GameStop stock forecast: Third-party price targets

GameStop Corp is a US-listed specialty retailer focused on video games, consumer electronics and collectibles, trading on the New York Stock Exchange. Explore third-party GME price targets and technical analysis.

GameStop Corporation (GME) is trading around $23.68 in intraday dealings on 16 February 2026, within a session range of $23.15-$24.20, on Capital.com’s feed as of 3:36pm UTC. Past performance is not a reliable indicator of future results.

Price action comes amid elevated single-name activity in GameStop. Recent reports highlight unusually large options volumes and increased insider share purchases disclosed in regulatory filings, alongside mixed third-quarter 2025 results (MarketBeat, 22 January 2026). The company reported revenue of about $821m, down roughly 4.6% year on year, while profitability and cash flow improved (SEC, 9 December 2025). Broader US equity sentiment remains cautious as major indices struggle to extend gains near recent highs, leaving risk appetite sensitive to company-specific news and options positioning in volatile names such as GME (CNBC, 16 February 2026).

GameStop stock forecast 2026–2030: Third-party price targets

As of 16 February 2026, third-party GameStop stock predictions show a wide range of indicative targets and scenarios. This dispersion reflects uncertainty around the company’s business model, trading-driven volatility and the broader US equity backdrop. The following mini-briefs summarise selected third-party views for 2026. They are independent opinions and do not represent Capital.com estimates or recommendations.

Public.com (retail broker forecast snapshot)

Public.com reports that financial analysts covering GameStop have set a 2026 price target of about $13.50 per share, described as the current consensus projection relative to spot levels. The platform notes that the analyst universe is small and frames the estimate in the context of meme-stock volatility and questions over the sustainability of GameStop’s turnaround and cash flows (Public.com, 12 February 2026).

Simply Wall St (valuation-focused fair-value marker)

Simply Wall St states that one of its discounted cash flow scenarios implies a fair-value estimate of around $220 per share for GameStop, while stressing that this output is highly sensitive to underlying assumptions. The note reassesses valuation after recent price swings and highlights how differing views on long-term profitability and capital allocation can produce materially different theoretical values in a volatile environment (Simply Wall St, 10 February 2026).

CoinCodex (quantitative/technical long-term band)

CoinCodex indicates that its model projects GameStop trading between roughly $13.37 and $33.45 during 2026, with an overall bearish sentiment tag. The site attributes these ranges to a rules-based system combining moving averages, momentum indicators and historical pattern analysis, within what it describes as volatile trading conditions (CoinCodex, 16 February 2026).

Stockscan.io (scenario-based yearly averages)

Stockscan.io forecasts that GameStop could average about $82.07 in 2026, with an internal range from approximately $22.20 to $141.94. Its methodology applies scenario analysis to historical volatility and pattern recognition. The commentary notes that wide ranges reflect both past meme-style price spikes and uncertainty around future market participation (Stockscan.io, 15 February 2026).

Intellectia.ai (pattern-correlation model)

Intellectia.ai reports that its GME stock forecast model projects an average GameStop price of about $23.10 for February 2026, with a monthly range between roughly $21.53 and $24.69. For December 2026, it models an average near $26.37. The service states that its outlook draws on correlations between GME and a basket of historically similar stocks, alongside moving-average signals that it characterises as modestly bearish (Intellectia AI, 13 February 2026).

Predictions and third-party forecasts are inherently uncertain, as they cannot fully account for unexpected market developments. Past performance is not a reliable indicator of future results.

GME stock price: Technical overview

The GME stock price is trading around $23.68 as of 3:36pm UTC on 16 February 2026, with price holding close to the 20/50/100/200-day simple moving average (SMA) cluster, near approximately $23.7/$22.5/$22.8/$23.9. The 14-day relative strength index (RSI), at around 51, sits in neutral territory, while an average directional index (ADX) reading near 37 indicates an established trend backdrop rather than a clearly range-bound market.

On the topside, the first level in focus is the classic R1 pivot near $25.87, with R2 around $27.87 coming into view only on a sustained daily close above that level. On pullbacks, the classic pivot at $23.02 marks initial support, with the 100-day SMA near $22.80 forming the next area of interest. A move below that zone would bring the S1 area around $21.02 into focus (TradingView, 16 February 2026).

This technical analysis is for informational purposes only and does not constitute financial advice or a recommendation to buy or sell any instrument.

GameStop share price history (2024–2026)

GME’s stock price has experienced pronounced swings over the past two years, moving from low double digits in early 2024 to the mid-$20s by mid-February 2026. The stock traded below $12 in April 2024 before a meme-style resurgence in May and June, when GME briefly spiked above $80 intraday and later retreated towards the low $20s by the end of the summer.

Through late 2024 and early 2025, the price largely ranged between about $20 and $33, with repeated rallies and pullbacks rather than a sustained directional trend. In 2025, GME moved back into the low $30s in January before trending lower over the course of the year, dipping under $23 during periods of volatility and closing 2025 around $20.50.

So far in 2026, the share price has edged higher, rising from roughly $20.75 on 2 January to $23.68 at the close on 13 February 2026, leaving it modestly above its end-2025 level as of mid-February.

Past performance is not a reliable indicator of future results.

GameStop (GME): Capital.com analyst view

Over the past two years, GameStop’s share price has reflected its position as both a retailer undergoing strategic change and a high-beta meme stock. Periods of intense volatility have interrupted longer stretches of range-bound trade. Episodes such as the May-June 2024 spike illustrate how quickly flows linked to social media activity and retail participation can influence intraday price action.

Recent commentary has pointed to a leaner store footprint, a growing mix of collectibles and digital sales, and sizeable cash reserves as elements that may support the company’s transition. At the same time, analysts continue to flag pressure on legacy software revenues and the risk that speculative trading activity can drive prices away from underlying financial performance.

