Precious metal volatility spikes after prices hit fresh record highs

Precious metals surge to fresh record highs in thin holiday trade

Precious metal prices swing in holiday-thin liquidity after hitting fresh record highs.

Gold and silver surge to new all time highs

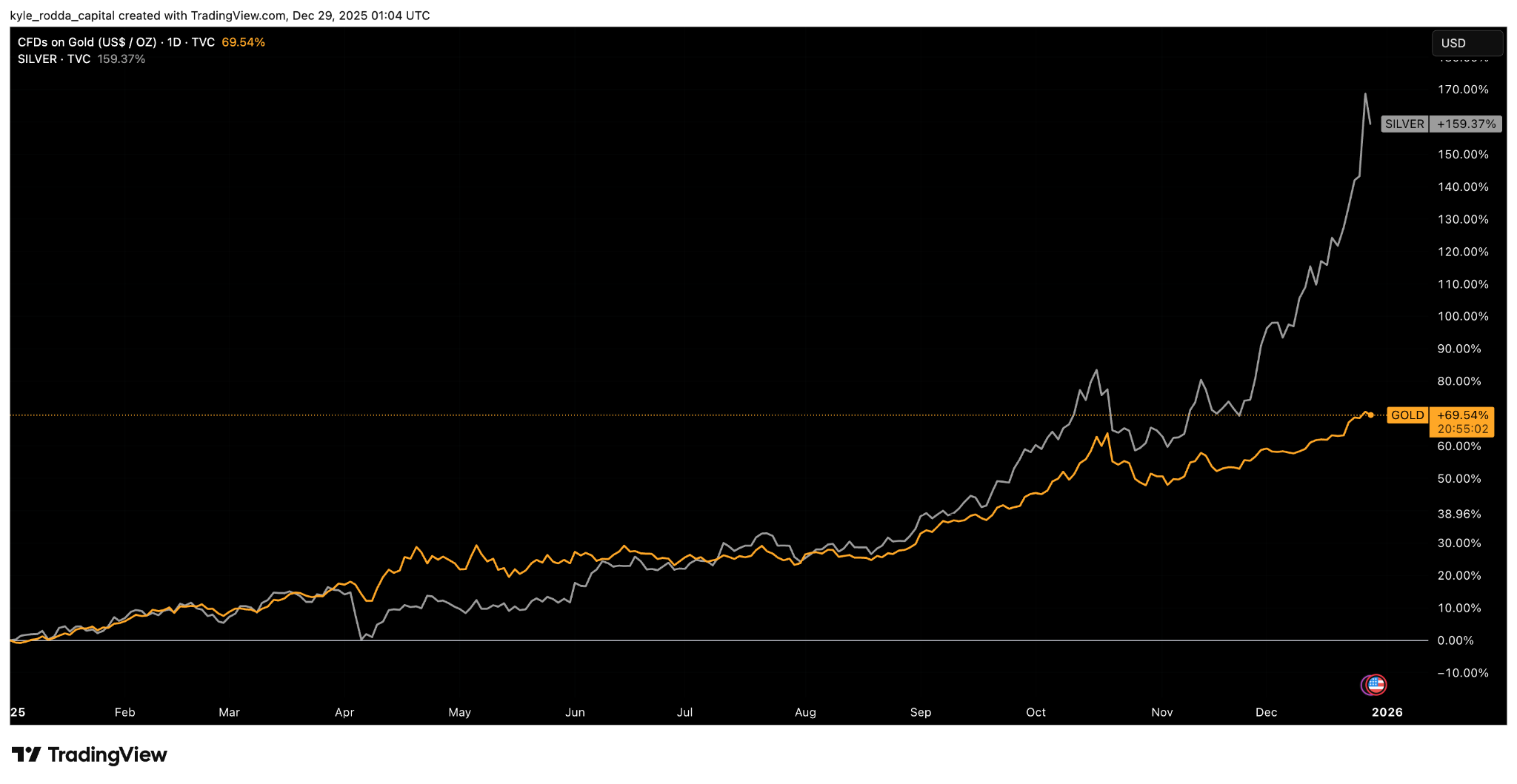

Precious metals markets continue to round out the year on a high, adding to what were already extraordinary gains. To kick-off the final week of the trading year, spot gold and silver prices have hit record highs at approximately $US4550 and $US83 per ounce, respectively. The move extended the gains for gold for the year to more than 70%. Meanwhile, the rise for silver saw it near a 170% gain.

(Source: Trading View)

(Past performance is not a reliable indicator of future results)

Fundamentals remain strong for precious metals

Demand for precious metals remains driven by several fundamental factors. Most recently, a relatively dovish US Federal Reserve at its final meeting of the year raised hopes for further interest rate cuts in 2026. Meanwhile, strategic competition and geopolitical risks continue to simmer around the world. Tensions between the US and Venezuela have been piled on top of the wars in the Middle East and Eastern Europe as drivers of precious metal demand. The drive for alternative stores of value to the US Dollar to park reserves by some of the US’s major adversaries is also supporting prices. That dynamic is being compounded by concerns about the sustainability of US fiscal settings.

