Australia Labour Force and Wages Data Preview: Stable Jobs and Slowing Wages Support RBA Cut Case

Australia’s labour market and wages data for the March quarter and April month are set to take centre stage this week, with implications for the Reserve Bank of Australia's (RBA) upcoming interest rate decision on May 20.

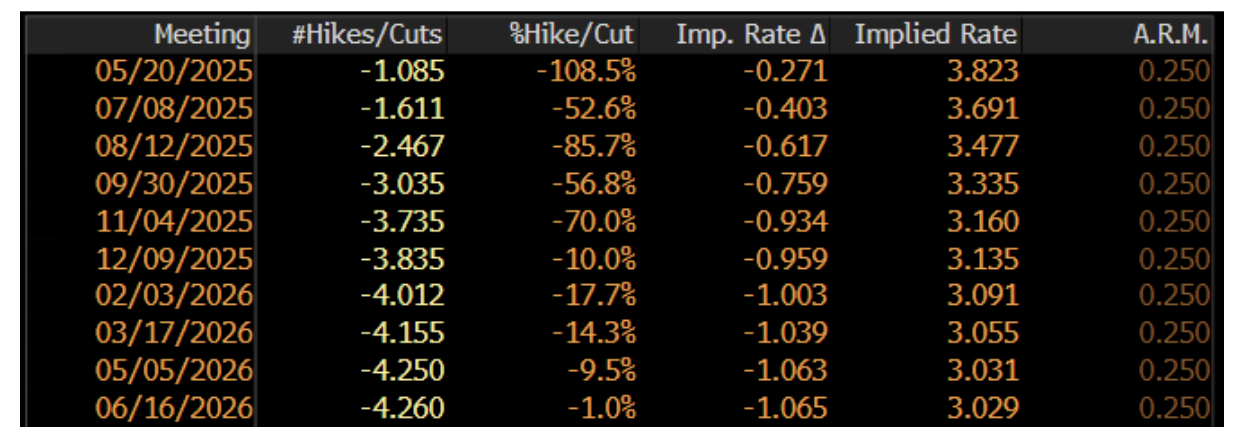

Markets are fully pricing in a 25 basis point cut, and confirmation of stable employment conditions and subdued wages growth could give the RBA the green light to ease further.

Jobless rate tipped to remain steady

The April Labour Force Survey, due Thursday, is expected to show that the unemployment rate remains steady at 4.1%, with consensus pointing to a 20,000 increase in employment. While this headline figure suggests a still-resilient labour market, it's notably below the level needed to offset strong population growth—a point that could flag underlying labour market slack if confirmed by a softening in the participation rate.

Despite high interest rates, the labour market has remained one of the more robust components of Australia’s economic landscape. However, household consumption is soft, GDP growth has stagnated—driven by a long-running per capita recession—and leading indicators such as job ads and hours worked have begun to soften. A downside surprise in employment could reinforce the view that the jobs market is gradually losing momentum.

Wage growth seen as moderate, low risk to inflation

Of greater importance for the RBA will be the March quarter Wage Price Index (WPI), also due this week. Market expectations are for wages growth to remain at 3.2% year-on-year—unchanged from the previous quarter and well below the cycle high of over 4% in early 2023. The figure is expected to confirm that labour market tightness is no longer putting upward pressure on wages, reducing the risk of a wage-price spiral.

This moderation in wage growth, particularly when combined with cooling inflation—now back within the RBA’s 2–3% target band—gives the central bank more flexibility to support the economy without stoking new inflation risks.

Markets price in a May rate cut

Markets are fully pricing a 25 basis point cut at the May meeting, which would bring the cash rate down to 3.85%—the second move lower in this easing cycle following February’s initial cut. While some uncertainty remains over the timing of further policy easing, the key determinant is whether incoming data validate the view that economic slack is building and inflation pressures are sustainably easing.

If the employment and wage figures meet expectations—indicating a stable yet gradually softening labour market—the RBA will likely feel comfortable delivering another rate cut. However, any significant upside surprise, especially in job creation, could water down expectations and push the next move further out.

(Source: Bloomberg)

Conclusion: The final hurdle to confirm rate cut

In the context of weakening global demand, elevated borrowing costs, and persistent softness in domestic consumption, the upcoming data will be pivotal in determining the RBA’s room to manoeuvre. If the labour market continues to cool and wages remain contained, the case for further easing will only strengthen—particularly as the economy continues to absorb the deflationary shock of slower global growth and trade uncertainty stemming from U.S. tariffs.