Roku stock forecast: Streaming pioneer outlines its vision?

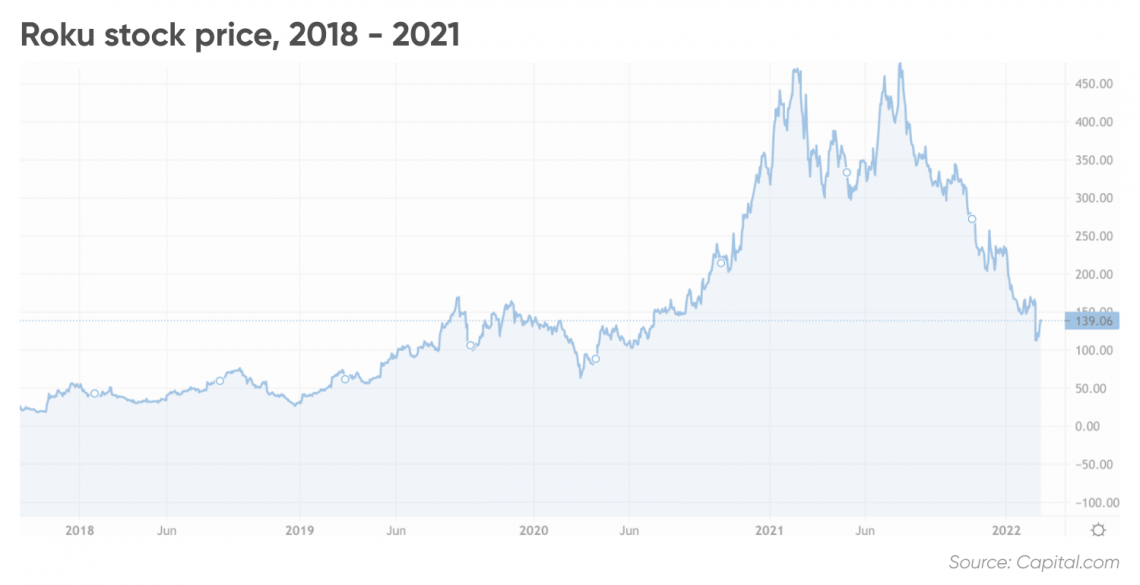

Television streaming pioneer Roku (ROKU) has seen its stock price fluctuate wildly over the past couple of years while the world has wrestled with Covid-19.

The US company, which celebrates its 20th anniversary later this year, makes a variety of digital media players, runs an advertising business, and licences its hardware and software.

But while shares benefited hugely during the first year of the pandemic as people stayed at home, supply chain issues and antipathy towards growth stocks have since taken their toll.

In this article, we take a look at the company’s insistence that it has a competitive advantage in what it believes will be a streaming boom and at what factors will shape the Roku share price forecast in 2022.

Roku stock soared during the first year of Covid-19, increasing 515% from $76 in March 2020 to $467.31 in the middle of February 2021. However, it’s had a tougher time more recently with the stock price down more than 70% since last summer – and 42% since the start of this year.

A strong year for the business

Roku’s total net revenue grew 55% year over year in 2021 to $2.76bn, according to a shareholder letter accompanying its fourth-quarter results.

Gross profit was up 74% year on year to $1.4bn, while active accounts reached 60.1 million, a net increase of 8.9 million from the fourth quarter of 2020.

Streaming hours increased by 14.4 billion hours, year-on-year, to 73.2 billion, while the average revenue per user (ARPU) climbed 43% to $41.03.

The company went on to say that 2021 had been another strong year with record results achieved in revenue, gross profit, adjusted earnings before interest, taxes, depreciation and amortisation (EBITDA), and ARPU.

Reaction to the results

According to Danni Hewson, financial analyst at AJ Bell, Roku’s fourth-quarter results “didn’t paint a pretty picture” for investors expecting the growth story to continue.

“Revenue came in below expectations as the business got caught up in the mire of supply-chain issues that impacted production of TVs that snap up its operating systems at exactly the same time some would-be advertisers were trimming budgets,” she told Capital.com.

While acknowledging the company is doing well, Hewson suggested investors may query whether it warrants its “rather inflated” valuation.

“Is the market now simply too saturated, that the opportunity for mega growth is no longer available and in fact keeping subscribers happy will come with an ever-increasing cost?”

Will all television be streamed in the future?

Roku is very optimistic about the future and has predicted all television – and television advertising – will be streamed.

