Uber Technologies stock forecast: Third-party price targets

Uber Technologies is a US-listed technology company operating ride-hailing, delivery and logistics platforms globally, with its share price influenced by company performance, regulation and broader market conditions. Explore third-party UBER price targets and technical analysis.

Uber Technologies, Inc. (UBER) is trading around $77.17 via stock CFDs on Capital.com as of 10:56am on 4 February 2026 (UTC), moving within an intraday range of $76.95–$81.15. The price action reflects a broader pullback from recent cash-market levels near the upper end of its 52-week range around $101 on the NYSE. Past performance is not a reliable indicator of future results.

The stock is trading against a backdrop of relatively resilient US equity indices, with the Nasdaq Composite recently holding above 23,500 and the S&P 500 registering a series of record or near-record prices in January (CNBC, 27 January 2026). Market participants continue to monitor Uber’s operating performance and forward guidance following its latest quarterly earnings release (CNBC, 4 November 2025).

Uber Technologies stock forecast 2026–2030: Third-party price targets

As of 4 February 2026, third-party Uber Technologies stock predictions focus on 12-month horizons. The following broker views summarise publicly available analyst expectations and should be read as market commentary rather than investment advice.

BNP Paribas (initiation)

BNP Paribas initiated coverage of Uber with an Outperform rating and a 12-month price target of $108 as of 14 January 2026, setting out its central scenario for the stock over the coming year. The broker highlights expectations for ongoing growth in mobility and delivery, alongside operating leverage and improving profitability, while also referencing competitive and regulatory considerations (Yahoo FInance, 18 January 2026).

Cantor Fitzgerald (broker update)

Cantor Fitzgerald maintained an Overweight rating on Uber and lowered its 12-month price target from $108 to $99 on 8 January 2026, reflecting an 8.33% reduction in its fair-value estimate. The analyst notes that the revised target reflects updated growth and valuation assumptions, as well as a reassessment of risk-reward amid changing macro and sector conditions (GuruFocus, 8 January 2026).

Needham (broker update)

Needham set a 12-month UBER stock forecast target of $109 while maintaining a positive stance. The analyst points to expectations for continued expansion in gross bookings and profitability across key segments, while noting sensitivity to competition, regulation and broader equity-market conditions (Quiver Quantitative, 3 February 2026).

Predictions and third-party forecasts are inherently uncertain, as they cannot fully account for unexpected market developments. Past performance is not a reliable indicator of future results.

UBER stock price: Technical overview

The UBER stock price is trading around $77.17 as of 10:56am UTC on 4 February 2026, with the price remaining below a declining cluster of simple moving averages. The 20-, 50-, 100- and 200-day SMAs sit near 83, 84, 90 and 89 respectively. The 14-day RSI near 35 suggests subdued, lower-neutral momentum, while an ADX reading around 17 points to a relatively weak trend environment rather than a strong directional move.

On the topside, the first level to monitor is the classic R1 pivot near 85.72, with R2 around 91.40 only coming into view if price action sustains a daily close above initial resistance. The classic pivot at 82.57 acts as an initial support reference, while S1 around 76.90 may come into focus if the market continues to trade below the pivot zone (TradingView, 4 February 2026).

This technical overview is provided for informational purposes only and does not constitute financial advice or a recommendation.

Uber Technologies share price history (2024–2026)

UBER’s stock price has recorded a notable advance over the past two years, rising from around $60 at the end of December 2024 to approximately $77.17 by 4 February 2026. Daily price movements have been volatile at times, with the stock moving above $100 in late 2025 before retreating into the high-$70s and low-$80s range in early 2026.

During 2025, UBER climbed from the low-$60s in January to test the $100 area by autumn, with several swings between the high-$80s and mid-$90s along the way. By late December 2025, the share price had eased back into the low-$80s before declining further to close at $77.17 on 4 February 2026, leaving it below late-2025 highs but still above levels seen a year earlier.

Past performance is not a reliable indicator of future results.

Uber Technologies (UBER): Capital.com analyst view

Uber Technologies’ share price has been volatile over the past two years, rising from the low-$60s at the end of 2024 to trade around $77.17 as of 4 February 2026, after briefly moving above $100 in late 2025. This pattern illustrates changing market views on growth-oriented technology stocks, including Uber’s ability to expand across its mobility, delivery and freight businesses.

From a fundamental perspective, expansion in ride-hailing and delivery, investment in logistics and platform technology, and efforts to improve profitability may support the share price under certain market conditions. At the same time, the stock remains sensitive to regulatory decisions on driver classification, competitive pressures and shifts in consumer spending. Developments often cited as long-term opportunities, such as autonomous driving or geographic expansion, could also weigh on the price if execution risks materialise or costs outpace revenues.

