AUD/IDR forecast: Australian dollar losing steam against robust Indonesian rupiah

We look at the drivers or the Aussie dollar’s performance against the Indonesian rupiah and the latest potential AUD/IDR forecast from analysts.

The Australian dollar (AUD) has declined against the Indonesian rupiah (IDR) since mid-August on the risk of recession in Australia and the US dollar (USD) breaching a key level against the Chinese renminbi (CNH), while the Indonesian currency has found support from rising commodity exports.

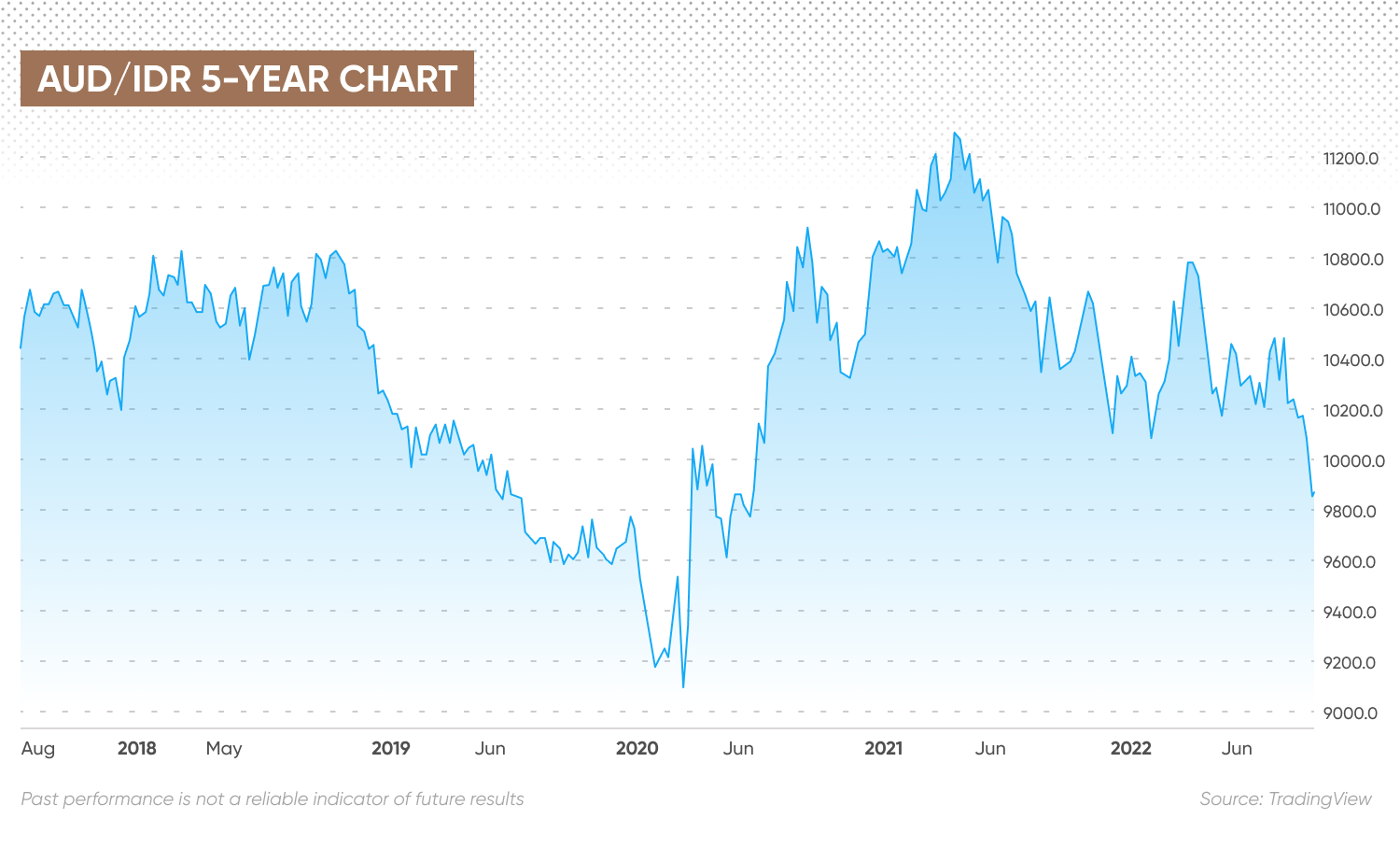

The Australian dollar, also known as the Aussie, has declined from a six-year high against the rupiah of above 11,000 in April 2021 to a two-year low at the end of September.

