UK CPI overshoots in April, delaying hopes of BOE rate cuts

UK inflation rises more than expected in April, pushing back on hopes that the Bank of England can continue lowering rates

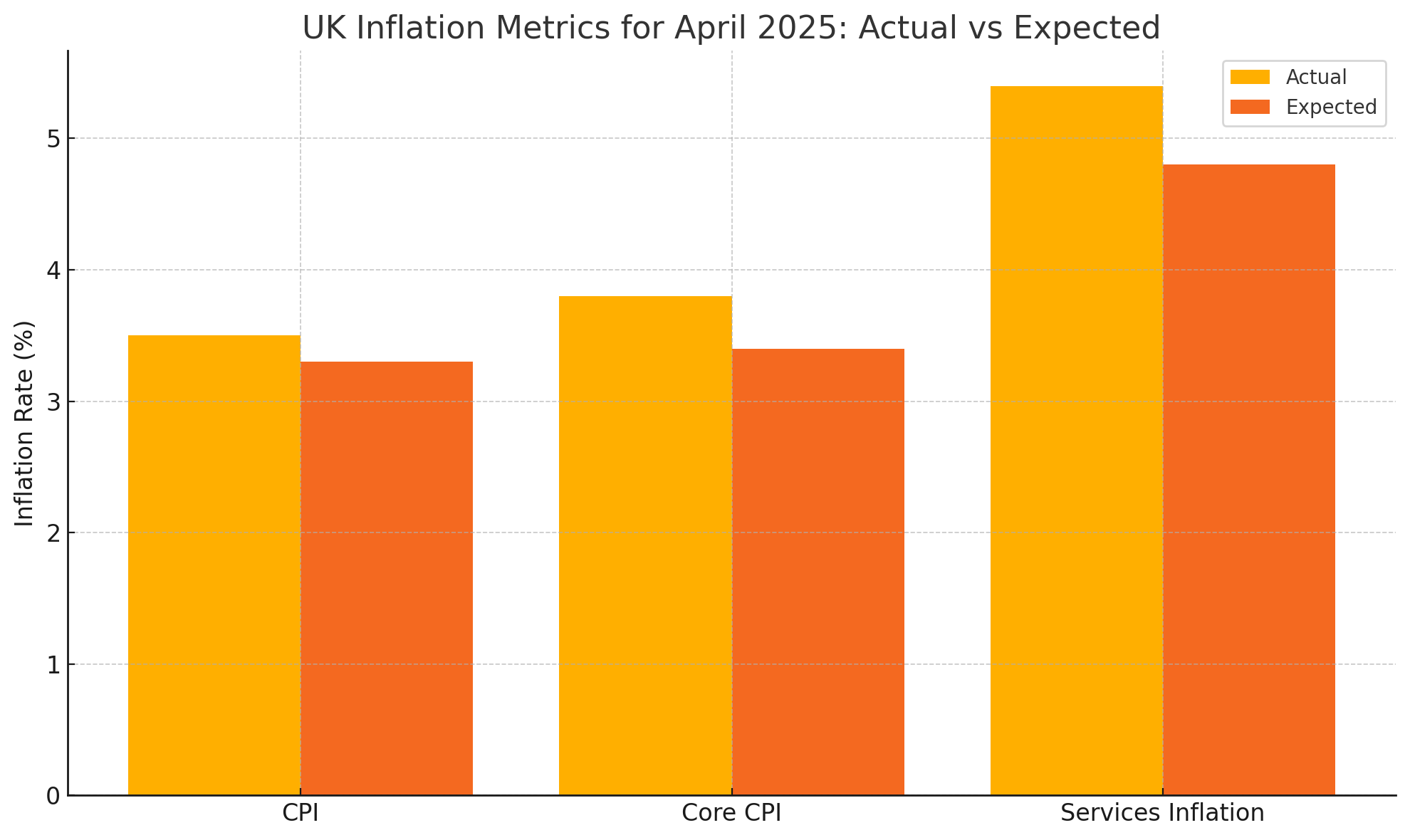

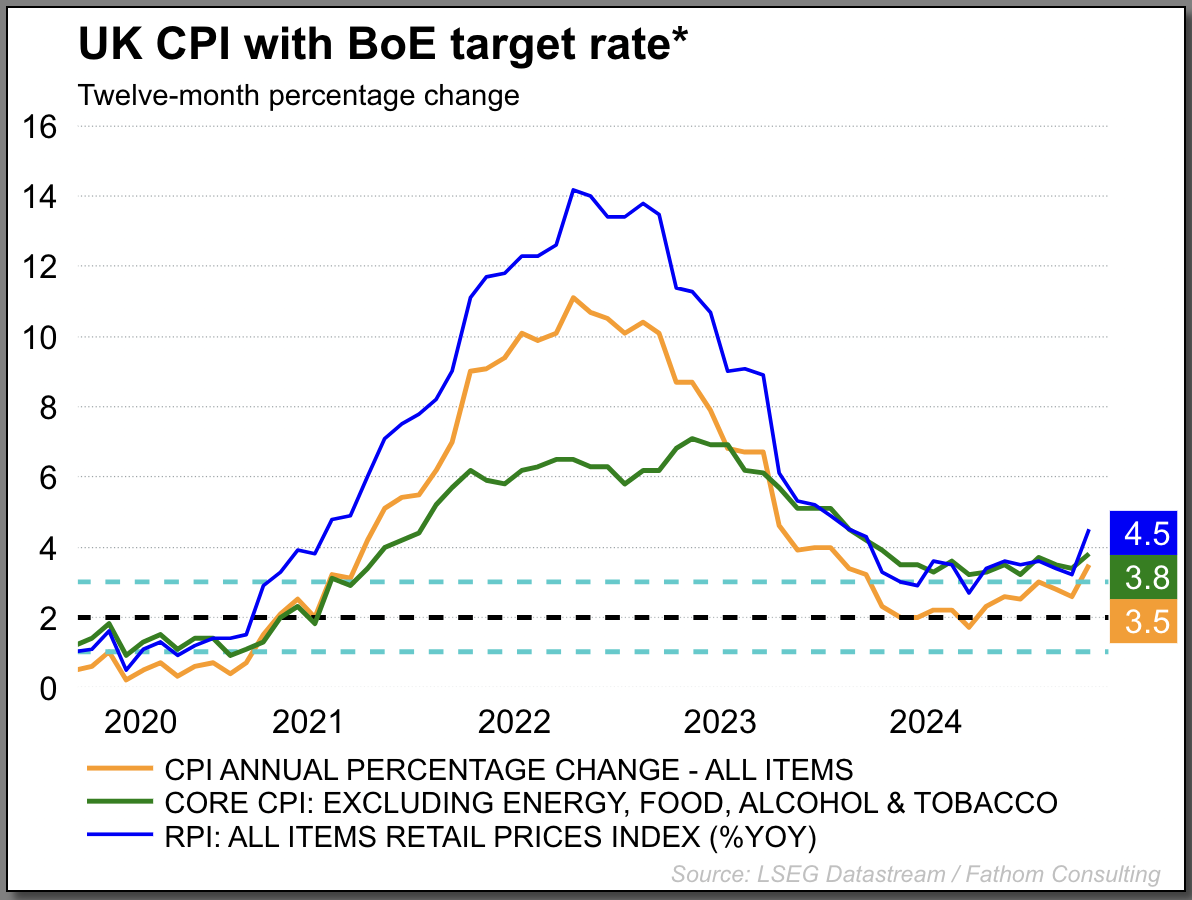

UK inflation rose sharply in April, surprising markets with a higher-than-expected reading and likely delaying further interest rate cuts by the Bank of England (BoE). Annual consumer price inflation accelerated to 3.5% in April, up from 2.6% in March, and exceeded the consensus forecast of 3.3%.

The uptick was largely driven by significant increases in energy and water bills, adjustments to vehicle excise duty, and council tax hikes—all of which were anticipated to push inflation higher. However, the scale of the rise was greater than what had already been priced in.

Core CPI, which excludes volatile components such as food and alcohol, also rose more than forecast, climbing to 3.8% from 3.4% (versus expectations of 3.6%). A closer look reveals that services inflation remains the primary driver of upward pressure, with CPI services inflation jumping from 4.7% to 5.4%. Goods inflation also picked up, rising from 0.6% to 1.7%.

