What is MicroStrategy, and how do you trade it?

What is MicroStrategy?

Founded in 1989 by Michael Saylor and Sanju Bansal, and headquartered in Tysons, Virginia in the US – MicroStrategy Incorporated develops enterprise software for data visualisation, analytics, mobile intelligence, hyperintelligence, and report generation.

Its core platform, MicroStrategy ONE, provides analytics and AI-driven insights for businesses, available both in the cloud and on-premises, in industries such as finance, healthcare, and retail.

Since 2020, MicroStrategy has gained significant attention for its strategic pivot towards bitcoin investment, having become one of the largest corporate holders of the cryptocurrency. Under Saylor’s leadership, the company adopted bitcoin as a treasury asset in 2020, financing large-scale purchases through debt offerings.

Strategy vs MicroStrategy: What’s changed?

MicroStrategy rebranded to Strategy on 5 February 2025, reflecting its shift from a business intelligence firm to a bitcoin-centric holding company.

Despite the new name, its legal entity remains MicroStrategy Incorporated, the company still trades under the MSTR ticker on the Nasdaq Stock Market, and continues to offer its enterprise analytics and business intelligence products – including MicroStrategy ONE.

Alongside the name change, MicroStrategy redesigned its logo, replacing its traditional corporate emblem with a bitcoin-inspired symbol, reinforcing its new focus.

Strategy now manages over 506,000 BTC, as of 24 March 2025. To fund future acquisitions, it introduced the ‘21/21 Plan’, aiming to raise $42 billion over three years.

Here’s how the company brands compare:

|

MicroStrategy |

Strategy |

|

|

Stock ticker |

MSFT |

MSFT |

|

Years active |

1989–2025 |

2025– |

|

Logo |

Red ‘MicroStrategy’ text |

bitcoin-stylised emblem with ‘Strategy’ name |

|

Primary focus |

Business intelligence & analytics software |

bitcoin investment & treasury management |

|

Enterprise software |

Core product offering |

Still active, but secondary to bitcoin strategy |

|

Capital strategy |

Conventional debt & equity financing |

‘21/21 Plan’ – aims for $42bn in equity and debt for BTC purchases |

|

Balance sheet role |

bitcoin as a reserve asset |

bitcoin as core treasury asset |

What is MicroStrategy’s (MSTR) share price history?

Past performance isn’t a reliable indicator of future results

MicroStrategy went public on 11 June 1998, listing on the Nasdaq under the ticker symbol ‘MSTR’ at an adjusted price of $8 per share. MSTR’s share price peaked at $333 (adjusted for splits) on 10 March 2000, during the dot-com boom. However, this price tumbled once the dot-com bubble burst, along with an accounting scandal – and MSFT closed at $9.50 on 29 December 2000 – and fell to its all-time low of $0.42 on 3 July 2002.

MSTR closed at $1.51 on 31 December 2002 – a 259% increase over all-time low – and grew steadily over the following years. The stock price climbed higher between 2003-2006, closing at $11.40 on 29 December 2006, before facing setbacks in 2007- 2008.

MSTR’s price volatility persisted during the late 2000s, trading in a $3-13 range.

The 2010s onward

Between 2010 and 2019, the share price traded between $7-23, reflecting moderate growth and industry competition. MSTR ended 2019 at $14.20 per share.

In August 2020, MicroStrategy announced its first bitcoin purchase, marking a significant shift in strategy. This pivot attracted widespread investor attention and aligned the company more closely with the performance of digital assets. As BTC’s price soared, so did MSTR – reaching $131.50 on 9 February 2021.

This bullish momentum faded as the crypto market declined, and MSTR fell below $54.55 to close 2021. Nonetheless, the company continued adding bitcoin to its balance sheet throughout the downturn, positioning itself as a de facto BTC holding vehicle.

Recent price action

In 2023 and 2024, MSTR rebounded amid renewed enthusiasm for digital assets and growing institutional adoption of bitcoin – reaching its $545 all-time high on 20 November 2024. MSTR’s stock closed at $289.62 on 31 December 2024 – MicroStrategy’s highest closing price to date – as BTC’s price approached new all-time highs.

On 5 February 2025, MicroStrategy rebranded to ‘Strategy’, reflecting its transition into a bitcoin-centric holding company. The rebrand was accompanied by heightened trading activity. While MSTR’s price initially rallied, it later retreated amid investor concerns over dilution linked to its capital-raising efforts. The stock closed at $304 on 21 March 2025.

All prices are adjusted for stock splits.

MicroStrategy stock splits

MicroStrategy Incorporated (MSTR) has undertaken several stock splits since its initial public offering (IPO) in 1998.

|

Date |

Split |

Type |

Effect on share count |

|

27 January 2000 |

2-for-1 |

Forward stock split |

Doubled |

|

31 July 2002 |

1-for-10 |

Reverse stock split |

Reduced to one-tenth |

|

8 August 2024 |

10-for-1 |

Forward stock split |

Increased tenfold |

Which factors might affect the MSTR live stock price?

