零佣金交易

黃金、港股 50、USD/JPY 等熱門 CFD 交易。零佣金超低點差——黃金低至 0.3 點,香港 50 低至 5 點。

本平台由巴哈馬證券委員會 (SCB) 授權並監管

黃金、港股 50、USD/JPY 等熱門 CFD 交易。零佣金超低點差——黃金低至 0.3 點,香港 50 低至 5 點。

本平台由巴哈馬證券委員會 (SCB) 授權並監管

展示我們的 4 星和 5 星好評。為遵守 GDPR 要求並保護用戶隱私,用戶的具體資料已被匿名處理

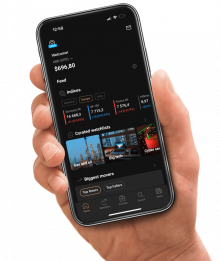

全面且完善的服務、專業工具與優質資源,助您持續提升交易技能。

利用 100+ 種技術指標、直觀圖表和繪圖工具,助力市場分析。

在精選市場以低按金掌控更大交易頭寸。杠杆不僅能提升盈利潛力,也會加大虧損風險。可能存在杠杆限制。

我們的專業團隊提供全天候支援服務,隨時為您答疑解惑。

時刻關注您最愛資產的價格走勢,把握市場機遇,優化交易策略。

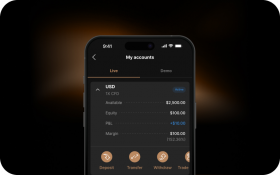

根據我們 2024 年的內部伺服器數據,99% 的出金請求在 24 小時內處理完畢。

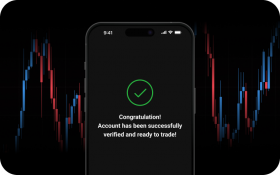

選擇 Capital.com,開啟您的交易之旅。

零風險體驗交易,輕鬆積累實戰經驗。

享受專業且友好的全天候客戶支援服務。

靈活設定交易規模,優化資金管理,穩健掌控風險。

使用止蝕單1在市場走勢對您不利時及時止蝕。

1止蝕可能無法保證執行