What is trading and how does it work?

Trading is the act of buying and selling assets like shares or commodities in an attempt to profit from price changes. In this piece, we’ll explore how to trade online, covering concepts from leverage trading to how forex trading works.

What is trading?

Trading involves speculating on the price movements of financial instruments like shares, commodities, or forex, without owning the underlying asset. This is known as derivatives trading, which is typically done through online brokers using leverage (margin trading). Leverage allows you to control a larger position with a smaller initial outlay, increasing both potential gains and risks.

Trades are executed using instruments like contracts for difference (CFDs), where you’ll attempt to profit from short-term price fluctuations by speculating on assets either rising or falling in value. Popular strategies include day trading, where trades are opened and closed within the same day, and swing trading, where positions are held for days or weeks to capture larger price movements.

Find out the key differentiators of trading vs investing.

What markets can you trade?

There are many financial markets that you can trade, categorised into asset classes like commodities such as gold and oil, indices, such as the US Tech 100 and France 40, and more. You can trade individual assets using derivatives such as CFDs, but instruments like ETFs can give exposure to a broader range of markets in one position.

Shares

Shares trading involves the buying and selling of stock derivatives representing publicly traded companies like Apple or Tesla. Profits are made by capitalising on price movements of individual stocks.

Learn more about share trading.

Forex

Forex is the world’s largest financial market by volume, where you can exchange currencies like the US dollar (USD) against the euro (EUR) (EUR/USD). Forex trading is popular for its liquidity and operates 24 hours a day, except weekends.

Learn more about forex trading.

Commodities

This asset class includes trading physical goods like gold, oil, or agricultural products like corn. Traders can speculate on commodity prices through futures contracts or other derivatives.

Learn more about commodities trading.

Indices

Indices like the US 500 or Germany 40 represent a group of stocks and offer a way to trade the overall performance of a market segment rather than through individual shares.

Learn more about indices trading.

Cryptocurrencies

Cryptocurrencies are digital assets like Bitcoin and Ethereum, often based on blockchain technology. This asset class is known for high volatility and rapid price movements, meaning that leveraged trading on such markets may amplify profits and losses more than usual.

Learn more about cryptocurrency trading.

How does trading work?

When trading, you’ll profit if the price of the asset moves in your favour, and make a loss if it moves against you. Prices fluctuate based on supply and demand; when more people are buying an asset (higher demand), its price rises. Conversely, when more people are selling (higher supply), the price falls. Your aim is to predict these movements by going long (buying) if you expect prices to rise, or going short (selling) if you anticipate a price drop.

Skilled trading requires strategic timing, risk management, and the use of tools like leverage and stop-losses. Below is a simple breakdown of the basic steps involved in the trading process, although everyone’s process will be slightly different.

Make hypothetical profit and loss calculations with our CFD trading calculator.

