What is EUR/CHF (Euro-Swiss franc pair), and how do you trade it?

Discover what EUR/CHF is, what moves its price, trading strategies, and how to trade the pair using CFDs.

What is EUR/CHF?

EUR/CHF is a forex trading pair that shows the exchange rate between the euro and the Swiss franc (CHF) – the official currency of Switzerland – indicating how many francs equal one euro.

Monetary policies, including interest rate decisions from the European Central Bank (ECB) and Swiss National Bank (SNB), influence the EUR/CHF exchange rate. As a result, euro-to-CHF is closely monitored by traders, analysts and market experts to gauge and speculate on economic shifts between the eurozone and Switzerland.

Learn more in our comprehensive trader’s guides

Why trade EUR/CHF?

EUR/CHF measures the value of the euro against the Swiss franc – representing the relative performance of the eurozone’s economic data with the Swiss franc’s historical stability. The unique relationship between these two currencies can reveal distinct trading setups.

-

Policy divergence: alterations in European Central Bank (ECB) policy may lead to discernible movements, while the Swiss National Bank (SNB) often acts pre-emptively or independently – influencing price direction in unexpected ways.

-

‘Safe-haven’ Swiss franc: CHF has historically strengthened during periods of geopolitical stress or market risk aversion, driven by investor demand for perceived safety, making EUR/CHF a barometer for regional and global sentiment shifts.

-

Lower volatility: historically, EUR/CHF has exhibited moderate price fluctuations – potentially suitable for range-based strategies in calmer markets.

-

Eurozone exposure with CHF stability: the combination of varied eurozone economic data and the stability of the Swiss franc indicates a mix of cyclical opportunity and risk mitigation.

-

Consistent liquidity: EUR/CHF has historically presented reliable liquidity during key European sessions with competitive spreads.

As with all forex pairs, past performance does not guarantee future results, and EUR/CHF remains subject to economic and policy shifts.

Potential risks of trading EUR/CHF in forex

Despite its historically steady profile, EUR/CHF may experience sudden price movements under certain conditions.

-

Policy divergence: shifts in ECB policy or differing rate paths may cause abrupt moves in the pair, requiring attentive risk management.

-

SNB interventions: while often signalled in advance, surprise action by the Swiss National Bank can trigger sudden volatility.

-

Market sentiment: as a traditional safe-haven currency, the CHF can strengthen rapidly during periods of geopolitical or financial stress, pressuring the EUR/CHF rate.

-

Price volatility: although generally less volatile, the pair can experience sharper swings around key economic releases or monetary policy decisions.

Trading strategies, supported by tools like stop-loss and take-profit orders, are essential to help manage exposure when trading EUR/CHF via CFDs.

Discover forex market price drivers and more on our market analysis page.

