CFDs vs stocks: What should traders know?

How does trading CFDs compare with stock trading? Below, we’ll look into the essential similarities and differences to know between these key trading terms, from leverage to asset class information and more.

CFDs and stocks: how do they compare?

CFDs (contracts for difference) and stocks (shares) trading are often compared, but they’re quite different.

CFDs are derivatives, which means they derive their price from an underlying asset. That asset might be a forex pair, a commodity like gold, an index like the S&P 500, or stock in a company like Apple. You might open a CFD position on a market if you wanted to speculate on its future price.

A stock or share, however, is a unit of ownership in a company. You’d buy stock if you wanted to invest in a company’s future, have a say in shareholder matters, benefit from dividends and so on.

You can use CFDs to trade on share prices. But unlike buying shares outright, they don’t give you any ownership rights.

What are CFDs?

CFDs are derivatives that let you trade on price movements across various assets – like stocks, commodities, or forex – without owning them. They’re flexible, with no fixed end date, so you can keep your position open as long as you like. CFDs are popular for short to medium-term trading and allow leverage (also known as margin trading). This means you can control a larger position with a smaller outlay, though this also increases potential losses as well as profits.

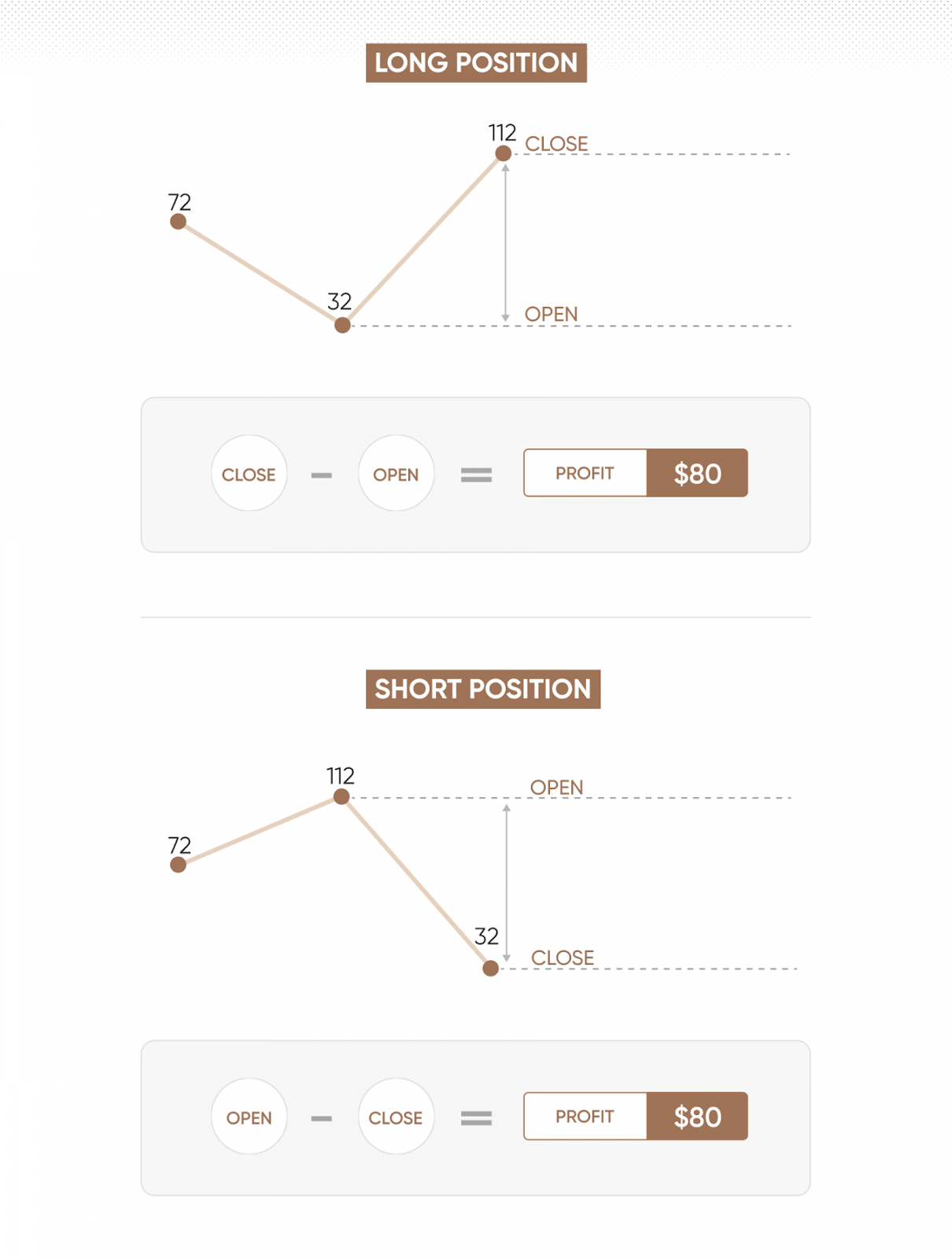

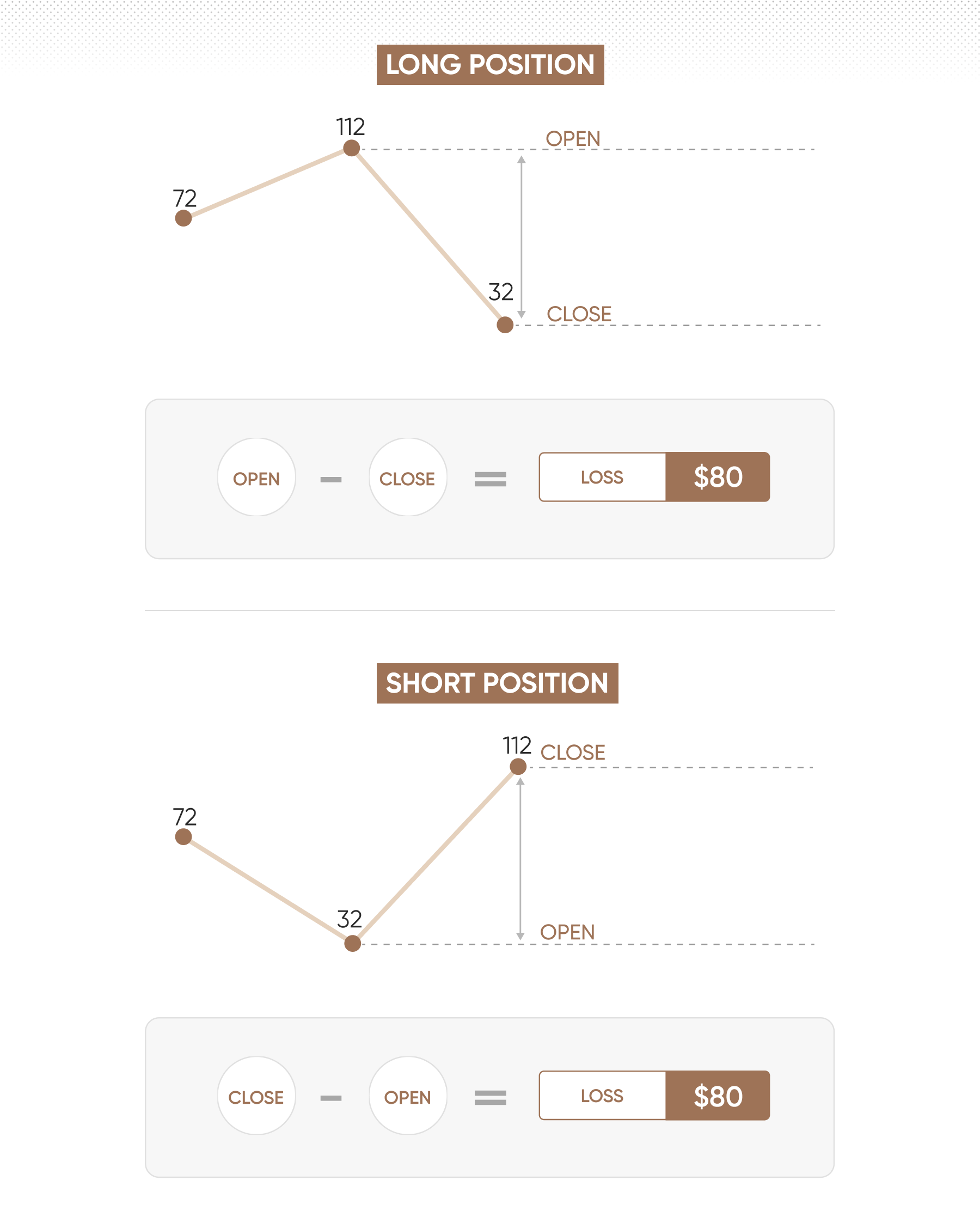

With CFDs, you have the choice of taking a position on an asset rising in price, known as a long position, or falling in price, known as a short position.

Learn more about CFD trading and how it works.

What are stocks?