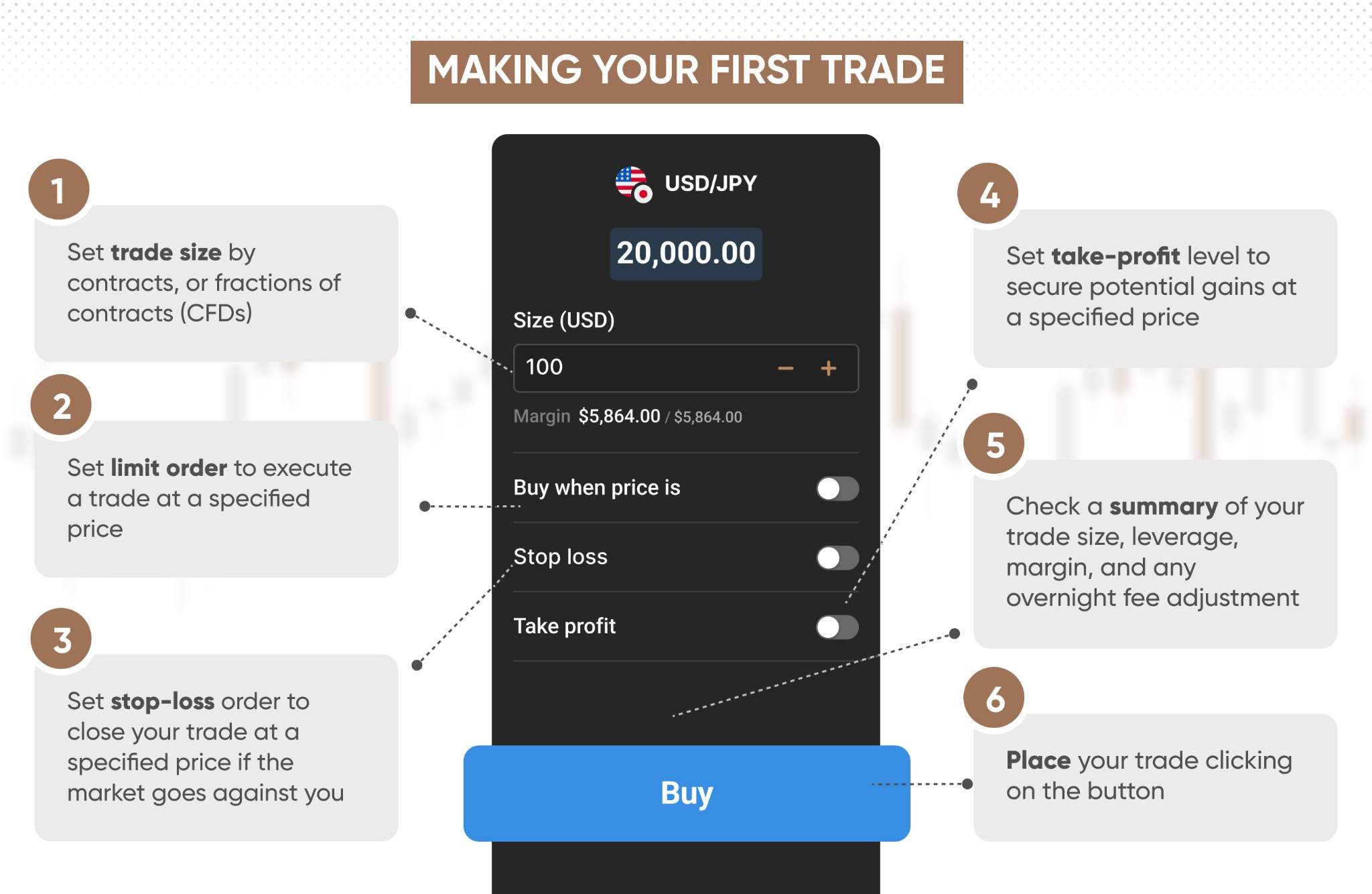

How to make your first trade

1. Choose a broker

Start by selecting a broker that supports the instruments and markets you want to trade, such as CFDs, stocks, or forex, and offers essential tools like leverage, stop-loss orders, and technical analysis features. Once you’ve chosen one and your account is improved, it’s time to deposit funds.

