UK CPI jumps back above 2%, coming in hotter than expected

UK inflation jumps to 2.3% in October, surpassing the Bank of England's target and market expectations. Core CPI rises to 3.3% year-on-year, driven by higher energy costs and services sector pressures. Markets adjust rate cut odds as bond yields climb and GBP shows mixed performance.

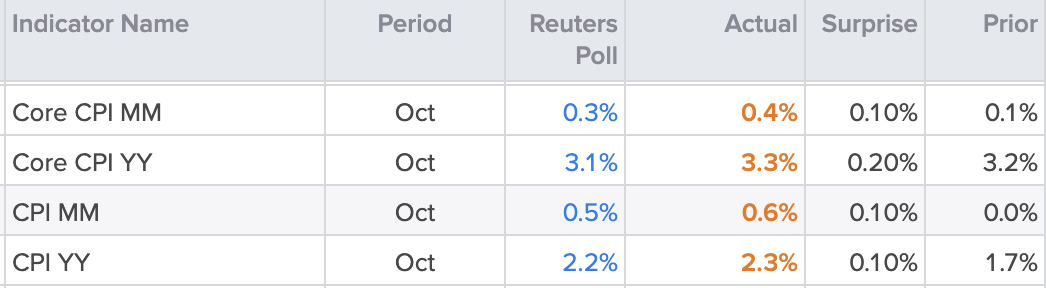

UK inflation came in higher than anticipate din October, confirming it is back above the Bank of England’s (BOE) target. Headline CPI rose 2.3% from the same time last year, from 1.7% in September and above expectations of 2.2%. On a monthly basis, prices rose 0.6% in October. Core CPI, which excludes more volatile prices like food and energy, rose 0.4% on the month, rising to 3.3% on a yearly basis, a rise from the previous month and above expectations.

Source: refinitiv

Higher energy bills have caused headline inflation to rise after a price cap hike from the regulator Ofgem last month, but the rise in core inflation highlights the continued price pressures in the services sector, which has been a key focus of the Bank of England Markets are showing a 15% chance that the Bank of England will cut rates again in December. The odds have decreased slightly after the stronger CPI reading but they have been negatively stacked against a cut for a while now. Since the autumn budget was released, there is an expectancy that the central bank will have to take rate cuts gradually as labour’s tax plans are expected to put upward pressure on prices in the coming year. Governor Bailey confirmed such expectations on Tuesday when he pointed out a gradual approach to removing monetary policy restraint in order to observe the risks to the inflation outlook. As a result of the higher CPI data adding further pressure on diminished rate cut hopes, UK bonds have been sold off at the open, with the 10-year yield rising 0.9%, followed closely by the 2-year yield at 0.8%.

Meanwhile, the pound has recovered some bullish appetite, especially against the yen and the euro. There has also been some bullish push in GBP/USD but the continued appreciation in the dollar has limited the upside potential. With tensions rising once again between Russia and Ukraine and the threat of nuclear involvement we have seen safe haven demand increase this week, which has pushed higher an already strengthened US dollar. If this dynamic continues, then GBP/USD will likely find it hard to find the support to move higher, which has already faltered around 1.27.

GBP/USD daily chart

Past performance is not a reliable indicator of future results.

Because of the dollar dominance, traders may wish to focus on other GBP pairs when trading UK events and data. GBP/JPY and EUR/GBP both have greater follow-through potential.