What is financial leverage?

What is leverage in finance?

Leverage is an essential concept in finance that refers to the use of borrowed capital to amplify potential returns or losses on an investment. It's a tool that allows businesses to increase their purchasing power and expand their operations beyond their existing resources.

Understanding the concept of leverage can help stock investors who want to conduct a thorough fundamental analysis of a company's shares.

Key takeaways

-

Leverage refers to the use of borrowed capital to amplify potential returns or losses on an investment, and it comes with advantages and risks.

-

There are three main types of leverage companies can use: financial leverage, operating leverage, and combined leverage.

-

Factors that affect the level of leverage a business can take on include size, industry, competition and goals.

-

Stock investors and analysts can calculate the extent of leverage undertaken by a company by debt-to-equity, debt-to-assets, and interest coverage ratios.

-

Leverage used by business is different from leverage in trading on margin, which allows traders to open larger positions with smaller initial deposits, magnifying potential losses and profits.

Financial leverage explained

The origins of leverage in finance can be traced back to the creation of modern banking institutions in the 17th century. Since then, the use of leverage has become increasingly prevalent in financial markets, and today it is a widely accepted practice. Leveraged finance allows companies to use debt to finance an investment, with most large investment banks having separate divisions dedicated to it.

However, the use of leverage can lead to a cycle of booms and busts known as the leverage cycle. It’s characterised by periods of high borrowing in an economy, which lead to price bubbles, followed by a deleveraging process and economic meltdowns, such as the global financial crisis of 2008.

Leverage in finance can be compared to using a magnifying glass to focus sunlight. Just as a magnifying glass concentrates light to create a more intense flame, leverage amplifies the potential gains or losses. However, just as holding a magnifying glass too close to a flammable object can cause it to ignite, using too much debt can lead to the risk of default.

Note that leverage can be used by both companies and traders. Leverage and margin in trading allow control of larger positions with less funds, amplifying potential profits or losses. In leveraged trading, traders essentially borrow money from their brokers, and it’s enabled through financial derivatives such as contracts for difference (CFDs).

Types of leverage

There are three main types of leverage companies can use: financial leverage, operating leverage, and combined leverage.

What is financial leverage?

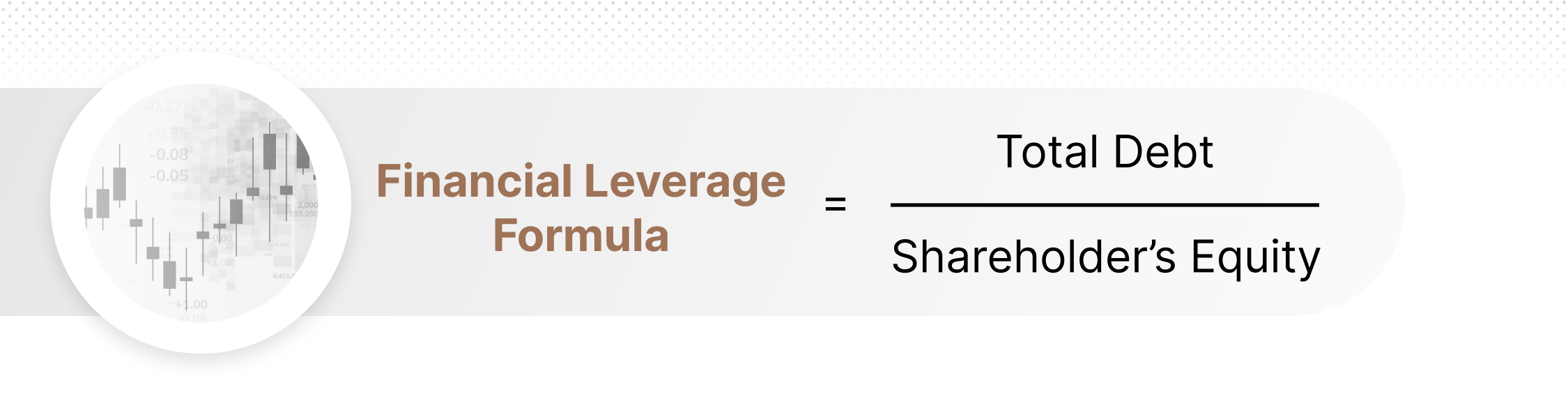

Financial leverage refers to the use of borrowed capital to increase the potential return on investments. It involves using debt financing, such as loans or bonds, to buy assets or invest in projects, which expect to generate higher returns than the cost of borrowing.