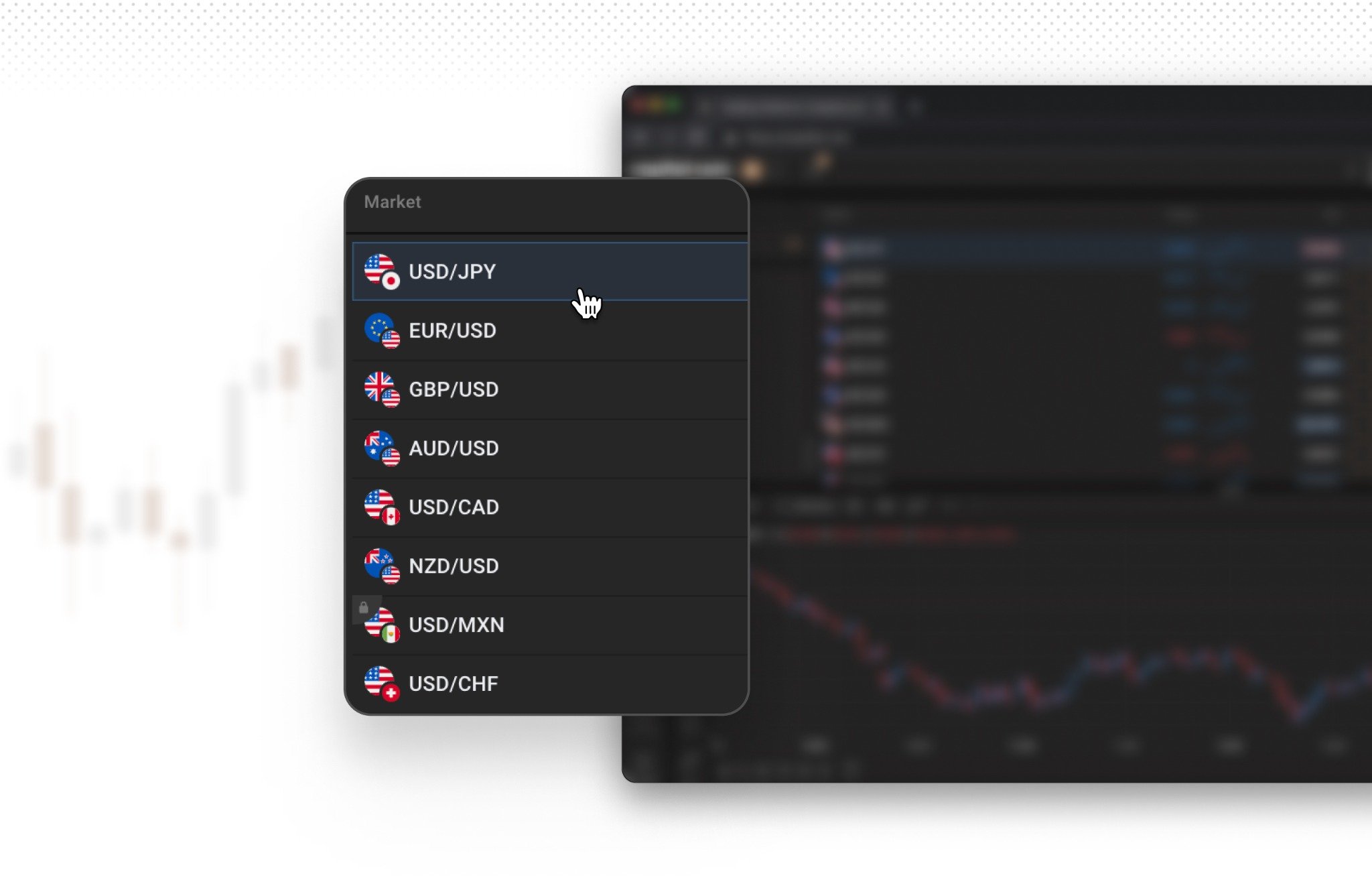

2. Choose an asset to trade

Next, select the financial instrument you want to trade, such as a specific share, forex pair, or commodity, based on your trading goals, using the search bar.

