FED PREVIEW: no doubt about another rate pause

Markets have no doubt that the Fed will keep its rate unchanged despite stronger GDP data

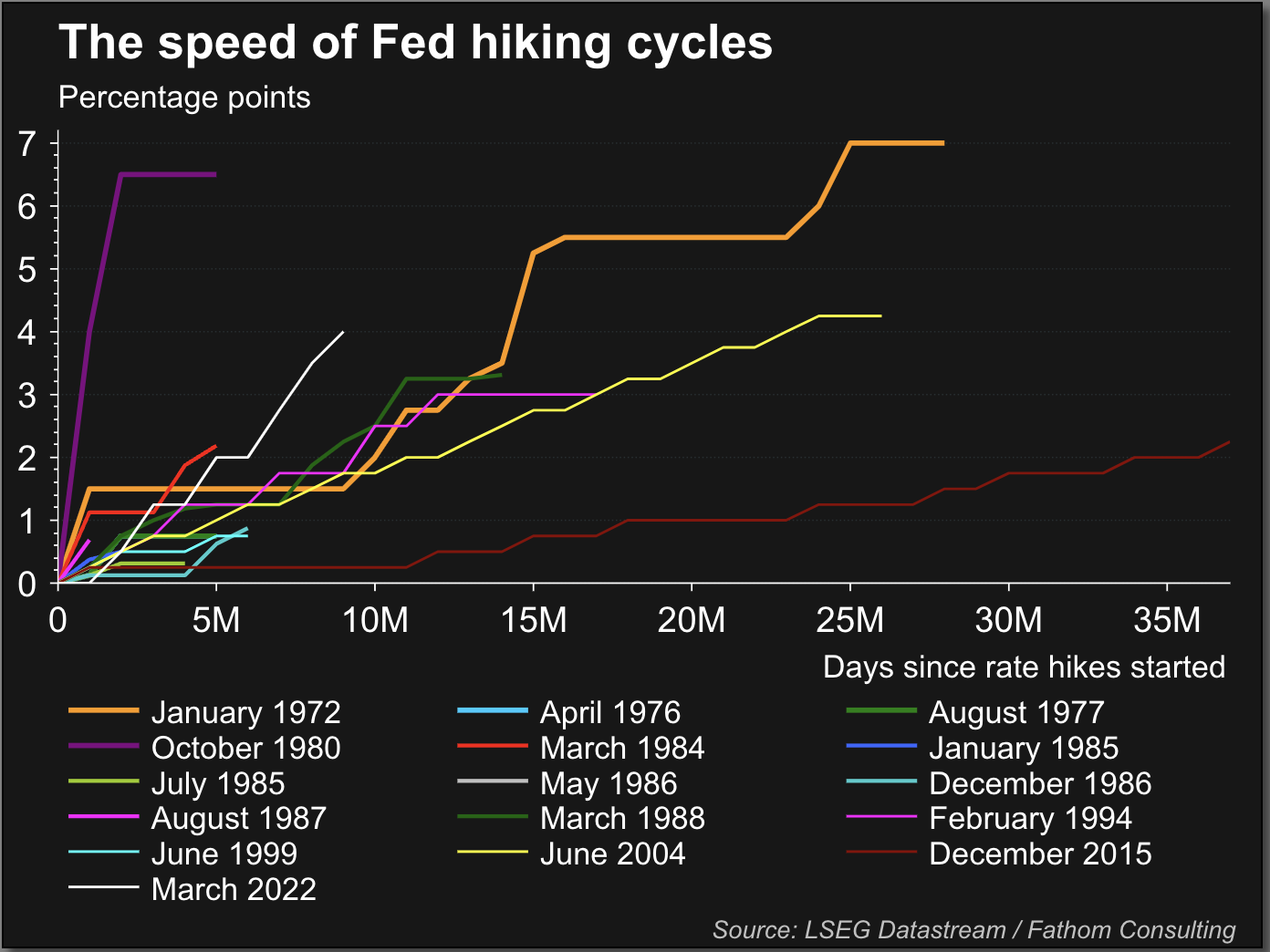

The Federal Reserve (Fed) will deliver its latest policy update on Wednesday, 1 November 1. As per data from Reuters, market participants are certain the Fed will keep rates on hold at the current range of 5.25% - 5.5% for the second time in a row, with a probability of 100% just days before the meeting. Up until the previous meeting in September, the Fed had hiked continuously for 18 months, increasing the rate by 500bps, the strongest tightening cycle since the 1980s.

