Coca Cola stock forecast: Third-party price targets

Coca-Cola trades at $67.36 as of 9:13am UTC on 15 October 2025, after moving within an intraday range of $66.64 to $67.37. The stock gained 0.88% from the prior session’s close of $66.80, continuing a gradual recovery from recent lows while remaining well below the 21 April 2025 peak of $74.38.

Coca-Cola’s upcoming third-quarter earnings release on 21 October keeps near-term focus on its fundamental performance (The Coca Cola Company, 28 September 2025), following the company’s announcement of a $6bn share buyback programme running through 2030 (Yahoo Finance, 13 October 2025).

The US 10-year Treasury yield eased to 4.02%, near April lows, amid expectations of further Federal Reserve rate cuts (Trading Economics, 15 October 2025). The US dollar index (DXY) slipped 0.18% to 98.89, offering a modest supportive backdrop for multinational consumer stocks (Trading Economics, 15 October 2025).

Coca Cola stock forecast: Analyst price target view

Barclays (Overweight rating)

Barclays maintains an Overweight rating on Coca-Cola with a price target of $71.00, after revising the target downward from $78.00. Analyst Lauren Lieberman continues to recommend the stock as beverage-sector volumes soften ahead of third-quarter earnings set for 21 October 2025 (MarketScreener, 10 October 2025).

Wells Fargo (research note)

Wells Fargo maintains an Overweight rating on Coca-Cola with a $75 price target, lowered from $78. The firm cites continued confidence in the company’s organic sales model, but notes volume headwinds in certain international markets and limited near-term margin expansion (MarketBeat, 25 September 2025).

JPMorgan (equity research update)

JPMorgan reaffirmed an Overweight rating and $79 price target. The bank highlights Coca-Cola’s capacity to sustain long-term organic growth of 4–6%, supported by its hydration and ready-to-drink protein product lines, aligned with evolving consumer preferences (Investing.com UK, 22 September 2025).

Morgan Stanley (top-pick designation)

Morgan Stanley maintained an Overweight rating and $81 price target, having named Coca-Cola its top pick in the beverages sector in June 2025. The firm notes Coca-Cola’s steady organic sales growth outperforming peers and expectations, along with strong pricing power and ongoing market share gains in a stable competitive landscape (The Globe and Mail, 26 September 2025).

Predictions and third-party forecasts are often inaccurate, as they can’t account for unforeseen market developments. Past performance isn’t a reliable indicator of future results.

KO stock price: Technical overview

Coca-Cola (KO) is trading at $67.36 as of 9:13am UTC on 15 October 2025, holding below its longer-term moving-average cluster – the 50-, 100-, and 200-day SMAs are positioned around 68, 69, and 69, respectively – while price finds support above the shorter 10-, 20-, and 30-day SMAs near 67, 66, and 67. The 20-day SMA remains above the 50-day SMA, maintaining a near-term alignment that keeps the immediate trend slightly constructive, despite the stock trading beneath the broader moving-average range.

Momentum is broadly neutral: the 14-day RSI at 54.4 reflects a balanced stance, while the ADX at 18.4 indicates limited directional strength. The MACD level of –0.24 has turned marginally positive, suggesting early signs of upward bias if the stock reclaims levels above the 50-day average.

On the upside, the first level to monitor is the Classic pivot R1 near 68.74; a daily close above this could bring the 50-day SMA around 68 into focus and, if cleared on a sustained basis, open a move towards R2 near 71.15. Beyond that, the 200-day SMA zone around 69 remains the key resistance area that has capped previous rallies.

On pullbacks, initial support lies at the Classic pivot near 67.04, with the 20-day SMA at 66.48 providing the next notable floor. A break below the 30-day SMA near 66.83 would weaken the short-term structure and increase the risk of a retracement towards the S1 pivot around 64.63 and the late-September lows (TradingView, 15 October 2025).

This analysis is for informational purposes only and does not constitute financial advice or a recommendation to buy or sell any instrument.

Coca Cola share price history

Coca-Cola shares have traded within a relatively contained range over the past two years, moving between a low of $52.79 in October 2023 and a high of $74.33 in April 2025.

The stock opened 2024 at $59.71 and spent the first quarter consolidating around $60, before dipping to $57.88 in mid-April during a broader market retracement. Shares then rose steadily through the summer, crossing $70 in late September and finishing the year at $62.21 – a modest annual gain of about 4.2%.