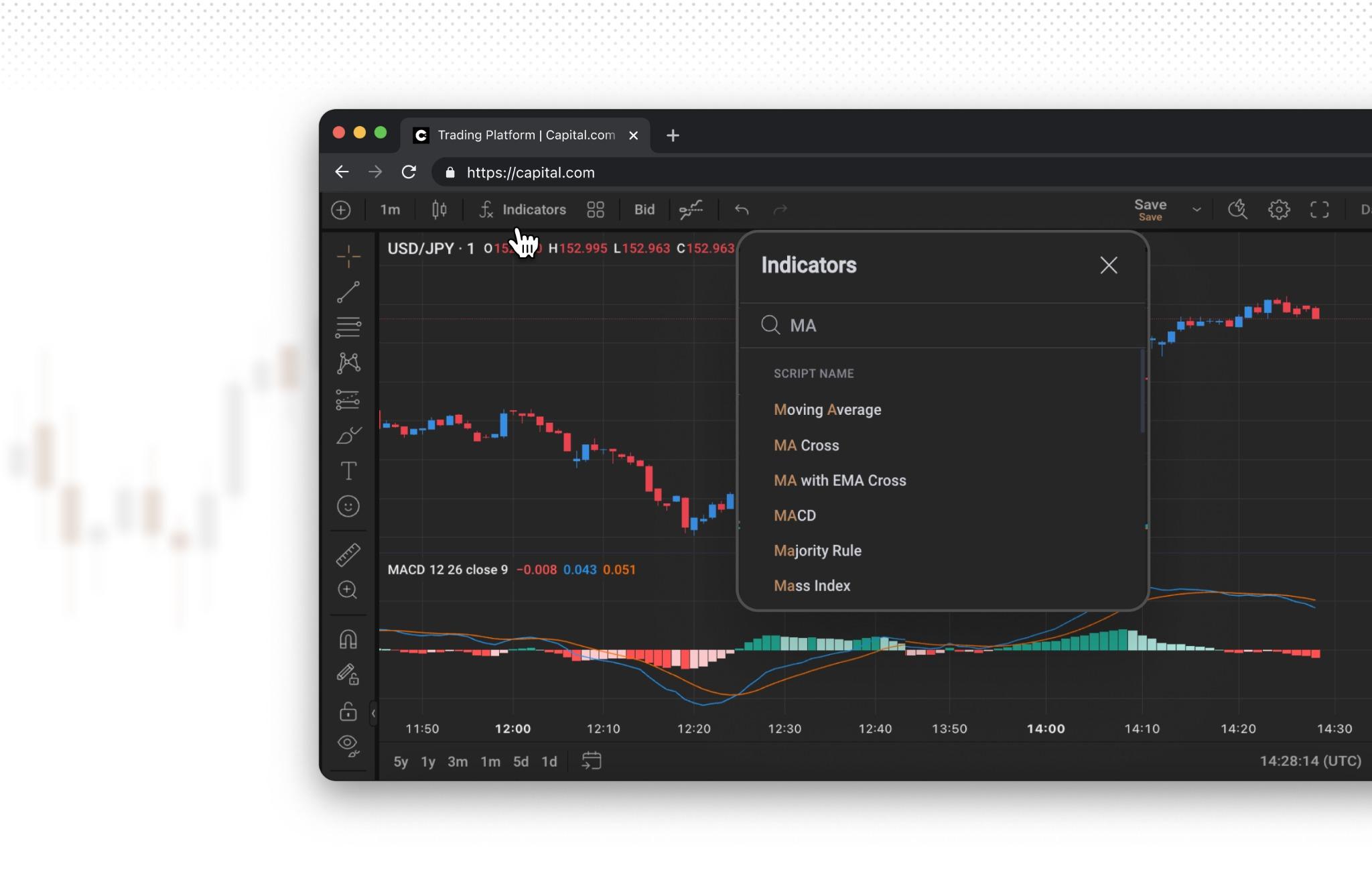

3. Analyse the market and price movements

Conduct a thorough market analysis, using tools like price charts and technical indicators such as MACD (shown below) to evaluate market trends and price fluctuations. For shares in particular, you may want to conduct fundamental analysis, which explores the macroeconomic drivers of markets, such as interest rates, company earnings, and inflation. These techniques can help you decide whether to go long (buy) or short (sell).

Past performance is not a reliable indicator of future results.