Physical shortages driver silver’s outperformance

Silver’s outperformance comes amid the additional benefit of strong industrial demand and a growing supply deficit. The deficit in the market has existed for a long time, with silver an important component in products like electric vehicles, solar panels and artificial intelligence technology. The ratcheting up of silver demand comes as production fails to keep up. The commodity is produced as a byproduct of other metals, meaning very inelastic supply. Such is the scale of the squeeze in silver markets, China has taken steps to reduce exports by implementing stricter licensing requirements for smaller producers to secure supply of the critical mineral. That’s fueled fears about future supply further, helping prices to record highs.

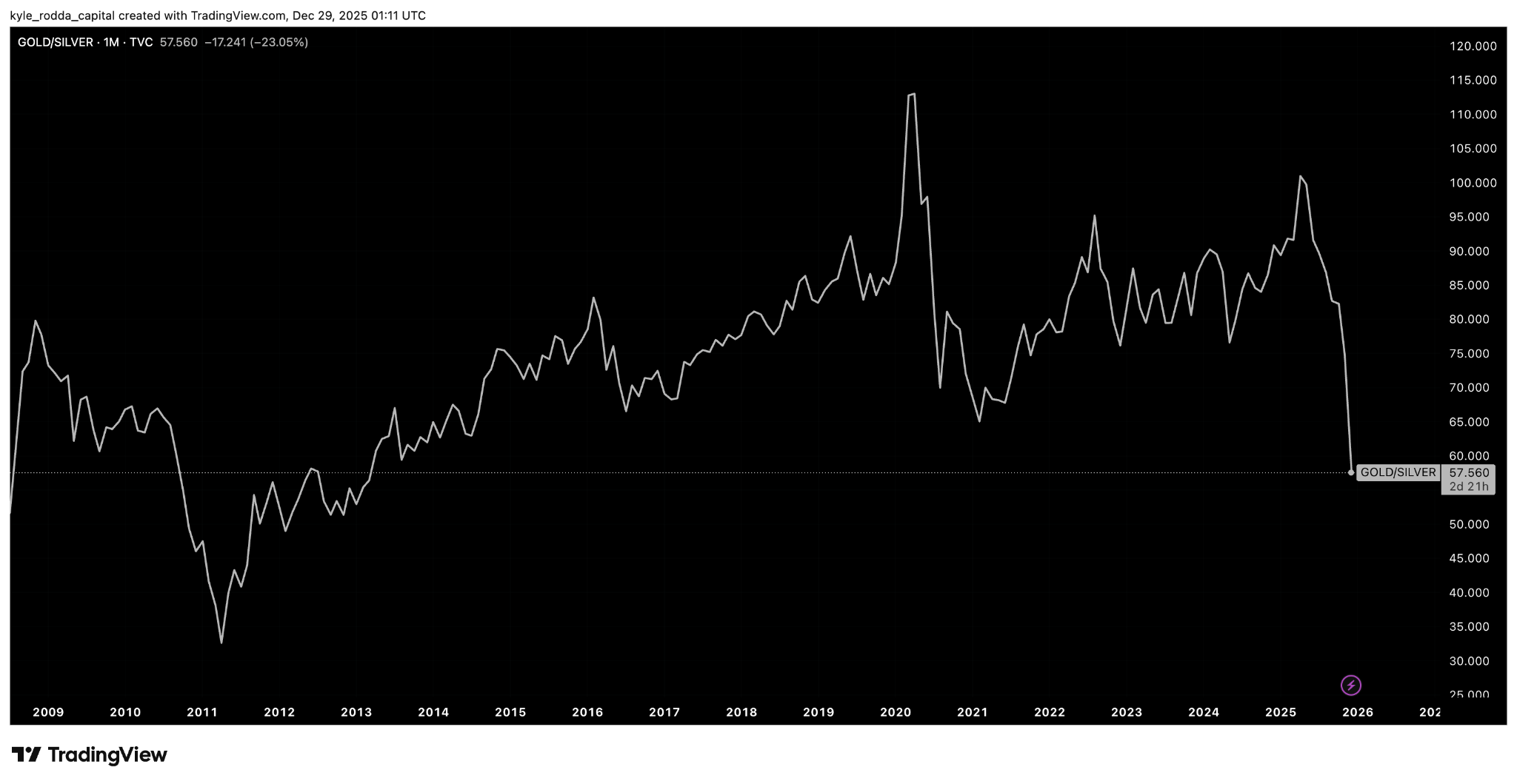

The dynamic has pushed the gold-to-silver ratio to a nearly 10 year low. The extremes in the ratio imply the moves in silver could be in overstretched territory.

(Source: Trading View)

(Past performance is not a reliable indicator of future results)

Gold and silver remains in an uptrend amid fresh volatility

Gold and silver spiked to fresh record highs to kick-off the final trading week of the year. Thin liquidity because of the holiday season has caused big swings in prices, especially in silver.

Gold prices remain in a clear primary uptrend, once again having broken out from a symmetrical triangle formation, and then through resistance at previous record highs. That resistance level at roughly $US4380 represents new technical support. Despite a bullish primary uptrend, the market could be poised for another pull back and period of consolidation with the RSI in overbought territory and bullish momentum moderating.

(Source: Trading View)

(Past performance is not a reliable indicator of future results)

Silver prices are also in a clear uptrend following its break through resistance at $US55 per ounce. The daily RSI is also pointing to overbought conditions although momentum remains skewed to the upside, implying a lower risk of an imminent pull back. A key short-term level could be upward sloping trendline support, a break of which could signal a deeper pull back.

(Source: Trading View)

(Source: Trading View)

(Past performance is not a reliable indicator of future results)