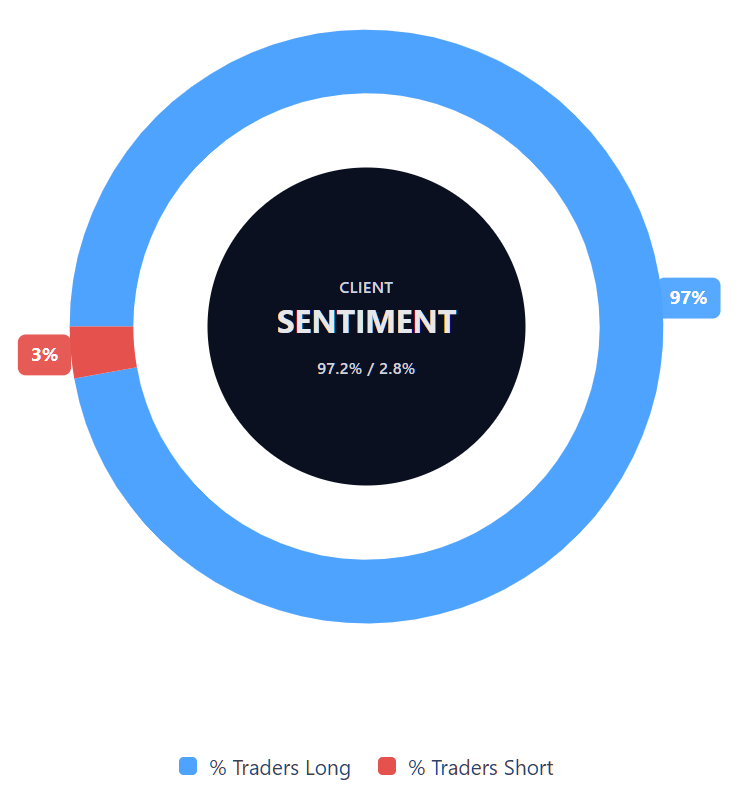

Capital.com’s client sentiment for Uber Technologies CFDs

As of 4 February 2026, Capital.com client positioning in Uber Technologies CFDs is currently skewed towards long positions, with buyers accounting for 97.2% of open positions and sellers for 2.8%. This places buyers ahead by approximately 94.4 percentage points at this snapshot. Client sentiment reflects open positions on the platform at a specific point in time and may change as market conditions evolve.

Summary – Uber Technologies 2026

- Uber Technologies traded within a wide range during 2025, rising from the low-$60s in January to test the $100 area in early November before easing back into the $80s by year-end.

- As of 4 February 2026, Uber is trading around $77.17 on Capital.com, below late-2025 highs but still materially above end-2024 levels.

- Recent technical signals show the price trading below a declining moving-average cluster, with RSI near the mid-30s and ADX readings indicating a relatively weak trend backdrop.

- Potential influences on Uber’s share price include developments in growth and profitability across mobility, delivery and freight, alongside macroeconomic conditions, regulation, competition and technological change. These factors can support or pressure the price depending on how they unfold over time.

Past performance is not a reliable indicator of future results.

FAQ

Who owns the most Uber Technologies stock?

Uber Technologies has a widely distributed shareholder base, with significant ownership held by large institutional investors such as asset managers, pension funds and index-tracking vehicles. These institutions collectively account for a substantial proportion of the company’s outstanding shares, alongside holdings by company executives and early investors. Ownership levels may change over time as funds rebalance portfolios, insider holdings adjust, or market conditions influence institutional positioning.

What is the five-year Uber Technologies share price forecast?

There is no single, agreed five-year UBER stock forecast. Most published analyst estimates focus on shorter, typically 12-month, horizons, reflecting the uncertainty involved in longer-term projections. Over a multi-year period, Uber’s share price may be influenced by factors such as revenue growth, profitability trends, regulatory developments, competitive dynamics and broader market conditions. Longer-term forecasts should therefore be treated as speculative scenarios rather than precise predictions.

Is Uber Technologies a good stock to buy?

Whether Uber Technologies is considered a good stock varies by individual objectives, risk tolerance and time horizon. Some market participants focus on Uber’s scale, platform growth and efforts to improve profitability, while others highlight regulatory risks, competitive pressures and sensitivity to economic cycles. For CFD traders, shorter-term price movements and volatility may be more relevant than long-term ownership, although outcomes remain uncertain and losses are possible.

Could Uber Technologies stock go up or down?

Uber Technologies’ share price can move up or down in response to company-specific news, earnings results, guidance updates, regulatory decisions and broader market sentiment. Macroeconomic conditions, shifts in technology-sector valuations and changes in investor risk appetite can also influence price movements. When trading Uber share CFDs, both rising and falling markets can create trading opportunities, although price movements are unpredictable and may move against a trader’s position.

Should I invest in Uber Technologies stock?

This information does not constitute investment advice. Deciding whether to invest in Uber Technologies stock involves assessing personal financial circumstances, risk tolerance and investment goals. Investors typically consider factors such as business fundamentals, valuation, market conditions and alternative opportunities. For those trading CFDs rather than owning shares outright, it is also important to understand leverage, costs and the risk of losses exceeding deposits, and to apply appropriate risk-management tools.

Can I trade Uber Technologies CFDs on Capital.com?

Yes, you can trade Uber Technologies CFDs on Capital.com. Trading share CFDs lets you speculate on price movements without owning the underlying asset and to take long or short positions. However, contracts for difference (CFDs) are traded on margin, and leverage amplifies both profits and losses. You should ensure you understand how CFD trading works, assess your risk tolerance, and recognise that losses can occur quickly.