Market Mondays: inflation data, geopolitics and sentiment in focus

Inflation in focus this week as markets will want to gauge whether the Federal Reserve will be able to lower rates next month

The primary focus early in the week will be on inflation. On Tuesday, the U.S. will release July’s Consumer Price Index (CPI) data. Expectations suggest that core inflation will tick up slightly to +0.3% from June’s +0.2%, driven in part by tariff-related pressures, with the year-over-year figure expected to creep back up to 3%. Later in the week, on Thursday, the Producer Price Index (PPI) will be released, which also expected to show marginal increases. These data points are critical for shaping investor expectations around Federal Reserve policy. With markets already pricing in a high probability of a rate cut in September, any deviation from expectations could shift sentiment and influence rate futures and yields.

Overlaying the economic story is a key geopolitical risk: the expiration of the current U.S.–China tariff truce, also scheduled for Tuesday, August 12. Markets are watching closely to see whether the agreement will be extended, which would likely support risk assets, or whether tensions will escalate again, triggering renewed volatility. An escalation could revive concerns about inflation and supply chains, while an extension may offer temporary relief and bolster investor confidence.

Another geopolitical event arrives on Friday when U.S. President Donald Trump is set to meet with Russian President Vladimir Putin in Alaska. Their summit could have meaningful implications for global oil markets, especially if discussions result in either the easing or reinforcement of energy sanctions. An improvement in relations might pressure oil prices by easing supply constraints, while renewed tensions could drive prices higher. This meeting could also influence safe-haven assets such as gold, which is currently trading in a consolidating pattern without a strong directional signal. Any rise in geopolitical risk could reinvigorate gold demand as investors seek protection from uncertainty.

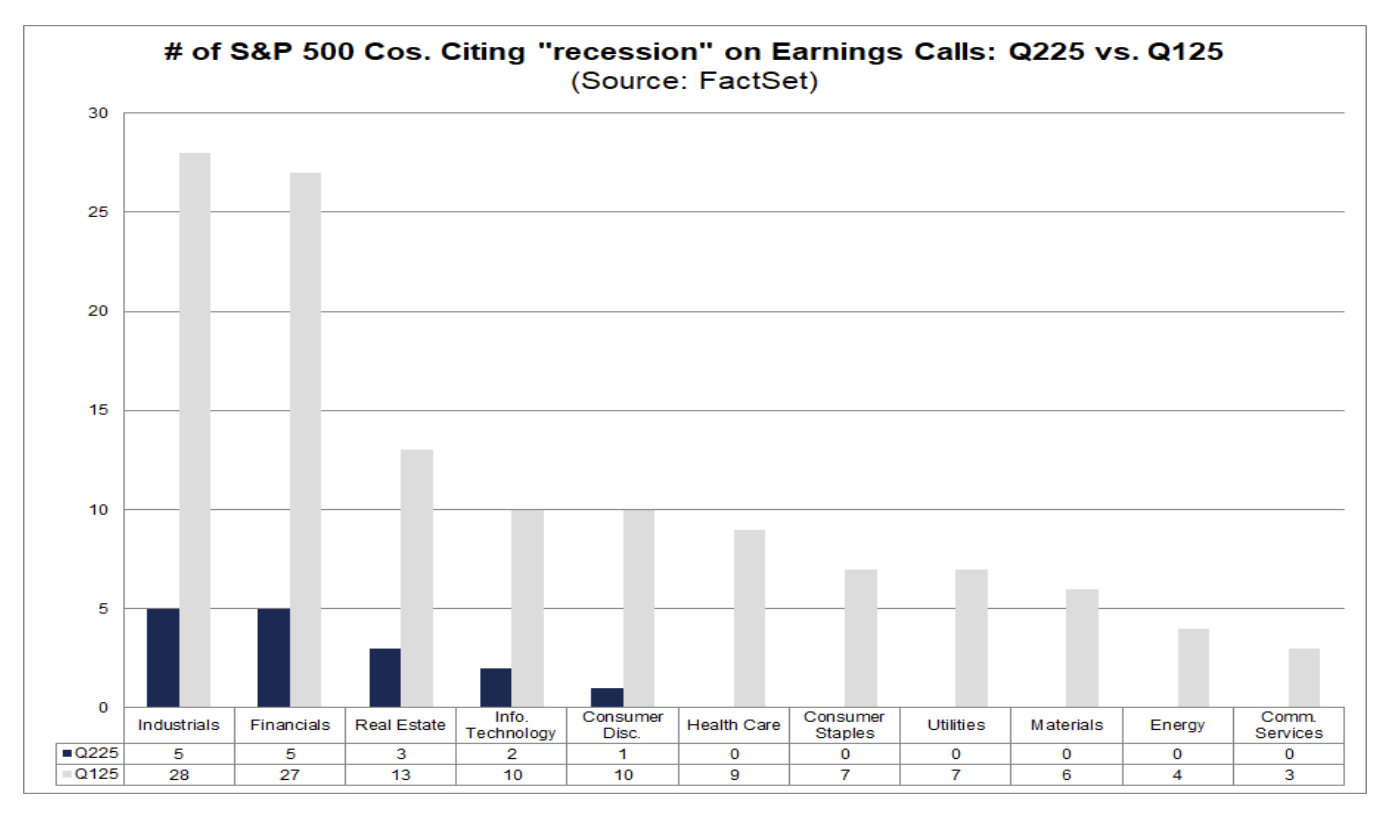

Regarding the earnings calendar, most of the heavy hitters have already reported, with the expected of NVIDIA, which is scheduled for later on in the month. So far, the Q2 earnings season is showing mostly positive results so far. Around 80% of S&P 500 companies have outperformed analyst expectations and the magnitude of earnings beats remains robust, driving double-digit year-over-year growth in many cases. Furthermore, the mentions of "recession" during earnings calls have dropped sharply, suggesting executives are less focused on recession risk

Source: factset

Meanwhile, market sentiment heading into the week appears cautiously optimistic, with U.S. stock futures showing modest gains. Throughout the week, markets will remain on edge, with inflation fears, geopolitical risk, and technical factors all contributing to potential swings across different asset classes.