Trading Gold as it Breaches $4,400

Technical overview remains volatile on the precious metals front with gold no exception, and both clients and CoT speculators are majority buy.

U.S. equity index futures are up following Friday’s rebound as the AI trade attempts to regain its footing into year-end following last week’s Micron earnings and an unconfirmed report regarding the Trump administration reviewing Nvidia’s advanced AI chip sales to China, but it’s the commodities front where things are most exciting.

A record high for gold jumping to breach $4,400, with excitement across the precious metals sphere as silver climbs 3% it too enjoying a record high above $69, and even bigger percentage gains for both palladium and platinum with the latter not too far off making a record high of its own. An uptick in geopolitical tensions both off the coast of Venezuela and between Russia and the Ukraine on the lack of a weekend breakthrough is a factor in addition to 2026 Federal Reserve (Fed) rate cut likelihoods firming up, and where it’s near a coin toss on a third 25bp (basis point) rate reduction by December of next year according to market pricing (CME’s FedWatch).

We did hear from a couple FOMC (Federal Open Market Committee) members, the Fed’s Hammack more cautious arguing policy may already be below neutral and warning inflation could be closer to 3% than headline data suggest reinforcing her expectations for a prolonged hold into spring rather than near-term cuts, and Williams that “technical factors” likely distorted November’s CPI data pushing “down the CPI reading, probably by a tenth or so”. Comments that failed to dent gold’s run, as market participants expect more dovish Fed members in the future and a chair who will be in favor of much lower interest rates according to President Trump.

As for economic data, it was largely a disappointment last Friday, UoM’s (University of Michigan) consumer sentiment data for December marginally weaker than expected, with sentiment at 52.9 (vs 53.4 forecast) and expectations at 54.6 (vs 55). One-year inflation expectations ticked up to 4.2% (from 4.1%), while five-year expectations remained unchanged at 3.2%. Housing data also disappointed, existing home sales edging up to 4.13m in November but below the 4.2m forecast.

Week ahead

And the holidays means there will be less to get excited about when it comes to both earnings and the economic calendar, with much of the items releasing tomorrow including preliminary Q3 GDP (Gross Domestic Product), durables, and consumer confidence. The weekly claims will release on Wednesday instead of Thursday as both stock and bond markets will be closed.

