Australia mortgage interest rates forecast 2025: What to expect?

Australia mortgage interest rate forecasts, with third-party analysts’ insights, and how to trade mortgage rates via forex & share CFDs.

Mortgage interest rates represent the percentages charged by lenders on home loans. In Australia, these are closely tied to the Reserve Bank of Australia’s (RBA) official cash rate, which shapes broader borrowing costs and affects affordability across the housing market.

For CFD traders, mortgage rate trends are more than just domestic finance – they signal shifts in central bank policy and broader economic sentiment. These shifts may affect trading in AUD forex pairs, banking and housing-related shares, and interest rate-sensitive assets.

In this guide, we explore expert forecasts for Australian mortgage rates, RBA drivers, and how to position around potential rate changes using CFDs.

Mortgage interest rates in Australia: Third-party forecasts

Following the Reserve Bank of Australia’s (RBA) decision to cut the cash rate by 25 basis points to 3.85% in May 2025 – the first reduction since February – third-party analysts have shifted focus to mortgage interest rates.

A majority of forecasts signalled further mortgage interest rate reductions across Australia as the RBA maintains an accommodative stance, although the pace and timing of future cuts remain nuanced.

Short-term mortgage rates projections for 2025

Trading Economics forecasted average mortgage interest rates for Australia, based on three-year bank lending rates, declining steadily – averaging 5.72% in Q2 2025 before dropping to 5.22% by Q4 2025 and holding stable into early 2026.

Deloitte’s Global Economic Outlook 2025 highlighted that, while additional rate cuts are expected, the pace will be moderate due to persistent services inflation and fiscal policy constraints. Similarly, NAB has projected further 25bps cuts in July, August, and November 2025, following their accurate forecast of a 50bps reduction in May.

Westpac emphasised that recent interest rate reductions represent: 'One of the largest falls in household debt servicing costs seen in the past 30 years'. However, the bank noted that many borrowers have yet to benefit fully, as refinancing from higher previous mortgage rates in Australia takes time. Westpac further observed: 'To the extent borrowers are choosing relatively more expensive shorter-term rates in anticipation of further cuts, the full benefit will be delayed – but not cancelled.'

Longer-term predictions: Australian mortgage rates in 2026

Fitch Ratings noted expectations that mortgage rates in Australia may decline towards 5.0% in 2026, down from a projected 5.5% average in 2025. Fitch also predicted falling arrears rates, citing how reduced mortgage repayments would ease financial stress on households throughout the year.

While the consensus mortgage interest predictions indicate Australian rates trending downward – actual outcomes will largely hinge upon the RBA’s ongoing response to inflation dynamics, fiscal policy settings, and the pace at which households refinance into lower-rate loans.

Past performance is not a reliable indicator of future results.

What’s the Australia mortgage interest rate history?

Mortgage interest rates in Australia have fluctuated significantly in recent years, primarily in response to the Reserve Bank of Australia's (RBA) monetary policy.

Australian mortgage rates experienced a steady decline from 2019 through early 2022, influenced by a low inflation and accommodative RBA policies. During this phase, mortgage rates in Australia averaged a record low of 2.63% in April 2022, which made home loans more affordable for borrowers.

However, from mid-2022 onwards, rates began to rise sharply, mirroring the RBA's rate hikes designed to combat rising inflation. This upward trajectory continued into early 2025, with mortgage interest rates in Australia reaching a recent high of 6.15% in January 2025. Subsequently, rates started to retreat slightly, falling to 6.03% in February 2025, and 5.97% in May 2025.

What’s the average mortgage interest rate in Australia?

Australian mortgage interest rates averaged 5.97% in March 2025, according to the latest data from Trading Economics. This followed a slight easing from 6.03% in February, aligning with the Reserve Bank of Australia's recent policy shift towards rate reductions.

