Top five momentum indicators to trade with

Whether you are an experienced trader or a beginner, momentum indicators can help you spot a trend reversal.

Momentum indicators are meant to help traders spot whether the market trend will continue or reverse.

Below is our take on some of the most popular momentum indicators available on the Capital.com platform, and how one could incorporate them into their trading strategy.

What is a momentum indicator?

Momentum indicators are tools used in technical analysis. They help traders understand the strength of a price trend.

They are called "momentum" indicators as the principles behind price movements are similar to the ones used to calculate speed, momentum, and acceleration.

Types of momentum indicators

There is a wide range of momentum indicators in technical analysis. The most popular fall into three categories, as explained in the following momentum indicators list.

Closing price compared to the previous close

Using indicators of this type, traders can identify leading momentum trading signals. They seek to understand if the market is overbought or oversold at close and if it could be about to change direction.

Examples of these momentum indicators include the Relative Strength Index (RSI) and the Rate of Change (ROC).

Closing price compared to range

This type of momentum technical indicator compares the current price action to how the market has behaved over a past period of time, when it established a relative range (low to high and vice versa). These indicators try to show whether the market is stronger or weaker, while filtering out the volatility associated with leading indicators.

Examples include the Commodity Channel Index (CCI) and the Stochastic Momentum Index (SMI).

Closing price compared to moving average

These are used primarily for trend-following signals. They are lagging indicators that compare the current price to averages over a previous period. Traders can observe if the price moves faster or slower relative to its average behaviour in the past. An example of such a momentum indicator is the Moving Average Convergence Divergence (MACD).

Top five momentum indicators in technical analysis

There is no single momentum technical indicator that fits all occasions. That’s why it’s essential to know different indicators and how to use them in different trading strategies.

For example, traders are advised to avoid using a momentum indicator suited for sideways markets when a market is trending.

Here are the top 5 momentum indicators you could use when trading.

Note that the S&P 500 charts below are used for educational purposes only and do not reflect the current market price of the index.

RSI (Relative Strength Index)

The Relative Strength Index (RSI) is the most commonly used momentum trading indicator. It works by comparing the average number of higher closes in a given period, divided by the average number of lower closes. It then inverts it to create an oscillator of 0 to 100, with overbought and oversold levels at 70% and 30%, respectively.

Let's look at the RSI’s momentum indicator formula:

The RSI uses 14 periods as default. The period is used as follows to calculate RS:

Rather than identifying overbought and oversold zones, many traders use the RSI to identify divergences. This is where as the price continues to trend, the momentum indicator points the other way.

