What is a direct investment?

A direct investment is often referred to as foreign direct investment, or FDI. Investors put money into a business operating in another country. They aim to get a strong voice in the management of the enterprise and a long-term presence in a foreign country.

Foreign direct investment may be performed either organically, by expanding the operations of an existing business into a foreign country, or inorganically, by buying a business in the target country.

Where have you heard about direct investments?

FDI often involves reorganisation of management and the transfer of technology or expertise. Direct investments exclude purchase of a company’s shares, if this purchase does not bring the investor control of more than 10 per cent of the company’s stock.

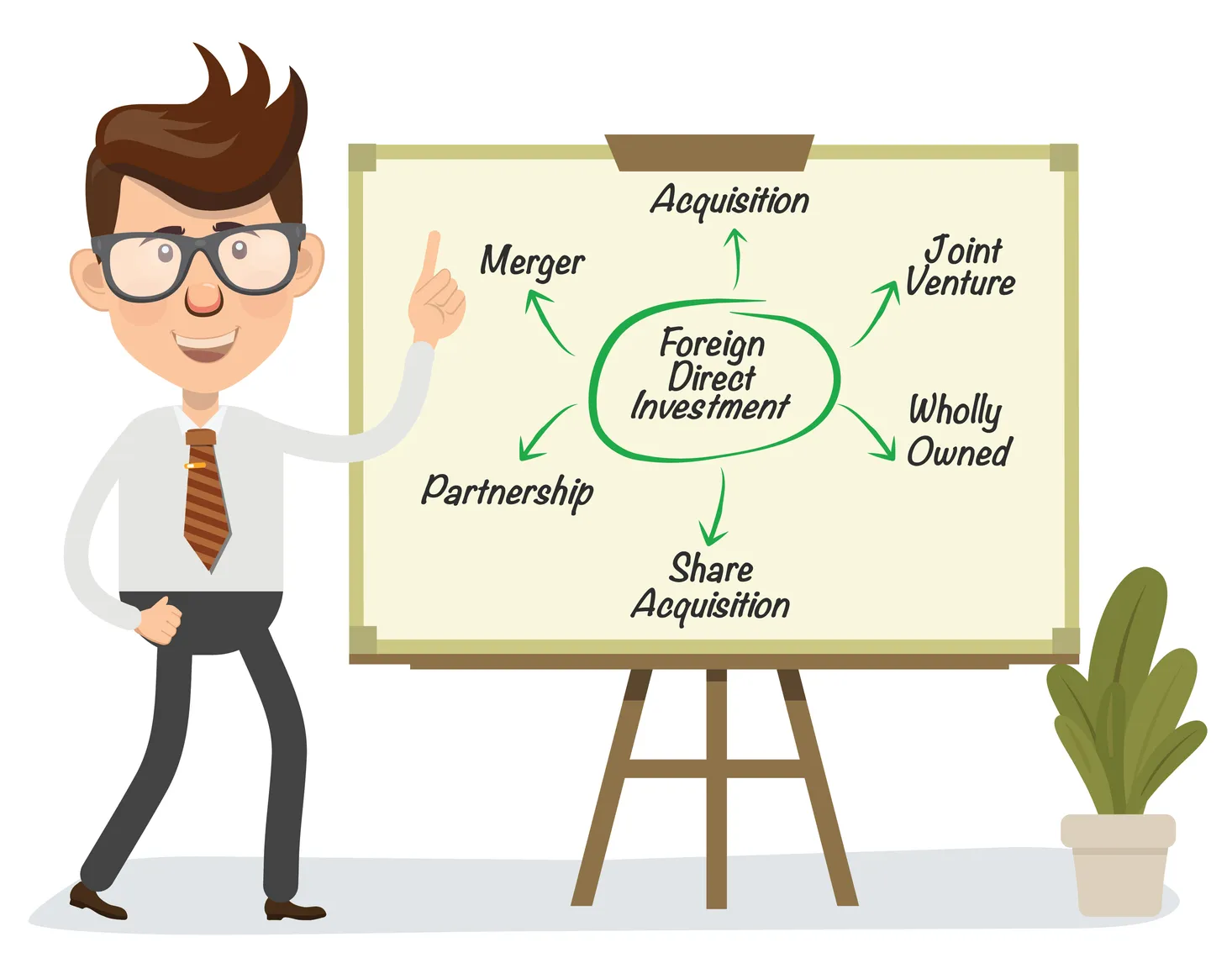

Direct investment can take any of the following forms:

- company acquisitions

- joint ventures

- whole ownership

- partnership

- mergers

- share acquisition

What you need to know about direct investment

Direct investment provides a company with capital funding. In return investors get a long-term equity interest in a company abroad.

Often organisational and management systems or technology are included as part of the investment. Investing companies do not necessarily have to buy regular shares of a company's stock.

A direct investment can involve the investor getting a majority interest in a company. Alternatively, they may gain a minority interest that is big enough to give them effective control of the company.

You should distinguish foreign direct investment from foreign portfolio investment, which is a passive form of investing in the securities of a foreign country.

There are three major types of direct investment

-

Horizontal FDI occurs when a company makes a copy of its home-based business abroad through direct investments.

-

Vertical FDI happens when a company moves down or up stream in different value chains through a direct investment. For example, when companies perform value-adding activities in a host country.

-

Conglomerate FDI is a less common type of direct investment, where an existing company adds an unrelated business operation abroad.

An increase in direct investments is often associated with a host country’s economic growth due to increased tax revenues and an influx of capital. Host countries tend to dedicate foreign direct investment into new infrastructure and other growth projects that can contribute to the country’s economic development.

Competition between those companies seeking investment can boost productivity and increase efficiency. Furthermore, the local population can benefit from the new employment opportunities created by emerging businesses.