Tesla stock forecast: Third-party price targets

Tesla is one of the most closely watched names in global equities, with its share price often reacting to a mix of company updates, sector trends and wider market conditions. Discover the latest third-party TSLA stock predictions.

The move comes after Tesla’s latest quarterly delivery figures showed weaker electric-vehicle shipments and a second consecutive year of declining volumes (Investopedia, 2 January 2026). Meanwhile, broader US tech benchmarks such as the Nasdaq Composite have remained comparatively firm, edging higher even as the S&P 500 and Dow Jones Industrial Average eased (KITCO, 7 January 2026). Investor focus also remains on Tesla’s autonomous driving and robotaxi plans, following recent commentary from CEO Elon Musk and ongoing competition headlines in self-driving technology (Finvix, 5 January 2026).

Tesla stock forecast 2026–2030: Third-party price targets

As of 8 January 2026, third-party Tesla stock predictions show a wide dispersion across Wall Street and independent research, with institutions focusing on delivery trends, valuation, and the outlook for autonomous driving and energy segments. Targets span from deeply discounted scenarios to optimistic upside cases, underlining uncertainty around execution, competition, and broader equity market conditions.

GLJ Research (bearish valuation case)

GLJ Research has raised its 12-month TSLA stock forecast to about $25 per share, up from roughly $19, while maintaining a Sell stance, framing the move within a view that the stock remains substantially overvalued versus fundamentals. The research firm cites concerns over Tesla’s core automotive business, projected delivery declines, and increased discounting amid intensifying competition, even as it acknowledges ongoing profitability and a solid balance sheet (Investing.com, 7 January 2026).

24/7 Wall St. (consensus snapshot)

A 24/7 Wall St. summary reports a median one-year Tesla price target of about $395.89 from 31 covering analysts, implying potential downside from prevailing spot levels and aligning with an overall Hold consensus. The article notes that this central view sits between a wide range of individual targets, as analysts weigh slowing growth and competitive pressure against potential contributions from software, AI, and energy businesses (24/7 Wall St., 6 January 2026).

Morgan Stanley (balanced large-cap view)

Morgan Stanley is reported to have an equal-weight stance on Tesla with a $425 price target, after previously upgrading the target while cutting the rating from overweight. The broker points to AI and the Optimus robot initiative as important value drivers even as it flags execution risk and softer auto volume forecasts amid a more competitive EV landscape (Yahoo Finance, 11 December 2025).

Piper Sandler (growth-tilted scenario)

Piper Sandler is cited with a $500 Tesla price target, alongside an outperform-type rating, positioning the stock above consensus but within the broader Wall Street range. The firm’s stance reflects expectations for continued scaling of Tesla’s energy and software offerings, as well as potential benefits from autonomous driving initiatives, amid typical uncertainties on regulation and demand (Quiver Quantitative. 15 December 2025).

Wedbush (higher-end upside case)

Wedbush analyst Dan Ives maintains a 12-month Tesla price target of $600 per share, with the view reiterated in early January 2026 coverage following Tesla’s latest delivery update. The broker cites Tesla’s role in EVs and AI, as well as a pipeline that includes robotaxis and broader software monetisation, while acknowledging that execution on these themes and macro conditions will be key swing factors (CNBC, 2 January 2026).

Predictions and third-party forecasts are inherently uncertain, as they cannot fully account for unexpected market developments. Past performance is not a reliable indicator of future results.

TSLA stock price: Technical overview

TSLA is trading near $429.69 as of 11:11am UTC on 8 January 2026, with the price positioned below a tight daily moving-average cluster formed by the 10-, 20-, 50- and 100-day SMAs at roughly 456 / 463 / 445 / 421, while the 200-day SMA sits lower, near 363. The corresponding EMAs broadly track these levels, with the 200-day EMA around 384, reinforcing a layered longer-term support zone below the current price. From a momentum perspective, the 14-day RSI near 41 points to mid-range, slightly negative conditions, while the ADX around 21 suggests a modest trend that is not strongly established.

On the topside, the nearest Classic pivot resistance is R1 around 492, with the R2 area near 534 only coming into focus if a daily close above the first barrier is achieved. On pullbacks, the Classic Pivot at about 457 marks the initial level to watch, followed by the 100-day SMA near 421 as a key moving-average reference, while a break below S1 around 415 would open the way to a deeper move towards the lower pivot band (TradingView, 8 January 2026).

This is technical analysis for informational purposes only and does not constitute financial advice or a recommendation to buy or sell any instrument.

TSLA stock price history (2024–2026)

Tesla’s share price has seen notable swings over the past two years, moving from the low-$200s in early 2024 to the high-$400s by late 2025 before easing back. The stock closed at about $234 on 10 January 2024, fell under $150 during April 2024’s sharp sell-off, then recovered into the low-$200s by mid-year as volatility picked up around quarterly results and broader tech sentiment.

TSLA climbed from roughly $402 at the end of 2024 to levels above $450 in December 2025, and, despite recent pullbacks from the late-December highs near $485, it was last seen around $430 on 8 January 2026.

Past performance is not a reliable indicator of future results.

Tesla share price: Capital.com analyst outlook

TSLA stock price movements have remained choppy into early 2026, with the stock pulling back from late-December highs near the upper-$480s to trade closer to the low-$430s by 8 January 2026 on Capital.com’s feed. This leaves TSLA still well above its mid-2024 levels but showing signs of consolidation after a strong run, as intraday ranges widen and client sentiment on the platform skews more heavily towards the buy side than the sell side.