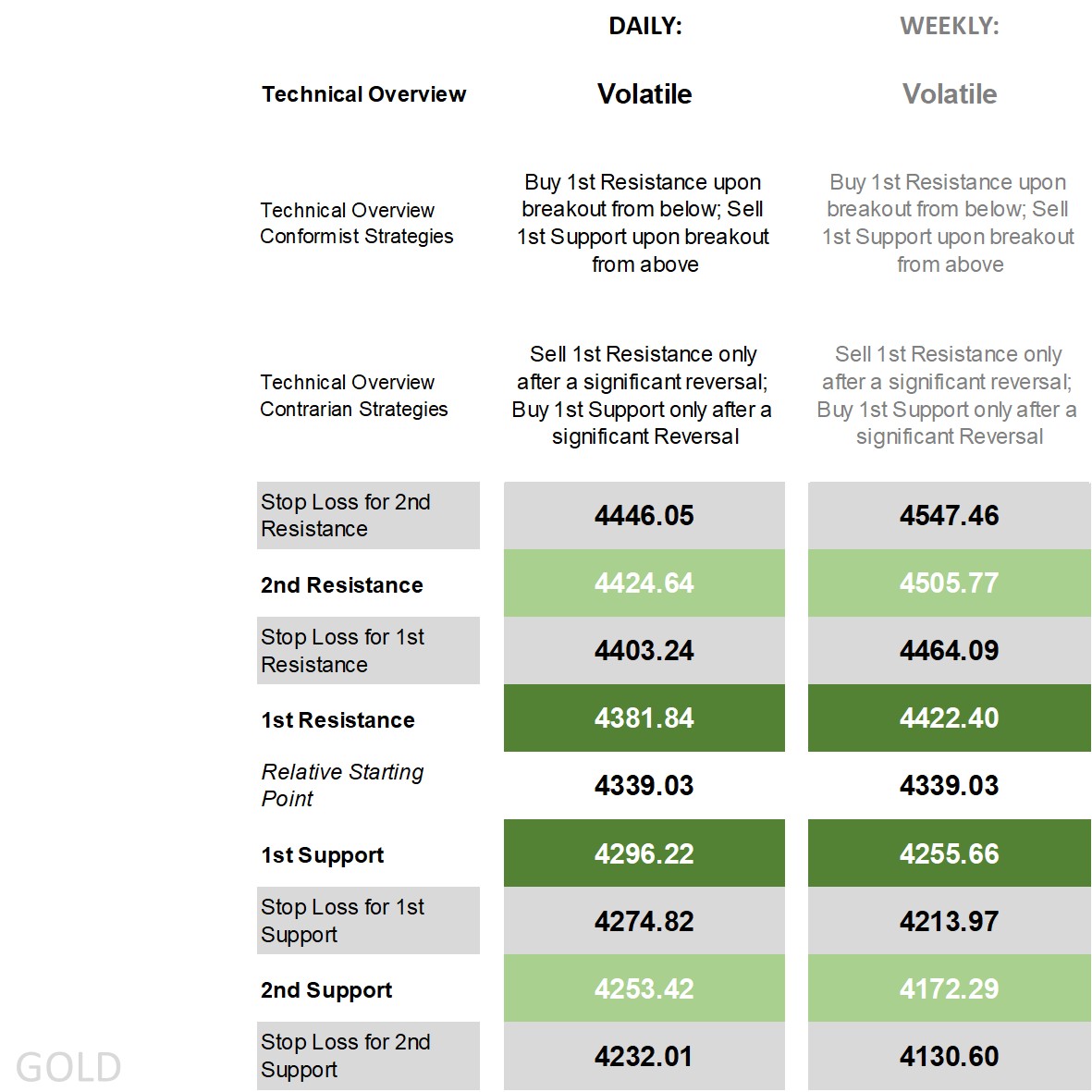

Gold’s technical overview, strategies and levels

Looking at the daily time frame and price is above all its main moving averages (MA), walking the upper end of the band, on the DMI (Directional Movement Index) front the +DI well over the -DI easily classifying it as positive, an RSI (Relative Strength Index) above 80 well in overbought territory, and an ADX (Average Directional Movement Index) in trending territory. It’s a similar story when looking at the key technical indicators on the weekly time frame.

Tempting to label as bullish then, yet the moves combined with the record high has kept it ‘volatile’ in both time frames, meaning conformist strategies are breakouts off the 1st Resistance and Support levels (whether on the daily or weekly time frames) while contrarians who expect calmer waters will be working with reversal strategies meaning buying off the 1st Support or selling off the 1st Resistance only after the level breaks and there’s a reversal back, else leaving the uptick in market volatility to its own devices. Those who see the overview as bullish would mean buy strategies off the 1st levels for conformists but ideally only after a significant reversal off the 1st Support cautious buying into any dip that could carry additional volatility, and buying via breakout off the 1st Resistance levels.