This latest inflation reading takes the UK further away from the BoE’s 2% target, restricting the central bank’s ability to continue its recent monetary easing. Earlier this month, the BoE cut interest rates by 25 basis points to 4.25%. However, the unexpectedly strong inflation data is likely to spark fresh debate within the Monetary Policy Committee (MPC). At its previous meeting, Chief Economist Huw Pill voiced concerns about the pace of rate reductions, warning that the decline in inflation was “stuttering.”

Market expectations now reflect a 97% probability that the BoE will hold rates steady at its next meeting. The next rate cut is currently priced in for November, with only 34 basis points of total easing expected by year-end.

Despite the current inflation surge, the BoE forecasts that CPI will peak at 3.7% in September before gradually returning to its 2% target by 2027.

Market Reaction

The most notable market response was seen in sterling, particularly the GBP/USD pair. After an initial dip following the inflation release, the pair rebounded to a new intraday high of 1.3465—its highest level since February 2022, surpassing previous April highs. The near-term bias remains to the upside, supported by continued weakness in the US dollar. With the Relative Strength Index (RSI) indicating further room to rally before entering overbought territory, the pair may encounter resistance at the 1.35 mark. A break above this level could open the path toward 1.3640, a technical level that capped gains multiple times in 2022.

GBP/USD daily chart

(Past performance is not a reliable indicator of future results)