Recent moves are unfolding against a mixed fundamental backdrop: Tesla’s Q4 2025 vehicle deliveries fell about 15% year on year to roughly 418,000 units, marking a second consecutive annual decline and missing analyst expectations, which some commentators see as evidence of tougher EV competition and demand headwinds. Other third-party analysts highlight record energy-storage deployments and ongoing investor interest in Tesla’s AI and autonomy ambitions as potential offsets, while also noting that a prolonged macro slowdown, changing policy incentives, or execution risks in new lines of business could weigh on sentiment as well as support it.

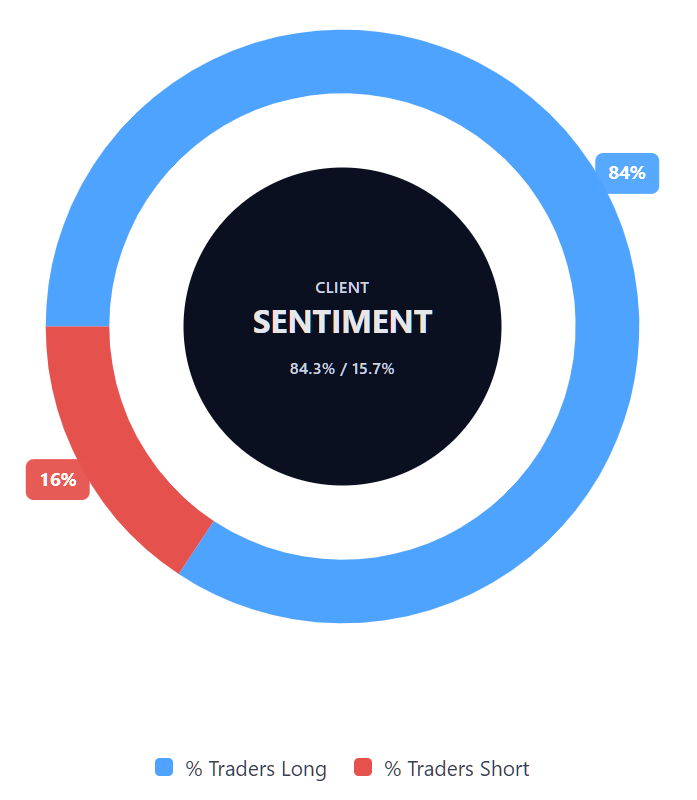

Capital.com’s client sentiment for Tesla CFDs

As of 8 January 2026, Capital.com client positioning in Tesla CFDs shows buyers at 84.3% versus sellers at 15.7%, indicating a strong tilt towards long positions, with buyers ahead by 68.6 percentage points. This snapshot reflects open positions on Capital.com and can change.

Summary – Tesla price 2025

- Tesla’s share price rose from about $403 at the end of 2024 to the mid–$450s–$480s range in late December 2025, before easing into early January 2026.

- Intraday in early January 2026, TSLA was quoted around $429.69 on Capital.com’s stock CFD feed, below its recent December highs but still well above mid-2024 levels.

- Technicals show price trading under a tight 10/20/50-day moving-average cluster, with longer-term 100/200-day averages still rising beneath, which may suggest a market that has rallied but is consolidating.

- Third-party analyst price targets for Tesla into 2026 span a wide range, from about $25 up to $600 per share, reflecting very different views on EV demand, competition, and monetisation of software and autonomy.

Past performance is not a reliable indicator of future results.

FAQ

Who owns the most Tesla stock?

Tesla’s largest individual shareholder has often been CEO Elon Musk, but exact holdings can change over time due to share sales, option exercises, and corporate actions. Beyond insiders, major ownership is typically spread across large institutional investors such as index and asset-management firms, reflecting Tesla’s inclusion in widely held benchmarks. For the most up-to-date breakdown, check Tesla’s latest regulatory filings and recent institutional ownership disclosures.

What is the five-year Tesla share price forecast?

There is no single, reliable five-year TSLA stock forecast. Longer-term projections vary widely because they depend on factors that are difficult to model, including EV demand trends, competition, pricing strategy, margins, and the pace of progress in autonomy, software, and energy. Even professional forecasts can be wrong, and unexpected events can shift outcomes quickly. Past performance and third-party forecasts are not reliable indicators of future results.

Is Tesla a good stock to buy?

Whether Tesla is a 'good' investment depends on your objectives, time horizon, and risk tolerance. The article highlights a mixed backdrop, including weaker delivery figures alongside continued focus on autonomy and energy. Analyst price targets also vary significantly, suggesting differing views on valuation and execution risk. This information is for educational purposes only and is not financial advice. Consider researching the company and, if needed, seeking independent advice.

Could Tesla stock go up or down?

Yes. Tesla’s share price can move in either direction and may be volatile, sometimes over short timeframes. Moves can be driven by company-specific updates such as deliveries, earnings, pricing decisions, and product developments, as well as broader market factors like interest-rate expectations and tech-sector sentiment. Technical levels and client sentiment may offer context, but they do not predict outcomes. Market conditions can change quickly, and losses are possible.

Should I invest in Tesla stock?

Only you can decide, and it should reflect your personal circumstances. The article shows that views on Tesla differ materially, with analyst targets ranging widely and key uncertainties around EV demand, competition, and monetisation of software and autonomy. If you’re considering exposure, it may help to assess how much volatility you can tolerate and how Tesla fits within a diversified approach. This is not a recommendation to buy or sell.

How can I trade Tesla CFDs on Capital.com?

You can trade Tesla share CFDs on Capital.com. CFD trading means you’re speculating on price movements rather than owning the underlying shares. Contracts for difference (CFDs) let you take a long or short position depending on your outlook. However, CFDs are traded on margin, and leverage amplifies both your profits and your losses.