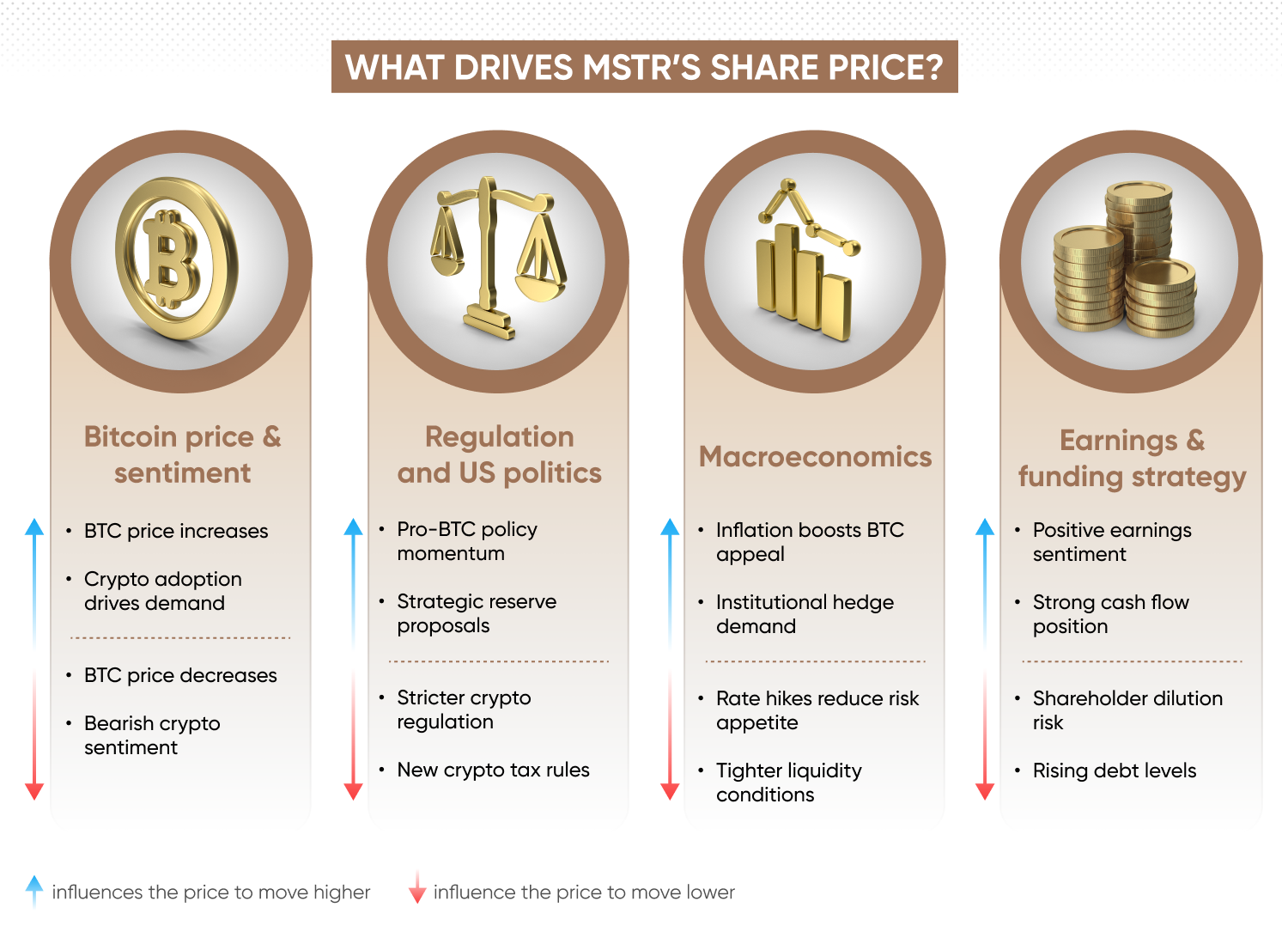

The live stock price of MicroStrategy, also known as Strategy, could be influenced by various potential events and factors, such as bitcoin’s price movements, regulatory developments, macroeconomic conditions, and earnings performance.

BTC’s price & crypto sentiment

MicroStrategy's stock price closely tracks bitcoin’s movements due to its significant holdings. As of 24 March 2025, the company owns approximately 506,000 BTC. A rise in BTC’s price increases the value of these holdings, often driving MSTR higher.

Conversely, a bitcoin downturn can erode the company’s asset value, pushing the stock lower. On 19 November 2024, BTC’s price surpassed $90,000 for the first time, lifting MSTR. However, in early January, BTC fell below $90,000, leading to a drop in MSTR’s price.

US politics & regulation

Regulatory changes and political decisions can impact both bitcoin and MicroStrategy. The US Securities and Exchange Commission (SEC) has taken an active stance on cryptocurrency regulation, with bitcoin ETF approvals and broader crypto-related regulatory discussions shaping sentiment.

On 6 February 2025, lawmakers in Washington reportedly discussed a potential US ‘strategic bitcoin reserve’ – a proposal that could encourage corporate bitcoin adoption. However, new capital gains tax policies on digital assets, announced on 15 January 2025, could make bitcoin investment less attractive and weigh on MSTR’s valuation.