Between 2019 and 2025, the average mortgage rate in Australia was approximately 4.21%. This figure reflects both the historically low rates seen during the pandemic – when the RBA slashed the cash rate to support economic activity – and the rapid tightening phase that began in mid-2022 as inflation pressures intensified.

Looking ahead, third-party mortgage interest rate forecasts suggest the average rate may trend lower into 2026, though the pace will depend on the RBA’s policy stance, inflation outcomes, and the speed at which borrowers refinance existing loans.

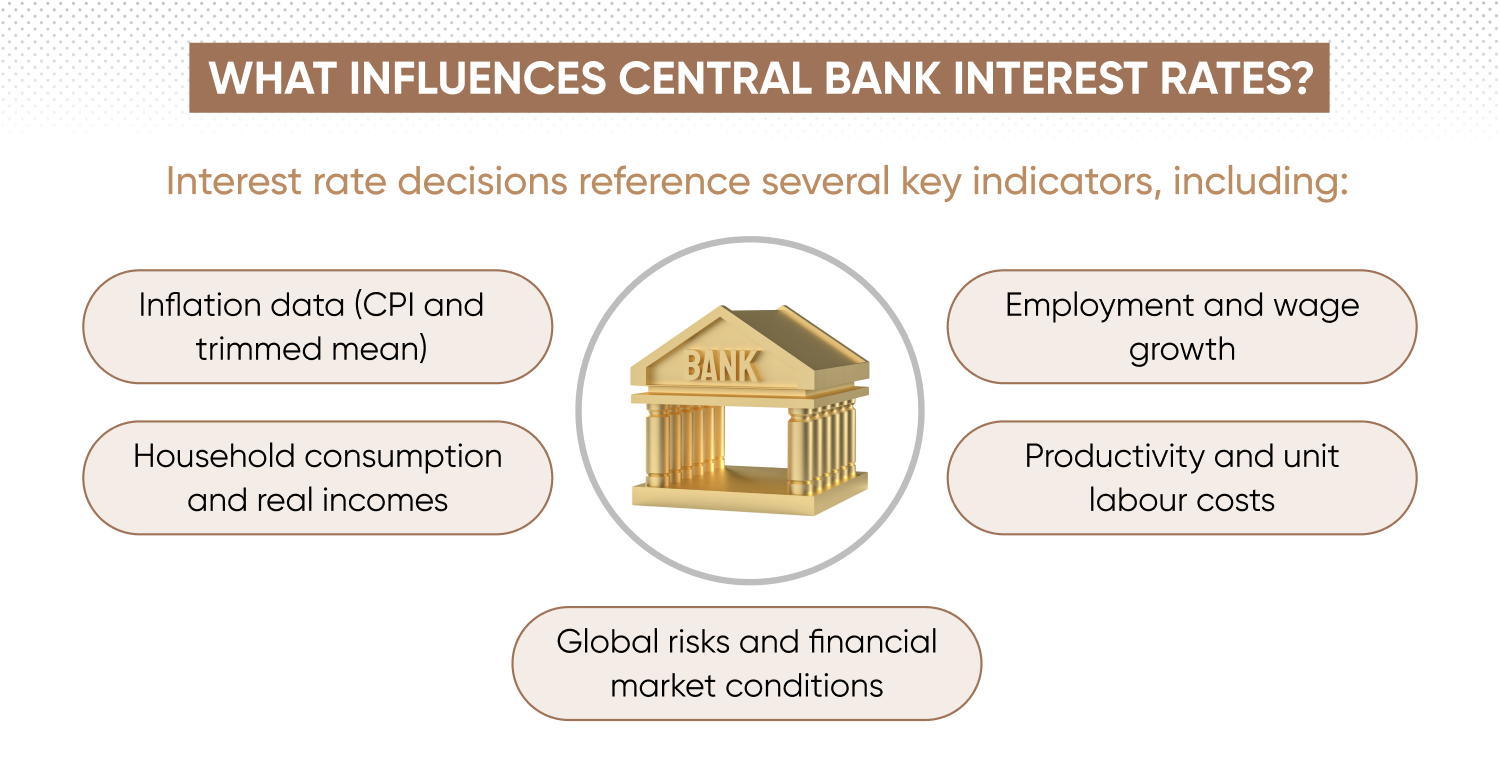

How does the RBA influence mortgage interest rates?