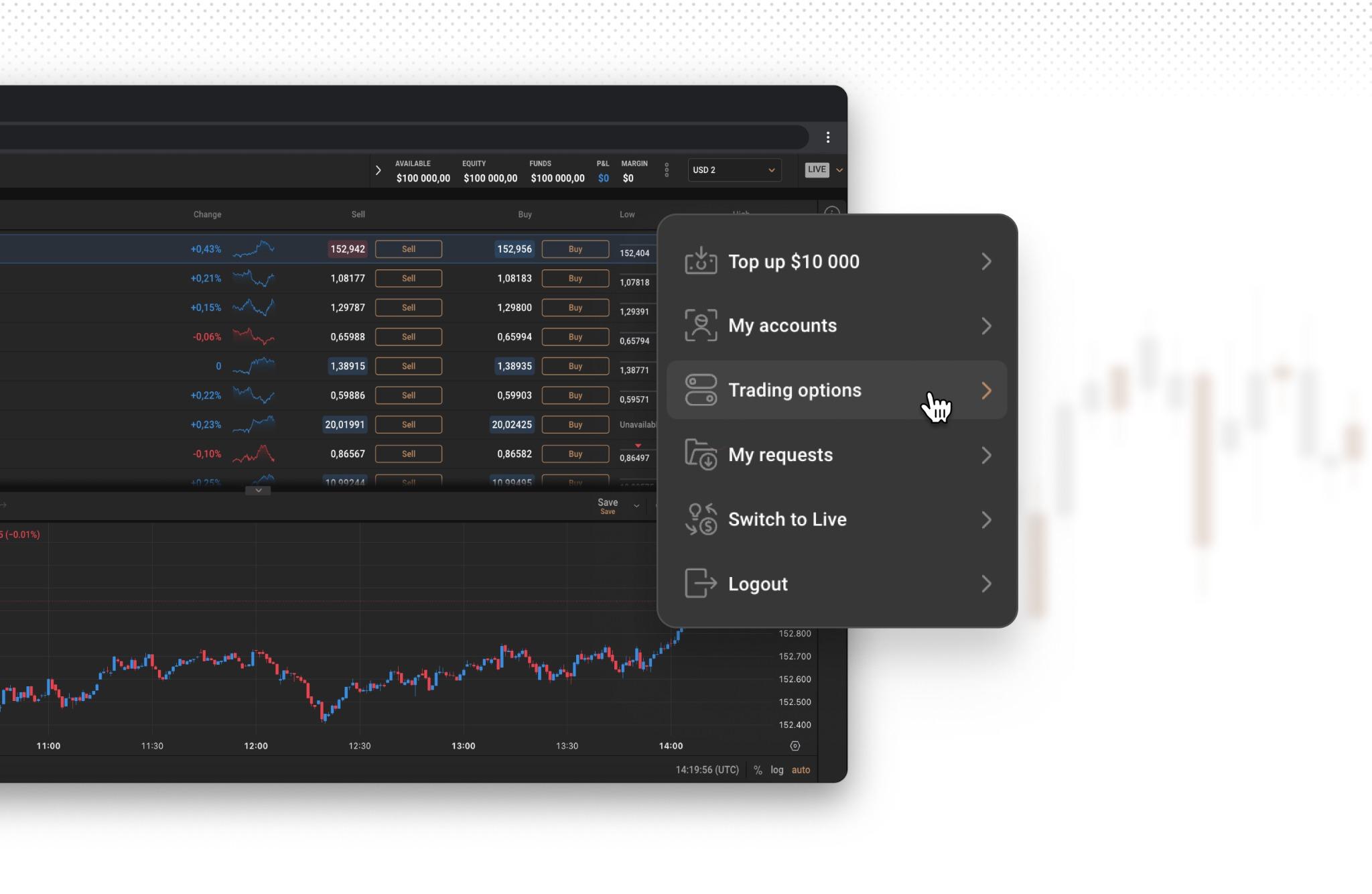

4. Decide on leverage

Before placing the trade, decide whether the default leverage for the market you’re trading is right for you. Leverage allows you to control a larger position with a smaller amount of capital, but it increases both potential gains and risk of loss.

Choose an appropriate level based on your risk tolerance. This can be done in the ‘Trading options’ section after clicking on the LIVE button in the top right of the desktop platform. On the app, this feature is in the ‘My accounts’ section.

Find out more about leverage (margin trading).

