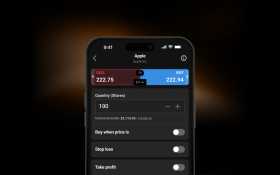

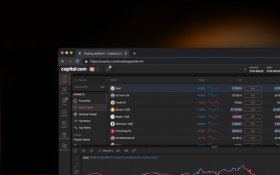

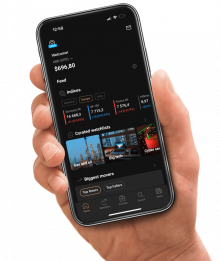

Tradez avec un courtier mondial de confiance

Rejoignez une communauté de plus de 740 000 traders du monde entier. Nos clients nous font confiance au point qu' ils ont négocié plus de 1 000 milliards de dollars sur notre plateforme.

Autorisé et réglementé par la Securities Commission des Bahamas (SCB)