Non-Farm Payrolls Preview: Tariffs, trade tensions, and a resilient labour market

As we enter a pivotal week for US macroeconomic data, all eyes turn to Friday’s release of the May Non-Farm Payrolls (NFP) report.

As we enter a pivotal week for US macroeconomic data, all eyes turn to Friday’s release of the May Non-Farm Payrolls (NFP) report. While markets are generally optimistic and risk assets remain bid, the employment figures—alongside a suite of other key indicators—will provide an important gauge of the resilience of the US economy amidst persistent uncertainty around trade policy and fiscal sustainability.

Labour market outlook: Resilience amid trade volatility

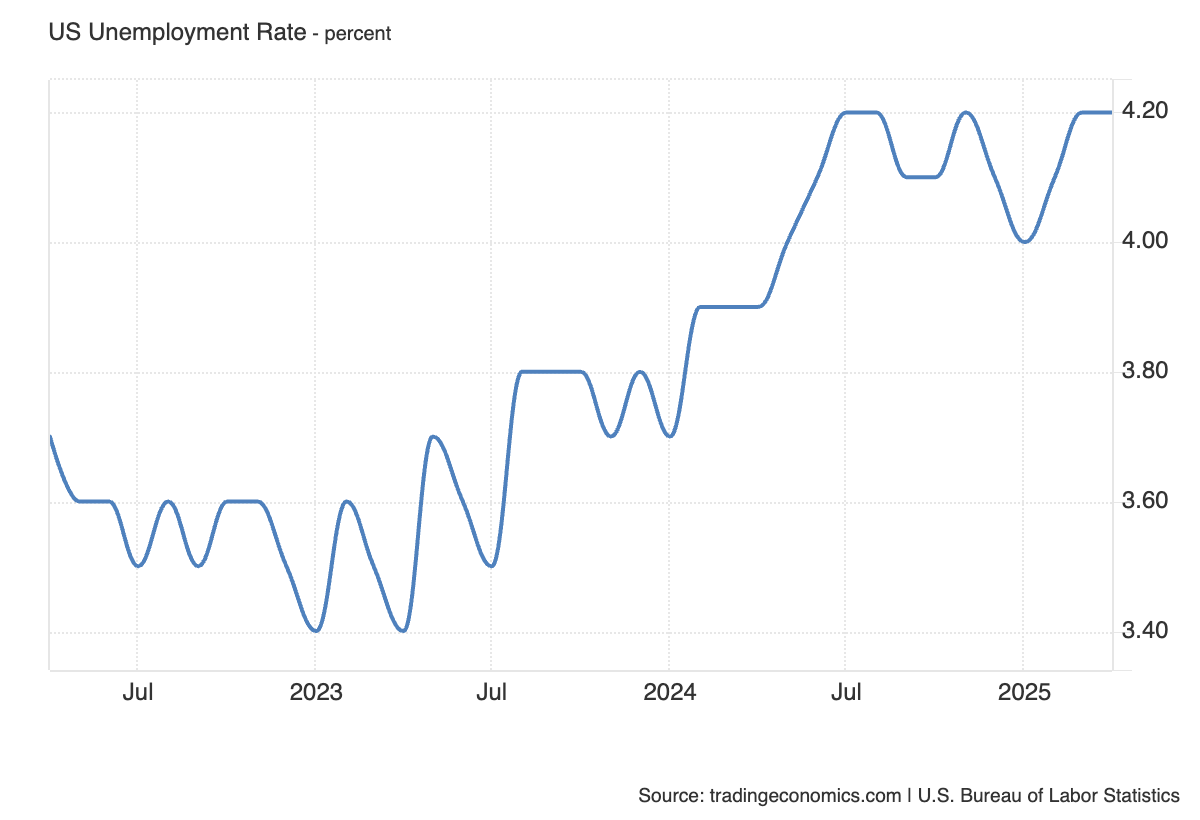

Consensus expectations are for job growth to moderate, with Non-Farm Payrolls projected to rise by approximately 125,000 jobs, and the unemployment rate to edge slightly higher to 4.2%. While this reflects a slowing labour market, it's not indicative of outright weakness. In fact, it would mark another month of stable—albeit decelerating—employment gains that suggest the US economy continues to grind forward, even in the face of significant macro headwinds.

The employment figures will arrive just days after ISM Manufacturing and Services PMIs are released, which are expected to show a modest pickup in activity after a turbulent April. These surveys, along with the NFP data, will offer markets a more complete picture of how the economy is absorbing recent shocks from trade policy shifts and wavering global demand.

(Source: Trading Economics)

(Source: Trading Economics)

Trade tensions and the “TACO” trade

The broader macro backdrop, however, remains clouded by geopolitical and policy-driven uncertainty. Former President Donald Trump’s tariff rhetoric has returned to centre stage, with threats directed at both China and the European Union creating renewed volatility. Investors have grown increasingly familiar with the so-called “TACO” trade—Trump Always Chickens Out—a sentiment reflecting markets’ tendency to look through his aggressive posturing in anticipation of eventual retreat or compromise.

But this strategy is not without risk. As seen in recent days, even the threat of revived tariffs has been enough to jolt equities and shake the bond market. Investors were caught off guard by last week’s volatility following Trump’s comments on China’s alleged non-compliance with recent trade agreements. Although tensions eased on reports of a potential meeting between the two nations’ leaders, the asymmetric risk remains: markets are not fully pricing in the downside scenario in which tariffs re-escalate.

Implications for the Fed and US monetary policy

The Federal Reserve will be closely monitoring this week’s data. The modest softening expected in NFPs, alongside other indicators, could increase pressure for a policy shift—particularly if growth risks continue to mount. Yet, the Fed’s reaction function remains highly data-dependent. If the economy continues to show resilience, it may delay any dovish pivot, especially with inflation still hovering above target.

That said, trade policy is introducing a significant wildcard. Should tariffs return in full force—or even partially—it could dampen growth expectations, justify rate cuts, and reintroduce volatility across risk assets. At present, market pricing reflects optimism that worst-case scenarios will be avoided, but that optimism is vulnerable to sudden headline risk.

Market implications: Equities, the Dollar, and risk appetite

US equities have remained surprisingly buoyant, with the S&P 500 just a few percentage points from all-time highs. The persistent bid in stocks is being driven by a mix of resilient earnings, belief in Fed flexibility, and the expectation that Trump will retreat from his most extreme trade threats. However, as we’ve noted, this bullishness could be upended quickly if markets are forced to reprice the risk of prolonged or deepened trade conflict.

In currency markets, the US Dollar remains under downward pressure. The greenback’s recent bounce was rejected last week after a failed attempt to break above 100 on the DXY, and technical signals continue to suggest a bearish trend. Unless Friday’s NFP data surprises significantly to the upside—or there’s a meaningful de-escalation in trade rhetoric—the dollar may remain a “sell-the-rally” story, especially as Fed rate cut bets mount.

(Source: Trading View)

(Source: Trading View)

Past performance is not a reliable indicator of future results.