Stocks, also called shares, represent ownership in a company. When a company goes public, it often raises money by issuing shares to investors, which can then be bought and sold on stock exchanges like the New York Stock Exchange or London Stock Exchange.

Companies first issue shares in the primary market through initial public offerings (IPOs), where investors buy them directly. Once listed, shares trade in the secondary market, where their prices fluctuate based on supply and demand.

Learn more about shares trading and how it works.

Why do traders choose CFDs?

Here’s an overview of why you might choose to trade CFDs.

- Broad market access: trade shares, commodities, forex, and more from a single platform.

- Leverage: control larger positions with a smaller initial outlay (called 'margin'), enhancing potential returns and risks.

- Short- and medium-term focus: may suit day trading, where people look to respond to immediate market conditions.

Why do traders choose stocks?

Here’s an overview of why you might choose to trade stocks.

- Back a company you believe in: invest in the future of companies across a range of industries and sectors.

- Shareholder rights: benefit from dividend payments and voting rights on a company’s future.

- Long-term focus: you might buy shares with the intention of selling them much later on, if you thought a company’s value was set to rise.

Stock investing vs stock CFDs

| Feature | Stock investing | Stock CFDs |

| Underlying assets | You own the shares outright. | No ownership – you speculate on price movements. |

| Leverage | Full payment required upfront. | Trade on margin, requiring only a fraction of the full value. |

| Market direction | Benefit only from rising prices. | Trade both rising and falling prices (long or short). |

| Potential costs | Broker commissions, exchange fees, and potential capital gains tax. | Spread, overnight funding, guaranteed stop-losses (when activated). |

| Dividends | Eligible for dividends if declared by the company. | No direct ownership, but adjustments may be made for dividend payments. |

| Contract duration | No expiration – you hold shares indefinitely unless sold. | No fixed expiry – positions stay open as long as margin requirements are met. |

| Trading hours | Limited to exchange hours. | Limited to exchange hours (unless trading extended hours). |

| Regulation | Regulated as securities investments. | Regulated as derivative trading products. |

How are stocks traded with CFDs?

When trading stocks via CFDs, traders speculate on a stock’s price movements without owning the underlying shares. A share CFD mirrors the price changes of the stock listed on an exchange, allowing traders to profit from rising or falling prices by going long or short.

With CFD share trading, traders can use leverage, which means they only need to put down a portion of the full trade value – known as margin. This allows for potentially greater exposure for a smaller outlay, though it also amplifies both gains and losses. Additionally, share CFDs provide the flexibility to go long (if expecting a stock to appreciate) or short (if anticipating a depreciation).

Traders can also benefit from features like extended trading hours on select stocks and the ability to react to market events without the restrictions of direct share ownership.

Which is better: CFDs or stocks?

Whether CFDs or stocks are better depends on your individual trading goals and market preferences. CFDs offer broad market access, covering various asset types like commodities, indices, and shares, allowing for diversification within a single account. If you're looking to speculate across multiple asset classes, this can be useful.

Stock trading, on the other hand, is focused solely on taking a position on company shares. Traditional share investing involves ownership, which comes with additional factors such as corporate actions (eg, dividends and voting rights).

In short, CFDs could be better if you value market variety and flexibility, and want to take a shorter-term view. Investing in shares outright may be better if you prefer to invest solely in companies, and take a longer-term approach. Each has unique advantages (and drawbacks), so the choice largely depends on your strategy and preferred assets.

Need more support? Try our step-by-step stocks course to guide you through the basics to the advanced concepts.

FAQs

Is stock trading CFD trading?

No. When you buy stocks outright, you’re purchasing a share of ownership in a company.

When you trade stock CFDs (contracts for difference), you don’t own the shares. Instead, you're speculating on their price movements – whether up or down. CFDs let you trade on margin and use leverage, which can amplify both profits and losses.

What is a CFD in stock trading?

A CFD (contract for difference) in stock trading allows you to trade without owning the underlying shares. It’s a contract between you and the broker to exchange the difference in the stock's price from when you open the trade to when you close it. This lets you go long or short on shares and trade with leverage. Remember, leverage amplifies both profits and losses relative to your initial outlay.

Can you trade shares without CFDs?

Yes, you can trade shares directly without using CFDs or derivatives, although it’s more commonly referred to as investing. This most often involves buying shares via a stockbroker or investing platform with the intention of profiting from price rises. Many brokers offer direct share dealing accounts specifically for this purpose, which may have different costs and features compared to CFD trading.

Find out more about share & CFD trading

What is CFD trading?