Australia’s CPI set to show inflation back within target, sets up May RBA cut

Australia’s quarterly inflation figures, due on Wednesday the 30th of April, 2024 are poised to reinforce the view that the Reserve Bank of Australia (RBA) is moving closer to meeting its inflation mandate – and, critically, may soon have the green light to begin cutting interest rates.

Australia’s inflation set to return to target

Australia’s quarterly inflation data, due Tuesday, is expected to show price pressures easing meaningfully, reinforcing the view that the Reserve Bank of Australia (RBA) is steadily winning its battle against inflation. Consensus forecasts point to a trimmed mean CPI figure of 2.8% year-on-year for Q1 — comfortably within the RBA’s 2–3% target band for the first time since 2021. On a quarterly basis, trimmed mean CPI is tipped to rise by just 0.6%. Headline CPI is also expected to moderate, with annual inflation falling to 3.4% and quarterly inflation at 0.8%. The figures could mark an important inflection point for monetary policy, with inflation sustainably back on track after a prolonged tightening cycle.

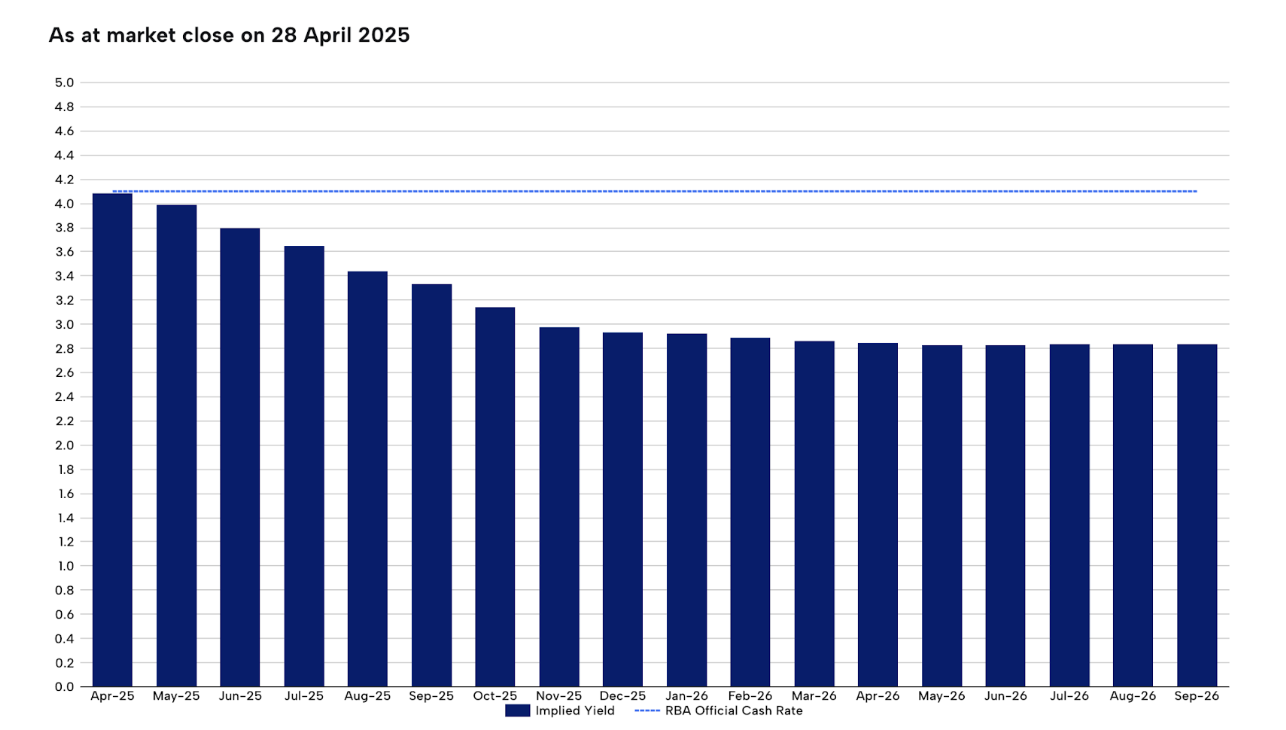

Markets fully price RBA cuts amid global headwinds

The improving inflation outlook has fueled market expectations that the RBA is nearing the start of an easing cycle. Futures markets now fully price a 25-basis point cut at the RBA’s May meeting, with a modest chance of a 50 basis point move. The cash rate is projected to fall below 3% over the next year. Although Governor Michele Bullock has maintained a cautious tone, signaling the need for more evidence before cutting, a return to target inflation — combined with a likely global growth slowdown driven by protectionist US trade policies — strengthens the case for policy easing. Barring a higher than expected trimmed mean CPI read, the stage appears set for the RBA to pivot toward lower rates.

(Source: ASX)

AUD/USD firms on universal US Dollar weakness

AUD/USD is testing resistance at 0.6440 with the critical 200-day SMA coming into view. The RSI shows mild bullish bias but fading strength. A break above that level could see the pair test the 200-day MA, while failure to clear resistance may trigger a pullback toward support at 0.6344. A break of that level may signal that the AUD/USD is poised to renew its primary downtrend.

(Source: Trading View)

(Past performance is not a reliable indicator of future results)