Woodside Energy stock forecast: WDS stock on pace to outperform ASX as oil price powers Oz energy giant

We look at the performance of Australian oil and gas stock WDS and the latest Woodside Energy stock forecast from analysts.

Australia oil and gas producer Woodside Energy (WDS) has seen its share price soar by 73% year to date as high energy prices have lifted its revenue and production after it merged with BHP’s petroleum business earlier this year.

Woodside is the largest independent oil and gas company listed on the Australian Stock Exchange (ASX) and has outperformed the ASX 200 Index (AU200), which has fallen 8.6% since the start of the year.

What is the outlook for the WDS stock price? Will it continue to rack up gains?

In this article, we look at the stock’s recent performance and some of the latest Woodside Energy stock predictions.

What is Woodside Energy?

Founded in 1954, Woodside Energy Group (previously known as Woodside Petroleum) is a petroleum exploration and production company headquartered in Perth, Australia. The company is named after the town of Woodside, Victoria, where it initially focused on the Gippsland Basin.

During the 1960s, the company shifted to northern Western Australia and formed the North West Shelf consortium with Shell and Burmah Oil. Burmah was later replaced with BHP, becoming a shareholder in Woodside along with Shell (RDS) in 1985. BHP sold its stake in 1994 and Shell sold a part of its stake. After Shell failed to take over the company in 2001 after the Treasurer of Australia blocked the buyout on national interest grounds, it reduced its stake in 2010 and sold off its remaining shares in 2017.

In August 2021, Woodside agreed to merge with BHP’s oil and gas assets. The merger was completed on 1 June 2022 and the combined company launched secondary listings on the New York Stock Exchange and the London Stock Exchange.

“Merging Woodside with BHP’s oil and gas business delivers a stronger balance sheet, increased cash flow and enduring financial strength to fund planned developments in the near term and new energy sources into the future,” the company stated.