The Reserve Bank of Australia (RBA) sets the official cash rate to help manage inflation and support employment. This rate directly influences mortgage interest rates across the economy.

In a 20 May 2025 monetary policy statement, the RBA noted that recent tariff announcements by the US have increased uncertainty. The Board acknowledged that global volatility could weigh on domestic activity. 'The Board judged that the risks to inflation have become more balanced,' the RBA stated, adding that monetary policy remains: 'Well placed to respond decisively' if global conditions deteriorate.

On 21 May 2025, ANZ’s head of Australian economics, Adam Boyton said: 'There’s a concern from the RBA’s perspective that the uncertainty globally will have an impact on the domestic economy... A lot will depend on how negotiations between the US and its trading partners progress.'

What’s next for mortgage interest rates?

Markets are pricing in further cuts, with ANZ having forecast a potential 25bps reductions in July and August, bringing the potential cash rate to 3.35% by Q3 2025. However, the pace and scale of further moves may depend on near-term inflation data, wage outcomes, and how global trade policy evolves.

Explore third-party RBA rate forecasts on our Australian interest rate projections page.

Interest rates: How do they affect mortgages?

The RBA cash rate influences Australian mortgage prices. When the central bank changes its official rate, lenders adjust their variable mortgage rates accordingly – though the relationship isn’t always one-to-one, and the flow-through can vary in both timing and magnitude.

Global interest-rate settings also play a role. If major central banks like the US Federal Reserve or European Central Bank shift policy, it can influence Australian bond yields and funding markets.

Here’s how two cash rate scenarios might impact variable mortgage rates:

| Scenario | Reaction | Result |

|---|---|---|

| RBA hikes the cash rate | Lenders may increase variable mortgage rates. | Higher repayments may reduce borrowing capacity, potentially weighing on housing prices. |

| RBA cuts the cash rate | Lenders may reduce variable mortgage rates.* | Lower repayments may stimulate demand, potentially supporting housing prices. |

*However, lenders may delay or partially pass on cuts, especially if their funding costs remain elevated.

For fixed mortgage rates, the link to RBA moves is less direct. Fixed rates reflect expectations about future interest rate changes and domestic bond market conditions, making them sensitive to shifts in RBA guidance and investor sentiment.

Discover third-party European Central Bank (ECB) interest rate predictions.