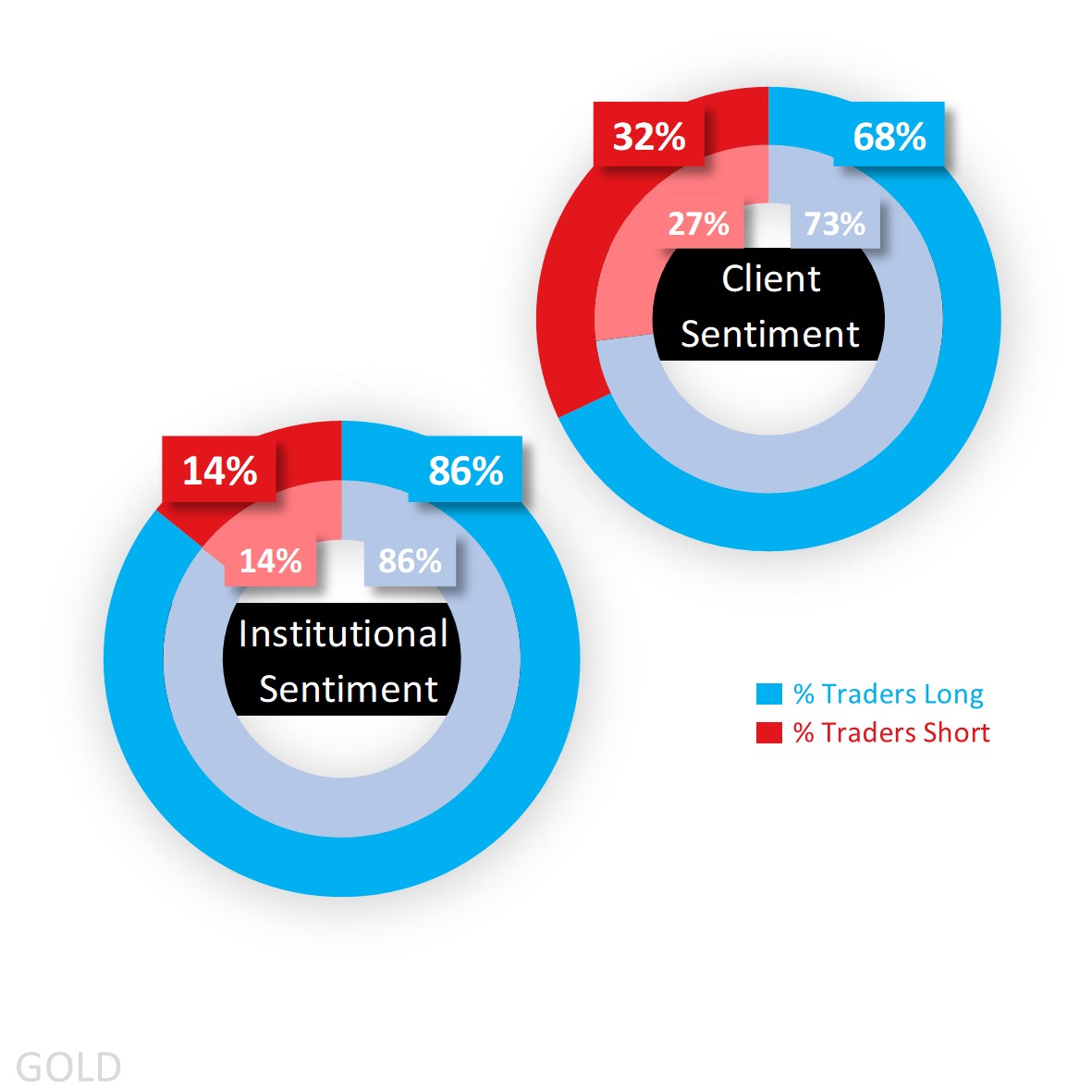

Capital.com’s client sentiment for Gold

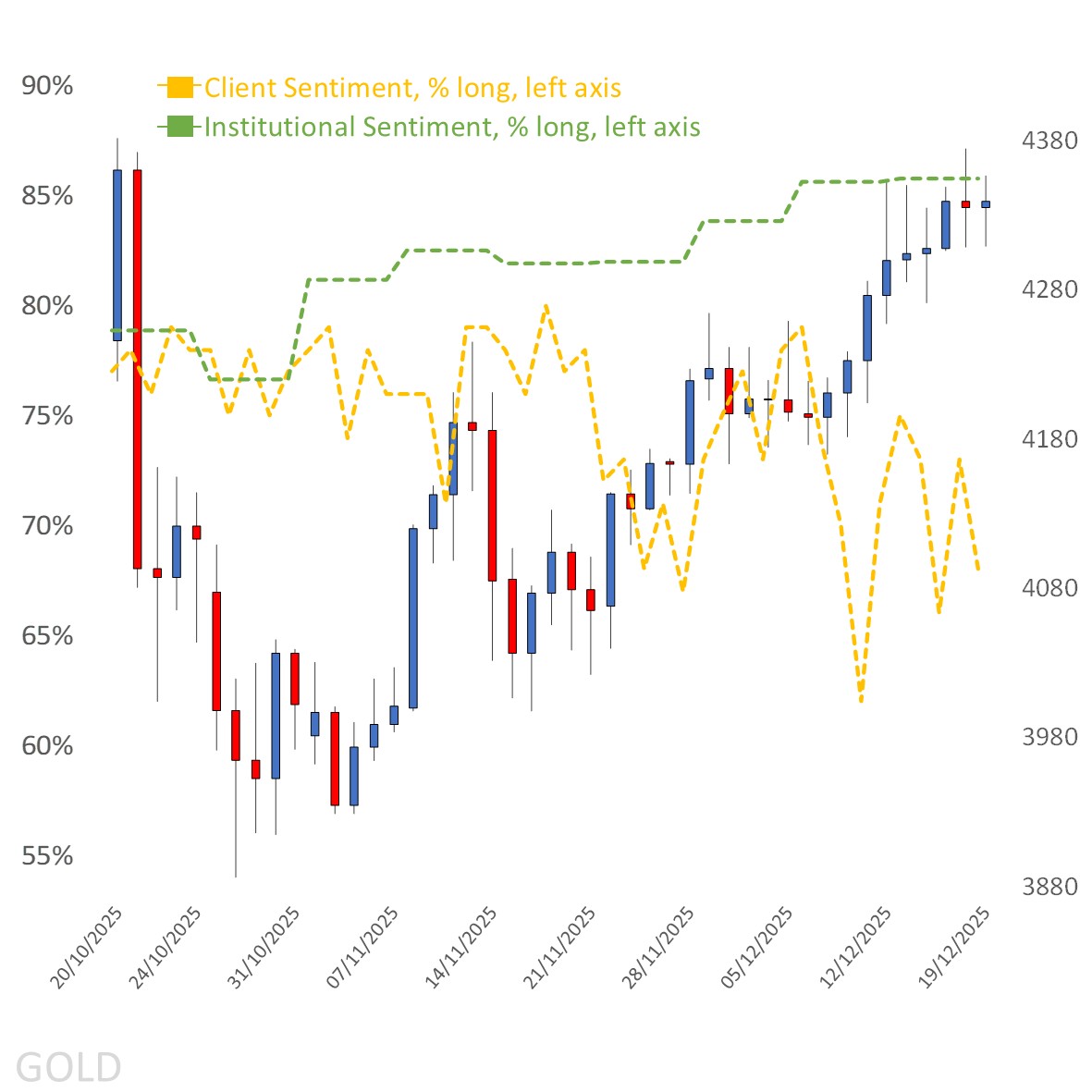

Client sentiment was and remains in majority buy territory, but there’s been a notable drop as they were at a heavier 73% last Friday before falling to 68% at the start of this week and to 63% as of writing falling out of heavy buy as longs close out due to profit taking and shorts initiate anticipating a reversal. A similar story played out in silver where they were an extreme buy 78% on Friday morning before falling to 71% as of this morning.

CoT (Commitment of Traders) speculators according to the latest report out of the CFTC were and remain extreme buy at 86%, with the increase in longs (by 7,154 lots) far outdoing the increase in shorts (by 828) to keep the percentage identical. They’ve raised their net long bias in silver to 76% from 74% with a big uptick in longs over shorts there, and just a couple notches shy of extreme buy territory.

Client sentiment mapped on the daily chart

Period: October 2025 – December 2025

Past performance is not an indicator of future results.

Gold’s chart on Capital.com’s platform with key technical indicators

Source: Capital.com

Source: Capital.com

Period: October 2025 – December 2025

Past performance is not an indicator of future results.