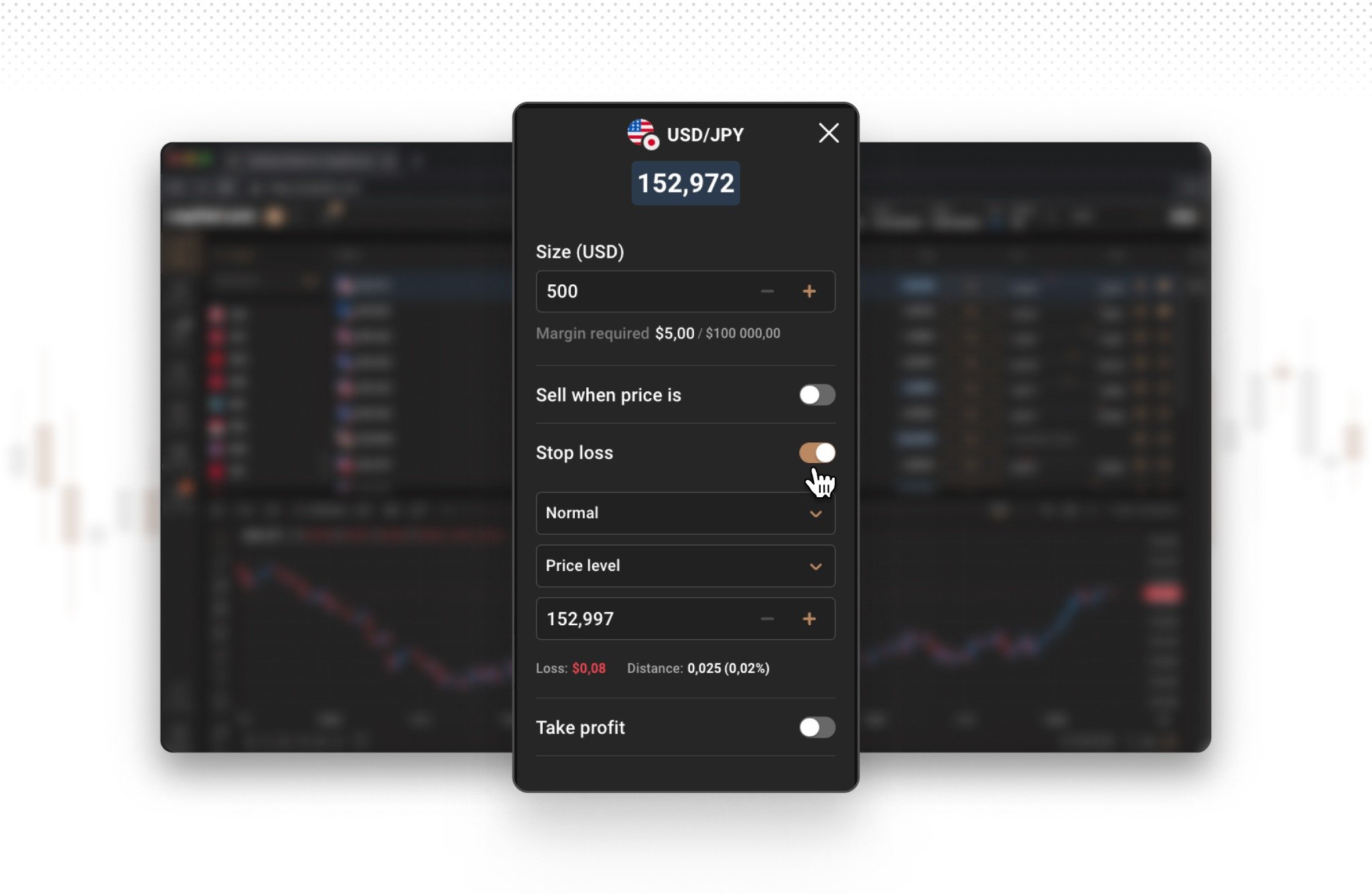

5. Set a stop-loss* for risk management

As part of your order setup, determine your stop-loss level to manage risk. A stop-loss will automatically close your trade if the market moves against you by a certain amount, helping to limit losses.

*Stop-losses are not guaranteed.