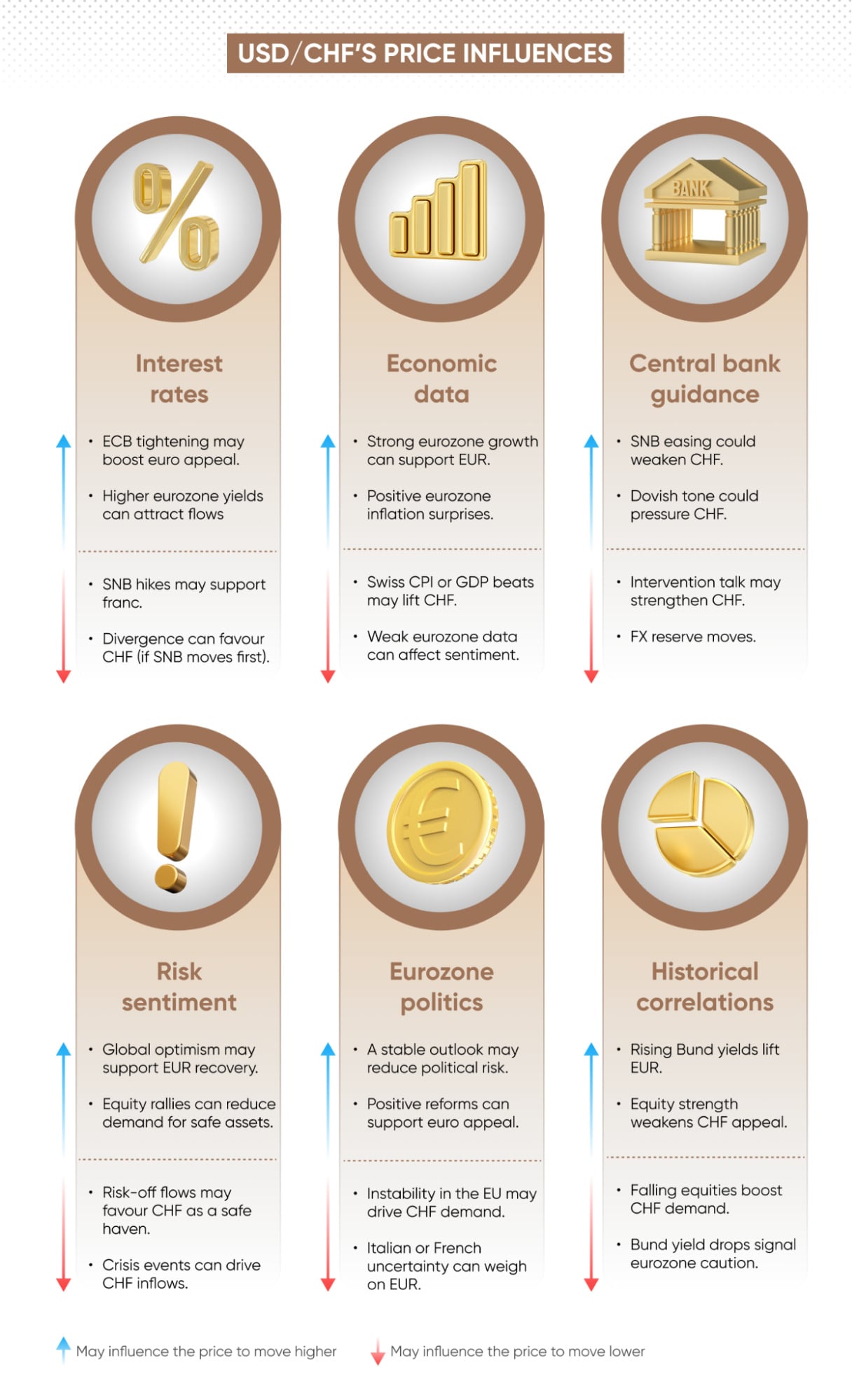

What influences the EUR/CHF rate?

The EUR/CHF rate (or Swiss franc to euro exchange rate) is driven by a combination of regional monetary policies, economic data, and market sentiment

Monetary policy divergence

The EUR/CHF rate is sensitive to the policy stances of both the European Central Bank (ECB) and the Swiss National Bank (SNB), including interest rate adjustments. For instance, expectations of monetary tightening by the ECB may support the euro, whereas SNB actions – such as rate cuts or currency interventions – may weaken or strengthen the franc depending on policy goals.

Macroeconomic data releases

Key economic indicators – such as inflation, GDP and employment figures – from the eurozone and Switzerland significantly influence EUR/CHF. Surprise data from either region may trigger market adjustments.

Safe-haven demand for Swiss franc

The Swiss franc is considered a traditional safe-haven currency. During periods of global uncertainty or risk aversion – such as geopolitical tensions, financial instability, or equity market drawdowns – CHF could appreciate, pushing EUR/CHF lower. In contrast, when risk appetite returns, the EUR/CHF rate might rise as flows rotate out of defensive assets.

Cross-asset correlations

EUR/CHF can respond to movements in related markets, including German Bund yields, gold, or broader equity indices, reflecting its integration with broader financial markets.. A sharp rally in European equities may weaken demand for the Swiss franc, while falling Bund yields can reduce euro support by signalling a more dovish policy outlook.

Discover forex market price drivers and more on our market analysis page.

What are some top EUR/CHF trading strategies?