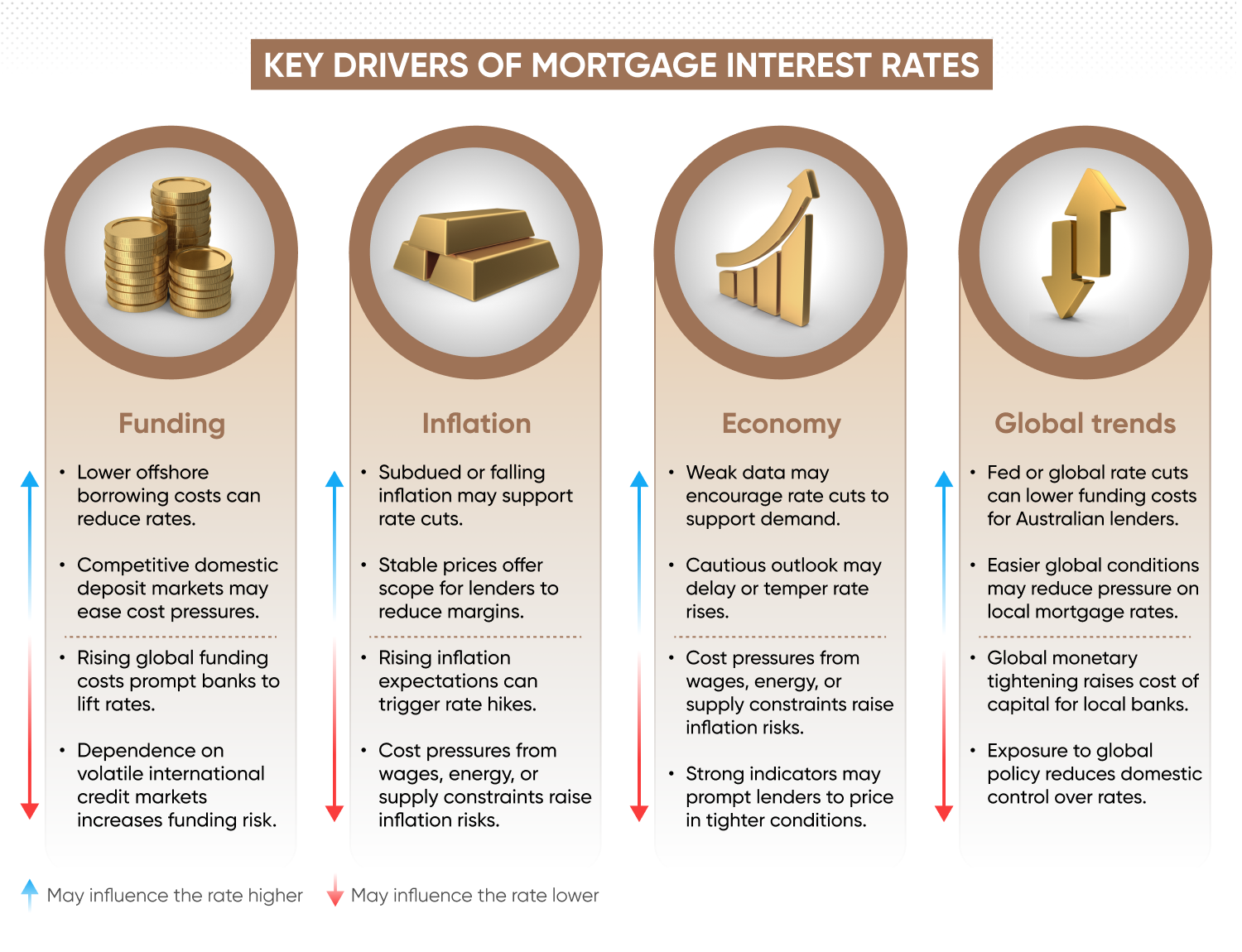

Which other factors influence mortgage rates?

Although the cash rate is a primary driver of mortgage rates in Australia, several other factors influence how lenders price home loans – including inflation, economic indicators, and macroeconomic trends.

Bank funding costs

Australian lenders source funds from both domestic deposits and global credit markets. When wholesale funding costs rise – potentially driven by interest rate moves in the US or Europe – banks may lift mortgage rates to protect margins. If offshore borrowing becomes cheaper, lenders sometimes pass on lower costs to borrowers, even without an RBA rate cut.

Inflation trends

Though the RBA targets inflation, lenders also monitor pricing pressures. If inflation expectations rise – due to wages, energy prices or supply constraints – banks may raise mortgage interest rates in anticipation. If inflation remains subdued or falls, they may have scope to reduce rates if funding conditions are supportive.

Economic indicators

Employment, wage growth, GDP and consumer sentiment all influence lender confidence. Strong data can lead to higher mortgage rates as lenders anticipate growth and tighter monetary conditions, while weaker readings may prompt caution and upward pressure on mortgage rates, regardless of RBA moves.