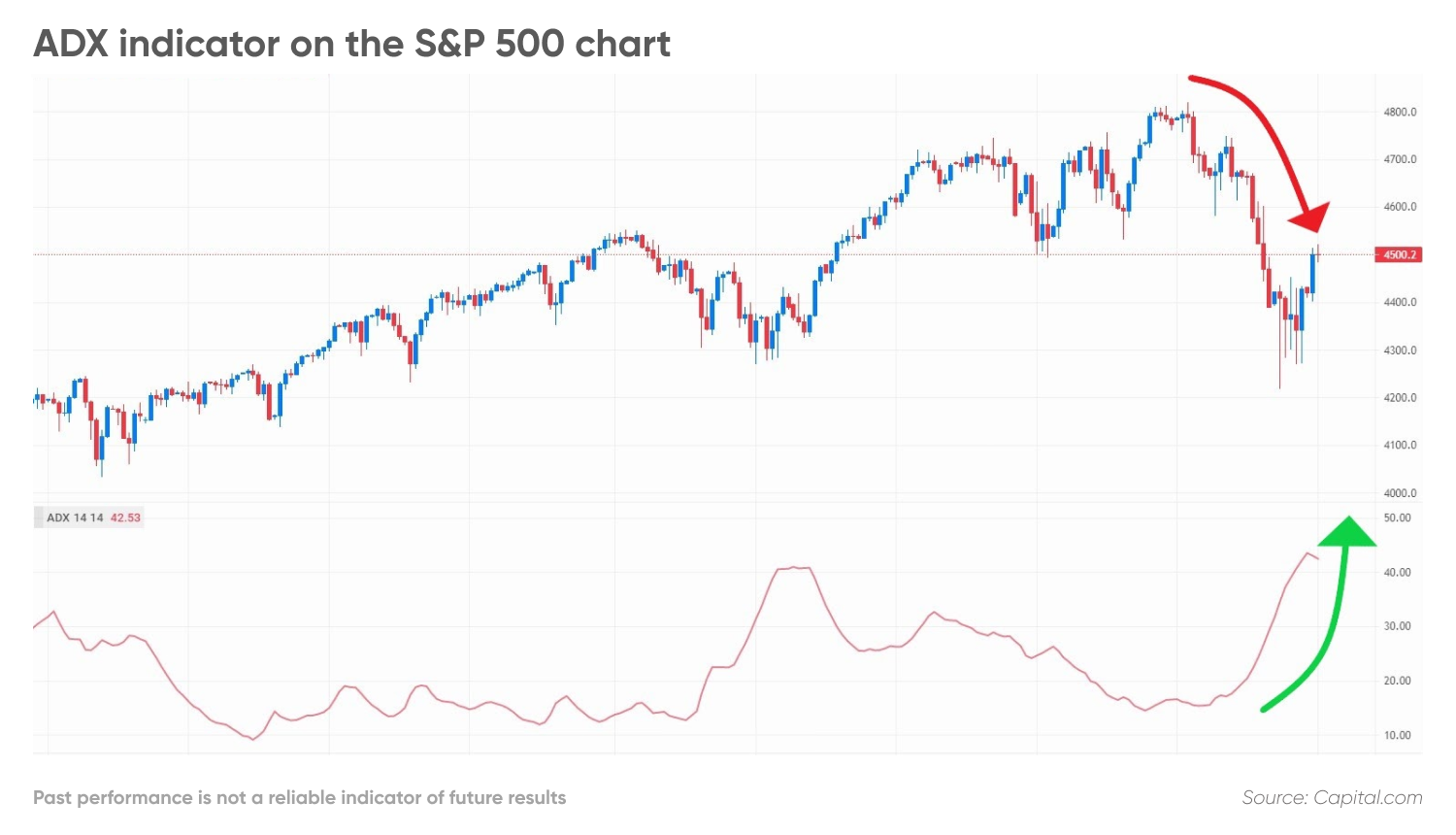

ADX (Average Directional Index)

This momentum indicator was developed by Welles Wilder, the same person who invented the RSI. The ADX line is used in conjunction with two other lines: the Minus Directional Indicator (-DI) and the Plus Directional Indicator (+DI).

The ADX is the average of the -DI and +DI, which are calculated from the comparison of two consecutive ‘lows’ and the respective ‘highs’, using the average true range (ATR).

It does this via the following rather extensive momentum indicator calculation:

Behind the mathematics, the intent is quite simple: to measure the difference in the price range of the current bar or candle versus the previous 13 candles and then smooth out the differences.

ADX rises when the price momentum increases, whether the trend is up or down. Since downtrends tend to be the most volatile, quite often the ADX will move up as the price moves down.

