RBA meeting preview: No change to policy expected as inflation fight continues

The Reserve Bank of Australia is expected to keep its cash rate on hold at 4.35% when it announces its policy decision at 2.30PM on the 5th of November, 2024. Despite ongoing evidence of soft demand, upside risks to inflation are likely to remain the central bank’s primary concern.

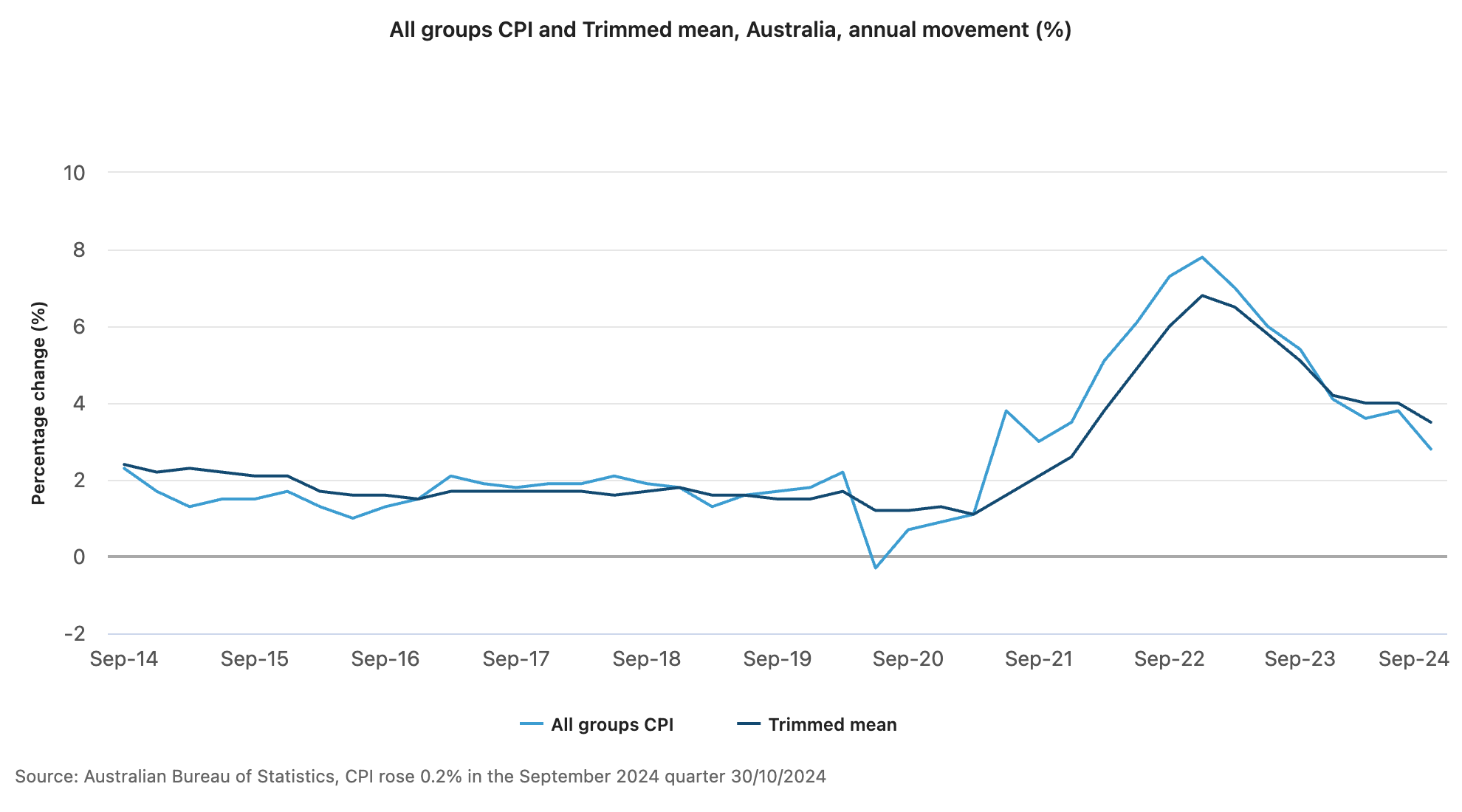

Last week’s quarterly CPI figures revealed a drop in trimmed mean CPI to 3.5%, above the RBA’s 2-3% target band. Headline inflation fell to 2.8% for the quarter. However, that was due to the effects of government subsidies for electricity as well as a fall in automotive fuel prices. Promisingly, the ABS’s monthly CPI indicator, which encompasses approximately 85% of the official CPI basket, signalled further progress towards the RBA’s target. The headline figure plunged to 2.1%, again because of the impacts of government subsidies. However, the trimmed mean fell to 3.2%, implying inflation has fallen to its lowest level since the end of 2021.

