss of £300 (15 x 2,000 x £0.01), minus any overnight funding charge if applicable.

Conversely, had the price fallen by 15 points instead, you would have made a profit of £300 (15 x 2,000 x £0.01), before any charges.

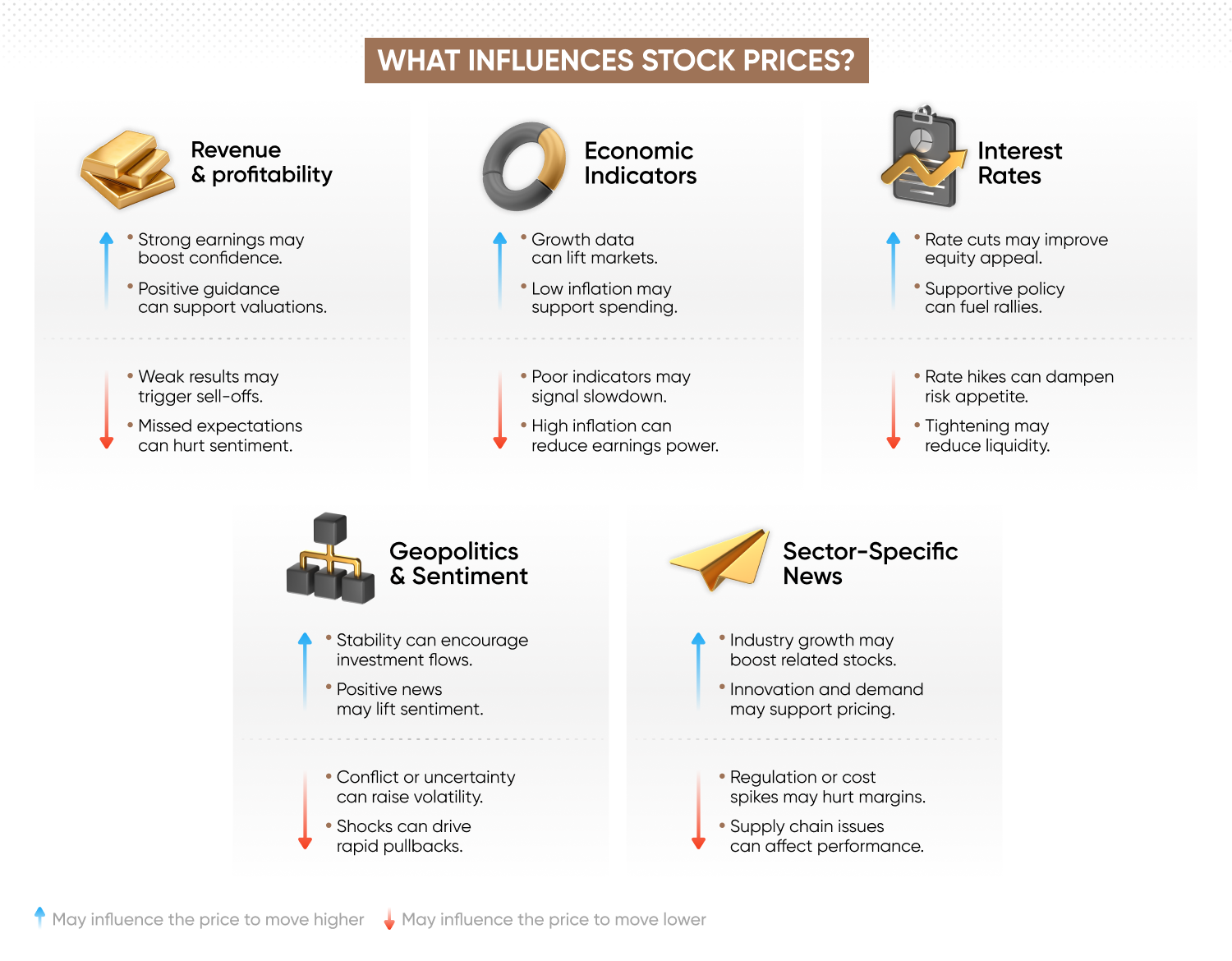

What influences stock prices?