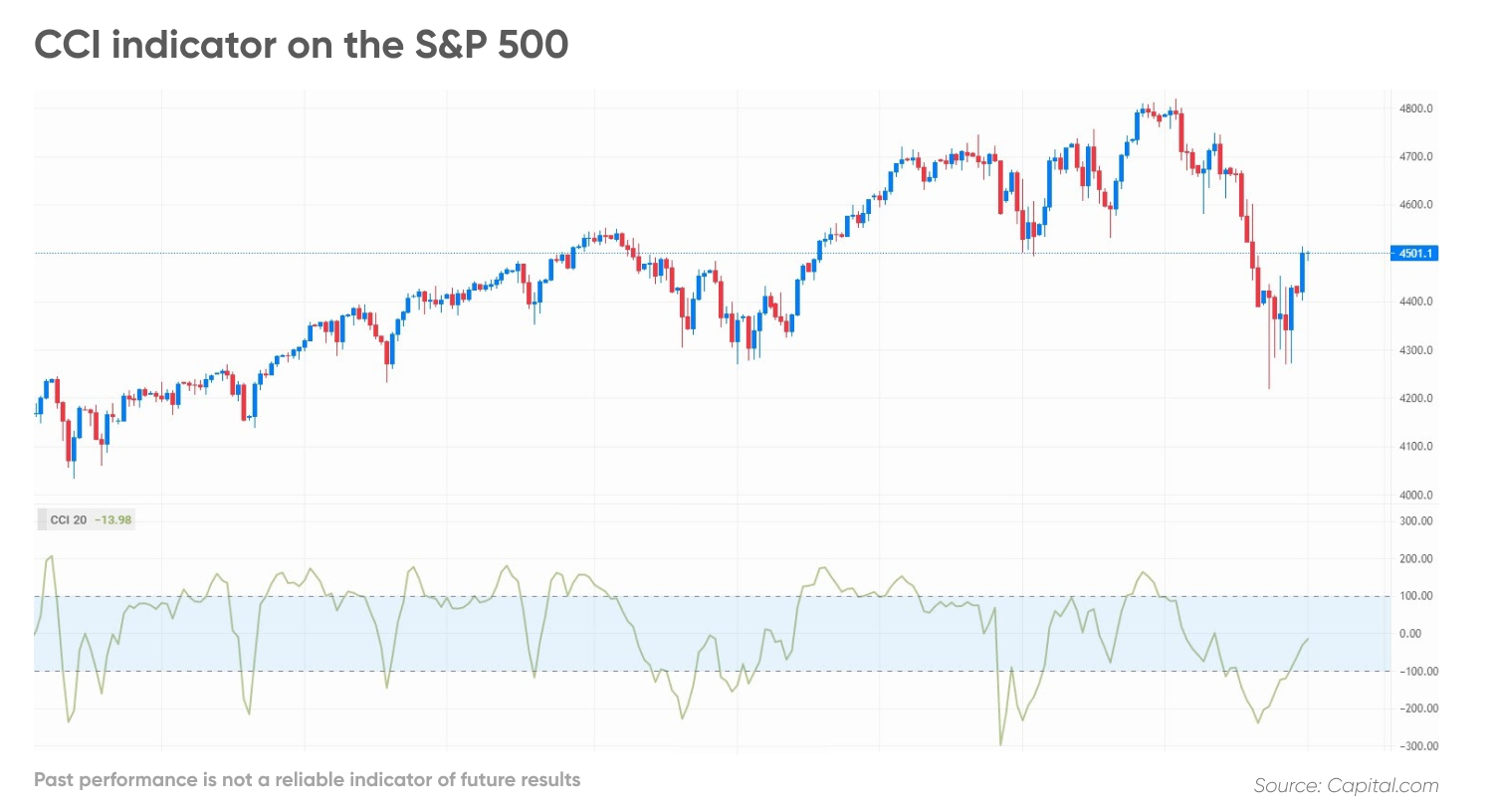

CCI (Commodity Channel Index)

The Commodity Channel Index (CCI) uses a formula comparing the "typical" price of the asset with a moving average, and then to the mean deviation:

Generally, CCI is used to find indications of a new trend when ranges break.

Looking at the chart below, it can be seen that the price moving out of the middle band (-100 to +100) and then back into it is associated with turning points.

Note: Like many momentum indicators it pays to take the signal in the direction of the underlying trend. Countertrend signals tend to fail more often.

To summarise these rules for taking trades from the CCI in an uptrend, let’s look at the S&P 500 chart below.

-

When it goes under 100 and back above it, it’s understood as potentially a dip to buy within the uptrend.

-

When it moves to below above 100 then below 100, it indicates a potential trend reversal or simply a pause in the uptrend.

-

While within limits, the trend is sideways.

The CCI value suggests that the S&P 500 has left the oversold zone and may have turned into a ranging or bullish market.

Aside from trading when the price reaches the ranges between +/-100, traders use the CCI to identify extremely overbought and oversold zones with boundaries at +/-200.