Debt financing is seen as an alternative to equity financing, which would involve raising capital through issuing shares via initial public offering (IPO).

A financial leverage example would be a company that borrows funds to buy a new factory with the expectation that it will produce more revenue than the interest on the loan.

What is operating leverage?

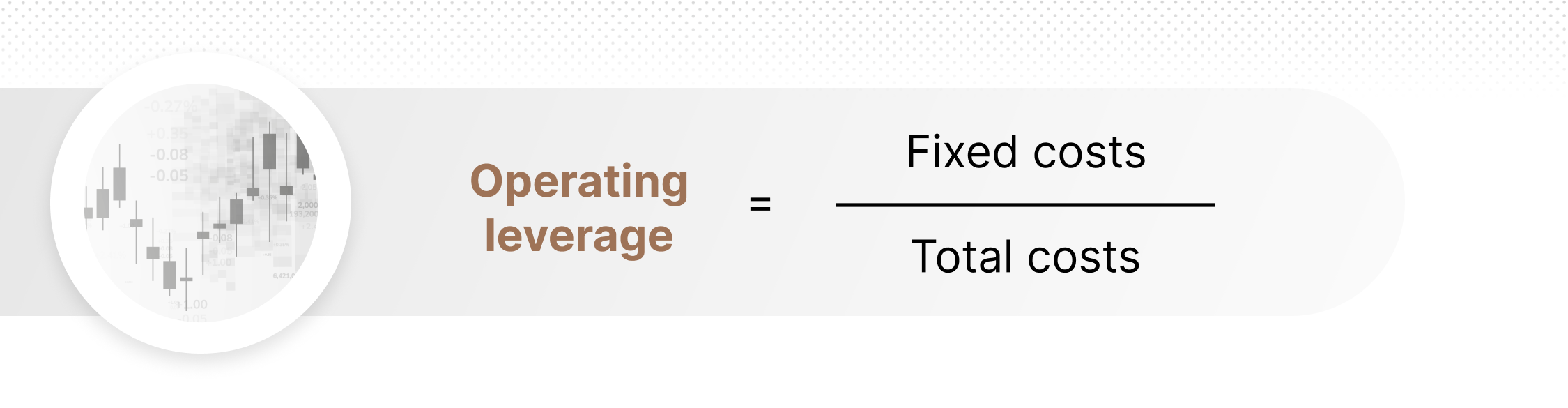

Operating leverage refers to the use of fixed operating costs to increase the potential return on investments. It involves using fixed costs, such as rent and salaries, to produce goods or services that could generate higher revenues than the fixed costs.

An operating leverage example would be if a company rents a factory and hires employees to produce goods, and expects revenue generated from sales to cover for these costs, it’s essentially using an operating leverage.

What is combined leverage?

