Activision Blizzard shareholders: Who owns the most ATVI stock?

News has emerged of a bid by Microsoft to buy Activision Blizzard. Who stands to benefit most from this transaction?

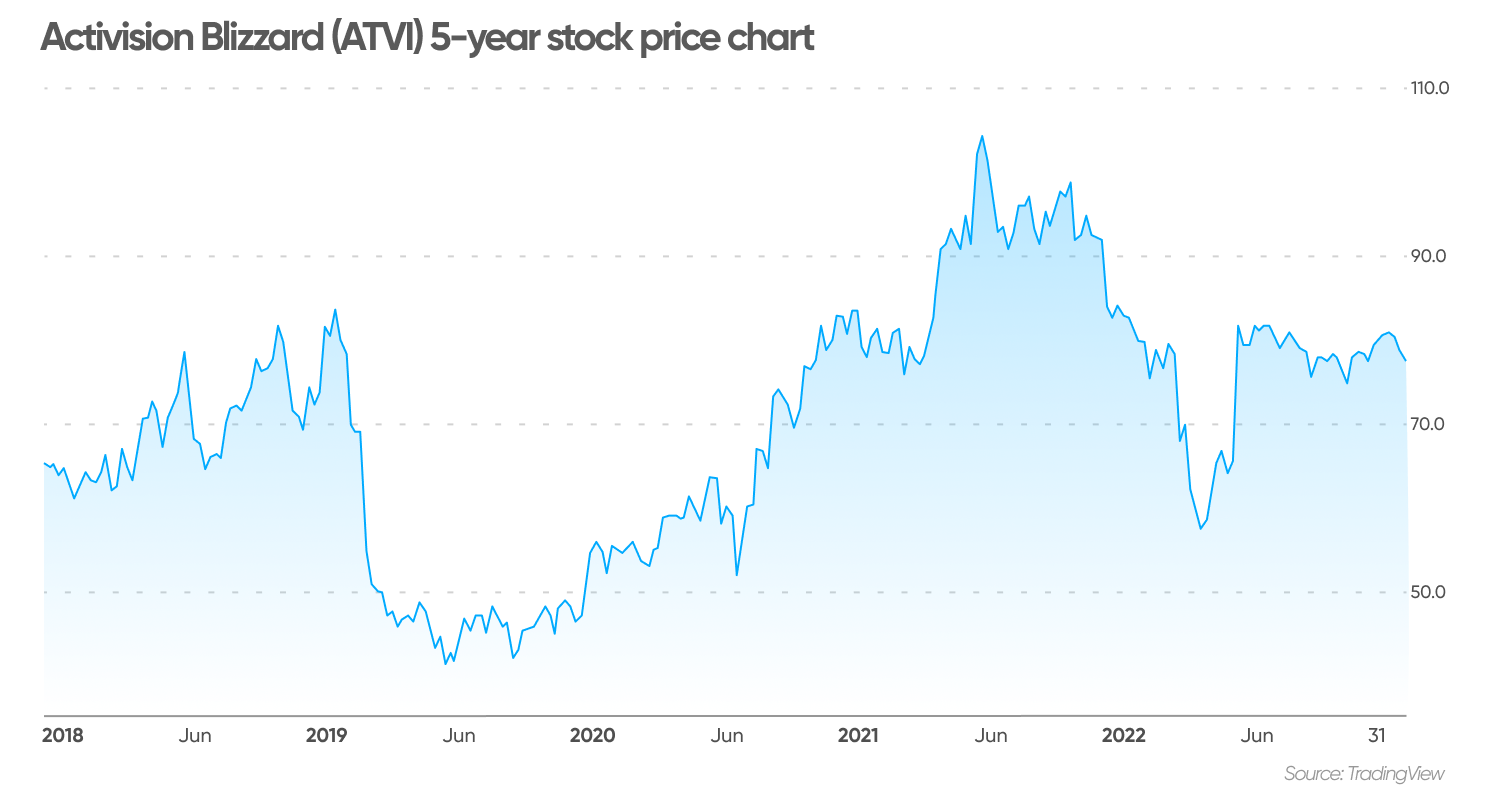

Activision Blizzard (ATVI) stock made the headlines in January this year after Microsoft (MSFT) made a bid to buy the videogame developer for $68.7bn ($95 a share) in an all-cash deal.

If closed, the acquisition will turn Microsoft into the world’s third-largest gaming company. It will own Activision’s most iconic titles, including Warcraft, Call of Duty and Candy Crush.

Who stands to gain the most from this transaction? In this article, we bring you details about who Activision Blizzard shareholders are, and why it could be a good idea to keep an eye on what they do with their holdings.

What is Activision Blizzard (ATVI)?

Activision Blizzard was created by the merger of Activision, a company whose roots go back to the well-known Atari company, and Blizzard Entertainment, the creator of popular role-playing games, like Diablo and Warcraft.