Global monetary policy

Interest rate decisions by central banks like the US Federal Reserve shape global funding conditions. Fed rate cuts can lower borrowing costs for Australian banks, potentially reducing mortgage rates in Australia. Conversely, global tightening cycles may lift funding costs and drive rates up – even if domestic conditions are stable.

How to trade CFDs on mortgage interest rates

While mortgage interest rates aren’t directly tradeable, rate shifts can influence a range of assets – particularly in the shares and forex CFD markets. Here’s how to gain exposure to mortgage rate movements.

Shares

Mortgage interest rate changes have a direct impact on sectors exposed to housing, lending, and property markets. These include banks, mortgage-focused REITs, and home builders – all of which can see earnings and valuations shift based on rate expectations.

Here are some shares CFDs that react to mortgage rate trends:

- Commonwealth Bank of Australia (CBA) – one of Australia’s largest mortgage lenders; sensitive to changes in domestic interest rates – trade CBA

- Westpac – significant exposure to the Australian mortgage market; margins respond to RBA rate changes – trade Westpac

- ANZ Group – mortgage lending represents a major share of its retail banking income; affected by refinancing activity – trade ANZ

- JPMorgan Chase & Co – large US bank with exposure to mortgage-backed assets and home lending – trade JPMorgan Chase

- Bank of America – one of the biggest US mortgage lenders; benefits from rising net interest margins if lending demand stays robust – trade Bank of America

- HSBC – global bank with mortgage portfolios in the UK and Asia; exposed to global rate moves – trade HSBC

- Lloyds – UK retail lender with a large residential mortgage book; impacted by BOE rate expectations – trade Lloyds

Learn more about shares trading.

Forex

Mortgage rates are closely tied to long-term interest rates, which are influenced by central bank policy and macroeconomic conditions. The same factors also affect currency values.

Let’s use US interest rates as an example:

Here are some forex CFDs you can trade now, aligned with mortgage rate moves:

- AUD/USD – may move on divergence between Reserve Bank of Australia (RBA) and Fed policy; changes in RBA guidance can influence the Aussie – trade AUD/USD

- USD/JPY – has historically correlated with US Treasury yields; higher US mortgage interest rates could support USD – trade USD/JPY

- EUR/USD – can react to US interest rate outlook; a more hawkish Fed can lift USD relative to the euro – trade EUR/USD

- GBP/USD – sensitive to differing rate paths between the Fed and Bank of England; interest rate differentials can drive movement – trade GBP/USD

- NZD/USD – like the Aussie, this pair is influenced by central bank policy and economic data – trade NZD/USD

- USD/CAD – Canada’s housing market is a key part of its economy; housing-sensitive data may shape outlook – trade USD/CAD

Learn more about forex trading

FAQs

Could Australia mortgage interest rates go up or down?

At the moment, mortgage interest rates in Australia have recently been reduced following decisions by the Reserve Bank of Australia (RBA). In May 2025, the RBA cut the cash rate to 3.85%, with some market participants expecting further reductions this year. That said, future moves will depend on inflation, wage growth, and global risks. If inflation rises again, or global conditions worsen, the RBA could pause or reverse course. For now, third-party Australia mortgage interest rate forecasts point to further cuts – but it’s not guaranteed.

How often does the RBA change interest rates?

The RBA meets 11 times a year to set the official cash rate – usually on the first Tuesday of each month, except January. Rate changes don’t occur every meeting. Decisions depend on inflation data, economic growth, employment figures, and global events. So far in 2025, the RBA has made two cuts – in February and May – as inflation has come back within its target range.

How do Australian mortgage rates affect forex trading?

Mortgage interest rates Australia forecast trends tend to follow the RBA’s policy outlook. When rates fall, it usually signals looser monetary conditions – which can weigh on the Australian dollar (AUD). Forex traders often monitor average mortgage interest rate Australia trends as a signal for AUD pairs like AUD/USD or AUD/JPY. If the RBA is cutting while the US Fed holds or hikes, that rate gap can push AUD lower against USD.