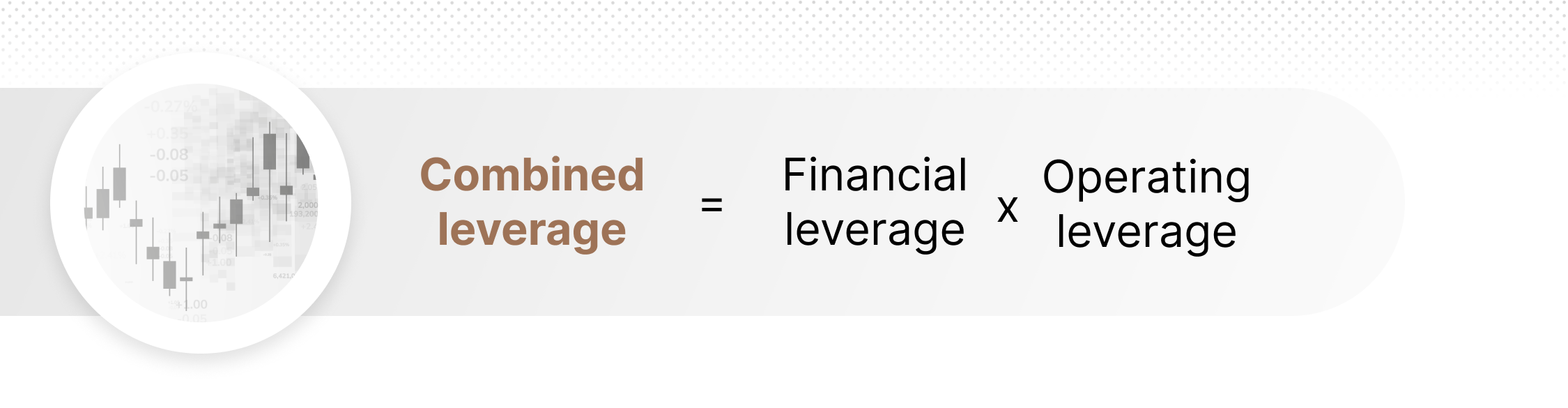

Combined leverage refers to the use of both financial and operating leverage to increase the potential return on investments. It involves using both debt financing and fixed costs to purchase assets or invest in projects.

A combined leverage example would be if a company both rents a factory and hires employees to produce goods, and borrows funds to buy a new factory, hoping that its debt interest and fixed costs would be offset by revenues that resulted from the use of leverage.

Factors that affect leverage

Several factors affect the level of leverage a business can undertake, including:

-

Business size: Larger businesses can typically undertake more leverage than smaller businesses due to their size and resources.

-

Industry: Industries with stable cash flows and low operating costs, such as utilities, can typically undertake more leverage than industries with high operating costs, such as airlines.

-

Competition: Firms that operate in a highly competitive environment may need to take more leverage to contend with their peers.

-

Financial goals: Companies with aggressive financial ambitions may undertake more leverage than those with conservative goals.

Why companies may choose leverage

While leverage comes with inherent risks, it also offers various benefits to businesses. Here are some of its advantages:

Increased returns: One of the primary pros of leverage is that it can help businesses or investors achieve higher returns. By using borrowed funds, they can increase the amount of capital they have at their disposal, which can help them make larger investments and generate higher profits.

Tax-deductibility*: Leverage may provide tax benefits in some countries, as the interest paid on borrowed funds is generally tax-deductible. For example, in the UK business loans allow you to claim interest repayments as a tax deduction. The tax treatment, however, would highly depend on the country a firm is operating in. Always conduct a thorough research and check official government websites for local tax rules.

Risks associated with leverage

While leverage can offer advantages, it also comes with several drawbacks.

Risk of default: Perhaps the most significant disadvantage of leverage is the risk of default. Borrowing funds exposes businesses to greater financial risk, as they must make loan payments regardless of their profitability or cash flow. If they are unable to meet debt obligations, they may face serious consequences, including bankruptcy or foreclosure.

Interest and financing costs: Borrowing funds also comes with interest, which can be a burden for companies. If a loan is taken with a variable rate, a hike of base interest rates by central banks can make it more expensive to borrow money, creating a greater financial burden for a company.

How to calculate leverage

There are several ways to calculate the extent of leverage used by a company in fundamental analysis, depending on the type of leverage being measured.