Macroeconomic conditions & interest rates

Broader economic trends shape demand for bitcoin and, in turn, MSTR. Rising inflation often strengthens bitcoin’s appeal as a store of value, attracting institutional investment. However, higher interest rates, such as the US Federal Reserve’s 0.50% rate hike on 29 February 2025, can reduce liquidity in financial markets, making riskier assets like bitcoin and MSTR less attractive.

For instance, MSTR’s stock price decreased following the Fed’s announcement on 1 March 2025, reflecting the market’s reaction to tighter monetary policy.

Earnings performance

While MSTR's stock price moves with bitcoin, investors also assess its financial health. MicroStrategy funds BTC purchases through stock sales and debt issuance, which can impact shareholder value.

On 28 February 2025, MicroStrategy completed a $2 billion private offering of 0% convertible senior notes due 2030 to finance additional bitcoin acquisitions, raising concerns about potential shareholder dilution. Earnings reports can provide additional insights into cash flow, debt levels, and bitcoin holdings.

Is MicroStrategy classified as a technology or crypto stock?

MicroStrategy is listed as an enterprise software company, but its strategic pivot towards bitcoin has blurred the distinction between a technology stock and a crypto stock.

Historically, MicroStrategy operated within the technology sector, providing business intelligence and analytics software. However, since 2020, its primary focus has shifted towards bitcoin accumulation, with the company now holding over 506,000 BTC as of 24 March 2025.

Traders looking for exposure to crypto-related stocks might also consider – Coinbase (COIN), Hive Blockchain (HIVE), Hut 8 Mining (HUT), CleanSpark (CLSK), and Bitfarms (BITF) – companies involved in cryptocurrency exchanges, mining operations, blockchain infrastructure, or digital asset holdings.

What are MicroStrategy’s stock trading hours?

MicroStrategy’s stock market trading hours are the same as the NASDAQ Stock Market – which is open Monday to Friday – where it's listed under the symbol, ‘MSTR’:

NASDAQ Stock Market

-

In standard time (winter), from 2:30pm to 9:00pm UTC.

-

In daylight saving time (summer), from 1:30pm to 8:00pm UTC.

You can follow MicroStrategy’s stock performance with our MicroStrategy stock chart.

Monitoring MicroStrategy’s activity can help you to keep an eye out for the effects of any fundamental or technical events that may affect short-term movements in the MicroStrategy share price.

How to trade MicroStrategy shares with CFDs

There are two ways to take a position on MicroStrategy shares: buying physical shares or trading contracts for difference (CFDs). Buying physical shares is considered a long-term investment as you’re hoping for the price to rise over time. CFD trading allows you to speculate on MicroStrategy's stock market price movements without actually owning the asset.

Unlike traditional investing, CFD traders can either hold a long position (speculating that the price will rise) or a short position (speculating that the price will fall). CFDs are traded on margin, which means that a trader can get exposure to larger positions with a relatively small outlay. This amplifies both potential profits and losses, making such trading risky. Consider using a trading strategy for a more structured experience.

You can learn how to trade shares in our comprehensive shares trading guide.

To trade MicroStrategy stock CFDs with us, just sign up for a Capital.com account, and once you’re verified, you can use our advanced web platform or download our intuitive yet easy-to-use app. It’ll take just a few minutes to get started and access the world’s most-traded markets.

Create an account Open a demo account

FAQ

Why did MicroStrategy change its name to Strategy?

MicroStrategy rebranded as Strategy in February 2025 to reflect its shift from a business intelligence firm to a bitcoin-focused holding company. Despite the new name, it remains legally registered as MicroStrategy Incorporated and continues to trade under the ticker MSTR on the Nasdaq. The rebrand also introduced a bitcoin-themed logo, underscoring its long-term commitment to BTC.

What is MSTR stock?

MSTR is the stock ticker for Strategy (formerly MicroStrategy) on the Nasdaq. Originally a software stock, it is now closely tied to bitcoin (BTC) due to the company’s large crypto holdings. Its price movements are influenced by BTC’s price, regulatory changes, and capital-raising activities. As of 14 March 2025, Strategy owns approximately 205,000 BTC, making MSTR a high-volatility stock with exposure to the cryptocurrency market.

What’s the fair value of MSTR?

MSTR’s fair value depends on BTC’s price, MicroStrategy’s debt levels, and investor sentiment. Analysts often use net asset value (NAV) by calculating the market value of its bitcoin holdings minus liabilities. As of 24 March 2025, the company holds over 506,000 BTC, but its debt and stock dilution risks impact valuation. Other methods include price-to-book (P/B) ratio and technical analysis.

How could I buy MicroStrategy (MSTR) stock?

You can buy MSTR shares directly through a brokerage with Nasdaq access. This requires opening an account, funding it, and placing a buy order.

Alternatively, you can trade MSTR via contracts for difference (CFDs), which allow speculation on price movements without owning the shares. CFDs offer leverage and the ability to go long or short but carry higher risks due to market volatility.