Adobe stock forecast: Third-party targets

Adobe (ADBE) is trading at $357.45 as of 10:15 UTC on 10 September 2025, rebounding slightly within today’s intraday range of $354.95–357.15 and positioning near the upper end of that band.

Trading momentum is being influenced by two main developments: anticipation of Adobe’s Q3 FY2025 earnings announcement, scheduled for release after market close on 11 September (MarketBeat, 9 September 2025).

Adobe share price forecast: Analyst price target view

Rothschild & Co. Redburn (downgrade)

Redburn cut Adobe to sell with a price target of $280. The note flags intensifying competition from generative-AI tools as a headwind for pricing power and growth amid a shifting creative-software landscape (Marketwatch, 2 July 2025)

UBS (CIO/analyst update)

UBS reduced its price target to $400 from $430 and kept a neutral rating. The stance reflects a more balanced risk-reward into Q3 earnings amid macro uncertainty and product execution watchpoints (Yahoo Finance, 29 August 2025).

Morgan Stanley (research note)

Morgan Stanley reiterated overweight with a $510 target as of 2 August 2025. The view highlights potential value capture from generative-AI capabilities across Creative and Document clouds, with execution and competitive dynamics monitored (Yahoo Finance, 2 August 2025).

RBC Capital (research update)

RBC Capital kept outperform with a $430 target. The analysts point to pricing actions and AI-driven product innovation as supportive factors, while acknowledging market volatility around outlook resets (Investing,com UK, 8 September 2025).

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Fees, spreads and other charges apply.

Any price forecasts or projections are provided for information purposes only and do not constitute investment advice. Market prices are volatile and may move in either direction. Past performance or forecasts are not reliable indicators of future results.

ADBE stock price: Technical overview

Adobe (ADBE) last traded at $357.45 as of 10:15 UTC on 10 September 2025. On the daily chart, the simple moving average cluster sits near the 20/50/100/200-DMAs at ~353 / 360 / 376 / 407. The short-tenor band (10–20-day SMAs around 352–353) holds just above the pivot line at 350, while longer-term averages remain overhead. No clear 20-over-50 alignment is in place, with both the 50- and 100-day SMAs capping price action above current levels.

This is technical analysis for informational purposes only and does not constitute financial advice or a recommendation to buy or sell any instrument.

Past performance is not a reliable indicator of future results.

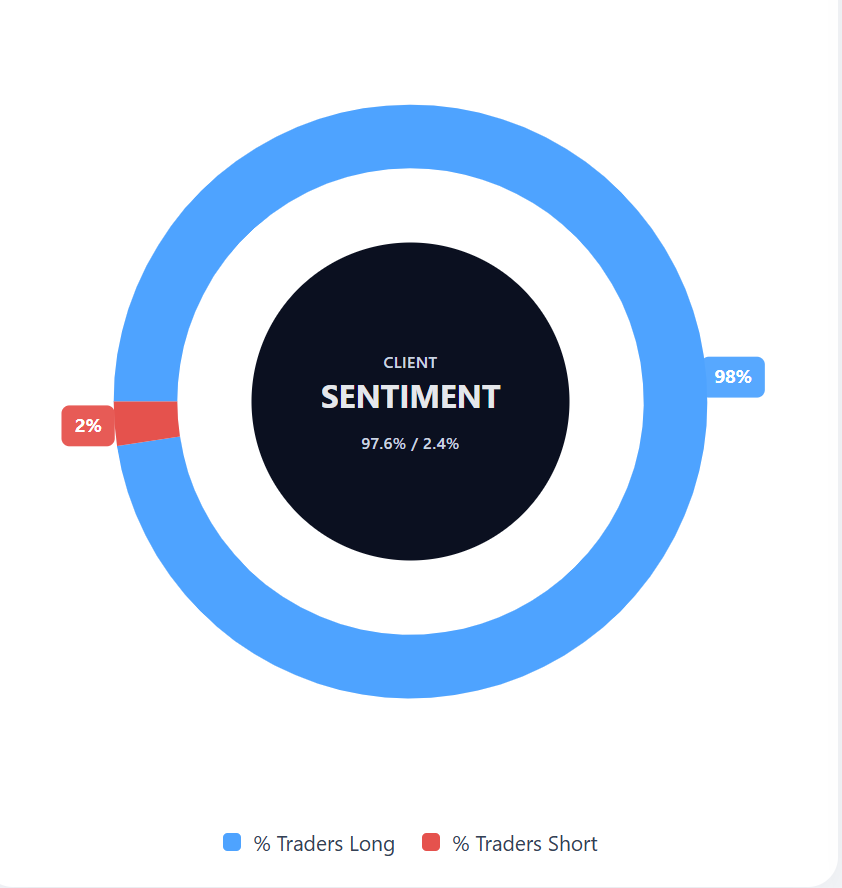

Capital.com’s client sentiment for Adobe CFDs

Capital.com client positioning in Adobe (ADBE) CFDs shows 97.6% buyers versus 2.4% sellers, a one-sided tilt towards longs that puts buyers ahead by 95.2 percentage points. This snapshot reflects open positions on Capital.com and can change. Data correct as of 10 September 2025.

FAQ

Who owns the most Adobe stock?

The largest shareholders of Adobe are institutional investors, with Vanguard Group and BlackRock holding the biggest stakes as of August 2025. Company insiders, including executives and directors, account for a smaller percentage of ownership compared with these large asset managers.

What is the 5 year forecast for Adobe stock?

Analyst price targets for Adobe in 2025 typically range from around $280 at the low end to about $590 at the upper range, reflecting differing views within the analyst consensus. Five-year scenario models suggest a wide range of potential outcomes, depending on shifts in competition, adoption of AI-driven tools, and macroeconomic trends.

Should I invest in Adobe stock?

That decision depends on your goals, timeframe, and tolerance for risk. Buying Adobe shares provides direct exposure to the creative software sector, while trading Adobe CFDs allows speculation on price movements without ownership. Both approaches carry risk, and CFDs in particular involve leverage, which can amplify losses as well as gains.