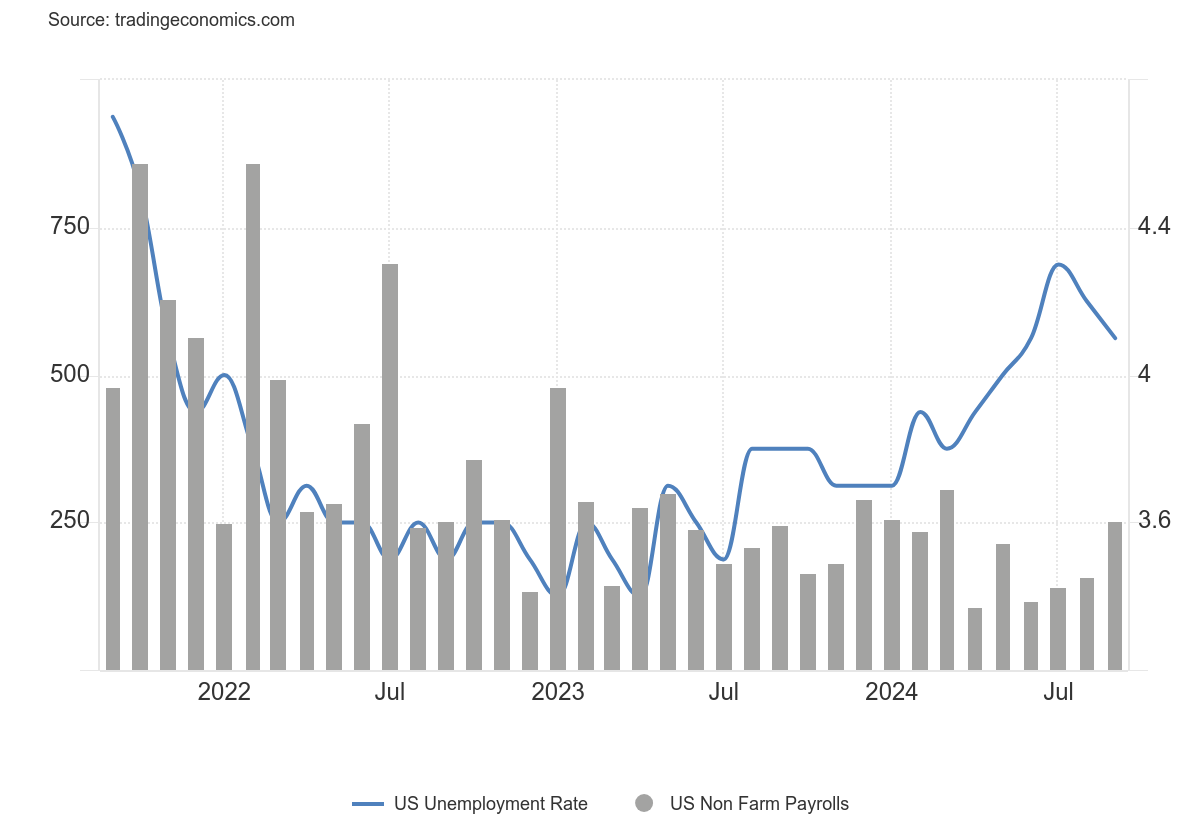

September Non-Farm Payrolls eases fears of US economic slowdown

Markets are reacting with a US Dollar surge and a potential trend reversal, highlighting the impact of robust economic activity outside of monetary policy influences.

US Non-Farm Payrolls data delivered a major upside surprise and the message is that the apparent deterioration in labour market conditions in July may be little more than a growth shock. The unemployment rate unexpectedly fell to 4.1% in September off the back of 254,000 jobs added to the economy. Forecasters predicted 4.2% and 150,000. What’s more significant is the unemployment rate was a few decimal points away from being rounded to 4.0% and previous months were revised up by 72,000, reversing a trend of downward revisions. On top of all that, monthly earnings growth more than expected, with the August number also revised higher.

Source: Trading Economics

The reaction in markets conveys what the key themes and risks for market participants are presently: economic growth and its impact, for equities, on future earnings. Rather than dropping in response to a pricing-out of roughly 20 basis points of cuts in the curve before end, futures have rallied on signs of resilient economic activity. There's also seemingly a revival of the US economic exceptionalism trade - the US Dollar is surging, especially against the Yen and Euro, the former which is also being weighed down by doubts about the prospect of further BOJ hikes, the latter facing headwinds from announced tariffs on Chinese auto imports in the Eurozone.

A macroeconomic takeaway is that the US economy's strength is being driven by factors outside of monetary policy - a fact that the markets may be failing to comprehend. One idea to explain why the US economy continues to expand at such a clip is the dominance of fiscal policy, especially the 5% deficit the government is running. Another is the productivity boom, possibly due to the pay-off from huge investments in artificial intelligence. To claim either argument as irrefutably true because of one solid Non-Farm Payrolls print is far too hasty. Nevertheless, it helps to frame why the economy continues to grow at an annualised rate of nearly 3%, add jobs at what is still a respectable pace, and deliver slow but steady disinflation.

US Dollar Index signals potential trend reversal

The US Dollar is potentially reversing its short-term downtrend. Having carved out a descending wedge pattern porterning such a move, a subsequent break-out and now push above resistance around the 200-day MA is signalling increased bullishness toward the US Dollar.

Source: Trading View

Past performance is not a reliable indicator of future results