Options market positioning and insider dealing disclosures have also kept GME in focus as a trading vehicle. Concentrated positioning can coincide with sharp price moves in either direction, particularly if broader market conditions shift. Past performance is not a reliable indicator of future results.

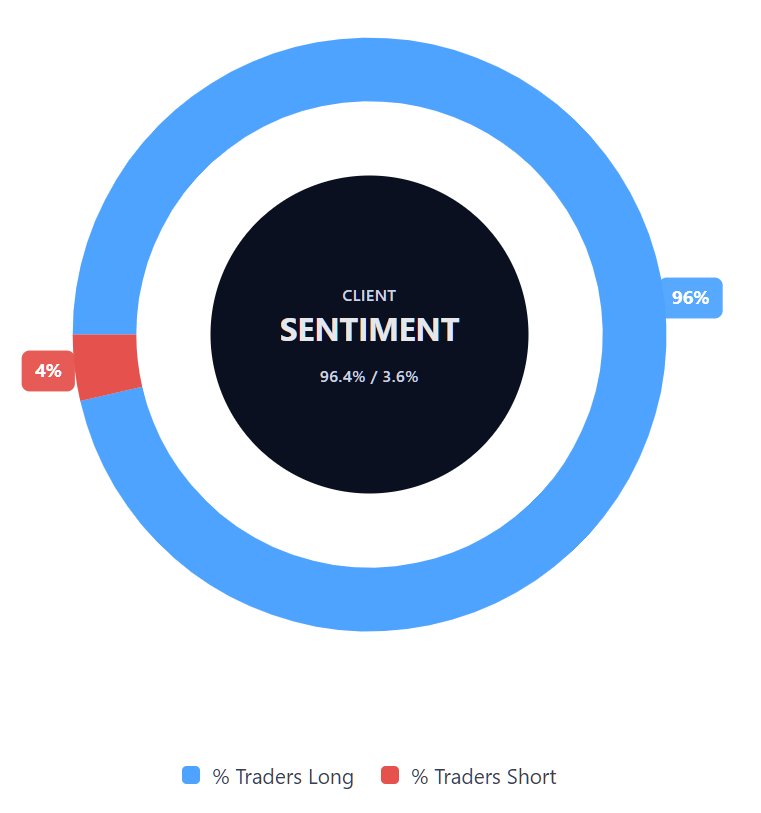

Capital.com’s client sentiment for GameStop CFDs

As of 16 February 2026, Capital.com client positioning in GameStop CFDs is skewed towards long positions, with 96.4% buyers versus 3.6% sellers. Buyers outnumber sellers by approximately 92.8 percentage points. This snapshot reflects open positions on Capital.com and can change over time.

Summary – GameStop 2026

- GameStop’s share price has remained volatile over the past two years, with sharp meme-style spikes in mid-2024 and a return to the low $20s by late 2025.

- Technical indicators show price trading close to a cluster of medium- and long-term moving averages in the low $20s, with RSI near neutral levels and ADX indicating an established trend backdrop.

- Overall, GameStop remains a volatility-sensitive stock where price can respond quickly to shifts in options activity, retail participation and evolving views on the company’s strategic direction.

Past performance is not a reliable indicator of future results.

FAQ

Who owns the most GameStop stock?

GameStop’s shareholder base includes a mix of institutional investors, index funds and retail traders. Large asset managers and exchange-traded funds (ETFs) often hold significant positions because the company is included in major US indices. At the same time, the stock has a sizeable retail following, which can influence trading volumes and short-term price dynamics. Ownership levels change over time as funds rebalance their portfolios and individual investors adjust their exposure.

What is the 5-year GameStop share price forecast?

There is no clear consensus on a five-year GME stock forecast. Third-party projections vary widely, reflecting uncertainty around the company’s long-term profitability, strategic direction and the impact of trading-driven volatility. Some valuation models produce higher theoretical estimates based on specific growth assumptions, while others outline more conservative scenarios. Long-term forecasts depend heavily on inputs such as revenue growth, margins and capital allocation, all of which can shift as market and company conditions evolve.

Is GameStop a good stock to buy?

Whether GameStop is considered ‘good’ depends on your investment objectives, risk tolerance and time horizon. The stock has shown significant volatility in recent years, influenced by both company fundamentals and retail trading activity. While some analysts focus on restructuring efforts and cash reserves, others highlight revenue pressures and uncertainty around future earnings. As with any share, potential returns must be weighed against the risk of capital loss. This information is for general educational purposes and does not constitute financial advice.

Could GameStop stock go up or down?

GameStop’s share price can move in either direction, sometimes over short timeframes. Technical indicators, options positioning and shifts in market sentiment have coincided with sharp intraday and multi-week price moves in the past. Broader equity market conditions and company-specific developments, such as earnings releases or regulatory filings, may also influence price action. Given its history of volatility, gains and losses can both occur quickly, particularly in sentiment-sensitive stocks.

Should I invest in GameStop stock?

The decision to invest in GameStop shares depends on your financial situation, investment goals and understanding of the risks involved. GameStop has experienced wide price swings, and past performance does not guarantee future results. Before investing, you may wish to consider diversification, time horizon and risk management. You should also assess whether you can afford to lose some or all of your invested capital. This information is for general educational purposes and does not constitute financial advice.

Can I trade GameStop CFDs on Capital.com?

Yes, you can trade GameStop CFDs on Capital.com. Trading share CFDs lets you speculate on price movements without owning the underlying asset and to take long or short positions. However, contracts for difference (CFDs) are traded on margin, and leverage amplifies both profits and losses. You should ensure you understand how CFD trading works, assess your risk tolerance, and recognise that losses can occur quickly.