What are bonds?

Bonds are an important asset class in financial markets that are often used in a diversified portfolio. Here we take a look at the bond definition in more detail, the mechanism behind how they work and what bonds are used for by investors and institutions.

Key takeaways

-

Bonds are obligations of debt issues by institutions such as governments (national and local), and companies to raise funds.

-

The key examples of bond types include government and municipal bonds, corporate bonds, high-yield (or junk) bonds, and mortgage-backed bonds.

-

Bonds can be classified into long, medium and short-term, depending on the maturity date.

-

Other key components of a bond are price, yield, face value, and coupon payment.

-

Credit agencies rate bonds and class them as investment-grade and non-investment grade (or junk) bonds.

-

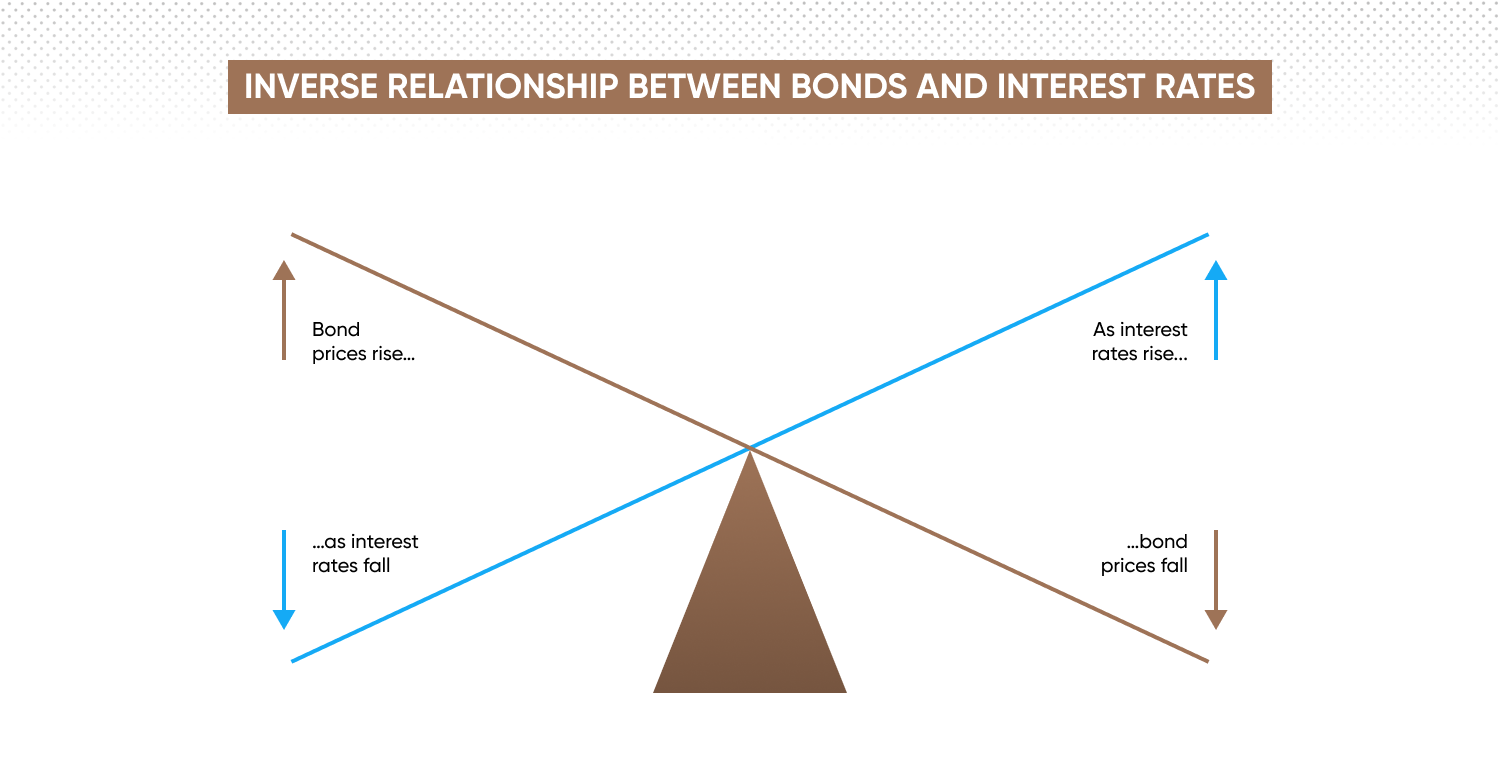

Bond prices and interest rates have an inverse relationship.

