Is Big Tech behind the apparent bull market rally?

While the Magnificent Seven have dominated market momentum in recent months, it’s not true that they are the sole drivers of the recent rally in equity markets.

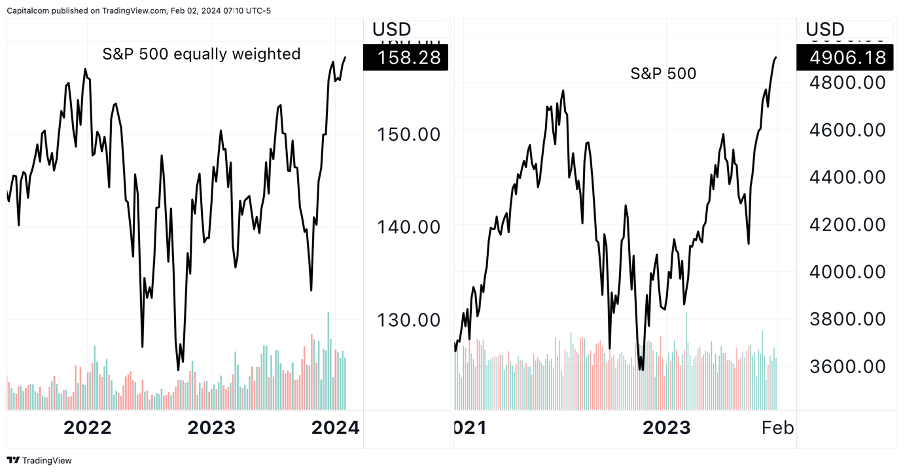

While the Magnificent Seven have dominated market momentum in recent months, it’s not true that they are the sole drivers of the recent rally in equity markets. Whilst the big tech stocks have indeed driven the S&P 500 and US Tech 100 to new all-time highs, the equally weighted S&P 500 proves that the bullish momentum is still carried throughout the broader market. In fact, despite taking a little longer, the equally weighted index has also reached new highs in the past few days.

(Past performance is not a reliable indicator of future results)

The question is, is this a bull market? The current situation resembles the pre-financial crisis of 2007 when valuations were excessive. According to recent forecasts from major banks, economists are still concerned about future growth with recession not being completely out of the picture for 2024 despite having achieved what seems like a soft landing.

Stocks had a hard time at the start of the new year as markets proceeded to price out some of the rate cut probabilities that formed after the December FOMC meeting. The less dovish FOMC meeting this week has also weighed on sentiment in equity markets, but stocks seem adamant to capitalise on risk appetite as they easily reverse the bearish momentum.

But the reality is that stocks and bonds have been showing a closer correlation than normal, and at some point, it is expected to revert. If we expect to see bond yields consolidating at around current levels it is hard to justify the valuations in the stock market. Elevated bond yields remain more attractive than current earnings yields, making stocks look expensive.

Unless there is a significant drop in bond yields, stock prices should come down to justify the added risk that comes with holding equities over bonds.

Right now, it’s hard to anticipate how data can impact markets. Stronger data is good for stocks as it shows resilience in the economy, but it also enables the Federal Reserve to keep monetary policy tight. Back in January 2022, when we saw the last all-time high, the situation was very different. Rates are much higher now and inflation and growth have slowed significantly. But right now, it seems like traders are still interested in piling into stocks, both tech and non-tech, even as the Federal Reserve pushes back on immediate rate cuts.

The situation is slightly different in Europe – inflation also remains stubborn, but growth is practically non-existent. Regardless, central banks are refusing to even start considering cutting rates as the risk of runaway inflation seems to weigh more than economic recession at this point. Generally, European stocks have been slightly underperforming Us stocks in recent weeks, but not falling too far behind. It seems like bullish sentiment is spilling across the Atlantic allowing valuations to remain high, but when the tide turns it feels like Europe has more to lose right now.