A key driver behind the gold sell-off has been the strength of the U.S. dollar which was given fresh impetus following the Fed’s hawkish ‘higher for longer comments’ at the latest FOMC meeting.

Marks & Spencer reported strong growth in both its Food and Clothing & Home businesses for the first 19 weeks of the financial year. Food sales increased by over 11%, driven by price changes, while Clothing & Home sales grew by more than 6%, primarily due to in-store growth. Despite economic uncertainties, the company expects significant improvements in full-year profit growth and half-year results compared to previous expectations of modest revenue growth.

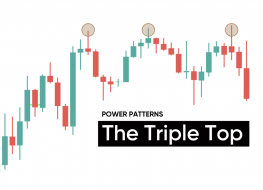

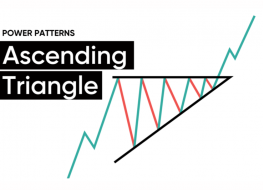

Welcome to Part 5 of our 7-part Power Patterns series. In this series, we'll be equipping you with the skills to trade some of the most indicative price patterns which occur on any timeframe in every market.

USDJPY’s powerful long-term uptrend has been reignited after last week’s sharply contrasting policy statements from the Federal Reserve and Bank of Japan.

EUR/USD is currently testing a key support level after the Federal Reserve indicated a potential extension of higher interest rates.

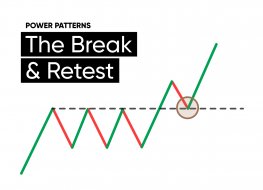

Welcome to Part 4 of our 7-part Power Patterns series where we delve into the Break & Retest pattern—a strategic approach to navigating breakout trades. If you've wrestled with the frustration of false breakouts, incorporating this pattern into your trading toolkit may help you overcome this challenge and put you on the path to becoming a more confident and consistent trader.

It’s a big week for Cable (GBP/USD) as both the Federal Reserve and the Bank of England are set to make crucial rate decisions.

In prior technical outlooks, we highlighted the importance of staying alert in sleepy markets, and last Thursday’s developments on the FTSE 100 serve as a prime illustration of this principle.

Tesla's share price gapped higher on Monday after investment bank, Morgan Stanely said Tesla’s supercomputer, known as Dojo had the potential to boost its market cap by $600 billion.

Welcome to Part 3 of our 7-part Power Patterns series. When it comes to powerful price patterns, the bearish engulfing pattern is right at the top of the list. It provides traders with a clear and decisive signal that sellers have taken control of the market.

Cable (GBP/USD) has been staircasing lower since mid-July and carving out a powerful downtrend on the 4hr candle chart

Last week’s price action saw gold break and close below the small ascending channel which had formed during the final week of August.

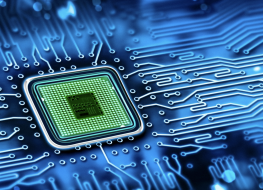

Nvidia, the chip manufacturer, has unquestionably been the standout stock of the year, driven by the increasing demand for its 'supercomputer' chips that are playing a key role in the AI revolution.

Welcome to Part 2 of our 7-part Power Patterns series. In this series, we'll be equipping you with the skills to trade some of the most powerful price patterns which occur on any timeframe in every market.