What are bonds?

Bonds are basically I-own-you (IOU) contracts. They are usually sold (or 'issued') to investors as a medium or long-term investment by companies or governments looking to raise funds for a specific project. Typically bonds pay out interest twice a year and can be traded as either an individual investment or as part of a pooled investment.

Bonds are also known as fixed-interest securities. A bond issuer owes the holders a debt and undertakes an obligation to pay them interest or to repay the principal at a specified date later, known as maturity date.

Bonds are an important asset for investors, and the bond market is key to the health of the global economy. In developed markets, stock prices and bond yields have an inverse correlation.

Stocks vs bonds

Stocks and bonds differ significantly, they are principally different asset classes. While stocks represent ownership of a company’s equity, bonds represent debt owned by a company. Bond holders don’t have any ownership rights, they don’t receive dividends and don’t attend shareholder meetings. They are however prioritised in case of a company’s bankruptcy as they would be paid first.

Purpose of bonds explained

While we established the importance of bonds in financial markets, what is the actual purpose of a bond? There are various uses for both investors and institutions:

-

Return: For investors, bonds provide a predictable income stream.

-

Diversification: Bonds are key in a well-balanced diversified investment portfolio.

-

Funds: Bonds help companies and governments to raise more money.

Types of bonds in financial markets

There are various types of bonds investors can choose from.

| Government bonds | Debt obligations issued by a national government - for example, Treasury in the US - and sold to investors to fund government spending. Considered low-risk investment due to the backing of the government. |

| Municipal bonds | Debt obligations issued by local authorities and sold to investors to fund municipal projects such as schools, infrastructure, libraries. Municipal bonds are commonly known as muni. |

| Corporate bonds | Debt obligations issued by companies and sold to investors to fund business operations, expansions or other needs. |

| High-yield bonds | High-yield bonds are corporate bands that have a credit rating of below BBB. These bonds are considered of higher risk, and a higher yield serves as a compensation. |

| Mortgage-backed bonds | Mortgage bond is a type of mortgage-backed security that contains a pool of mortgages. Lenders often sell those to real-estate investors, who have the right to for the collateral if a mortgage default. |

How do bonds work?

Bonds are complex financial instruments, hence investors and traders must grasp the mechanism behind them. Below are the key concepts that enhance your understanding of a bond.

Maturity date

Maturity date is the key feature of a bond. It shows when the bond contract will finish and the investor will be paid their last coupon payment. Bonds can hence be classified into three groups:

-

Short-term bonds: These bonds have a maturity date in less than two years.

-

Intermediate bonds: These bonds mature in two to 10 years.

-

Long-term bonds: Long-term bonds’ maturity date would approach in over 10 years.

An important concept here to understand is that the bond’s duration would affect to what extent the bond’s price and yields are affected by changes in interest rates.

Face value and coupon payments

Face value of a bond - also known as par value - is its value in currency, for example, in US dollars or British pounds, on the bond’s maturity date. Face value is different from the bond’s price, as prices can fluctuate, while par value stays relatively constant. Bonds can be sometimes referred to as trading above or below their par value.

A bond’s coupon payment is the annual interest rate on bond’s face value paid to investors from the bond’s start to its maturity date.

Bond pricing and yield

Every bond has a price and a yield. Bond yield is the percentage of return an investor receives over the term of the bond’s maturity.

Bond price can be calculated using the following formula:

Bond price = C* (1-(1+r)^-n/r ) + F/(1+r)^n

Where:

C = periodic coupon payment

F = Bond’s face value

R = Yield to maturity

n = number of periods till maturity

Bond prices tend to be inversely correlated to the interest rates, which means that when central banks hike rates, bond prices tend to fall, and vice versa. Bond yields, on the other hand, rise and fall in line with the rates.

Bond rating and credit risk

Bond ratings are assigned to bonds by private independent agencies such as Standard & Poor’s, Moody Investors and Fitch Ratings, to evaluate a bond’s creditworthiness, which is essentially the issuer’s ability to pay out the principal and interest to the bond investors on time.