Stock prices are influenced by factors that contribute to supply and demand, ranging from corporate earnings reports to global economic trends.

Revenue & profitability

Public companies release quarterly and annual earnings reports, providing insight into profitability, growth, and future expectations. Strong results can boost confidence and drive prices higher, while weaker-than-expected figures may lead to declines.

Economic indicators

The broader stock market can react to economic data releases, such as GDP, inflation, and employment figures. Economic indicators reflect the overall state of the economy, influencing sentiment and future expectations for corporate earnings and market growth.

Interest rates and monetary policy

Interest rates can influence borrowing costs, affecting business investment and consumer spending. Higher rates may reduce investor demand for equities, while lower rates can increase appetite for risk assets like stocks.

Geopolitics & sentiment

Global events, including elections, conflicts, and trade developments, can shift investor confidence, alter capital flows, and trigger volatility depending on perceived risk.

Sector-specific news

Developments in specific industries or changes in commodity prices could influence the prices of related stocks. Factors such as regulation, supply chain shifts, or input costs can affect company performance within a sector, influencing share prices accordingly.

What are the stock market trading hours?

Stock market trading hours vary by exchange and region, with most operating during regular business hours – Monday to Friday – except for holidays and exchange-specific maintenance windows. Learn more about world stock trading hours.

Here are the main trading hours for key global stock exchanges in coordinated universal time (UTC)*:

Summer trading hours:

|

Exchange |

Exchange hours* |

Our hours (via CFDs)** |

|

London Stock Exchange |

7:00am - 3:30pm |

Sunday 12:00am - Friday 9:00pm |

|

Frankfurt Stock Exchange |

7:00am - 3:30pm |

Sunday 12:00am - Friday 9:00pm |

|

New York Stock Exchange |

1:30pm - 8:00pm |

Sunday 12:00am - Friday 9:00pm |

|

NASDAQ Stock Market |

1:30pm - 8:00pm |

Sunday 12:00am - Friday 9:00pm |

|

Tokyo Stock Exchange |

12:00am - 6:00am |

Sunday 12:00am - Friday 9:00pm |

|

Hong Kong Stock Exchange |

1:30am – 8:00am**** |

Sunday 12:00am - Friday 9:00pm |

|

Australian Securities Exchange |

11:00am - 5:00am |

Sunday 12:00am - Friday 9:00pm |

Winter trading hours:

|

Exchange |

Exchange hours* |

Our hours (via CFDs)** |

|

London Stock Exchange |

8:00am - 4:30pm |

Sunday 12:00am - Friday 9pm |

|

Frankfurt Stock Exchange |

8:00am - 4:30pm |

Sunday 12:00am - Friday 9:00pm |

|

New York Stock Exchange |

2:30pm - 9:00pm |

Sunday 12:00am - Friday 9:00pm |

|

NASDAQ Stock Market |

2:30pm - 9:00pm |

Sunday 12:00am - Friday 9:00pm |

|

Tokyo Stock Exchange |

12:00am - 6:00am |

Sunday 12:00am - Friday 9:00pm |

|

Hong Kong Stock Exchange |

1:30am – 8:00am**** |

Sunday 12:00am - Friday 9:00pm |

|

Australian Securities Exchange |

12:00am - 6:00am |

Sunday 12:00am - Friday 9:00pm |

*Monday to Friday

**Daily break 9:00pm to 10:00pm

***Daily break 2:30am to 3:30am

****Daily break 4:00am to 5:00am

When trading share price movements via CFDs, you may be able to access extended hours depending on the asset and trading platform.

Get the latest shares trading hours on our stock market trading hours page.

Stock trading: What are the risks and benefits?

Stock trading involves both potential rewards and risks, influenced by factors such as volatility, leverage, and company-specific events.