EUR/CHF strategies provide a structured approach, allowing for short, medium, and longer-term trading styles.

-

Range trading: when ECB and SNB policies are relatively aligned, the pair may trade within a defined range. Range traders could use technical indicators, such as RSI or moving averages to identify support and resistance levels.

-

Mean reversion: assumes EUR/CHF tends to return to its average price over time. Traders use indicators like Bollinger Bands (which incorporate the 20-day SMA)to identify overstretched levels and potential reversal setups.

-

Day trading: focuses on short-term intraday price moves, often around economic data or European market opens. Although EUR/CHF is generally less volatile than many pairs, day traders may use real-time charts, technical indicators and strict risk controls to capture minor moves.

Explore more about shares trading in our shares trading guide and on our trading strategies page.

What are EUR/CHF’s forex trading hours & market overlaps?

EUR/CHF trades 24 hours a day, five days a week, in line with global forex market hours.

Liquidity is highest during active eurozone sessions, notably when Zurich and Frankfurt markets are both active, typically from 6am to 2pm UTC in summer and 7am to 3pm UTC in winter. Furthermore, other eurozone centres may also contribute to trading volume during these periods.*

Major trading sessions for the EUR/CHF forex pair:

|

Session |

Summer (UTC) |

Winter (UTC) |

|

Zurich |

6am to 2pm |

7am to 3pm |

|

Frankfurt |

6am to 2pm |

7am to 3pm |

|

London** |

7am to 4pm |

8am to 5pm |

This session timing highlights the role of eurozone economic releases and political developments in influencing liquidity and price levels.

For a full overview of trading hours, visit our forex trading hours page.

*Session overlaps and volatility patterns are based on historical averages and may vary.

**London, though not part of the eurozone, remains influential due to its integration with European markets.

How to trade EUR/CHF CFDs with us

Trade EUR/CHF with contracts for difference (CFDs) on our web platform or mobile apps. Once verified, you can begin trading the euro-Swiss franc pair in minutes.

- 1. Open a trading account and complete the verification process.

- 2. Select ‘EUR/CHF’ from our list of forex CFDs

- 3. Set trade parameters, including position size, leverage, stop-loss, and take-profit levels.

- 4. Place your trade based on your market view and chosen strategy.

- 5. Buy or sell? Go long if you expect EUR/CHF to rise, or short if you expect it to fall

- 6. Manage your position using our real-time charts, technical indicators, and custom alerts.

Our trading platform features advanced charting and analytical tools designed to facilitate an objective assessment of eurozone and Swiss economic data.

Start trading EUR/CHF CFDs today – open a demo account to explore the pair in live market conditions.

FAQs

What is the EUR/CHF forex pair?

EUR/CHF represents the exchange rate between the euro and the Swiss franc – indicating the number of francs (CHF) required to purchase one euro (EUR). It objectively demonstrates the contrast between the varied economic landscape of the eurozone and Switzerland’s conservative monetary system.

What currency is CHF?

CHF is the official currency code for the Swiss franc – the national currency of Switzerland. Known for its historical stability and safe-haven appeal, the franc is issued and regulated by the Swiss National Bank (SNB). The code derives from 'Confoederatio Helvetica' – the Latin name for Switzerland – combined with 'F' for franc, following ISO standards. Iit is commonly traded in forex markets, including in pairs such as CHF to GBP, and USD to CHF.

Is EUR/CHF a good pair for beginners?

EUR/CHF may suit market participants with some experience in forex trading due to its moderate volatility and reliable liquidity during peak European trading hours. However, beginners should be aware of its sensitivity to eurozone policy changes and ensure robust risk management.

When is the best time to trade EUR/CHF?

The pair typically exhibits its highest liquidity during the early European sessions, particularly during core European trading hours, which may vary slightly during summer and winter due to daylight saving adjustments.

How volatile is EUR/CHF compared to EUR/USD?

EUR/CHF generally displays lower volatility than EUR/USD, reflecting the stabilising influence of the Swiss franc. Although price movements are typically more subdued, objective technical strategies may identify trading opportunities within this environment.