The Fed enters a 10-day blackout period prior to its meetings, but judging by the comments from Fed Governor Jerome Powell in his last appearance it seems that markets may be correct in predicting another rate pause. The recent rise in bond yields – to highs not seen since the 2008 financial crisis – is playing its part in tightening monetary conditions, which takes some of the pressure off the central bank. Powell highlighted this in his comments, as well as the fact that recent data is showing progress towards the inflation goal. That said, growth and the labour market continue to show remarkable resilience, which led Powell to highlight that further tightening may be warranted.

US economic data since the last FOMC meeting

|

|

Q3 GDP |

CPI Sept. |

Retail Sales Sept |

NFP Sept. |

Unemployment rate Sept. |

PCE Sept. |

|

Previous |

2.1% |

3.7% |

0.8% |

227K |

3.8% |

3.4% |

|

Expected |

4.3% |

3.6% |

0.3% |

170K |

3.7% |

3.4% |

|

Actual |

4.9% |

3.7% |

0.7% |

336K |

3.8% |

3.4% |

Source: refinitiv

If we compare Powell’s messaging to that of the ECB’s Christine Lagarde, we can see that Lagarde has been more forceful about how much past rate hikes have been slowing growth. Powell, on the other hand, simply states that progress has been made. Unsurprisingly, we see this difference because US economic data has been much stronger than the eurozone in the past few months. Because of this, it’s going to make the Fed’s work of balancing too much vs too little tightening that much harder. It may also mean that markets may be in for a surprise at the upcoming meeting.

