Dogecoin price prediction: Third-party outlook

Dogecoin (DOGE) is trading at $0.1911 as of 10:00am UTC on 22 October 2025, near the lower end of its intraday range of $0.1911–$0.2052.

Support comes from mixed sentiment across cryptocurrency markets, as Bitcoin trades around $108,000 (The Economic Times, 22 October 2025) after failing to hold earlier gains near $114,000 (Blockhead, 22 October 2025). The broader market remains under pressure from ongoing tariff-related macro factors and a stronger US dollar, with the DXY rising to 99.0 (Trading Economics, 21 October 2025).

The Crypto Fear and Greed Index stayed at 25 (Fear)(Fear and Greed Index, 22 October 2025), while total cryptocurrency market capitalisation stood at around $3.66 trillion, following an $84 billion intraday decline earlier in the week (ABP Live, 22 October 2025).

Dogecoin price prediction 2025-2030: Analyst price target view

Changelly (algorithmic forecast)

Changelly’s algorithmic model projects a November 2025 trading range of $0.219–$0.244 for Dogecoin, with an average estimate of $0.232. The platform notes December 2025 at $0.224–$0.248, citing technical analysis based on historical volatility and market cycles. By the end of 2026, the forecast declines to $0.119–$0.184, reflecting an anticipated rotation in demand towards newer meme tokens (Changelly, 20 October 2025).

CoinCodex (machine learning)

CoinCodex employs a machine-learning model that integrates Bitcoin halving cycles and historical DOGE price data to forecast $0.1893–$0.2472 for 2025, with an updated short-term bearish sentiment. The model indicates a 13.08% potential upside to $0.2208 by mid-November. For 2026, the projected range remains broadly consistent, reflecting limited momentum, while maintaining the 200-day SMA near $0.2085 as a key technical reference (CoinCodex, 22 October 2025).

Finder (expert panel survey)

Finder surveyed 26 cryptocurrency industry specialists and reported a median year-end 2025 target of $0.57, a 76% increase from the survey’s $0.32 baseline. The panel’s methodology weighs factors such as community sentiment, social media visibility and celebrity endorsements. Longer-term projections extend to $2.02 by 2030 and $3.12 by 2035, although 36% of participants described DOGE as overvalued (Finder, 4 February 2025).

Brave New Coin (technical analysis)

Brave New Coin identified a cluster of 10.5 billion DOGE accumulated near $0.21, defining a key resistance zone as of 21 October 2025. The analysis highlights potential upside levels at $0.29, $0.45 and an extended $0.86 by March 2026 if the ascending channel remains intact (Brave New Coin, 22 October 2025).

Predictions and third-party forecasts are subject to uncertainty and may not reflect actual market outcomes. Past performance should not be considered a reliable indicator of future results.

DOGE price: Technical overview

On the daily chart, Dogecoin (DOGE) trades at $0.1911 as of 10:00am UTC on 22 October 2025, below its key moving-average cluster — the 20-, 50-, 100- and 200-day SMAs sit near $0.216 / $0.235 / $0.230 / $0.207 respectively. The price has moved below the 200-day line, establishing a bearish bias after failing to recover above the shorter-term averages. The 20-day SMA remains under the 50-day, keeping the intermediate structure weak.

Momentum remains subdued: the 14-day RSI at 39.6 sits in the lower-neutral range, indicating persistent selling pressure, while the Average Directional Index (ADX) at 29.3 signals a moderately defined trend. The MACD level of −0.014 and momentum of −0.016 both show negative readings, reinforcing the absence of upward momentum near current levels.

The first resistance area to monitor is the Classic Pivot R1 near $0.292; a daily close above this level would bring the R2 resistance at $0.311 into focus and draw attention to the 50-day SMA around $0.235. On retracements, initial support is seen at the Classic Pivot P near $0.248, followed by the 200-day SMA at $0.207. A move below this longer-term average could expose the Classic S1 support near $0.189 and retest the intraday low of $0.191 (TradingView, 22 October 2025).

This technical analysis is for informational purposes only and does not constitute financial advice or a recommendation to buy or sell any instrument.

Dogecoin price history

Dogecoin was launched in December 2013 as a light-hearted alternative to Bitcoin. DOGE reached a then all-time high of around $0.40 during the 2017–2018 bull cycle, but experienced prolonged weakness between 2018 and 2023. A renewed uptrend began in 2024, gaining momentum towards the end of the year.

