What is stock picking?

Stock-picking is an important investment strategy in the world of finance. Here we take a look at the stock picking definition and different strategies to pick stocks.

Stock pick or stock picking can be defined as a process where an analyst or an investor chooses a stock.

They usually study a string of factors, such as the company’s financial statements, technical indicators, company outlook, and many more, to decide whether the stock could be a suitable asset to trade.

Investors and analysts can also study an industry or sector where the stock belongs to as part of fundamental analysis.

Stock picking explained

What does stock picking mean? Investors who are picking stocks are engaging in an active strategy. The position taken by the investor can be long or short, depending on their outlook for the stock in question.

The opposite of this method is known as passive investing, as seen in the case of mutual and exchange-traded funds (ETFs), where a fund’s performance is meant to replicate that of a market index such as the S&P 500 (US500) or the Dow Jones Industrial Average (US30).

How does stock picking work

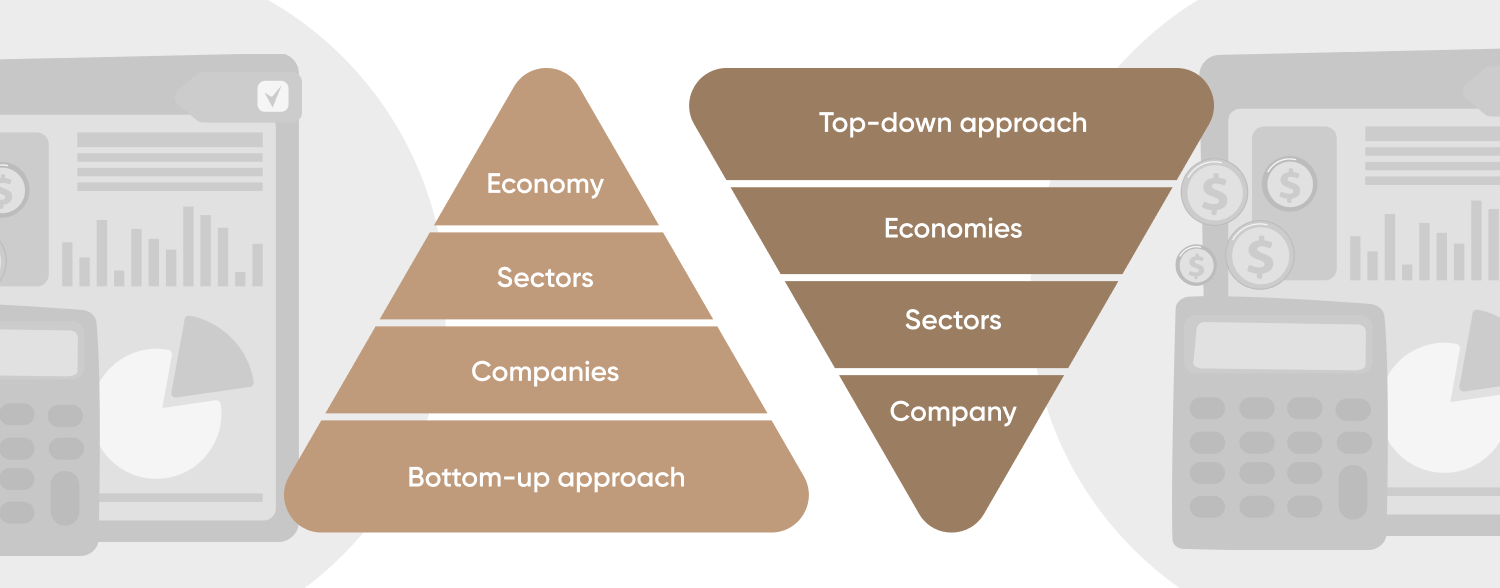

There are several ways to pick a stock. Some of the most popular methods are top-down strategy and bottom-up strategy, and are part of fundamental analysis.

In a top-down strategy, an investor or analyst takes into account macroeconomic factors such as gross domestic product (GDP), tax regime, the health of the job market, trade balance, currency performance and central bank’s monetary policy. The analyst then would move to industry or sector-specific factors and note their performance and projections.

In this approach, the investor usually picks an outperforming economic region and then focuses on stocks from that area. They only analyse the chosen company’s financial health at the very end of the process.

The bottom-up strategy essentially means that an investor first analyses stock fundamentals, and only then moves to macroeconomic and sectoral factors.

A stock picking example of bottom-up approach would be if an investor chooses a company X, and then analyses the firms’ earnings and revenue figures, operations, products and services, and market share. They will then move to analysing the wider industry and macroeconomic factors.