WDS benefits from oil price boom

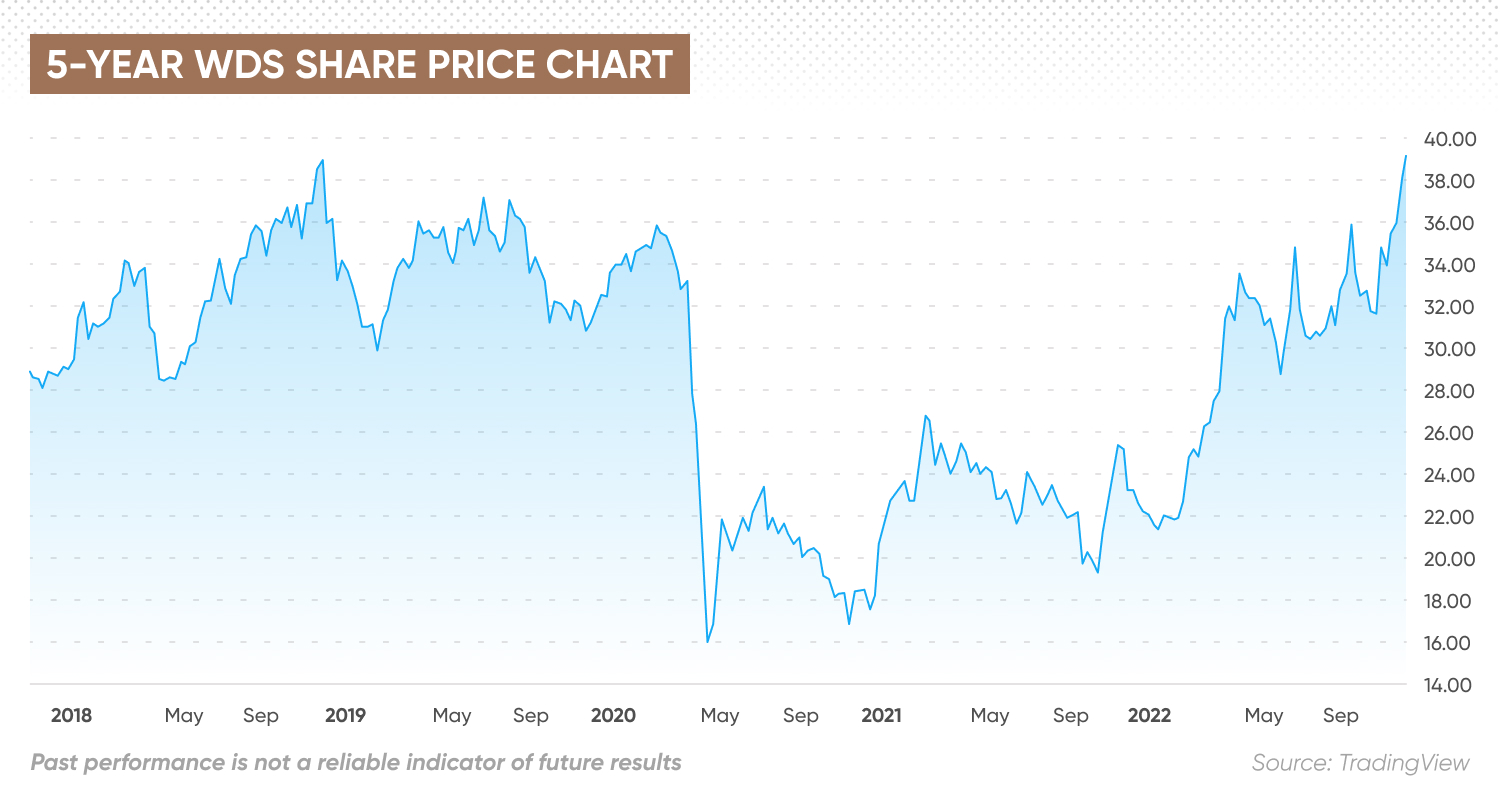

The WDS stock price returned to pre-pandemic levels in October, driven higher this year by rising oil and gas prices. The share price fell from A$35.86 in January 2020 to A$16 in March 2020 at the start of the Covid-19 pandemic on concerns about the demand impact, but then began to rebound as the crude oil market tightened.

The stock started 2022 at A$22.67, and spiked to A$34.41 on 7 March as the oil market rallied in response to the Russian invasion of Ukraine and concerns about sanctions on Russian oil exports. The stock pulled back to A$28.77 in late May but rebounded to $35.39 in June and has since remained above the $30 mark.

The WDS stock price has climbed from A$30.20 on 26 September to close at A$39.16 on 7 November, driven by a renewed oil price rise and the company’s strong third-quarter earnings report.

Woodside outperformed a 6% gain in the AU200 Index in October by climbing 13.6%. The quarter ended 30 September was the first full quarter that included BHP’s petroleum assets. The combined company reported a 70% increase in revenue from the second quarter, reaching a record US$5.86bn on a 59% increase in sales volume to 57.1 million barrels of oil equivalent (MMboe). The company’s average portfolio realised price increased by 7% to $102 per barrel of oil equivalent.

Woodside produced 51.2 MMboe, up 52% from the second quarter and more than twice the level in the third quarter of 2021. The company raised its full-year 2022 production guidance to 153-157 MMboe, up from its previous guidance of 145-153 MMboe. Woodside also said it would reduce its 2022 capital expenditure to a range of US$4bn to US$4.3bn from its previously forecast range of US$4.3bn to US$4.8bn.

Increasing its production at a time when energy prices are on the rise again will lift Woodside’s revenue and could provide support to the share price.

Crude oil prices climbed by 5% on 4 November to their highest level since late August on rumours that China could ease its zero-Covid policy, boosting commodity demand, and as a European Union ban on Russian seaborne crude oil exports approaches on 5 December, restricting supply. But prices retreated on 7 November after Chinese officials maintained that the country is committed to its strict virus containment policy.

Analysts at Australian financial services firm ANZ noted last week:

“Signs of weakness in oil demand continue amid high prices and the weak economic backdrop.

What does that mean for the WDS stock price in the future? What is a realistic Woodside Energy stock forecast?

Woodside Energy stock forecast: Can WDS continue to outperform?

At the time of writing 97 October), the analysts’ consensus Woodside Energy stock forecast was AU$38.09, suggesting the potential for downside from its closing price of AU$39.16 on 7 November, according to Stockopedia.

Data provider Trading Economics had a Woodside Energy stock forecast for 2023 of AU$34.32, down from AU$37.17 at the end of 2022.

But research firm Morningstar predicted that the share price could rise. “We make no change to our AUD 43 fair value estimate for no-moat Woodside,” wrote senior equity analyst Mark Taylor on 20 October, noting that shares jumped more than 5% intraday on the company’s quarterly earnings results, “but remain materially undervalued”.

For the longer term, the Woodside Energy stock forecast for 2025 from algorithm-based forecasting service Wallet Investor at the time of writing projected that the WDS price could climb to AU$53.952, up from AU$37.513 at the end of 2022 and $42.855 at the end of 2023.

Are you looking for a Woodside Energy share price forecast to decide how to trade the stock? It’s important to remember that stock markets are highly volatile, making it difficult for analysts and algorithm-based forecasters to come up with accurate long-term predictions.

We recommend that you always do your own research. Look at the latest market trends, news, technical and fundamental analysis, and expert opinion before making any investment decision. Keep in mind that past performance is no guarantee of future returns. And never invest money you cannot afford to lose.

FAQs

Is Woodside Energy a good stock to buy?

It is important to do your own research on WDS to determine if it is a good fit for your investment portfolio. Whether the stock is a suitable investment for you will depend on your risk tolerance and how much you intend to invest. Keep in mind that past performance is no guarantee of future returns.

Will Woodside Energy stock go up or down?

The direction of the WDS share price will likely depend on the company’s financial performance and crude oil prices, among other factors.

Should I invest in Woodside Energy stock?

Whether you should invest in WDS is a personal decision only you can make depending on your risk tolerance and investing strategy. You should do your own research to develop an informed view of the stock. Keep in mind that past performance is no guarantee of future returns.