Tesla profits expected to slide but focus remains on automation and battery growth

Tesla earnings are tipped fall but share price will be driven by outlook for robotics and batteries.

Tesla reports after Wall Street’s closing bell on the 28th of January, 2026.

Earnings growth forecast to drop on sluggish EV business

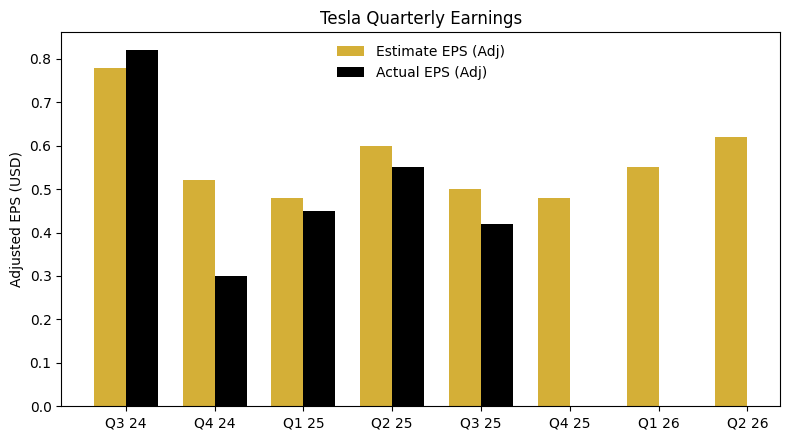

Tesla’s results are tipped to show a sluggish quarter for the EV maker. Consensus estimates suggest decent top line growth of about 11% to take revenues to roughly $US28.1 billion. However, earnings per share are projected to slide 35% to $US0.43 per share. The results follow underwhelming deliveries data from Tesla recently, with the company revealing a drop of 16% in Q4 to 418,000 vehicles. The drop reflects the impact of expiring tax credits for EV vehicles and falling market share as global carmakers, especially in China, eat into the EV market. Despite this, Tesla’s gross margins are expected to lift a bit, to about 18%, even as the company maintains a competitive pricing strategy to ward off lower cost rivals.

Investors lock-in on guidance about robotics and batteries

Although Tesla’s EV business is experiencing material headwinds, optimism about the company’s automation and batteries business is keeping the stock price well supported. As a result, most of the focus in this quarter's results will be about the growth in both business segments and the guidance the company provides about it. CEO Elon Musk continues to emphasise that Tesla remains an energy and, increasingly, robotics and automation company. Investors will be locked into what vision Musk projects about this so-called “robot army” he is building, including the scaling up of the Robo-Taxi and humanoid robots.

Tesla shares search for spark to drive to new highs

Optimism about artificial intelligence, robotics and US rate cuts helped push Tesla to record highs at the end of 2025. Price momentum has since slowed, with Tesla stock dropping below the upward sloping trendline from the April post-Liberation day lows. The stock is currently finding some modest support from the 100-day moving average. A meaningful level of technical support could be found around $US380 per share, a break of which could negate the prevailing uptrend. Meanwhile, resistance is around $US500 per share, with a break of that level a signal of a continued uptrend.

(Source: Trading View)

Past performance is not a reliable indicator of future results.