What is price slippage? A trader’s guide

Learn about price slippage in trading, what it is, and how to minimise its impact when trading CFDs on Capital.com.

What is slippage in trading?

Slippage in trading is when the price you expect for a trade differs from the price at which it's actually executed. This often happens when prices move quickly or there’s low liquidity, creating a delay between when you place an order and when it's filled.

If the price moves to a more favourable level before execution, slippage can even work to your advantage, but it can also work against you if the price worsens. You’ll see slippage most often with market orders, which aim to execute at the best current price rather than a specific one.

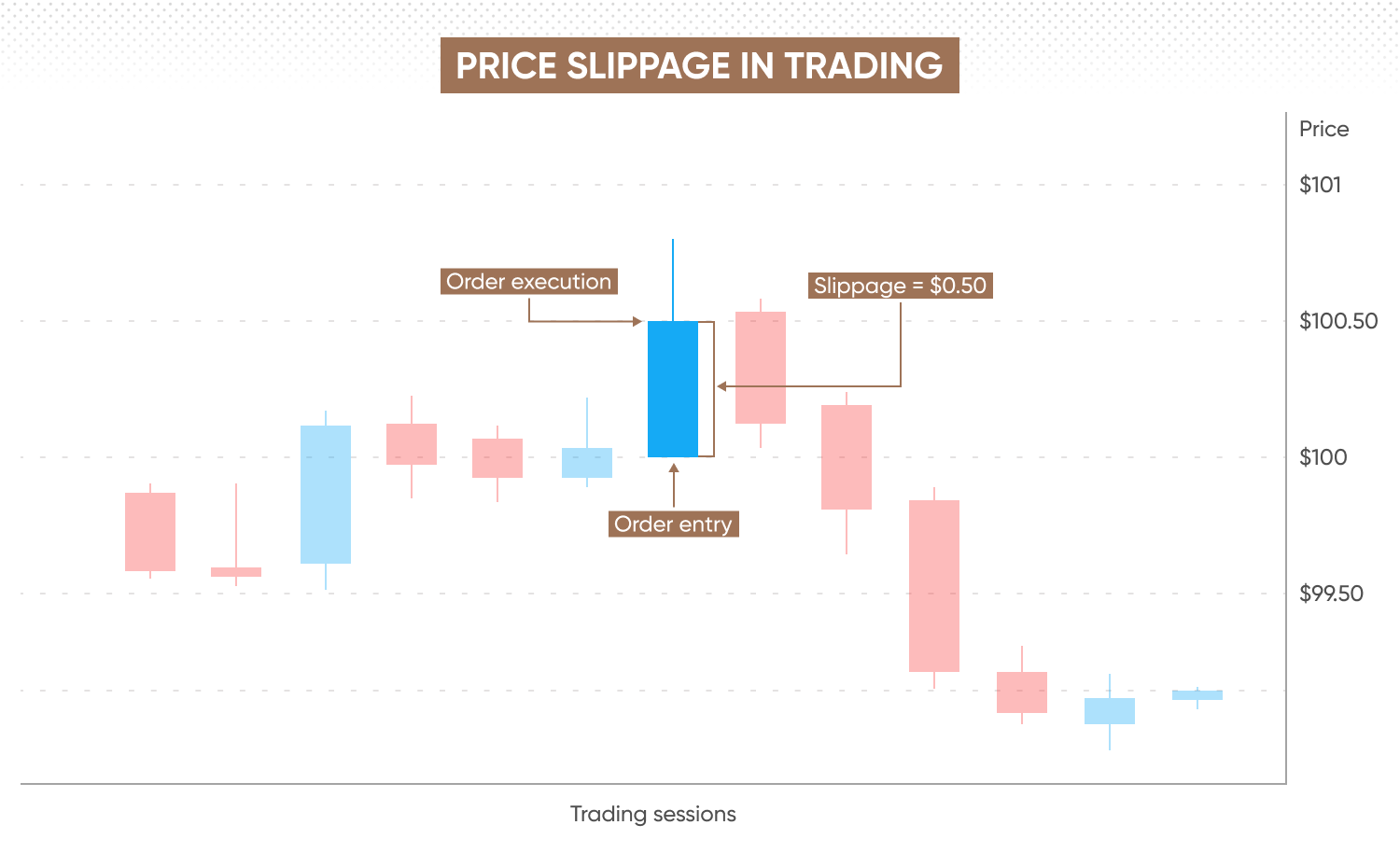

General slippage example

Let’s say you want to buy a CFD asset at $100. By the time the order goes through, the price has shifted to $100.50. That fifty-cent difference is slippage, and in this case, the price move is unfavourable.

Alternatively, if you choose to go short on the CFD and the price moves from $100 to $100.50 between order and execution, the slippage is favourable as it allows your short position to execute a sell order at the higher price.

What is slippage in forex trading?

In forex trading, slippage can be especially impactful due to the fast-paced, 24/5 nature of currency markets. Because forex prices can shift in fractions of a second, slippage often occurs when market conditions are highly volatile, such as during major economic releases, central bank announcements, or sudden geopolitical events. With high leverage trading commonly used in forex, even slight slippage can noticeably affect your position size and profitability.

For example, if you aim to buy the EUR/USD pair at 1.1050, but due to market movement, the order fills at 1.1053, that 3-pip difference can add up, particularly in large or highly leveraged trades. While forex markets are generally liquid, exotic currency pairs or off-peak hours can reduce liquidity and amplify slippage risks.

Slippage in shares trading

In shares trading, slippage can have a particular impact due to market structure, trading hours, and liquidity differences across stocks. Unlike the 24/5 forex market, shares trading is restricted to specific exchange hours, meaning slippage may often be highest at market open and close when prices adjust to new information or order flow increases. This effect is also pronounced during extended-hours trading, where liquidity is lower and price gaps between trades are more common.

