Commonwealth Bank stock forecast: Have CBA shares already priced in $2.5bn quarterly profit?

What’s next for the stock of one of Australia’s biggest banks?

One of Australia’s biggest banks, the Commonwealth Bank of Australia (CBA), is trading close to its all-time high share price, with the banking sector set to benefit from rising interest rates.

The stock has gained more than 17% since the start of October, ending a downward trend that began in August. The Australian Stock Exchange (ASX) 200 Index (AU200) has risen by 10% over the same period.

Is there further upside potential for the stock, or is it set to turn lower?

In this article, we look at CBA’s recent performance and the outlook for the share price heading into 2023.

What is Commonwealth Bank?

Commonwealth Bank, also known as CommBank, is one of the big four banks in Australia, along with Westpac Banking Corporation, National Australia Bank, and Australia and New Zealand (ANZ) Banking Group.

CommBank was founded in 1911 under the Commonwealth Bank Act in 1911, and started operations the following year to conduct general banking business and provide savings accounts.

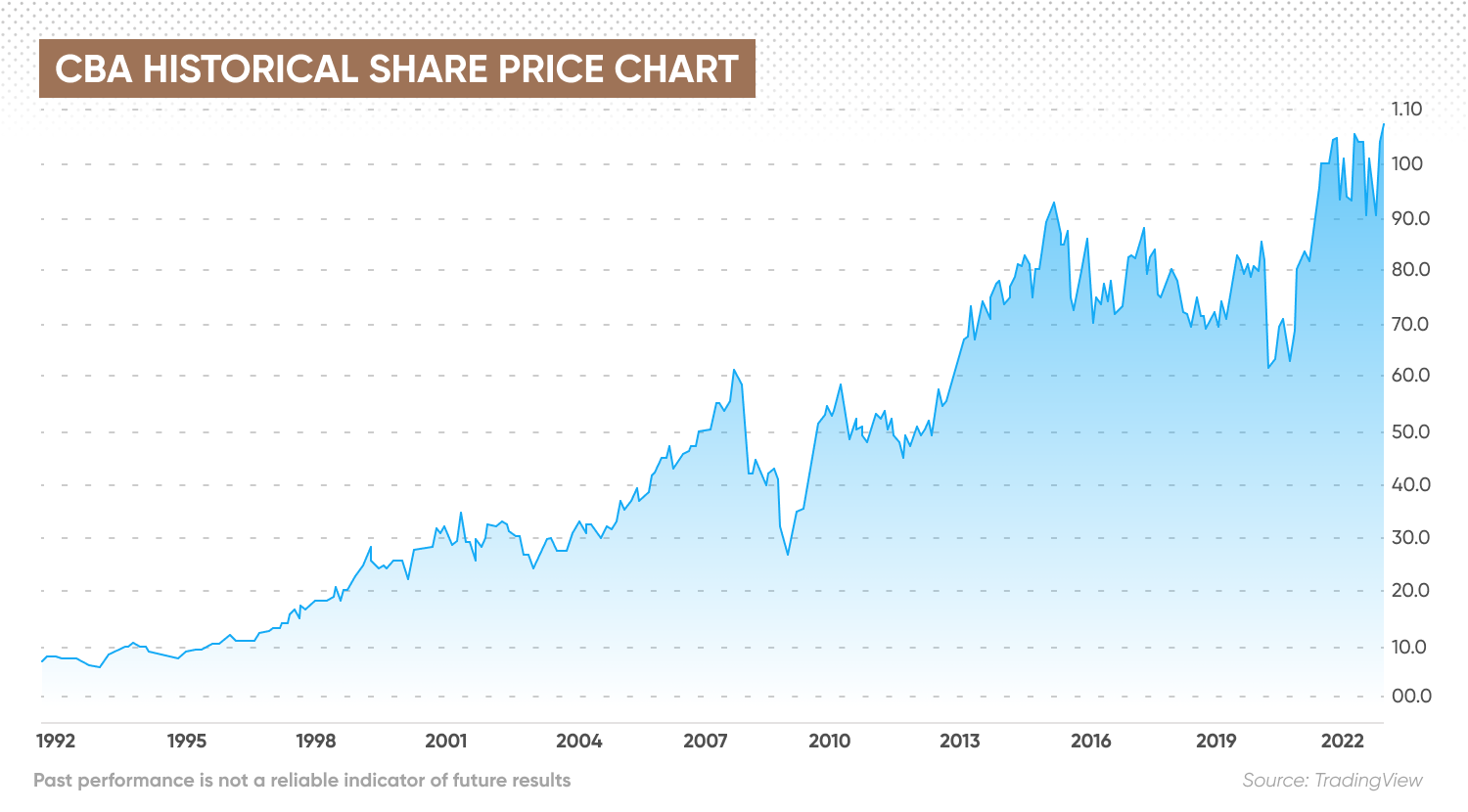

The bank was privatised in 1991, and started trading on the ASX at $5.40 a share. The stock has gained 1,873% over the past three decades. Until Woodside Petroleum’s merger with BHP Petroleum on 1 June, CBA was the biggest company on the ASX by market capitalisation. The stock is popular among Australian investors, some of whom have owned shares since the public listing. The bank now has more than 800,000 shareholders.

CBA has been a reliable dividend stock, paying shareholders biannually since its listing. In June 2018, CommBank demerged its wealth management and mortgage broking businesses and established a new stockbroking company, Commonwealth Securities (CommSec).

CommBank share price reflects macroeconomic volatility

The CBA stock price has recovered at the start of the Covid-19 pandemic in 2020 from A$90.99 to A$57.66 a share. The stock rebounded to the A$90 level in April 2021, then reached an all-time high of A$109.71 on 5 November 2021 amid the prospect of recovery from the economic slump seen during lockdowns.

