What is EUR/USD, and how do you trade it?

Go to market page

What is EUR/USD?

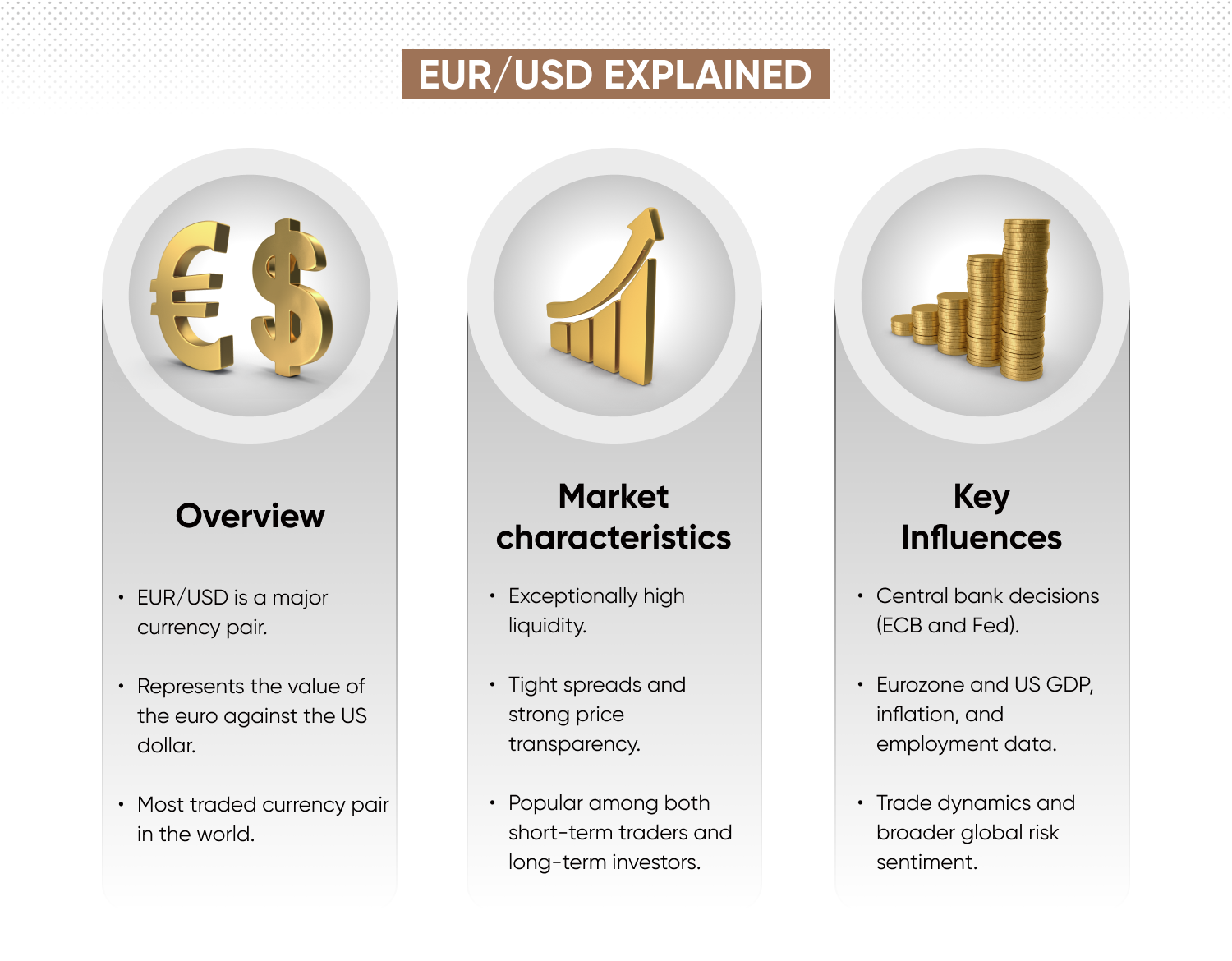

EUR/USD represents the exchange rate between the euro (EUR) and the US dollar (USD). It is the most actively traded forex pair globally, reflecting the economic relationship between the eurozone and the US.

