Europe embraces lower CPI as ECB poised for another rate cut

European assets trade higher on Monday as softer CPI reinforces expectations of ECB rate cuts.

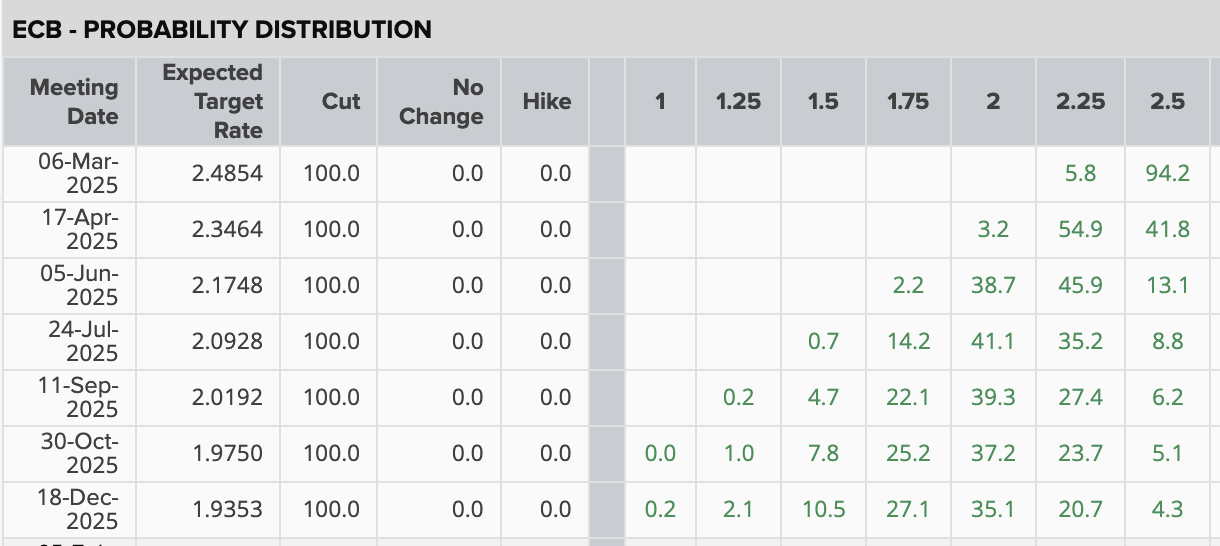

The European Central Bank (ECB) is widely expected to cut rates again when they meet on Thursday. Current market pricing indicates a 95% probability of a 25-basis point cut, which would bring the base rate down to 2.5%—the sixth reduction since the easing cycle began in June.

Inflation Data and Economic Outlook

Recent economic figures suggest that inflation is softening, albeit modestly. The Consumer Price Index (CPI), which measures the price changes of a basket of goods and services, dropped from 2.5% to 2.4% in February. Although economists had forecast a decline to 2.3%, this slight easing still reinforces a positive outlook. Similarly, core CPI—excluding volatile energy and food prices—fell from 2.7% to 2.6%, just shy of expectations.

While some analysts contend that the pace of disinflation may not justify further cuts, market sentiment remains bullish. Pricing implies an additional 80 basis points of cuts by the end of 2025, suggesting at least three more 25bps reductions, including the one expected this Thursday.

Source: refinitiv

Positive Market Reaction in Europe

Market pricing following the CPI release has been favourable for European assets. Equities continue to move higher with the STOXX 600 posting another high and the DAX 40 regaining the 22,800 level after the pullback earlier this month. German stocks remain bullish on the back of expectations of increase spending from the new government after years of fiscal constraint. Meanwhile, lower valuations and expected favourable conditions from lower ECB rates continue to act as tailwinds. The expected increased in defence and military spending in Europe has also been driving indices higher as the European Union braces itself for increased tensions with the US over the handling of the Ukraine-Russia peace talks.

STOXX 600 daily chart

Past performance is not a reliable indicator of future results.

On the currency front, EUR/USD is back above 1.04 on Monday as bulls recover some ground following last week’s dip. The re-emergence of tariff talks caused a small rebound in the dollar last week, but the bias has turned lower once again as there still seems to be a lack of clarity on how exactly these tariffs will be implemented even if the deadline was originally set for this week.

However, EUR/USD faces continued resistance past 1.05 making it hard for buyers to regain the upper hand. 1.0530 remains as the short-term resistance to beat before attempting to challenge the 1.06 level. The bias seems favourable in the longer-term with the RSI crossing into positive territory and the dollar possibly facing more fundamental weakness.

EUR/USD daily chart

Past performance is not a reliable indicator of future results.