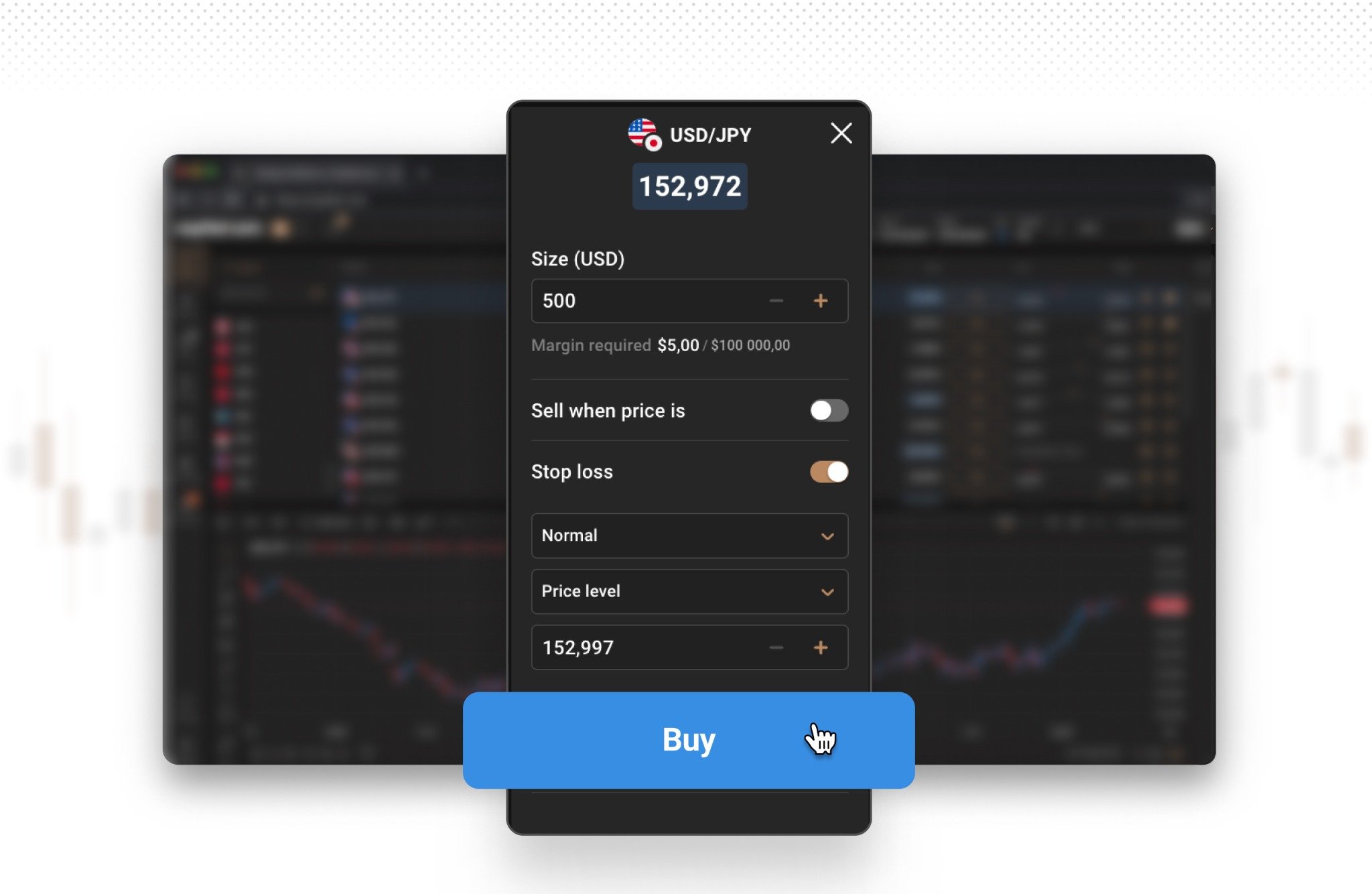

6. Place the market order

After setting your leverage and stop-loss, place the market order on your trading platform. Enter a buy order if you expect the price to rise (shown below), or a sell order if you expect the price to fall.

7. Monitor the trade

After placing the trade, monitor market conditions and price movements to assess how your position is performing. Be ready to adjust your strategy if the market signals a change.