While Australia is facing the prospect of recession in 2023, the CommBank share price has found support from rising interest rates. The Reserve Bank of Australia, the country’s central bank, has raised interest rates seven times this year, starting with a 25-basis point (bp) hike in May, and could opt for an eighth hike in December.

The CommBank share price started 2022 at A$102.51 and dipped to the $93 level twice in February. The stock climbed to A$107.35 in late March and traded above $100 until June, when it fell to A$87.26 a share. The stock rebounded to A$102.60 on 8 August, retreated to A$90.61 on 3 October, and then climbed to $107.46, its highest level since the November 2021 high.

On 8 August, CommBank reported net income of A$9.6bn for the year to 30 June, an increase of 11% from the previous financial year.

“Our operating context has changed significantly this year. The economy recovered strongly as we adjusted to living with COVID-19; however, many of our customers have been impacted by devastating natural disasters, and rising cost of living pressures. Around the world, geopolitical tensions have created additional uncertainty in financial markets,” the statement said.

“Against many measures, Australian households and businesses are in a strong position given low unemployment, low underemployment, and strong non mining investment. However inflation is high, and we have seen a rapid increase in the cash rate which is negatively impacting consumer confidence. We expect consumer demand to moderate as cost of living pressures increase,” said Matt Comyn, the bank’s CEO.

But the CBA stock price fell in the weeks after the earnings announcement, as Australian financial stocks retreated on increasing macroeconomic uncertainty. The rise in Australian interest rates has raised the prospect of mortgage defaults in a crowded market, which could tighten bank net interest margins (NIMs). NIM is a metric used to measure bank profitability, with higher figures indicating higher profitability.

CommBank reported a NIM of 1.9%, down 18 basis points from a year earlier and 2.07% in 2020. But the company added that: “Our medium term outlook remains unchanged, with margins expected to increase in a rising rate environment.”

The bank’s loan impairment expense decreased by $911m to a benefit of $357m, “driven by reduced COVID-19 overlays partly offset by increased forward looking adjustments for emerging risks including inflationary pressures, supply chain disruptions and rising interest rates.”