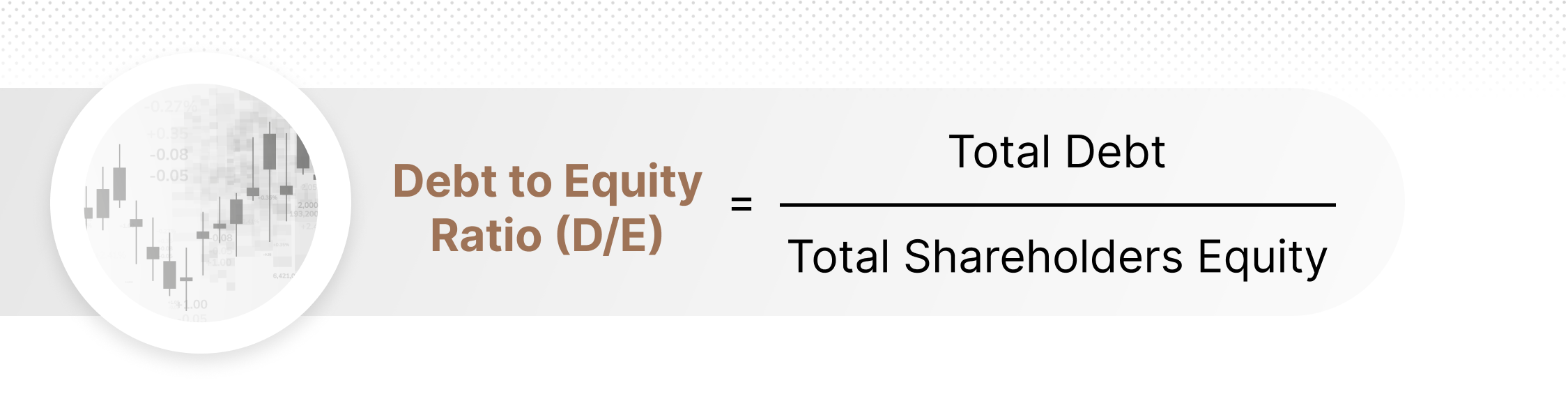

Debt-to-equity ratio

The debt-to-equity (D/E) ratio measures the amount of debt a business has relative to its equity. It is calculated by dividing the total liabilities by the total equity on a company’s balance sheet. A higher debt-to-equity ratio indicates that a business is more heavily reliant on borrowed funds.

Interest coverage ratio

The interest coverage ratio measures a business's ability to meet its interest payments on its debt. It is calculated by dividing the earnings before interest and taxes (EBIT) by the interest expense. A higher interest coverage ratio signifies that a business is more capable of meeting its debt obligations.

Debt-to-asset ratio

The debt-to-asset ratio measures the amount of debt a business has relative to its total assets. It is calculated by dividing the total liabilities by the total assets. A higher debt-to-asset ratio means that a business is more heavily reliant on borrowed funds.

Conclusion

Financial leverage is a key concept for stock traders and investors to grasp when evaluating a company’s fundamentals. With various types of leverage available – financial, operating, and combined – businesses can adopt different strategies to achieve their goals.

Several factors, including business size, industry, competition, and financial goals, influence the level of leverage a company may undertake. While leveraging borrowed funds can lead to increased returns and potential tax benefits, it can also come with the risk of default and interest payments.

Stock investors and traders can calculate key financial ratios such as debt-to-equity, interest coverage, and debt-to-asset ratios, to evaluate a company's fundamentals. Although an important part of fundamental analysis, investors and traders should conduct further research before taking a position in a stock, and never risk more money than they cannot afford to lose.

*Tax treatment depends on individual circumstances and can change, or may differ in a jurisdiction other than the UK.

FAQs

What does leverage mean in finance?

Leverage in finance refers to the use of borrowed capital, or debt financing, to amplify potential returns on investments, allowing companies to expand their operations beyond their existing resources. Leverage can also amplify losses and comes with the risk of default.

How to find leverage ratio?

To find the leverage ratio, key financial ratios such as debt-to-equity, interest coverage, and debt-to-asset ratios can be calculated using a company's balance sheet and income statement data.

Why is financial leverage important?

Financial leverage is important because it enables firms to achieve higher returns, access potential tax benefits, and increase their capital for growth opportunities, while also emphasising the need for prudent risk management due to the associated risks of default and increased interest costs. In fact, the free cash flow theory in finance states that firms that use debt financing waste less resources and ensure more discipline with budgets.