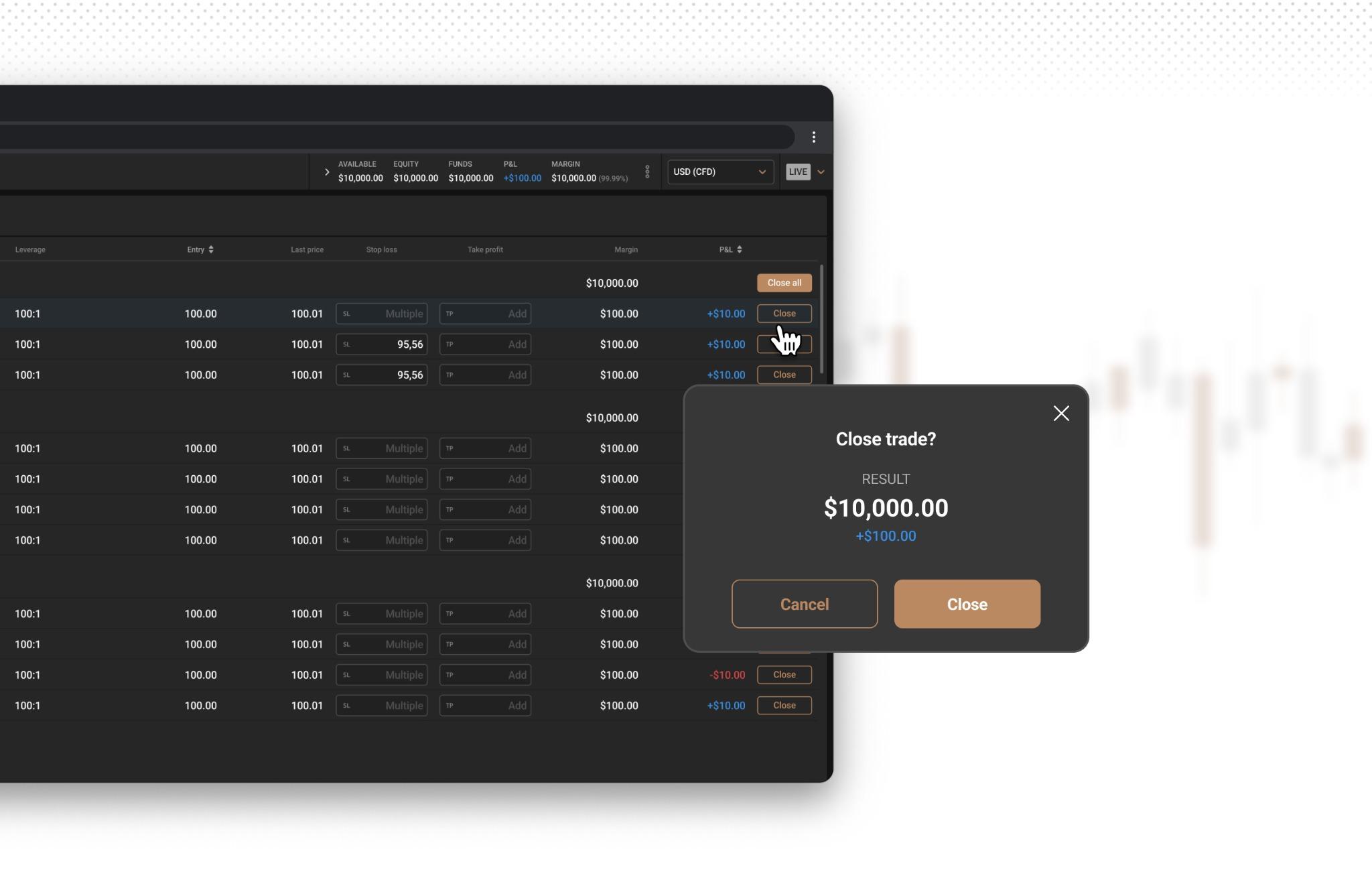

8. Exit the trade

When your profit target is reached, or if market conditions change, close your position. This could involve placing a sell order if you initially bought (shown below) or a buy order (if you initially sold short).

Ways to trade

There are various ways to trade the financial markets, with CFD trading the main instrument. You can also trade our 1X unleveraged CFD, which offers only long positions. Learn more of each method and the differences between them on our ways to trade page.

Whether you're looking for short-term opportunities or long-term positions, understanding the diverse strategies available can help you tailor your approach to your goals. Below, we explore some of the most common methods traders use to buy and sell assets across different markets.

Day trading

Day traders open and close positions within the same trading day. They aim to profit from short-term price movements and typically focus on highly liquid markets like stocks, forex, or indices. Day trading requires real-time market analysis and quick decision-making.

Learn more about day trading.

Swing trading

Swing traders hold positions for several days to weeks, aiming to capture short- to medium-term market swings. They typically use technical analysis to identify potential entry and exit points, allowing them to profit from broader price trends.

Learn more about swing trading.

Scalping

Scalping is an ultra-short-term strategy where traders aim to profit from small price movements, often within minutes or seconds. Scalpers make many trades throughout the day and rely on high liquidity and minimal price fluctuations to accumulate small, quick gains.

Position trading

Position traders take a long-term view, holding positions for months or even years. They rely on fundamental analysis and macroeconomic factors to predict future price movements, often disregarding short-term fluctuations.

Learn more about position trading.

Algorithmic trading

Algorithmic traders use automated programs, or ‘algos’, to execute trades based on predefined criteria. These systems can analyse markets and execute trades much faster than humans, making this method popular for high-frequency trading and institutional investors.

Learn more about algorithmic trading.

Trading examples

Trading examples come in many forms, each tailored to different strategies, timeframes, and risk levels. Whether you’re a short-term trader looking to capitalise on rapid market movements or a long-term investor seeking steady growth, there’s a trading style suited for your goals. Below are some examples of different types of trading, illustrating how each approach works across various markets.

Day trading example

You monitor the stock of Company X, which opens at $50. Based on technical analysis, you notice a potential breakout. You buy 100 shares at $50 and sell them later in the day when the price reaches $55, locking in a $500 profit (minus applicable fees) before the market closes. However, if the market falls $5, you would lose $500, in addition to fee costs.

Swing trading example

You identify a bullish reversal chart pattern in the EUR/USD forex pair. You buy the pair at 1.1000, aiming to hold it for a few days or weeks as the price rises. After two weeks, the price reaches 1.1200, and you sell, making a 200-pip profit, minus fees. However, if the price falls the equivalent amount, you would lose 200 pips of profit, in addition to fee costs.

Scalping example

You monitor the GBP/USD pair and notice very small price movements within a tight range over a few to tens of seconds. You enter a long position at 1.3750 and quickly exit at 1.3751, making a 1-pip profit. Over the next few minutes, you repeat this process multiple times. After executing 100 trades during the day, each yielding 1-2 pips, you accumulate a total of 100-200 pips. However, it’s important to note scalping can also result in daily losses, particularly in volatile markets.

Position trading example

You’re bullish on Company Y’s long-term prospects and buy 500 shares at $600. You hold the shares for four months, ignoring short-term fluctuations, and eventually sell them at $700, making a profit of $50,000 (minus fees). However, even over a longer-term period, price could see a downturn, resulting in losses instead of profits.