US Non-Farm Payrolls Preview: Forecasts point to a stable labour market

US labour market conditions are expected to have remained stable in May. The latest Non-Farm Payrolls data will be released on Friday, June 7th, 2024, and will provide a health check on the US jobs market.

US labour market conditions are expected to have remained stable in May. The latest Non-Farm Payrolls data will be released on Friday, June 7th, 2024, and will provide a health check on the US jobs market.

Economists predict steady jobs growth and stable jobless rate

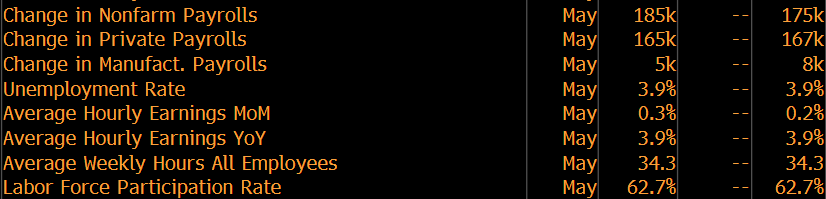

Forecasts indicate the US labour market produced steady jobs growth in April, with economists predicting the unemployment rate remained unchanged. According to Bloomberg, the consensus estimate is for 185,000 jobs to have been added to the economy, keeping the unemployment rate at 3.9%. The most consequential piece of data will be average hourly earnings growth, with forecasters also projecting that it was unchanged from the previous month at 3.9%.

(Source: Bloomberg)

Data signals looser labour market conditions

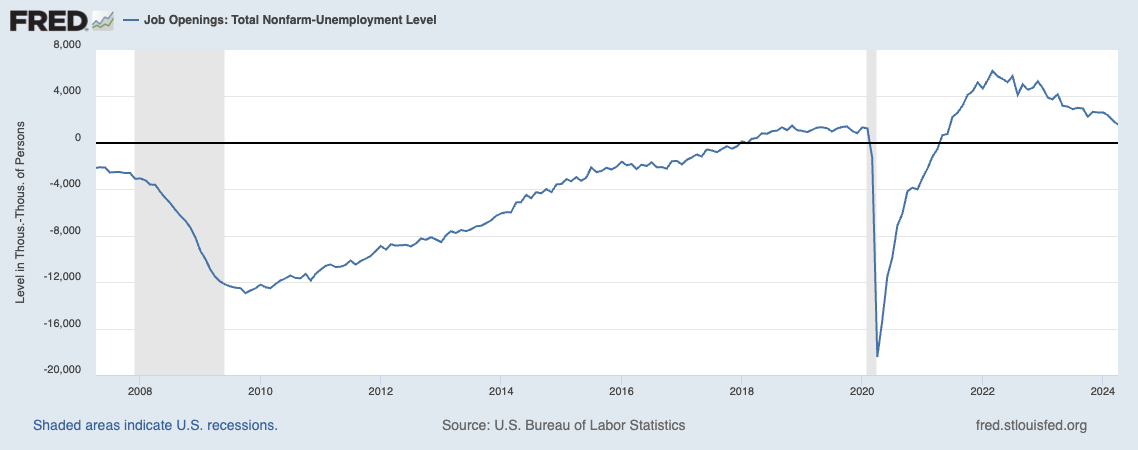

The underlying trends in recent data suggest that the tightness in the US labour market is easing. The latest JOLTS Job Openings data showed vacancies dropped to the lowest level since February 2021 in May as labour demand softened. Subtracting the total number of unemployed presented in the April Non-Farm Payrolls numbers from job openings reveals that while demand for labour is in excess of supply, the gap is narrowing. This dynamic, provided it is supported by the May NFPs, points to softer wage and inflation pressures moving forward.

(Source: St Louis Fed)

Markets grapple with timing and number of rate cuts in 2024

Mixed data and commentary from Fed officials recently have caused fluctuations in interest rate futures markets. Uncertainty about neutral rates, as conveyed by recent comments from the likes of Governor Christopher Waller and President of the Federal Reserve of New York John Williams, has stoked questions about whether Fed policy is sufficiently restrictive. Meanwhile, growth, activity and price data have shown softer price pressures but a potentially slower journey to get inflation back to target. Going into the NFPs data, the markets have nudged forward the timeline for the first rate cut to November. However, only one cut is fully priced-in in 2024. Softer jobs data, especially weaker wage growth, may increase the odds of two cuts from the Fed this year while simultaneously bringing the timing of the first expected cut forward. Alternatively, stronger jobs data could kick expectations for the first cut to December and reduce the odds of two cuts this year.

(Source: Bloomberg)

Technical Analysis: US Dollar Index

The US Dollar will be sensitive to other economic events leading into Non-Farm Payrolls data, including ISM Services PMI and the European Central Bank decision, at which the markets are pricing-in a rate cut. Looking at the weekly charts, the US Dollar Index’s price action indicates a slowing upside momentum after carving out a possible double-top after its test of 106.50 in May and breaking upward-sloping trendline support. In the long term, that level represents meaningful technical resistance, while on the downside, the next major support level could be a zone between 103.90 and 104.

(Source: Trading View)

(Past performance is not a reliable indicator of future results)