“Almost every major media company is reorienting its business around streaming and has launched a flagship service, spending billions on content and marketing to attract and retain subscribers,” it stated in its fourth quarter shareholder letter.

However, it noted the world was still in the early days of the secular shift to streaming, with a “significant gap” existing between viewership and ad budgets.

“Our competitive advantages – the Roku operating system, the Roku Channel, and our ad platform – position us strongly to continue leading this shift in the years ahead,” it added.

Roku’s letter also outlined its plan to continue to “invest aggressively in all our strategic initiatives”, to drive growth and enhance our competitive differentiation.

“We have an enormous opportunity ahead of us around the world,” it stated. “Time spent on TV streaming is increasing but is not yet equivalent to time spent on legacy TV, and ad budgets still significantly lag TV streaming viewership.”

What are the potential problems?

On the downside, it also predicted ongoing supply-chain disruptions will continue to affect the global economy, the broader consumer electronics space and, in particular, the TV industry.

“Overall TV unit sales are likely to remain below pre-Covid levels, which could affect our active account growth,” it warned.

Currently, its quarter one outlook predicts total net revenue of $720m, up 25% year over year, anticipated total gross profit of roughly $360m, and adjusted EBITDA of $55m.

“The global shift to TV streaming remains intact and, along with our competitive advantages, will continue to drive our business in 2022 and the years ahead,” it added.

Roku stock forecast 2022-2025

Roku stock had a consensus buy rating based on the consensus views of 26 analysts compiled by MarketBeat as of 25 February 2022. According to the site, 20 of the analysts rated the stock as a buy, while one had it as a hold and five had sell recommendations.

The consensus 12-month Roku stock price target was $272.80, with the price target ranging from a high of $500 to a low of $95.

Roku stock is an “awesome long-term (one year) investment”, according to the algorithm-based forecasting service Wallet Investor at the time of writing (25 Ferbaury 2022).

Its long term forecast for Roku stock predicted the share price could hit $272.69 by February 2024, $345.51 by February 2025, and $418.59 the following year. According to its five-year Roku forecast, the price could reach $476.82 by February 2027.

Please note that Roku price predictions can be wrong. Forecasts shouldn’t be used as a substitute for your own research. Always conduct your own due diligence before investing. And never invest or trade money you cannot afford to lose.

Analyst views on Roku

Neil Macker, senior equity analyst at Morningstar, attributes recent share price weakness to “weak 2022 revenue growth guidance” of 35% – well below the 55% mark posted in 2021.

“Management also noted that the firm expects to ramp up operating expense spending that was pulled back in 2021 due to COVID-19 uncertainties,” he wrote in a broker note.

He pointed out that management expects 2022 adjusted EBITDA to be flat with 2020 on an absolute basis, implying a $300m drop from 2021.

“While we view the EBITDA guidance as conservative, we are slashing our fair value estimate to $150 from $195 to account for lower top-line growth and much slower margin expansion,” he said.

Macker is also sceptical about management’s belief that the firm’s investment in more headcount and the development of RokuOS will drive greater future revenue growth.

“The landscape for streaming devices and software is very competitive, with many players having much deeper pockets,” he said.

“Additionally, we expect Google and Amazon to remain very aggressive in both pricing and incentives to lure TV manufacturers over to their operating systems, which Roku may try to match.”

Macker also warned the continued investment in content may backfire as the streaming landscape contains many participants from both media and tech businesses that are ramping up their content spending.

“We expect the player segment gross margin will remain negative in 2022 as both the chip shortage and higher shipping costs will persist,” he added.

“Roku will be unable to raise prices against aggressive competition from both Amazon and Google.”

However, Cory Carpenter, an analyst at JP Morgan, believes Roku is well-positioned as TV viewing increasingly shifts to streaming.

“Our bull thesis is largely driven by what we believe to be Roku’s significant advertising opportunity, with streaming accounting for 45% of TV viewing time for 18 to 49 year olds in the US, but only an estimated 18% of TV ad budgets,” he said.

Please note that analyst can and do get their predictions wrong. Always conduct your own due diligence before investing. And never invest or trade money you cannot afford to lose.

Is Roku a good stock to buy?

Whether Roku stock is a suitable investment for you will depend on your opinion of the company and your personal investment objectives. You will also need to research the stock and use this information to decide whether it meets your needs.

Should I buy Roku stock?

That will be up to you. The consensus recommendation from analysts compiled by MarketBeat was a buy at the time of writing (25 February), but it’s important to remember that markets are volatile and past performance of the stock does not guarantee future gains.

Markets in this article