What have the primary drivers for the AUD/IDR rate been?

In this article, we look at how the exchange rate has performed and the potential Australian dollar to Indonesian rupiah forecast outlook from analysts.

What drives the AUD/IDR exchange rate?

The AUD/IDR exchange rate in foreign exchange (forex; FX) trading refers to how many Indonesian rupiah are required to buy one Australian dollar. The Aussie dollar is the base currency and the rupiah is the quote currency.

The Australian dollar is the fifth most commonly traded currency on the FX markets, punching above its weight as the Australian economy is only the world’s 12th largest.

The Aussie dollar is valued as a commodity currency, along with the New Zealand dollar (NZD), Canadian dollar (CAD) and Singapore dollar (SGD). This is because the Australian mining industry accounts for 11.5% of the nation’s economy, with natural resources making up 68.7% of exports.

This means that commodity prices have a strong influence over the health of the economy. The Aussie is also commonly traded as a proxy for the Chinese economy, as China accounts for 36.5% of Australia’s exports.

The Indonesian rupiah is issued by the Bank Sentral Republik Indonesia (Central Bank of the Republic of Indonesia). It has been Indonesia’s official currency since it was introduced in 1949 to replace the Indonesian Dutch East Indies guilder. Following a sharp depreciation in the 1950s, a new version of the currency was issued in 1965 at a rate of 1,000 old rupiah to 1 new rupiah.

The rupiah is also affected by commodity markets, as Indonesia is the world’s largest exporter of palm oil and an important supplier of industrial metals such as steel, nickel and copper.

Foreign exchange rates are typically driven by macroeconomic data, such as the performance of a country’s gross domestic product (GDP), manufacturing activity, trade balances, employment, inflation and monetary policy on interest rates.

Interest rate policy has been a key driver for currencies in 2022, with many countries raising rates after years of near-zero or even negative rates in an attempt to battle soaring inflation. The US dollar has soared to 20-year highs, putting downward pressure on other currencies, particularly in emerging markets.

AUD/IDR volatility rises on global uncertainty

The AUD/IDR exchange rate has largely been in a downward trend since it reached an all-time high of 11,267.49 in April 2021, surpassing the previous high of 11,220.54 seen in mid-2014. The pair fell to 90.72.51 in February 2020, as the Australian dollar reacted more strongly to the spread of the Covid-19 pandemic on concerns about the impact on commodity prices and the Chinese economy.

The pair rebounded to above 10,000 in April 2020 and climbed to 10,846 in September 2020. Following a dip to 10.278 in October 2020, the pair resumed the upward trend and reached its all-time high last April. But the Aussie shed value against the rupiah for the remainder of 2021 and into 2022, reaching 10,064.41 on 23 January. The pair rose to 10,775 in March as commodity prices jumped in response to Russia’s invasion of Ukraine, but returned to the 10,100 level by May.

The AUD/IDR has since become increasingly volatile, with the US Federal Reserve (Fed) upping the pace of interest rate hikes since March and driving rapid exchange rate fluctuations, while at the same time partial Covid-19 lockdowns have disrupted the Chinese economy.

The AUD/IDR pair moved up to 10,520 at the start of June, but by 14 June was trading down at 10,102, only to bounce up to 10,403 two days later. The pair dropped back to 10,084 in mid-July, rose to 10,529 in August and then began to decline sharply, falling below the 10,000 mark on 13 September for the first time since June 2020. The AUD/IDR dipped further to 9,733 on 27 September and bounced to around 9,860 on 29 September.

Both the Aussie and the rupiah have found relative support compared with other Asia-Pacific currencies from strong trade surpluses, with Indonesian exports reaching an all-time high in August and the country recording a trade surplus since May 2020. But the US dollar breaching the 7 mark against the Chinese renminbi has added downward pressure, particularly to the Aussie.

The Reserve Bank of Australia (RBA) and the Bank Indonesia (BI) have each been raising interest rates, with the Indonesian central bank unexpectedly raising rates by 25 basis points (bps) in August in a pre-emptive hike ahead of a planned increase in subsidised fuel prices. The RBA raised rates by 50 bps at its September meeting, but indicated that it expected to slow the pace of future hikes.

What is the latest AUD/IDR prediction in the current volatile macroeconomic environment based on analysts’ forecasts?