Due to its massive trading volume, high liquidity, and tight spreads, EUR/USD is a preferred pair for traders around the world. It often responds to central bank announcements, economic data, and geopolitical developments from both regions.

The pair is known for strong trends and technical behaviour, making it suitable for various trading strategies and timeframes.

Learn more in our comprehensive trader’s guides

-

The role of central banks in forex

Why trade EUR/USD?

EUR/USD offers traders several compelling features:

-

Liquidity and volume – as the world’s most traded pair, EUR/USD often has the tightest spreads and deepest order books.

-

Volatility with structure – it combines liquidity with frequent but relatively predictable price moves.

-

Clear economic correlation – EUR/USD reacts sensitively to eurozone and US economic data and monetary policy.

-

Consistent patterns – the pair tends to respect technical levels, supporting chart-based strategies.

Past performance doesn’t guarantee future results.

Potential risks of EUR/USD

-

Sharp moves on economic news – sudden price changes around central bank announcements or inflation data can lead to slippage.

-

Currency correlation risk – EUR/USD may react to movements in related pairs like USD/JPY or EUR/GBP.

-

Global sentiment shifts – broader market fears (e.g., during crises) often drive capital into or out of the US dollar, impacting EUR/USD significantly.

Use risk management tools such as stop-loss and take-profit orders to help mitigate downside risk.

What moves the EUR/USD price?

EUR/USD, the most traded currency pair in the world, is influenced by a wide range of economic, political, and market-related factors. Understanding what drives EUR/USD price movements is key for identifying trading opportunities and managing risk.

Interest rate decisions (ECB and Fed)