The advance continued in early 2025, with KO surpassing $72 in March and reaching an all-time high of $74.33 on 22 April, supported by strong first-quarter results and firm pricing performance. However, momentum slowed in May as currency movements and softer volumes emerged, bringing the stock back below $69. A brief rebound into the low $70s during June and July was followed by renewed weakness in August, as shares eased towards $66 amid rotation within the consumer-staples sector.

Coca-Cola closed at $67.05 on 15 October 2025, below its April peak but higher year on year, reflecting a steady tone ahead of the company’s third-quarter results scheduled for 21 October.

Past performance is not a reliable indicator of future results.

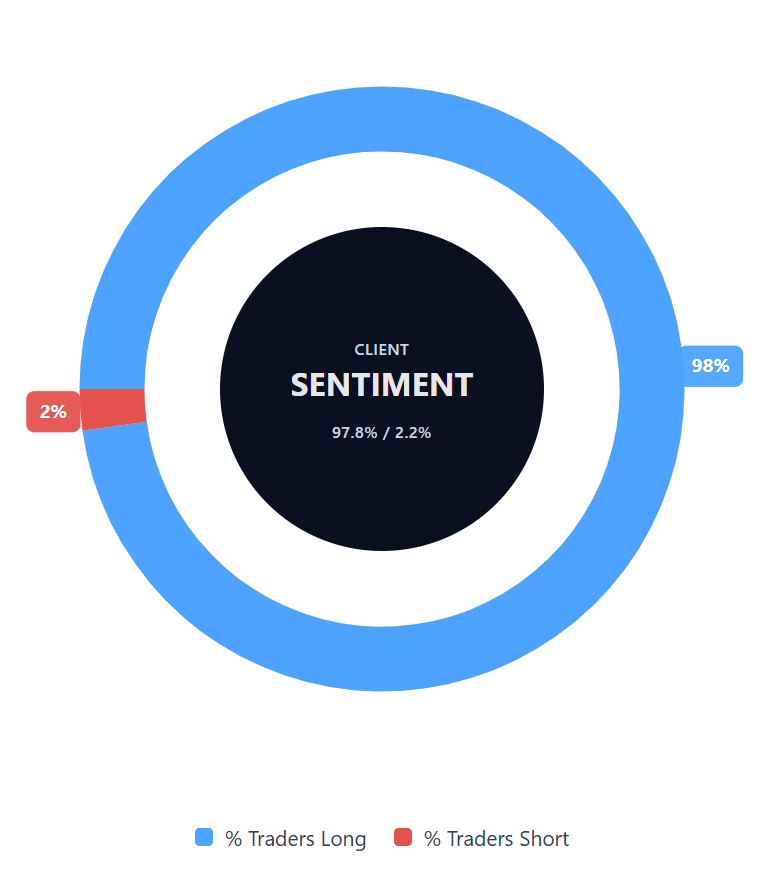

Capital.com’s client sentiment for Coca Cola CFDs

Capital.com client positioning in Coca-Cola share CFDs currently shows a strong long bias, with 97.8% of positions long and 2.2% short – a difference of 95.6 percentage points (15 October 2025). This indicates that most open positions on Capital.com are held on the long side, although sentiment may shift as market conditions develop.

FAQ

Is Coca Cola a good stock to buy?

Coca-Cola is one of the world’s largest consumer goods companies, known for its global distribution network and broad beverage portfolio. Whether it’s considered a good stock depends on individual goals and risk tolerance. It’s important to review recent financial performance, market conditions, and personal objectives before making any trading decision.

Could Coca Cola stock go up or down?

Like all publicly traded shares, Coca-Cola’s stock price can move in either direction depending on factors such as earnings results, investor sentiment, broader economic trends, and currency movements. Third-party forecasts suggest potential price targets for the next twelve months, though these are subject to revision and they don’t reflect future outcomes.

Should I invest in Coca Cola stock?

Capital.com does not provide investment advice. Traders should conduct independent analysis, review reliable data sources, and consider their financial position and risk appetite before investing in shares or trading Coca-Cola CFDs. Contracts for difference (CFDs) are traded on margin, and leverage amplifies both profits and losses.

What affects Coca-Cola’s share price?

Coca-Cola’s share price is shaped by a range of factors, including quarterly results, consumer demand, commodity prices, and global economic conditions. Broader market influences – such as interest rate changes or shifts in demand for defensive assets – may also affect performance over time.