Contemporary Amperex stock forecast: Third-party targets

CATL (3750) is trading at $425.75 HKD as of 13:29 UTC on 10 September 2025, within an intraday range of $425.55-$439.35 HKD.

Capacity expansion in Europe continues to be a focus, with the Debrecen, Hungary, plant set to begin production by early 2026, while operations at the Yichun lithium mine are expected to resume imminently after licence renewal, amid steady electric-vehicle battery demand trends. (Reuters, 7 September 2025).

Contemporary Amperex share price forecast: Analyst price target view

Goldman Sachs (research update)

Goldman Sachs raised its H-share target price to $436 HKD from $411 HKD, while downgrading to 'Neutral' after recalibrating earnings estimates following first-half results. The investment bank maintained its A-share target at RMB323, citing CATL's 50% dominance in China's EV battery market and potential for 25% compound annual growth rate in earnings through 2030 (Investing.com UK, 31 July 2025).

UBS (coverage initiation)

UBS initiated coverage with a 'Buy' rating and $390 HKD target price as of 26 June 2025, based on a 20.5x price-to-earnings multiple for 2026 estimated earnings. The bank highlighted CATL's position as the world's largest battery manufacturer with 37.9% global market share in EV batteries, forecasting stable unit profit of RMB107/kWh while achieving 20% volume growth over five years (Investing.com UK, 26 June 2025).

Morgan Stanley (tactical update)

Morgan Stanley set an 'Overweight' rating with 425 RMB target price for A-shares, citing an 80%+ likelihood of near-term price appreciation after recent pullbacks, emphasising CATL's AI-enabled battery monitoring ecosystem and enhanced software capabilities beyond traditional hardware supply (AASTOCKS, 31 July 2025).

Predictions and external forecasts are often inaccurate, as they cannot capture unexpected market events. Past performance isn’t a reliable indicator of future results.

CATL price: Technical overview

CATL (3750) trades at $425.75 HKD as of 13:29 UTC on 10 September 2025, above its key moving-average cluster – the 20/50/100/200-day SMAs at ~296 / 281 / 265 / 261 – with the 20-over-50 alignment intact. Momentum is neutral to firm on the 14-day RSI at 64.9, with the ADX (14) at 33.9 signalling an established trend.

This is technical analysis for informational purposes only and does not constitute financial advice or a recommendation to buy or sell any instrument.

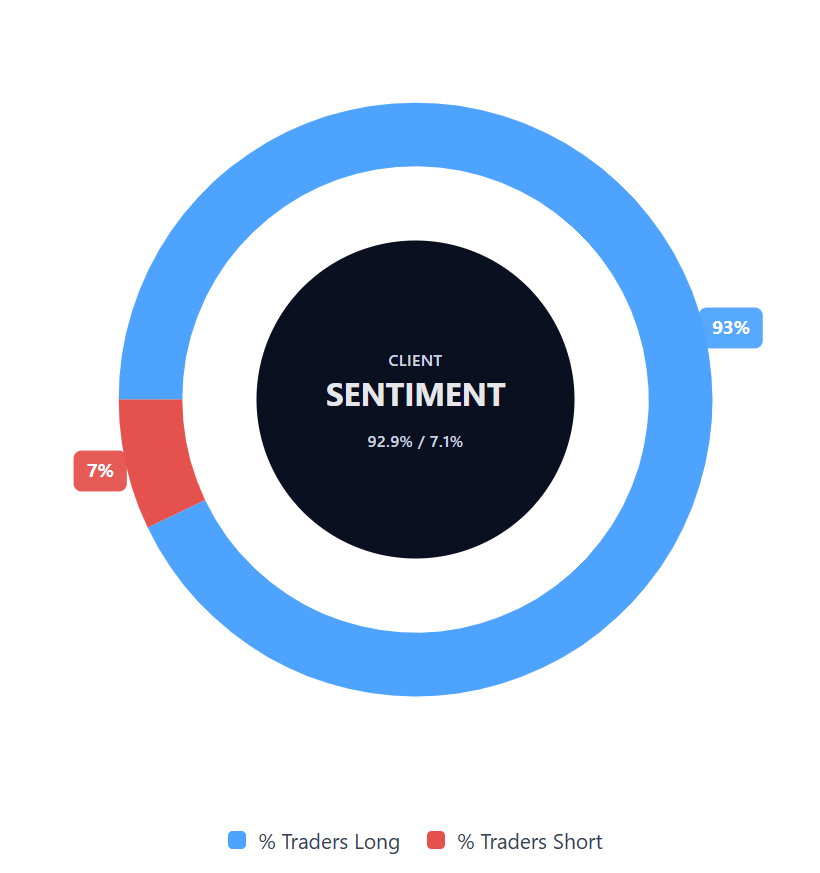

Capital.com’s client sentiment for Contemporary Amperex CFDs

CATL CFD buyers account for 92.9% versus sellers at 7.1%, indicating a strong skew towards long positions. The buy-side bias is 85.7 percentage points. This snapshot is based on open positions on Capital.com and is subject to change. Data correct as of 10 September 2025.

FAQ

Is Contemporary Amperex a good stock to buy?

Whether CATL is appropriate depends on your objectives and risk tolerance. Analysts’ views vary: some emphasise its scale and technology, while others highlight valuation pressures and industry risks. Key factors include its global expansion, raw material exposure, regulatory environment, geopolitical developments and EV demand trends. Independent research is essential to assess suitability.

Could Contemporary Amperex stock go up or down?

The share price may respond to earnings updates, contract announcements, policy changes and commodity trends. Broader sentiment toward Chinese equities and technology stocks may also play a role. Possible upside drivers include stronger EV sales or successful international expansion, while weaker demand, supply-chain issues or rising competition could weigh on performance.

Should I invest in Contemporary Amperex stock?

Suitability depends on personal circumstances. CATL shares can be traded directly on Chinese exchanges – A-shares in Shenzhen and H-shares in Hong Kong – or through CFDs for short-term exposure without owning the stock. CATL CFDs allow flexibility, but leverage amplifies both gains and losses. It is important to understand the associated risks, including margin calls and volatility, and to consider whether CATL aligns with your strategy and financial situation.