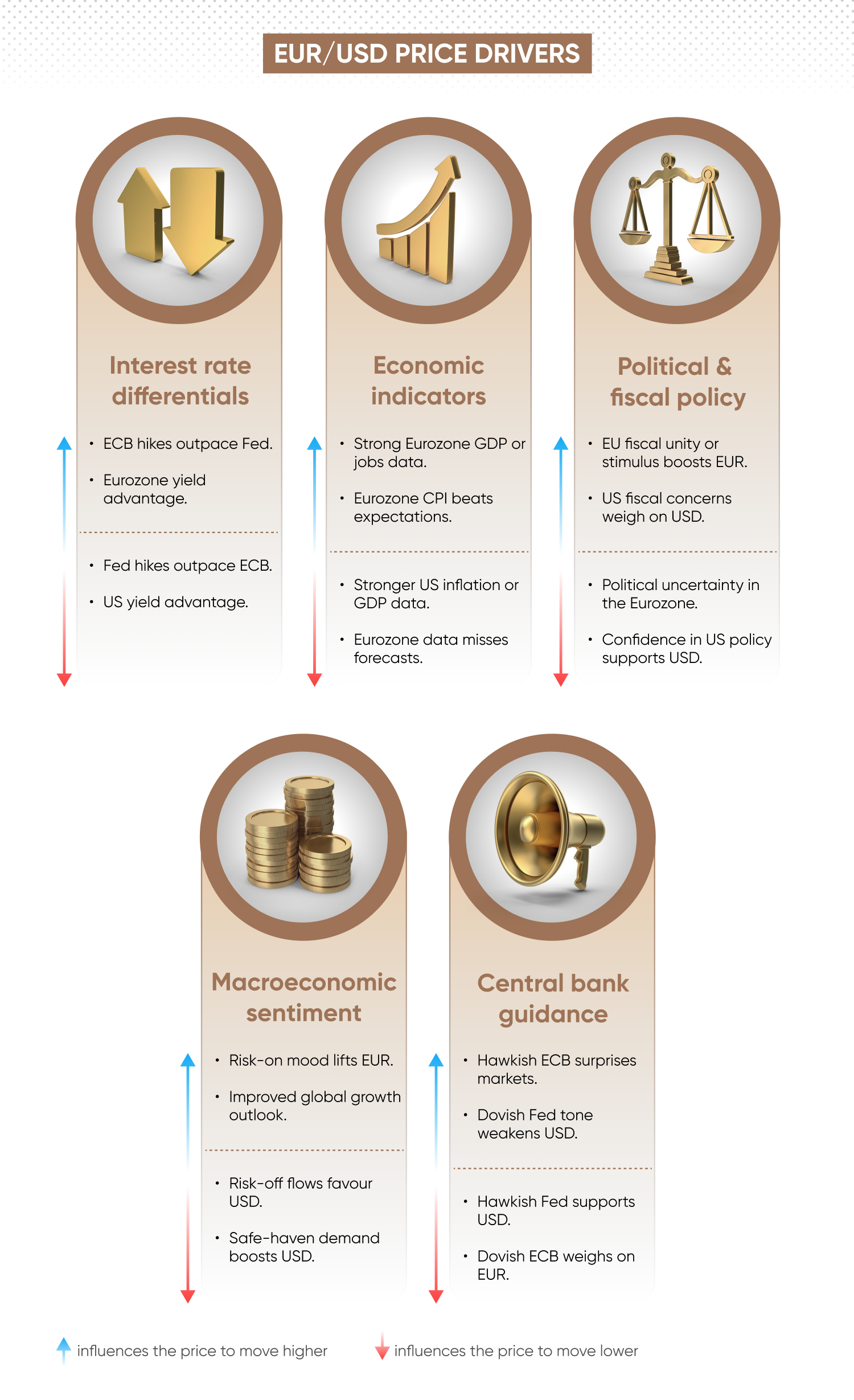

Interest rates set by the European Central Bank (ECB) and the US Federal Reserve (Fed) are among the most important drivers of EUR/USD.

When one central bank raises rates while the other holds steady or cuts, the relative yield advantage can lead to significant shifts in demand. For example, if the Fed hikes while the ECB remains dovish, EUR/USD may fall as investors favour the higher-yielding US dollar. Conversely, hawkish signals from the ECB could strengthen the euro.

Markets also closely follow official statements, press conferences, and meeting minutes for signs of future policy changes.

Economic indicators

Economic data from both the eurozone and the US has a direct impact on EUR/USD volatility.

Important indicators include inflation, measured by the consumer price index (CPI), GDP growth, employment data (such as US non-farm payrolls and eurozone unemployment), retail sales, and purchasing managers’ indices (PMIs). These releases influence expectations for monetary policy and economic strength, leading to shifts in the exchange rate.

A strong US jobs report, for instance, may fuel rate hike expectations and lift the USD, weakening EUR/USD.

Political developments and events

EUR/USD is sensitive to political events that affect either region’s economic outlook or investor confidence.

Eurozone politics – such as national elections, EU budget disputes, or debt concerns – can affect the euro’s stability. Similarly, developments in US fiscal policy, trade negotiations, or government shutdowns can influence the USD. Broader geopolitical tensions, including conflicts involving EU or US allies, may also cause volatility.

Traders often respond swiftly to unexpected headlines, with sharp price movements during uncertain or unstable periods.

Risk sentiment and global trends

EUR/USD often reflects global risk appetite, especially during periods of market uncertainty.

In ‘risk-on’ environments, such as during economic recovery or optimism about growth, traders and investors may favour the euro and other risk-sensitive currencies. In contrast, during ‘risk-off’ periods marked by financial stress or geopolitical tension, the US dollar may potentially strengthen as a safe-haven asset.

For example, during the early stages of the COVID-19 pandemic, global demand for USD surged, driving EUR/USD sharply lower.

Trade balances and capital flows

Trade and investment flows between the eurozone and the United States can influence EUR/USD direction.

A eurozone trade surplus may support the euro, while large US deficits can weigh on the dollar over time. Cross-border capital movements – such as foreign purchases of US Treasury bonds or European equities – also affect demand for each currency and, in turn, the exchange rate.