Completed in 2008, the merger created one of the world’s largest video game developers.

In July 2008, shares of Activision Blizzard traded under the ticker symbol ATVID, but were then relisted as ATVI. Robert Kotick was appointed CEO, and continues to hold the position.

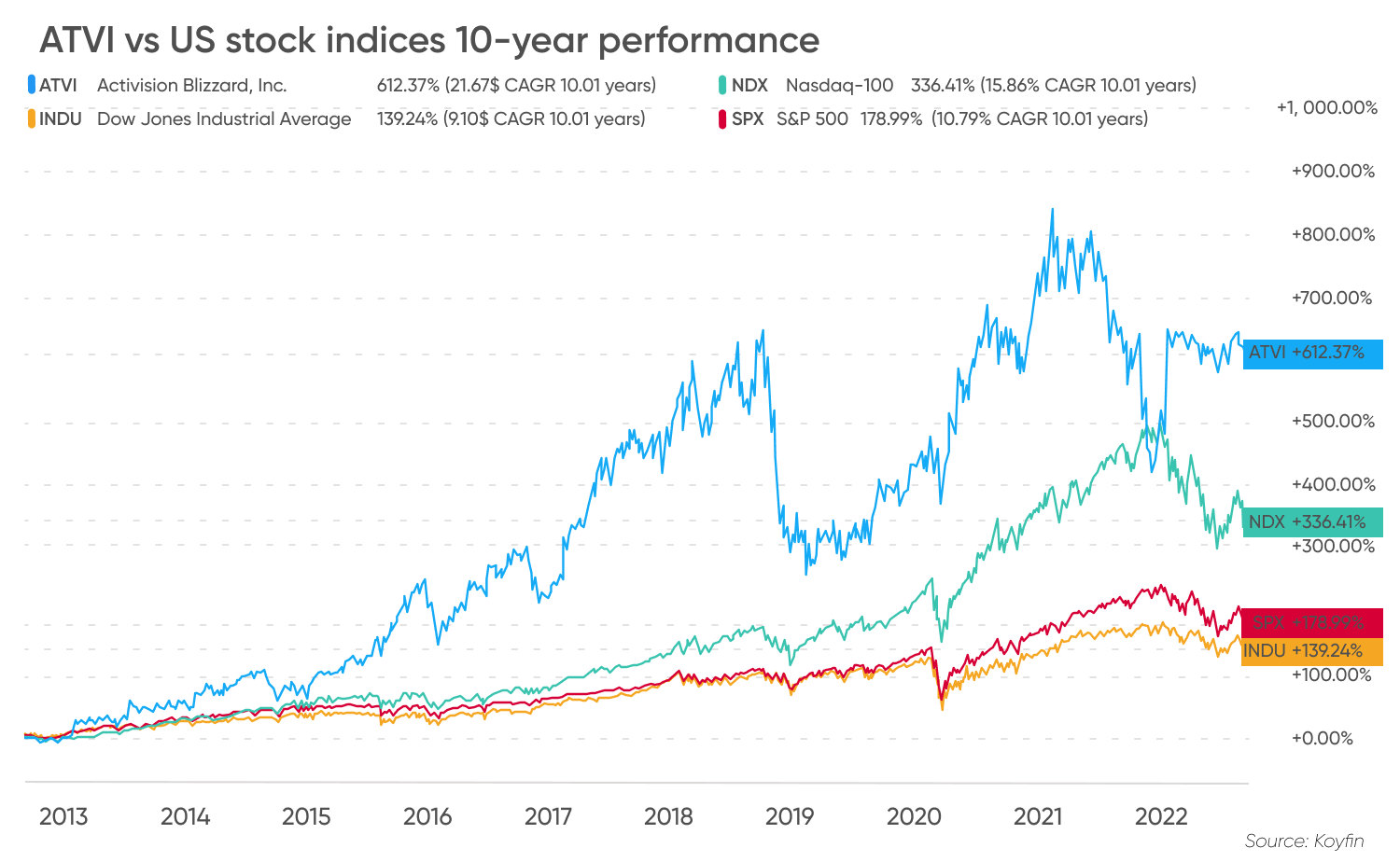

In the past 10 years, the ATVI price has risen 612.4%. The stock has beaten both the S&P 500 (US500) and the tech-heavy US Tech 100 (US Tech 100) during this period. The two indices have produced gains of 179% and 336.4%, respectively.

As of December 2021, Activision employed 9,800 full-time and part-time employees, most of whom were based in North America.

Who are the shareholders of Activision Blizzard?

According to Activision’s latest annual report filed with the US Securities and Exchange Commission (SEC), 1,482 stockholders of record held the company’s common stock, as of February 18 2022.

Who owns the most shares of Activision Blizzard? The biggest individual stockholder of Activision Blizzard is Warren Buffett’s conglomerate Berkshire Hathaway (BKR), which owns 68.4 million shares, resulting in an 8.7% stake, as per data from GuruFocus.