MACD (Moving Average Convergence Divergence)

The Moving Average Convergence Divergence (MACD) is one of the top momentum indicators for trend continuation. It works by comparing a longer exponential moving average (EMA) to a shorter-term EMA to produce the MACD line. That results in the ‘histogram’. That histogram then has a simple moving average calculated on top of it, called the ‘signal line’.

Here is the calculation for each component of the indicator:

The MACD uses the difference between the slower and faster EMAs to determine the market speed. The EMAs' defaults are 12 and 26 days. The rate is averaged out in the signal line, often at the nine-day EMA.

The generally understood trigger for trades using the MACD is when the signal line crosses the histogram (crossover). This can be interpreted as a change in the market's momentum, which could lead to a change in the price trend.

As its name suggests, when the lines converge, the price tends to continue in the direction of the trend. When they diverge, it reverses.

To add strength to the crossover signals, traders will use both the EMAs and the histogram. In addition, traders use price crossing over the zero line for bullish or bearish signals.

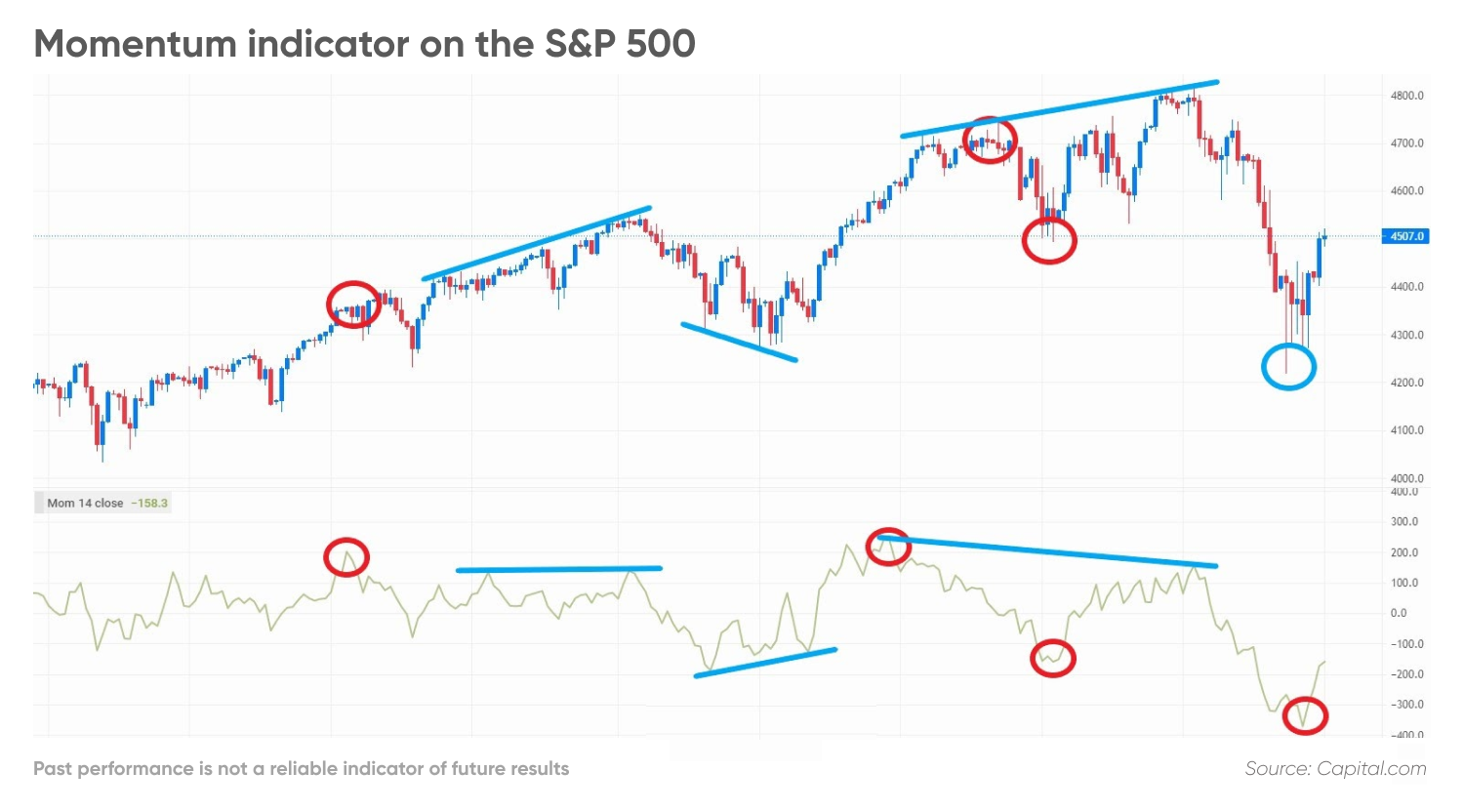

Momentum

Last but not least, let’s not forget the momentum indicator. It often gets overlooked for the more popular (and complicated) indicators mentioned above.

Here’s the formula for the momentum indicator:

The equation compares the last closing price to a previous closing price from a set number of periods ago. The default setting is 14. Some traders use 30 to further smooth out the signals.

On the chart below, two kinds of signals can be observed with the momentum indicator divergences (blue lines) and overbought and oversold signals (red circles).

The momentum indicator has less smoothing than other momentum-type indicators like RSI so the signal line is more reactive. Often the first signal will occur before any price turning point. That’s why it can help to use other indicators to confirm a momentum signal before placing a trade.

Momentum indicator trading strategies

Using momentum indicators to trade is about preference, strategy and the trading environment. The momentum indicators listed above can be used for mean reversions, range bound markets and trends. How you use them for each market type could produce a different return on investment.