CommBank declared a final dividend of $2.10 a share, for a total dividend for the year of $3.85 a share. With the share price at $107.46, that gives the stock a 12-month trailing dividend yield of 3.85%. CommBank said it will continue to target a full year payout ratio of 70-80% of its net income and an interim payout ratio of around 70%.

On 15 November, CommBank reported a 2% increase in its net income for the first quarter of the new financial year to $2.5bn. Operating income rose by 9%, with net interest income up by 16% driven by higher deposit earnings, growth in core product volumes, and the benefit of higher interest rates on replicating portfolio and equity hedge balances, partly offset by the impact of competition and higher lending product rates.

What is the long-term outlook for the CBA stock price?

Let’s look at some of the latest analyst Commonwealth Bank stock predictions.

Commonwealth Bank stock forecast: Will the share price set a new high?

Analysts at Fitch Ratings expect the big four Australian banks to weather high inflation and slowing economic growth. “We anticipate only a modest weakening in asset quality over 2023 despite the sharp rise in interest rates as we expect unemployment to remain relatively low and broadly supportive of asset quality. High household debt remains a risk factor in Australia, although appropriate serviceability buffers at origination and savings built up by households provide some offset,” the analysts commented on 15 November.

Australian stockbroker Morgans revised down its Commonwealth Bank share price forecast on 16 November after the bank’s first-quarter trading update. Senior analyst Nathan Lead noted Commbank’s loan impairment expense of $222m, 10 basis points of gross loans, compared to a provision release in the second half of the 2022 financial year of $282m, noting:

“We still assume that the loan impairment expense will normalise upwards to a long-run loan loss rate of 17 bps by FY24F… We estimate the current share price implies 2.5x [price-to-book value ratio] P:BV (end-FY22A) and 17.5x [price to earnings ratio] PER (FY23F). Our target price implies 2.1x P:BV (end-FY23F) and c.16x PER (FY24F).”

At the time of writing (22 November), the Commonwealth Bank stock forecast from data provider Trading Economics predicted the CBA share price to retreat from the highs, ending 2022 at A$103.01 a share and sliding to A$95.00 in a year’s time, based on global macro models projections and analysts’ expectations.

But the Commonwealth Bank stock forecast for 2023 from algorithm-based forecasting service Wallet Investor showed the stock trading at a new all-time high of A$120.46 by the end of the year, up from A$107.449 at the end of 2022. WalletInvestor’s Commonwealth Bank stock forecast for 2025 showed the share price continuing to climb, reaching $147.04 by the end of the year.

AI Pickup’s Commonwealth Bank stock forecast showed volatility on the stock over the coming years, averaging A$148.95 in 2023, A$148.10 in 2025 and declining to $77.80 by 2030.

When considering a Commonwealth Bank stock forecast to help inform your trading strategy, it’s important to remember that analysts and algorithm-based forecasters can and do get their predictions wrong.

We recommend that you always do your own research. Look at the latest market trends, news, technical and fundamental analysis, and expert opinion before making any investment decision. Keep in mind that past performance is no guarantee of future returns. And never invest money you cannot afford to lose.

FAQs

Is Commonwealth Bank a good stock to buy?

Whether CommBank is a good stock for your portfolio depends on your trading strategy, risk tolerance and how much you intend to invest. You should do your own research to take an informed view of the stock. Keep in mind that past performance is no guarantee of future returns. And never invest money you cannot afford to lose.

Will Commonwealth Bank stock go up or down?

The direction of the CommBank share price could depend on the performance of the Australian economy and the level of interest rates set by the Reserve Bank of Australia, among other factors.

Should I invest in Commonwealth Bank stock?

Whether you should invest in CommBank stock is a decision only you can make based on your personal circumstances. You should do your own research to take an informed view of the stock. Keep in mind that past performance is no guarantee of future returns. And never trade money that you cannot afford to lose.