Another prominent individual stockholder is the Public Investment Fund of Saudi Arabia, which owns a 4.8% stake.

GuruFocus reports that 65% of ATVI shares are in control of institutions, as of 4 September.

All ATVI shares have voting rights, meaning that shareholders of Activision Blizzard have a say in the company’s affairs in line with the proportion of ownership they hold in the firm.

Individuals who buy Activision Blizzard stock via brokers appoint them as a proxy, meaning the brokers can vote on their behalf. However, they can also opt to cast a vote on the company’s key decisions at the Activision Blizzard shareholder meetings.

Institutional Activision shareholders

The following is a list of Activision Blizzard major shareholders, according to data from both Market Screener and GuruFocus, as of 4 September 2022.

Berkshire Hathaway – 8.7%

Berkshire Hathaway (BRK) is a conglomerate run by billionaire investor Warren Buffett. It owns dozens of subsidiaries and a multi-billion stock portfolio made up of high-quality businesses picked by Buffett and his team.

Berkshire began amassing ATVI shares in January 2021, as it believed the company was undervalued. Lately, the firm has been acquiring more shares, as they are trading below Microsoft’s offering price of $95 a share.

The Vanguard Group – 7.7%

Vanguard is a US-based asset management firm that oversees more than $8trn in assets for investors. It operates several investment funds, including exchange-traded funds (ETFs) and mutual funds.

Vanguard is listed as one of the largest shareholders of Activision Blizzard but owns the shares on behalf of its clients.

Public Investment Fund (PIF) of Saudi Arabia – 4.8%

The Public Investment Fund of Saudi Arabia, also known as PIF, is an entity created by the Saudi government to oversee and allocate its vast resources across multiple opportunities found in different corners of the world.

By the end of the first quarter of 2022, the fund had assets exceeding $620bn. Its investments are focused on 13 strategic sectors, including entertainment, leisure and sports.

State Street Corporation (SSgA Funds Management) – 4.2%

State Street (STT) is a US-based financial services firm. The company oversees assets valued at over $4trn for its customers. It offers exposure to the US stock market through vehicles such as ETFs and mutual funds. As a result, it is listed among the top shareholders of Activision Blizzard. The company oversees assets valued at over $4trn for its customers.

Capital Research & Management Co. – 2.9%

With assets under management exceeding the $2trn, the Capital Group is ranked among the five largest asset management firms in the US. Founded in 1931 by Jonathan Lovelace, it provides guided investing solutions to investors across the world. This is the reason why Capital is listed among the top shareholders of Activision Blizzard.

Activision Blizzard shareholders among insiders

The following are considered Activision Blizzard’s biggest shareholders among the company’s insiders, according to GuruFocus. This list includes the firm’s top executives and members of the Board of Directors.

-

Robert Kotick – 3,908,698 shares.

-

Armin Zerza – 196,291 shares.

-

Daniel I. Alegre – 193,690 shares.

Insiders own around 1% of all outstanding common shares of Activision Blizzard, excluding the 41.5 million shares reportedly owned by Vivendi, which were sold to a third party in 2016.

These shares are typically granted to insiders by the company via stock options as part of their compensation package.

Robert A. Kotick

Robert Kotick was the head of Activision prior to the merger. He was appointed CEO in 2008 after the two businesses were combined. He has served on the Board of Directors of several top organisations, including the Coca-Cola Company (COKE) and The Harvard Westlake School.

Armin Zerza

Armin Zerza is CFO of Activision Blizzard. He’s been in the position since April 2021, having previously served as chief commercial officer. Zerza holds a master’s degree from the Vienna University of Economics and Commerce and previously served as CFO for Procter & Gamble’s Latin American division.

Daniel I. Alegre

Daniel Alegre is the Chief Operating Officer (COO) of Activision Blizzard. He was appointed by the board in April 2020 . He spent several years at Google (GOOG), where he helped develop the company’s Global Retail and Shopping unit. Alegre holds a dual MBA from the Harvard Business School and Harvard Law School.

FAQs

How many Activision Blizzard shares are there?

According to the latest Q2 earnings report from Activision Blizzard (ATVI), the company had a weighted average of common shares outstanding at 788 million on a fully diluted basis. Data from MarketBeat, as of 23 August, indicated the stock’s float size at 782.31 million.

How many shareholders does Activision Blizzard have?

According to Activision’s latest annual report filed with the US Securities and Exchange Commission (SEC), 1,482 stockholders of record held the company’s common stock by the end of January 2022.

Who owns Activision Blizzard?

Activision Blizzard is not owned by a single individual or company. Its shares are owned by a large number of individual and institutional investors. The biggest individual investors are Warren Buffett’s conglomerate Berkshire Hathaway and Saudi Arabia’s sovereign wealth management fund, the Public Investment Fund (PIF).