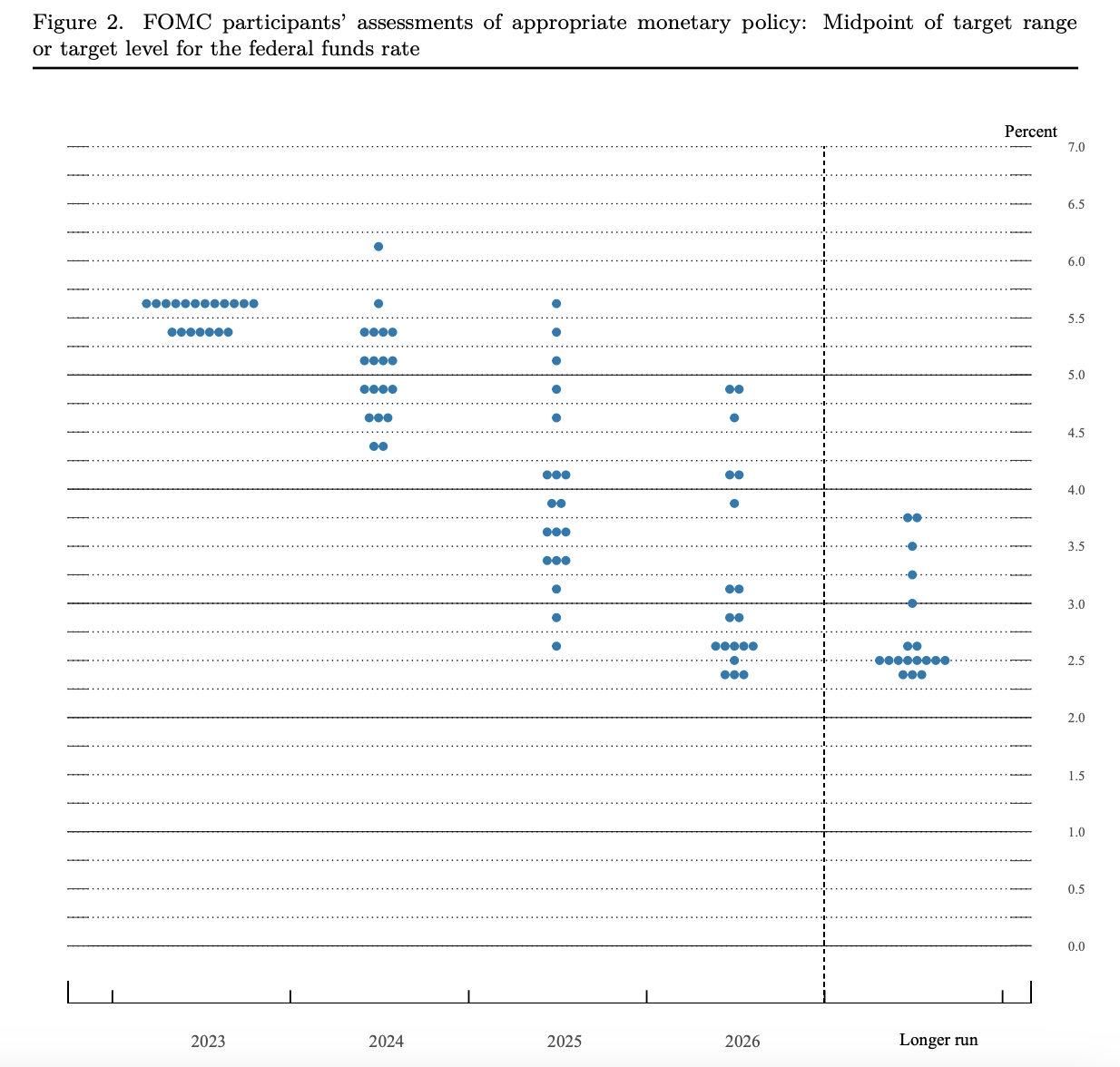

For now, it seems like much of the focus is on how long is “higher-for-longer” - the preferred phrase of most central banks in recent weeks, including the Fed. Based on Reuters data, markets aren’t anticipating another hike from the Fed, but they expect the current range to be kept untouched until the summer of next year. Based on the latest set of projections, about half of Fed members expect rates to remain above 5% in 2024, with the other half expecting a rate between 4.5% and 5%.

FOMC September dot-plot projections

US equity markets have started the week with a bearish bias as intensified attacks over the weekend in Gaza have caused risk appetite to drop further. The perception that the Fed will keep up its hawkish commentary also isn’t helping. The US Tech 100 and S&P 500 have dropped to five-month lows whilst the more sensitive small-cap index Russell 2000 has dropped below the 2022 lows that had been acting as support, and is now trading at a three-year low. The daily RSI is pushing into oversold territory once again, but there is still a margin for it to drop further on the weekly chart - suggesting bears could remain in control this week. A hawkish pause from the Fed would likely intensify the downside potential.

Russel 2000 daily chart

In the FX space, the US dollar has been edging higher in recent sessions, but the currency has perhaps been lacking the bullish push that many would have expected during such a “risk-off” period, given the conflict in the Middle East. That said, the rally in the dollar had already been overextended prior to the conflict, with traders opting for other safe havens like gold. US yields have also been pulling back slightly in the last few days, which has kept the dollar subdued.

EUR/USD has been an interesting pair to follow recently as it’s been trying to break away from its descending channel pattern without much success. Last Monday we saw the culmination of a recent bullish push in the euro taking EUR/USD to a one-month high and breaking above the descending channel for the first time since it was formed back in July. But momentum quickly reversed the following day and, despite continuing to see appetite to break higher, the pair is confined to the pattern once again. At this point, EUR/USD should see a few consecutive daily closes beyond the channel in order to start considering it a sufficient amount of momentum to sustain the bullish push.

EUR/USD daily chart