AUD/IDR forecast: Will the pair fall further or rebound?

Analysts at Singapore-based United Oversea Bank (UOB) expect the BI to follow the US Fed in raising interest rates, supporting the IDR. “We keep our view for BI to continue hiking in months to come with three more 25bps hikes in 2H22, taking its benchmark rate to 4.5% by the end of 2022,” they said. “By keeping pace with the Fed and maintaining a positive yield premium of Indonesian Government Bonds over US Treasuries, portfolio outflow pressures could lessen and its disruptive effects on IDR could be mitigated.”

Analysts at US-based Citibank see positives for the Aussie dollar ahead:

“Given Australia’s solid underlying domestic fundamentals, namely – (1) a record low unemployment rate, (2) a still robust housing market with limited financial stability risks, and (3) robust terms of trade, this should add to tailwinds for AUD.”

Analysis by Japanese financial services firm Mizuho last week pointed to the relative outperformance of Asian emerging markets currencies as “peculiar”.

“But this is owed to post-COVID supply-side snags followed by Russia’s war hitting the West harder. Whereas, inflation pass-through is quickly catching up in EM Asia eroding real rate advantages. What’s more, external accounts could also be under pressures as cost-push persists, but in addition, the topline also softens on pipeline demand slowdown. And so, this may well be a temporal aberration (of EM Asia out-performance vis-à-vis non-USD Majors), not a tectonic shift underpinning sustained preference for EM Asia FX over DM at times of stress (from Fed and war uncertainty).”

Both the AUD and IDR could find support from moves in China to support the slowing economy. As analysts at Malaysia’s Maybank noted recently: “China’s property malaise has driven a steep price correction for base metals such as iron ore but officials there have stepped up on measures – PBoC rate cuts, special loans for stalled projects which lifted the metal prices and the AUD more recently. Iron ore and copper prices could still remain susceptible to swings but may see some interim support as China acts with more urgency to keep growth from sliding further.”

The AUD/IDR forecast for 2022 from Australian bank Westpac was bullish on the outlook for a turnaround in the Aussie against the rupiah, predicting that the pair will rise to 10,143 by the end of the fourth quarter. The bank expects the pair to trade at 10,220 by the end of the first quarter of 2023 and 10,725 by the end of next year. The pair could climb further to 11,144 by the second quarter of 2024.

At the time of writing, however, the AUD/IDR forecast from Trading Economics projected that the pair could move down to 9,311.20 in one year from 9,669.80 at the end of the third quarter, based on global macro model projections and analysts’ expectations.

The AUD/IDR forecast from algorithm-based forecasting service Wallet Investor was bearish on the short-term outlook for the pair at the time of writing on 29 September but indicated a long-term recovery. The AUD/IDR rate could end 2022 at 9,893.856 and then move back above 10,000 in 2023 and end the year at 10,162.25. Wallet Investor’s AUD/IDR forecast for 2025 estimated that the pair could then move up to 10,719.04. Analysts have not issued an AUD/IDR forecast for 2030.

When consulting an AUD/IDR forecast for forex trading it’s important to remember that currency markets are highly volatile, making it difficult for analysts and algorithm-based forecasters to come up with accurate long-term predictions. We recommend that you always do your own research. Keep in mind that past performance is no guarantee of future returns. And never invest money you cannot afford to lose.

FAQs

Why has AUD/IDR been dropping?

The AUD/IDR has fallen to a two-year low on the risk of recession in Australia and slowing economic growth in China, while Indonesia economy has held up with rising commodity exports and strong trade surpluses.

Will AUD/IDR go up or down?

The direction of the Aussie dollar against the Indonesian rupiah could depend on the health of the domestic and global economies, commodity prices and monetary policy in Australian and Indonesia, among other factors.

When is the best time to trade AUD/IDR?

The most active trading time for the AUD/IDR market is usually around the release of major macroeconomic data and monetary policy statements or major geopolitical events, which tend to drive volatility on currency markets, increasing liquidity and creating opportunities for traders to profit. However, you should keep in mind that high volatility increases risks of losses.

Is AUD/IDR a buy, sell or hold?

Your trading strategy for the AUD/IDR pair depends on your risk tolerance, investing strategy and portfolio composition. You should do your own research to develop an informed view of the market. Keep in mind that past performance is no guarantee of future returns. And never invest money you cannot afford to lose.