RBNZ Preview: OCR expected to remain unchanged as central bank focuses on inflation

The Reserve Bank of New Zealand meets on Wednesday, July 10, 2024. We preview what to expect from the meeting and its possible impact on the NZD/USD.

The Reserve Bank of New Zealand meets on Wednesday, July 10, 2024. We preview what to expect from the meeting and its possible impact on the NZD/USD.

RBNZ likely to keep policy unchanged as inflation fight continues

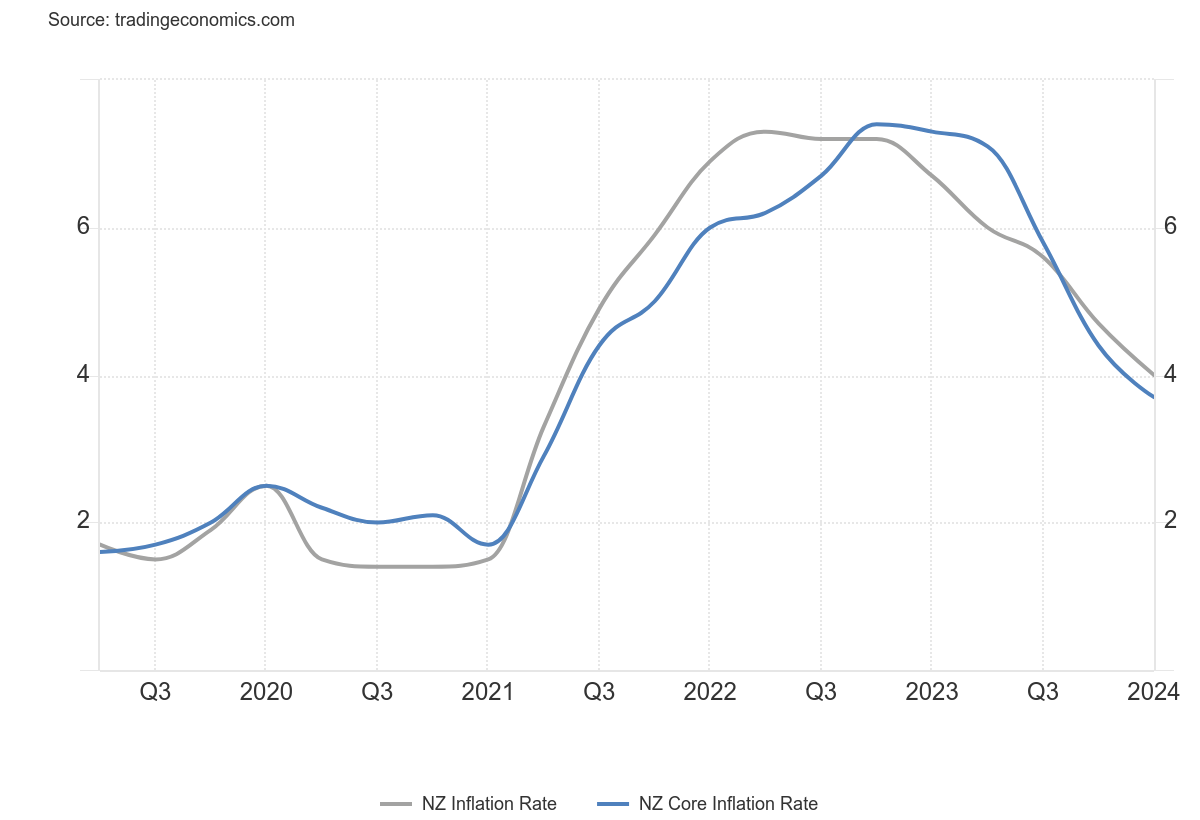

The markets expect the Reserve Bank of New Zealand to keep policy unchanged when it meets this week. Despite signs of weaker economic activity in New Zealand, including recessionary growth conditions and a rising unemployment rate, inflation remains above the RBNZ’s target. The quarterly inflation data revealed that headline CPI grew at 4% in the first quarter, while the critical core inflation number moderated to 3.7%. While the data marked a 2 ½ year low in New Zealand inflation, it remains above the RBNZ’s 1-3 % inflation target.

(Source: Trading Economics)

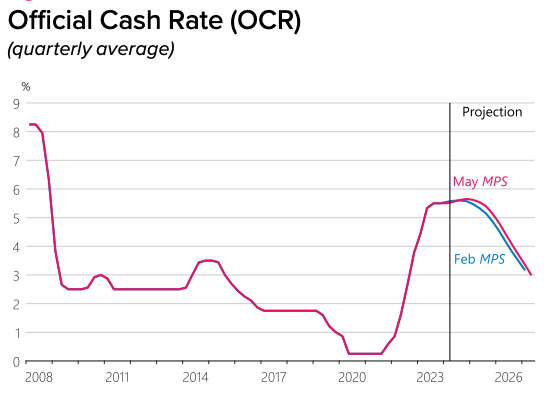

After the governing National Party changed its mandate, the RBNZ became a solely inflation-targeting central bank. As a result, the central bank’s assessment of the balance of risks to the economy minimises growth and employment in favour of returning inflation to target. The RBNZ made its intent clear at its May meeting, with the central bank lifting its projections for the OCR, flagging the risks associated with inflation running above target. This commentary contrasted pre-meeting expectations of a dovish pivot.

(Source: RBNZ)

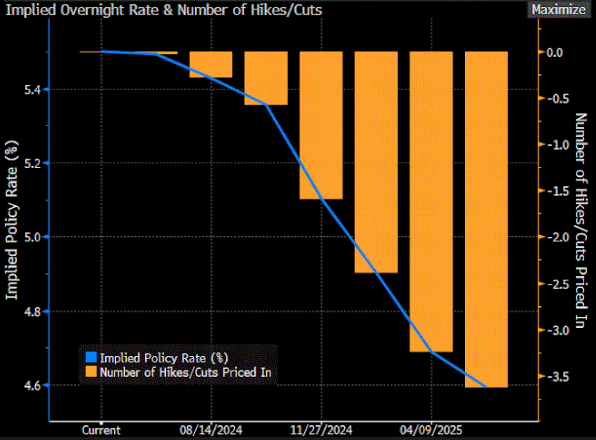

Although not priced in at this meeting, the markets are discounting that the RBNZ will cut rate cuts by the end of the year. As a result, the markets will peruse the central bank’s statement and press conference for signals about whether it sees a case for lowering rates this year or implicitly or explicitly pushes back on the notion.

(Source: Bloomberg)

Technical analysis: NZD/USD

US Federal Reserve policy is a more significant determinant of the NZD/USD, with the pair rising as the markets price in a rate cut in the US as soon as September and two full cuts before the end of 2024 following weaker-than-expected economic data last week. Pushback from the RBNZ on the prospects of a rate in New Zealand this year could add momentum to this rebound. Meanwhile, any shift to a more dovish bias could slow the momentum down. From a technical standpoint, dip buyers supported the NZD/USD below the 200-day moving average. However, the pair is trending sideways. Aside from the 200-day MA, a significant level of support could be 0.6050, while 0.6250 looms as potential resistance.

(Past performance is not a reliable indicator of future results)