For example, if you place a buy order for a stock at $50 during pre-market, but the low liquidity results in the order filling at $50.20, the 20-cent slippage reflects how quickly prices can change with fewer trades available to absorb orders. Stocks with lower trading volumes, such as small-cap stocks, are especially prone to slippage since there may not be enough buy and sell orders to match your intended price.

What are the causes of slippage?

There are a number of causes of slippage that may impact your derivatives trading, including market liquidity, volatility, and the technology your broker uses for execution. Here’s a closer look at these causes and how they might impact the price at which your trade is executed.

Market volatility and gapping

Rapid price movements during high-impact events, like economic announcements or unexpected geopolitical news, can cause prices to shift before trades are executed, leading to slippage. Market gapping, where prices jump over certain levels, also contributes to slippage, especially when there’s significant news between trading sessions.

Liquidity and trading hours

Slippage is more likely during periods of low liquidity, such as pre-market, post-market, or when trading low-volume assets, like corn or certain exotic currency pairs. Limited market activity during these times results in fewer available prices, so trades may not be filled at expected levels, especially with more significant orders.

Order types and execution speed

Market orders, which prioritise execution over a specific price, are more susceptible to slippage, particularly in fast-moving markets. Using limit orders helps control this, while faster broker execution can further reduce the risk, ensuring orders fill closer to the intended price.

Position size and market depth

Large trades in markets with limited depth increase slippage risk, as fewer buy or sell orders are available to absorb them at the desired price. Trading in high-volume assets with ample liquidity helps maintain tighter bid-ask spreads, reducing the likelihood of slippage.

Examples of slippage

As mentioned, examples of slippage and the reasons for it happening are numerous and diverse. Here are some common examples, illustrating the issues you can encounter.

Forex trading slippage example

Suppose you place a market order to buy GBP/USD at 1.2300. Just as your order is processed, a major economic report is released, causing the price to spike to 1.2303. Your order fills at 1.2303 instead of the expected 1.2300, resulting in 3 pips of slippage.

Shares trading slippage example

Let’s say you intend to buy a stock at $50 per share. Due to low liquidity right after market open, your order is filled at $50.20 instead. The 20-cent difference is slippage, a result of high initial demand and lower order availability at that moment.

Commodity futures slippage example

If you place a market order to buy oil futures at $75, but an unexpected supply report is released, increasing prices to $75.30, your order will execute at this higher price. This 30-cent slippage is common during sudden news-driven volatility in commodity markets.

Pre-market or after-hours stock trading: Suppose you place a buy order for a stock in after-hours trading at $25. Due to low liquidity, your order doesn’t have enough matching sell orders and fills at $25.10 instead, resulting in 10 cents of slippage.

How can I avoid slippage in trading?

Sometimes it isn’t possible to totally avoid slippage in trading, but taking action like choosing liquid assets, avoiding trading during times when high volatility is expected, and using guaranteed stop-losses, can mitigate its impact.

Use guaranteed stop loss orders

Guaranteed stop loss orders (GSLOs) ensure that your stop loss will be executed at the exact price you set, regardless of market conditions. GSLOs come with an additional cost, but they help protect you from unexpected slippage, especially in volatile markets.

Trade during times of high liquidity

In markets with set hours, trading during peak times (eg, when major exchanges overlap or at market open for sharess) can potentially help reduce slippage. High liquidity means more buy and sell orders are available, which helps keep prices stable and can fill orders closer to your intended price. Find out more about stock market trading hours.

Avoid trading around major news events

Market volatility often spikes during major economic releases or unexpected news, leading to rapid price changes and increased slippage risk. Monitoring economic calendars and avoiding these times can help you avoid sudden price shifts.

Choose liquid assets

Some assets, like large-cap stocks or major currency pairs, tend to have higher liquidity than others, making them potentially less prone to slippage. Less liquid assets often have wider bid-ask spreads and lower trading volumes, leading to larger price jumps.

Consider position size

Placing large orders in less-liquid markets can move the price and increase slippage. By reducing order size or breaking large orders into smaller chunks, you’re more likely to avoid significant price impacts.

Select a broker with fast execution

Some brokers offer faster execution speeds, which can reduce slippage by minimising the time between your order and its fulfilment. Our execution speed is 0.029 seconds on average (all Capital.com servers July 2024 to date).

FAQs

What is slippage?

Slippage occurs when a trade is executed at a different price than initially expected. This often happens in fast-moving markets or when there’s low liquidity, such as during market open or around major news events. For instance, if you place a buy order expecting a price of $100, but the order fills at $100.20 due to quick price changes, that 20-cent difference is slippage. It can work in your favour if the price improves, but it often results in a less favourable outcome.

How can I avoid slippage?

To avoid or minimise slippage, traders can build their activity around periods of high liquidity, such as when major exchanges are active. Using guaranteed stop-loss orders also helps by closing a trade out at the exact price you want, although this results in a fee if the GSLO is executed.

Does slippage only happen with market orders?

No, while slippage is most common with market orders due to their priority on execution over price, it can happen with any order type. Market orders are filled at the best available price, which may shift quickly in volatile markets. Limit orders, on the other hand, specify a set price and will only execute if the market matches that level, helping reduce slippage. However, if the market moves past your limit price, the order may not fill at all.

How does Capital.com deal with slippage?

In case of slippage, Capital.com will take all sufficient steps to execute market orders at the next best price available in the order’s size. In such a case, your order may be executed at a price that is different from the initial price selected. In addition, there may be times when certain financial instruments are not available for trading.