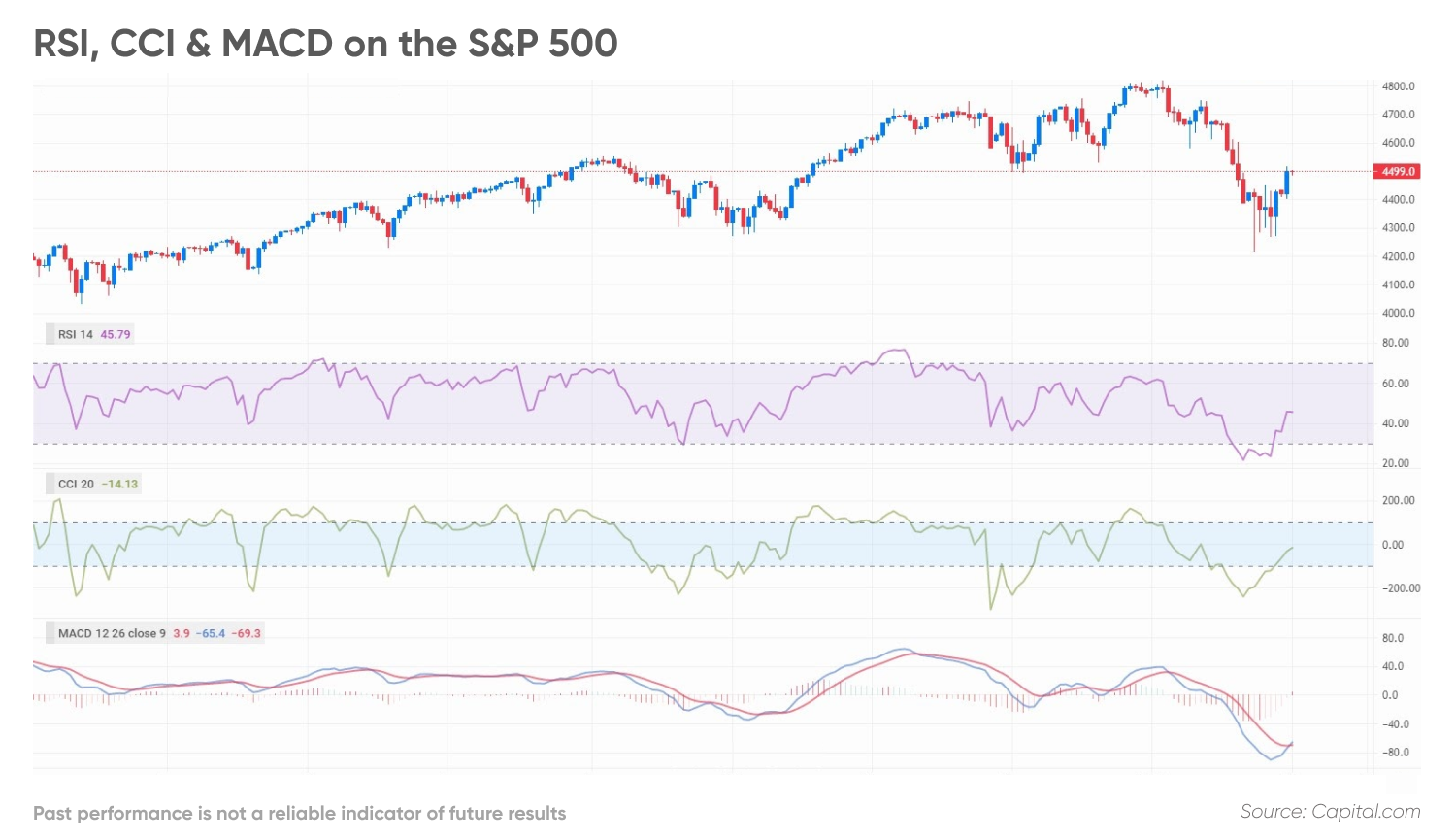

Using a combination of top momentum indicators could clarify the signal given by one indicator. If two momentum indicators show the same thing, it could give the trader more confidence to take the trade.

The concept behind this momentum trading example trading strategy is to:

-

Identify trend reversals ahead of time

-

Enter early with minimal risk

-

Follow the trend for maximum gains.

The trading example below uses the ROC, the CCI and the MACD together. The indicator settings to use are:

-

RSI 14 (OB/OS 70 and 30);

-

CCI 20 with hlc3 close (OB/OS -+100 and -+200);

-

MACD (12,26,9)

A trader could consider going long if:

-

RSI turns from the 30 oversold zone to above 30 and shows divergence

-

CCI turns from -200/-100 area above -100 and shows divergence

-

MACD histogram decreases and shows divergence (either on the histogram or the EMAs, or best, both)

Steps for a long trade example:

-

Entry: at the bar close

-

Stop loss: day's range from the day's open down

-

Risk management: move stop loss to breakeven when CCI hits 100 and to 2x the day's range when CCI hits 200

-

Take profit: when RSI reaches 70

Note that this article does not constitute financial or investment advice. Whether you should go long or short is your decision. Always conduct your own due diligence before trading, considering your attitude to risk, experience in the market, and portfolio margin. Never trade money you cannot afford to lose.

FAQs

How do you use a momentum indicator?

Momentum indicators help traders understand the strength of a price trend – they measure the rate of the rise or a fall in stock prices. They are called "momentum" indicators as the principles behind price movements are similar to the ones used to calculate speed, momentum, and acceleration.

How do you read a momentum indicator?

Different momentum indicators indicate different things – for example, when the RSI scores above 50, that signifies positive momentum, which can be indicative of an uptrend in the market. When the RSI exceeds the 70 mark, that can indicate an overbought market. Conversely, RSI numbers below 50 can point towards downtrend momentum, and values below 30 can potentially mean the market is oversold.

Your selection of momentum indicator should depend on your trading strategy and investment goals. Remember to do your due diligence before making an investment decision. And never invest or trade more than you can afford to lose.

How is a momentum indicator calculated?

Different momentum indicators have different formulas and serve different purposes. The most basic momentum indicator compares the last closing price to a previous closing price from a set number of periods ago. The default setting is 14, but ome traders use 30 to further smooth out the signals.

Your selection of momentum indicator should depend on your trading strategy and investment goals. It is essential that you do your research before making an investment decision. Remember not to invest or trade with more than you can afford to lose.