Shifts in global asset allocation or changes in investor preferences between US and eurozone assets can lead to price movements in EUR/USD.

Central bank speeches and guidance

Markets closely monitor speeches, interviews, and statements from central bank officials for clues about future monetary policy.

Even outside official rate decisions, comments from ECB or Fed members can move markets. Hawkish rhetoric may signal upcoming tightening, while dovish commentary might indicate a more cautious stance. Forward guidance, especially around inflation targets or economic risks, often shapes trader expectations and positions.

These signals can cause immediate and sometimes outsized moves in EUR/USD, especially if they diverge from market consensus.

How to trade EUR/USD CFDs with us

Trading EUR/USD contracts for difference (CFDs) on our platform is quick and intuitive once your account is approved. Just follow these steps:

- 1. Create an account and complete verification.

- 2. Search for ‘EUR/USD’ in our CFD instrument list.

- 3. Select your trade parameters – size, leverage, stop-loss, take-profit

- 4. Practise on demo to test strategies with virtual funds.

- 5. Place a real trade when ready – buy (if expecting a rise) or sell (if expecting a fall).

- 6. Manage your position using our platform’s real-time tools and alerts

Our web platform and mobile app are equipped with professional charting, a wide range of technical indicators, sentiment tools, and 24/7 customer support when you need assistance.

Ready to start trading EUR/USD? Try a demo account to experience our platform first-hand.

What are some EUR/USD trading strategies?

Whether you’re chasing short-term moves or trading the broader macro picture, EUR/USD offers a variety of strategic approaches. Here are a few common ways traders look to capitalise on its price movements:

-

Trend trading – many use indicators like moving averages and RSI to follow EUR/USD momentum, entering on retracements within a trend.

-

Breakout trading – identify key levels and trade breakouts during high-volatility sessions, often around ECB or Fed announcements.

-

Range trading – buy low/sell high during quieter periods, especially when EUR/USD is consolidating.

-

Macro trading – take a broader view and trade based on diverging monetary policy or economic performance between the US and eurozone.

Explore more in our shares trading guide and on our trading strategies page.

What are EUR/USD’s forex trading hours?

EUR/USD trades 24 hours a day, five days a week, in line with global forex markets. Activity peaks when London and New York sessions overlap – a period that often delivers the highest liquidity and tightest spreads.

Key market sessions for EUR/USD(UTC):

|

Session |

Summer (UTC) |

Winter (UTC) |

|

London |

7:00am to 4:00pm |

8:00am to 5:00pm |

|

New York |

12:00pm to 9:00pm |

1:00pm to 10:00pm |

Most active hours: 12pm-4pm UTC (summer) / 1pm–5pm UTC (winter).

For detailed, up-to-date forex trading hours, visit our dedicated forex trading hours page.

FAQ

Is EUR/USD good for beginners?

EUR/USD is often considered one of the most beginner-friendly currency pairs. Its deep liquidity and tight spreads could help minimise trading costs, and there’s a wealth of educational material and analysis available. However, it’s important to be cautious during major news events, as price swings can be sharp and unpredictable.

When’s the best time to trade EUR/USD?

The most active period is during the London–New York session overlap, typically from 12pm to 4pm UTC in summer and 1pm to 5pm UTC in winter. This window offers the highest liquidity and volatility, making it ideal for short-term traders looking for tighter spreads and more trading opportunities.

What’s the average EUR/USD spread?

EUR/USD typically has some of the lowest spreads in forex, often under 1 pip during peak trading hours. That said, spreads can widen significantly during off-peak times, low-liquidity periods, or around major economic announcements, so timing your trades matters.

How do interest rates affect EUR/USD?

Interest rate decisions are a major driver of EUR/USD. When the Federal Reserve raises rates, it often strengthens the USD by attracting capital flows. Similarly, ECB rate hikes can support the euro. Traders closely monitor central bank statements and economic indicators to anticipate potential shifts in policy.