The structure of grades would depend on the firm. Here are the ratings used by key agencies:

| Investment grade | Moody’s | Standard & Poor’s | Fitch |

| Strongest | Aaa | AAA | AAA |

| Aa1 | AA+ | AA+ | |

| Aa2 | AA | AA | |

| Aa3 | AA- | AA- | |

| A1 | A+ | A+ | |

| A2 | A | A | |

| A3 | A- | A- | |

| Baa1 | BBB+ | BBB+ | |

| Baa2 | BBB | BBB | |

| Baa3 | BBB- | BBB- | |

| Non-investment grade | Ba1 | BB+ | BB+ |

| Ba2 | BB | BB | |

| Ba3 | BB- | BB- | |

| B1 | B+ | B+ | |

| B2 | B | B | |

| B3 | B- | B- | |

| Caa1 | CCC+ | CCC+ | |

| Caa2 | CCC | CCC | |

| Caa3 | CCC | CCC | |

| Ca | CC | CC | |

| Weakest | C | C | C |

| D | D |

Based on their ratings, investors can group bonds into:

Investment-grade bonds: These are bonds with the highest credit ratings, typically Baa3/BBB and higher. They tend to carry lower risk, hence their yields are lower too.

Non-investment grade bonds: These bonds are also called high-yield or junk bonds, and have Ba1/BB+ credit rating and lower. They are more risky, but also pay higher yields.

Note that while credit ratings are an important part of your research into bonds, your investment can still go up and down. Hence you should always conduct your own due diligence before trading or investing in bonds.

Why do companies issue bonds?

Companies issue bonds to raise money. These can be used either to fund the current operations, or to invest in business expansion.

Examples of publicly-traded companies that issue bonds include Apple (AAPL), Amazon (AMZN), AT&T (T), Tesla (TSLA), and many more.

Bond market basics

Bond market, also known as the debt market, is a financial market dealing with the trade and issuing of debt securities, or bonds.

The bond market is a huge part of the credit market along with bank loans . It's particularly well-used in the USProjects dealt with over the bond market include pension funds and life insurance.

In the bond market, you can use the primary market to issue new debt, or trade debt securities in the secondary market. Trading is usually in the form of bonds, but it can also include bills and notes.

The participants of the bond market include institutional investors, traders and governments as well as individuals.

Factors that affect the bond market are the same factors that affect bond prices: interest rates, inflation, and stock market performance.

Benefits of investing in bonds

-

Diversification: Bonds are an essential part of a well-rounded portfolio, which can help in hedging exposure to stock market volatility.

-

Fixed income: Bonds can provide predictable income streams, depending on the credit worthiness of the bond provider.

-

Return of principal: If held till maturity date, investors can get back the full principal of the bond.

Risks of investing in bonds

-

Interest rates: As bond prices are tied into interest rates set by central banks, as rates rise bond holdings can decrease in value.

-

Inflation risk: If inflation shoots higher than the rate of return of a bond, investors can see the purchasing power of their bond holdings erode or even go negative, when adjusting for inflation.

-

Credit risk: Bond repayments depend on the bond issuer’s financial health, hence they are not necessarily guaranteed and there is always the risk of a default. A credit agency may also downgrade the bond’s rating.

Conclusion

Bonds are obligations of debt issues by institutions such as governments and corporations. They are a different asset class from stocks and do not involve equity ownership. Bonds are used for fixed-return and diversification by investors, and to raise funds by institutions.

The key types of bonds are government, municipal and corporate. Mortgage bonds are backed by a pool of mortgages and entitle the bond investor to a collateral. There are also investment-grade bonds and non-investment grade bonds (also called high-yield or junk) based on their credit rating.

The key component of a bond is its maturity date, which can group bonds into short, medium, and long-term. Face value, bond’s price, yield and coupon price are also important aspects of a bond. Bond prices tend to have an inverse relationship with interest rates set by central banks.

Bond market refers to the financial space dealing with trade and issuing of debt securities. Its key participants are institutional investors, traders, governments and individuals.

Some benefits of investing in bonds include diversification, fixed income, and return on principal if held to maturity date. Some risks of investing in bonds are interest rate risk, inflation, and credit risk.

FAQs

What are bonds and how do they work?

Bonds are debt obligations issued by institutions such as companies and governments to raise funds and sold to investors for fixed income. The key components of a bond include a bond’s price, yield, maturity date, coupon payment and face value.

What is the difference between a bond and a stock?

Stocks and bonds differ significantly, they are principally different asset classes. While stocks represent ownership of a company’s equity, bonds represent debt owned by a company. Bond holders don’t have any ownership rights, they don’t receive dividends and don’t attend shareholder meetings. They are however prioritised in case of a company’s bankruptcy as they would be paid first.

How are bond prices determined?

Bond price can be calculated using the following formula:

Bond price = C* (1-(1+r)^-n/r ) + F/(1+r)^n

Where:

C = periodic coupon payment

F = Bond’s face value

R = Yield to maturity

n = number of periods till maturity