(Source: ABS)

Recent labour force data pointed to resilience in the Australian jobs market, with employment increasing at a rate faster than RBA and market expectations. The latest ABS labour force statistics for September showed another significant jump in hiring, with the unemployment rate subsequently falling to 4.1%. The 64,100 person increase in employment marked the fifth consecutive month where jobs growth exceeded market estimates. It also showed that labour market trends are moving opposite to the RBA projections in its Statement on Monetary Policy.

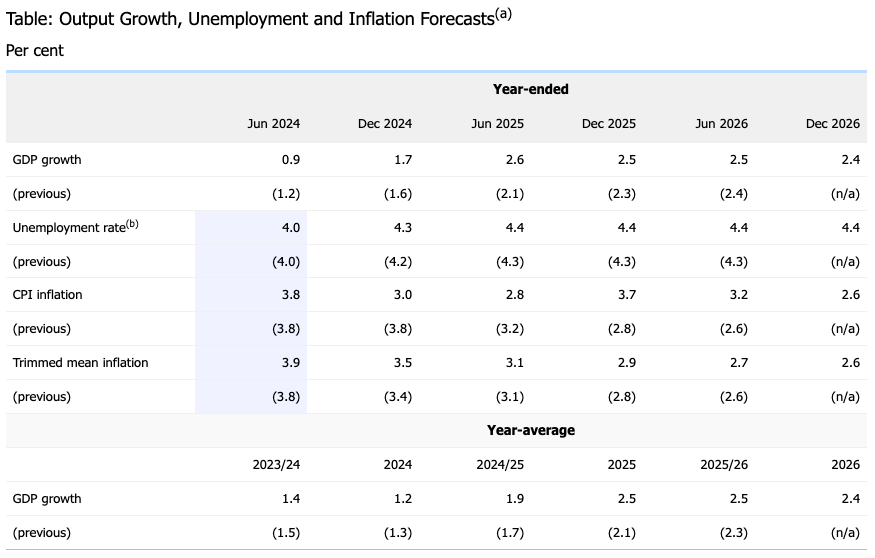

(Source: RBA)

The RBA releases its latest SOMP at this meeting, with market participants dialling into potential downward revisions to both the unemployment rate and CPI. Recent data is roughly consistent with the central bank’s August estimates for inflation. However, projections for the unemployment rate are tracking below the 4.3% that the RBA forecast for where joblessness would sit by the end of 2024.

The critical factor for the markets at this RBA decision is the central bank’s guidance regarding future policy and the tone it strikes about policy bias. The RBA has adopted a neutral-to-hawkish stance towards policy, emphasising it isn’t “ruling anything in or out” regarding interest rates and that the case for further hikes have been discussed at recent meetings. The central bank has also highlighted the perceived imbalance between supply and demand in the economy; that although clearly growth is tepid, sticky inflation is because of a lack of capacity.

Market analysis: AUD/USD

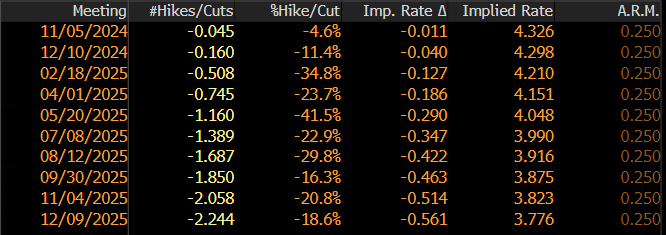

Cash rate futures markets point to a trivial risk of a move from the RBA at this meeting. The focus on the guidance means that the markets will be assessing the likely timing of the next move from the central bank, with futures pricing-in a cut by May 2025. Marginal changes in rates futures could drive AUD/USD volatility.

(Source: Bloomberg)

This RBA decision is happening against the backdrop of heightened market uncertainty, which could be a bigger driver of the AUD/USD. The US Presidential and the US Federal Reserve meeting dominates the week and will likely drive volatility in currency markets, especially the risk-sensitive pair. The recent sell-off in the AUD/USD has come as strong US data leads to a dialling back of Fed rate cut expectations, as well as a Trump victory, which is expected to lead to greater fiscal spending in the US and heightened trade tensions with China.

From a technical point of view, the AUD/USD’s short-term downtrend appears to be bottoming, with the daily RSI indicating a pick-up in short-term momentum. Technical resistance could emerge around 0.6620 and invite more buyers into the market if it breaks. Meanwhile, buyers defended tests of 0.6540 recently, with a break of that level a potential harbinger of further downside risks.

(Source: Trading View)

(Past performance is not a reliable indicator of future results)