Price volatility

Share prices can move sharply in response to earnings results, economic data, and wider market sentiment. While volatility can create trading opportunities, it also raises the risk of slippage, sudden losses, or stop-outs – particularly during periods of high uncertainty or unexpected news.

Diversification

Trading across multiple sectors or companies may reduce reliance on a single stock’s performance. However, during broader market sell-offs or global events, correlations between stocks can increase, limiting potential diversification benefits.

Leverage and margin

Stock trading via CFDs allows use of leverage, meaning you can gain full market exposure with a smaller upfront deposit. This can magnify profits on favourable moves, but also increases the risk of losses exceeding your initial margin if markets move against you.

Liquidity

Popular stocks – particularly of large-cap companies such as Apple or BP – exhibit relatively high trading volumes and narrower spreads. This supports more efficient trade execution. In contrast, small-cap or less frequently traded stocks may experience wider spreads and higher slippage.

Corporate risk

Stock prices are affected by company-specific developments such as profit warnings, management changes, or legal action. These risks are unique to individual firms and can significantly impact share performance, even if broader market conditions remain stable.

Dividends and corporate actions

Some companies distribute earnings as dividends, which can be reflected in ’buy’ CFD positions. However, dividend payments may be reduced or cancelled. Other actions – such as mergers, stock splits, or rights issues – may alter share value and affect open positions.

What are some stock trading strategies?

Stock trading strategies help to structure your approach to the market. Beginners in online stock trading might get started with a simpler strategy.

Trend trading strategy

Trend trading aims to capture sustained movements in a stock’s price. Traders identify upward (bullish) or downward (bearish) trends using tools such as moving averages or trendlines, entering trades in the direction of the trend and exiting when momentum shows signs of weakening.

Day trading strategy

Day trading involves opening and closing positions within the same trading day, aiming to profit from intraday price movements. Day traders typically rely on high liquidity and volatility, using short-term technical indicators to identify entry and exit points. Positions are not held overnight, helping to avoid exposure to after-hours news and gaps.

Swing trading strategy

Swing traders aim to profit from short- to medium-term price movements, typically holding positions for several days or weeks. This strategy focuses on identifying price swings within a broader trend, using chart patterns, support and resistance levels, and economic data releases to inform trades.

Position trading strategy

Position trading involves holding trades for longer periods – from several weeks to months or more – with the aim of capturing major price movements. This strategy relies heavily on fundamental analysis, including company performance, macroeconomic factors, and industry trends, potentially supported by long-term technical signals.

Discover more trading strategies on our comprehensive trading strategies page.

Need more support? Try our step-by-step stock course to guide you through the basics to the advanced concepts.

FAQ

What is stock trading?

Stock trading involves buying and selling shares in publicly listed companies, either directly or through derivatives. Traders aim to profit from price movements, either by purchasing shares outright or speculating on price direction using derivatives such as CFDs.

What is the meaning of stock trading?

‘Stock trading’ is the activity of trading company shares on a stock exchange or trading platform. Traders use technical and fundamental analysis to predict price movements and take a ‘buy’ or ‘sell’ position accordingly.

How do stock traders make money?

Stock traders aim to make money by buying shares at a low price and selling them at a higher one – or by short-selling, selling at a higher price and buying back lower, often via derivatives like CFDs. With CFDs profits (or losses) are based on the difference between the opening and closing price of a position.

What is a real life example of a stock?

Apple Inc. (AAPL) is a real-world example of a company listed on a major stock exchange – the NASDAQ Stock Market. Its share price is influenced by product launches, earnings reports, and broader tech sector trends. You can trade Apple shares directly, or speculate on their price using CFDs.

Curious about trading other assets?

We offer access to the most popular financial markets in the world.Forex trading

Find out more about the world’s most-liquid market and why so many people trade it.

Commodity trading

Why are gold and oil considered important markets? Find out more about these and other commodities.

Indices trading

Learn all about index trading, a popular way for traders to gain broad exposure to shares.