The 2025 performance has been volatile. DOGE opened the year at $0.3236, rising to $0.3408 by 21 January, approaching its annual highs, but encountered continued selling pressure amid persistent macroeconomic headwinds. The token declined sharply to $0.1313 on 10 October during a broader cryptocurrency market correction, before recovering modestly to $0.1912 by 22 October.

DOGE closed at $0.1912 on 22 October 2025, around 40.9% lower year to date, but 37.6% higher year on year.

Past performance is not a reliable indicator of future results.

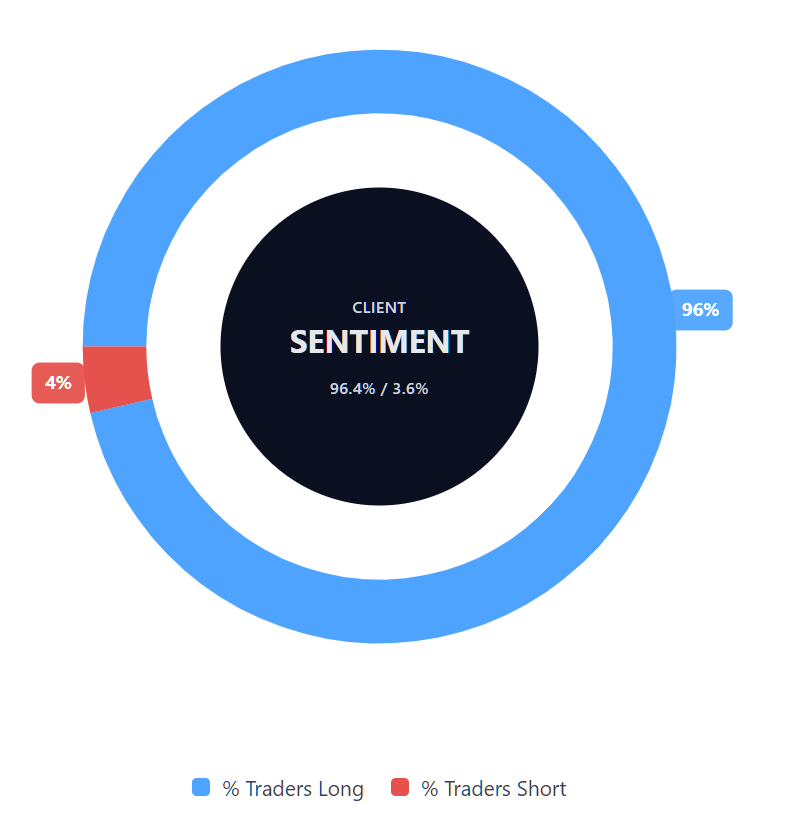

Capital.com’s client sentiment for Dogecoin CFDs

As of 22 October 2025, Capital.com clients’ positioning in Dogecoin CFDs is notably imbalanced, with 96.4% of traders holding long positions and 3.6% holding short positions. This represents a 92.8-percentage-point difference, indicating a predominantly long market sentiment. This snapshot reflects open positions on Capital.com and is subject to change over time.

FAQ

What is the Dogecoin price prediction?

Who owns the most Dogecoin?

The largest Dogecoin holdings belong to a small number of early blockchain addresses, including those linked to initial mining and exchange reserves. Dogecoin’s founders and early contributors hold considerably less than these institutional or exchange-associated wallets. Ownership data is publicly available on the Dogecoin blockchain.

How many Dogecoins are there?

Dogecoin has an uncapped supply, meaning new coins are continuously created through mining. The circulating supply currently exceeds 150 billion DOGE (CoinMarketCap, 22 October 2025).

Could Dogecoin’s price go up or down?

Yes. Dogecoin’s price is affected by market demand, investor sentiment, and broader cryptocurrency trends. Like all digital assets, its value can move sharply in either direction, and past performance is not a reliable indicator of future results.

Should I invest in Dogecoin?

Capital.com does not provide investment advice. Whether Dogecoin aligns with your trading approach depends on your risk tolerance, experience, and market perspective. Traders can speculate on Dogecoin’s price movements via Dogecoin CFDs on the Capital.com platform without owning the underlying asset. Contracts for difference (CFDs) are traded on margin, and leverage amplifies both profits and losses.